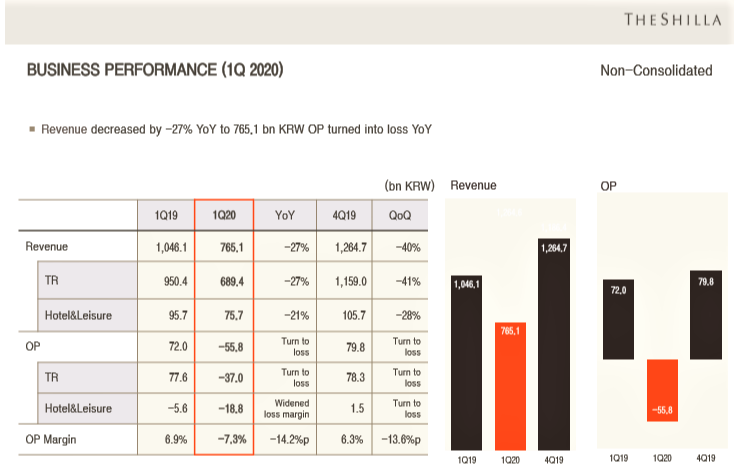

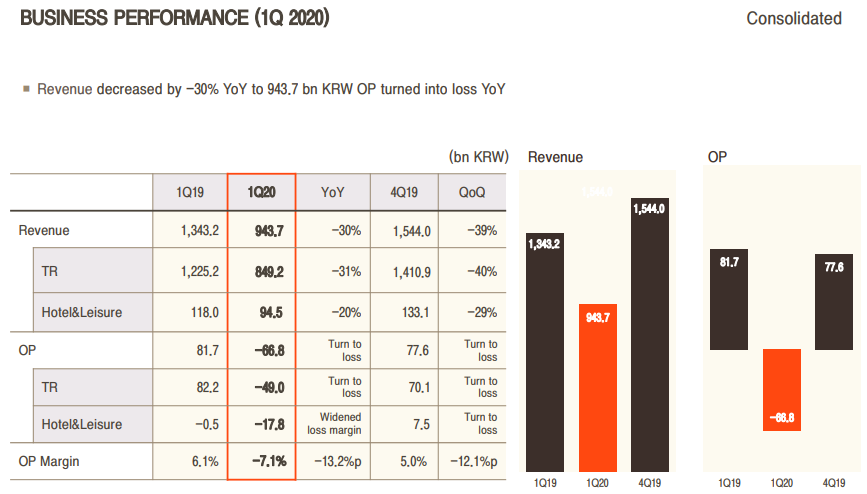

SOUTH KOREA. Hotel Shilla, parent of The Shilla Duty Free, reported a 27% year-on-year decline in consolidated first-quarter sales to KRW943.7 billion (US$766.9 million), posting an operating loss (-KRW66.8 billion/-US$54.3 million) for the first time in 20 years, writes Min Yong Jung* in Seoul.

Sales fell below the KRW1 trillion mark for the first time since breaking that threshold in Q1 2018.

The operating result underlines how drastically the company has been hit by the COVID-19 crisis. Even during the height of the China-Korea political crisis over South Korea’s deployment of the anti-missile system THAAD in 2017, Hotel Shilla surprised by reporting positive profits.

A difficult quarter was always expected leading up to the reporting on Friday. Investors and analysts were forewarned of the company’s performance with CEO Lee Boo-jin commenting during the Annual General Meeting of Shareholders that the company was “faced with great uncertainty from the beginning of the year – our main business travel retail is fighting desperately to survive”.

