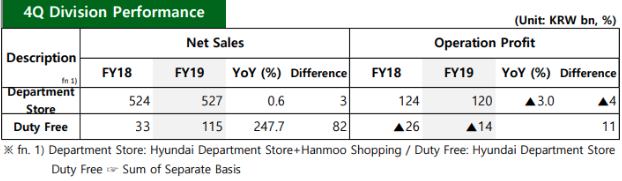

SOUTH KOREA. Hyundai Department Store Duty Free’s (HDS) sales surged in Q4 2019 by +247.7% year-on-year to KRW115 billion (US$97.8 million) off a low base, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung.

The comparison is skewed as the retailer only began its downtown duty free operations in Seoul in November 2018.

Hyundai Duty Free losses are easing: Q4 2019 saw a shortfall of KRW14.1 billion (US$12.0 million) compared with KRW26 billion in Q4 2018 (US$21.8 million). Operating profit margin was -6.1%, up 2.0 percentage points from the previous quarter.

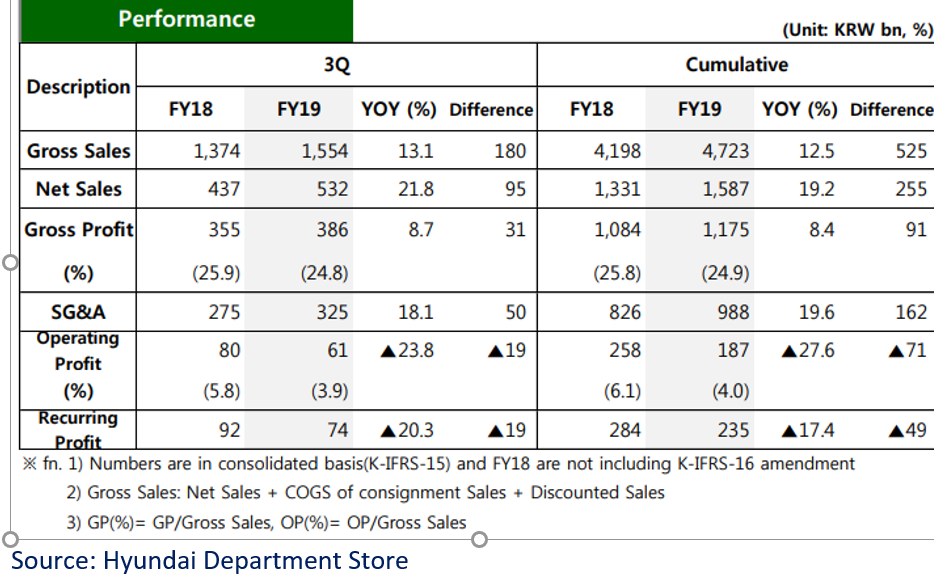

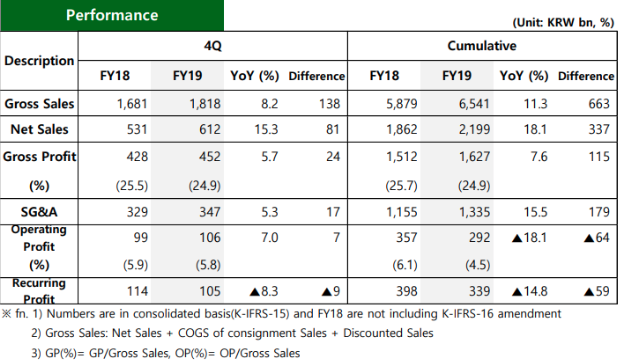

Hyundai Department Store’s overall Q4 2019 gross sales increased +8.2% year-on-year to KRW1,818 billion (US$1,545.9 million) and operating profit grew +7.0% to KRW105.6 billion (US$89.8 million). The result marks Hyundai Department Store’s first OP growth since launching its duty free business in Q4 2018.

The main difference between HDS’s and rival Shinsegae’s duty free operations is that the latter has a store in the key tourist area (and daigou magnet) of Myeong-dong, Seoul.

Hyundai’s downtown duty free store is roughly 15km away from Myeong-dong and transportation often takes over one hour during peak traffic hours. For daigou resellers who visit on average three to four stores per day to pick up limited quantities of best-selling products, Hyundai’s shop location limits their ability to maximise business.

That means that Hyundai Duty Free must pay above industry average commission rates to travel agents and resellers. This makes it difficult for the company to match the sales growth and profitability of its peers.

Compared to Shinsegae’s ramp-up of its downtown duty free store in 2016-2017, Hyundai’s quarter-on-quarter sales growth holds up well. But it has come at a heavy cost, primarily in the form of commissions paid to lure resellers to the store.

Shinsegae Duty Free posted positive profits for the first time in the fifth quarter of the new store’s operation but Hyundai will continue to incur losses in its equivalent quarter (Q1 2020). Any additional improvements to the business in cost saving are likely to be negated by the impact from the coronavirus outbreak and higher costs weighing on the business.

Hyundai Duty Free confirmed that the coronavirus has already begun to impact duty free sales in January and February. Daily average sales which were up to KRW2.4 billion (just over US$2 million) per day in Q42019 fell to KRW1.8 billion (US$1.5 million) in January and just KRW1.0 billion (US$839,000) to date in February.

Hyundai Duty Free’s target for the duty free business is to record a loss of KRW45 billion in 2020 (2019 OP KRW74.2 billion), although the coronavirus crisis jeopardises that plan.

Despite this, Hyundai remains set on opening its new Dongdaemun duty free store on 20 February. Korean media report that duty free sales are down by around 30-45% year-on-year in early February, with resellers focused on purchasing masks for medical purposes rather than their usual fare of masks for cosmetics use.

Even with Dongdaemun, Hyundai Department Store Duty Free will find it difficult to match the performance of the established big three (Lotte, Shilla and Shinseage) in Korean duty free. Unless additional funds are injected to invest in growing scale, the business will remain less competitive in procurement costs, and lag behind in the ability to secure best-selling products in sufficient quantities, especially key luxury brands.

Hyundai’s sales growth rate in the latest quarters has trailed behind Shilla’s downtown duty free store while operating margins are far inferior.

However, parent company Hyundai Department Store has always insisted that it is in the duty free business for the long term. In a statement of support for the channel, HDS this week announced that additional funds will be injected into duty free operations. The disclosure shows that KRW200 billion (US$168 million) will be allocated via the latest rights issue, taking the full amount the company has injected through five such rights issues for Hyundai Department Store Duty Free to KRW450 billion (US$377 million).

Department store blues

Despite reports of the luxury category’s strong performance in Korea throughout 2019, the warmer than usual winter climate dragged down department store sales.

Q4 2019 department store sales rose just +0.6% year-on-year, despite the Ministry of Trade Industry and Energy reporting luxury sales market growth of +20.5%, +22.4% and +20% year-on-year in October, November and December respectively.

Sales of fashion-related products declined by double digits throughout Q4 2019 and offset the positives from luxury. Profits slid by -3% with an increase in depreciation costs from store expansions conducted in 2019.