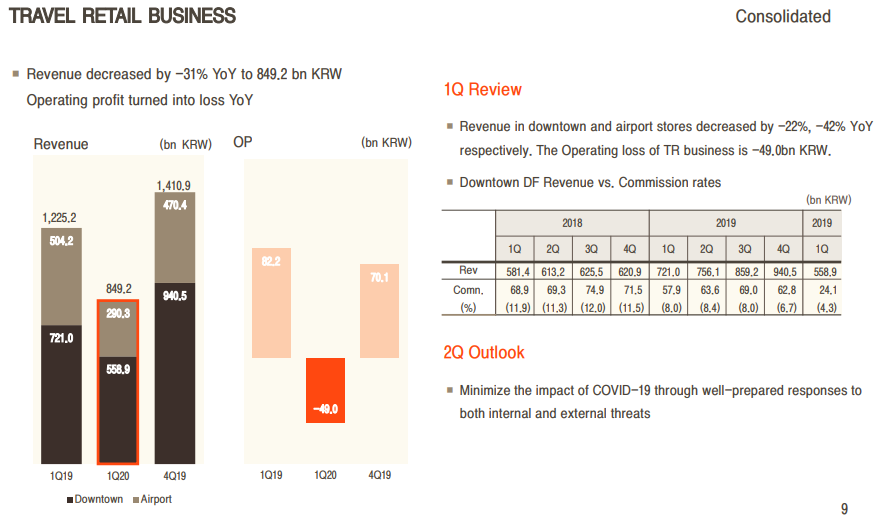

Travel retail sales down by almost a third

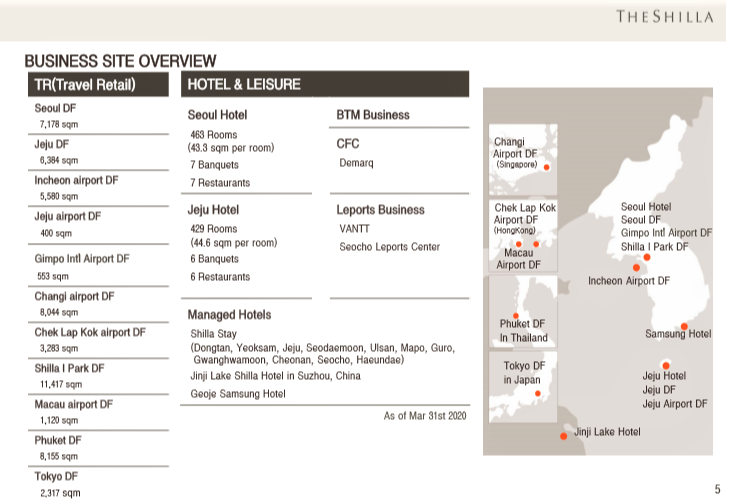

Hotel Shilla’s travel retail sales declined by -31% year-on-year in 1Q 2020 to KRW849.2 billion (US$560.2 million). Within that performance, downtown duty free sales fell -22% to KRW558.9 billion (US$454.2 million) and airport sales slumped -42% to KRW290.8 billion (US$235.9 million).

The travel retail business posted an operating loss for the first time since Q1 2000 when the company started reporting quarterly results. Q1 2020 operating profit was -KRW49.0 billion -US$39.8 million),

Hotel Shilla told The Moodie Davitt Report that losses from Incheon International Airport (where passenger numbers in recent weeks have slumped by over -90%) were overwhelming. Airport sales have fallen below rent payment requirements to Incheon International Airport Corporation (IAAC).

International passenger traffic at Incheon has declined from approximately 100,000 per day pre-crisis at the beginning of the year to 3,370 by 25 April with no recovery expected in coming weeks.

Although commission expense to resellers declined in Q1, the majority of the business currently done in the downtown duty free store is from large corporate daigou traders. Sales to such large reseller groups are less profitable than to other types of daigou. Unless travel restrictions between the Republic and China are eased, Hotel Shilla will have to depend on this group of daigou to prop up downtown duty free sales.

Overseas business slumps

Overall overseas sales plummeted by -42% year-on-year (Singapore Changi Airport -41% year-on-year; Hong Kong International Airport -51% year-on-year), while operating profit was -KRW12 billion (US$9.8 million). Overseas concessions benefited from relief packages offered by airport authorities and losses were much lower than in Korea.

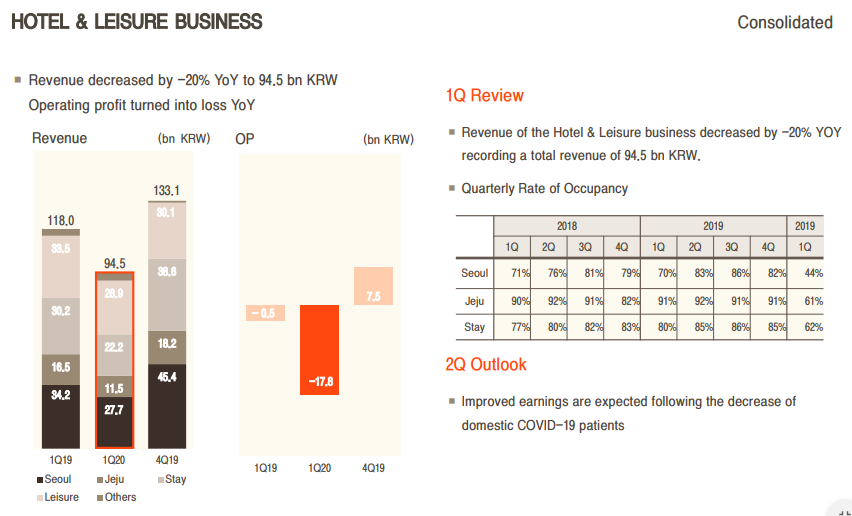

The hotel and leisure business was also impacted by COVID-19 and slumped back into loss after posting positive profits for three consecutive quarters in 2019. Sales of the hotel and leisure business fell -20% year-on-year to KRW94.5 billion (US$76.8 million) and operating profit recorded a loss of -KRW17.8 billion (US$14.5 million).

Better days ahead?

Despite the challenges to its business, Hotel Shilla is targeting improvements in the near term. As the spread of COVID-19 eases and news of Korea’s successful containment measures (just 64 new cases in the past seven days) is carried in local and international media, Hotel Shilla hopes foreign travellers will return and Koreans will also begin venturing abroad again.

“We are preparing for the future where business conditions have normalised by continuing to make investments,” the company said. “Our acquisition of [a large minority stake in] the world’s largest inflight duty free operator, 3Sixty Duty Free, is such an example.”

Clearly, further relief measures from IIAC are required for The Shilla Duty Free to improve its performance in the short term. IIAC President Koo Bon-hwan met with senior representatives from the three largest duty free retailers, Lotte, Shilla and Shinsegae on 22 April. The retailers stated at the meeting that the decline in sales and a related accumulation of inventory has led to such a dire situation that it is difficult to justify operations at Incheon.

According to an IIAC source, President Koo remarked that IIAC is also faced with deficits but recognises the importance of concessionaire partners and will investigate ways to provide additional relief measures for them.

*Note: Korean national Min Yong Jung, formerly based in London and since this month in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a new level of research and analysis for the travel retail channel.

*Note: Korean national Min Yong Jung, formerly based in London and since this month in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a new level of research and analysis for the travel retail channel.

Jung has a rich background in the travel retail channel and related consumer goods markets. Before joining The Moodie Davitt Report, he worked as an equity research analyst both on the buy and sell side of the finance industry at Kiwoom Asset Management and CLSA in Seoul. Jung is an arts graduate in International Affairs from George Washington University in the USA.

Do you have research needs related to the Korean and Asia Pacific travel retail and luxury markets? Min Yong Jung can be contacted at minyong@moodiedavittreport.com