INTERNATIONAL. Profitability among the world’s airlines will remain weak in 2012, according to the latest forecasts from the International Air Transport Association (IATA).

The association said that the continuing Eurozone crisis “puts severe downside risk” on the 2012 outlook. IATA downgraded its central forecast for 2012 airline profits from US$4.9 billion to US$3.5 billion for a net margin of 0.6%.

In a worst case scenario, should the Eurozone crisis evolve into a full-blown banking crisis and European recession, IATA estimates that the global aviation industry could suffer losses exceeding US$8 billion in 2012.

For 2011, profitability remains unchanged at US$6.9 billion for a net margin of 1.2%.

“The biggest risk facing airline profitability over the next year is the economic turmoil that would result from a failure of governments to resolve the Eurozone sovereign debt crisis. Such an outcome could lead to losses of over US$8 billion-the largest since the 2008 financial crisis,” said Tony Tyler, IATA’s Director General and CEO.

|

2011 forecast

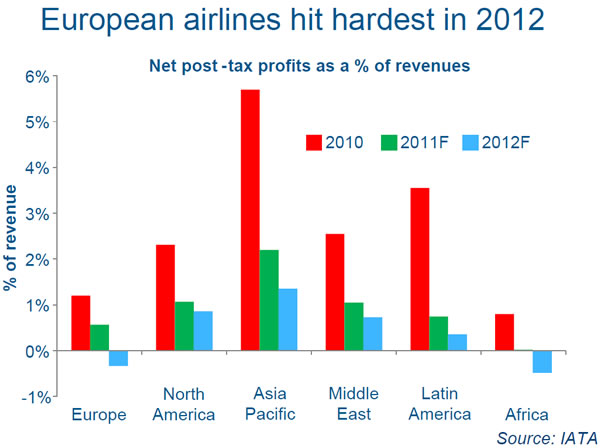

The global forecast for 2011 is unchanged at US$6.9 billion, said Tyler. “But regional differences have widened, reflecting the very different economic environments facing airlines in different parts of the world. And the overall margin of 1.2% tells you just how difficult the battle for profitability in this business is.”

European carriers are by far in the most challenging position, said IATA. Higher passenger taxes and weak home market economies have limited profitability in Europe. The region’s carriers are forecast to generate a collective profit of just US$1.0 billion this year, down from the previously forecast US$1.4 billion, and an EBIT margin of 1.2%. Low profitability has been despite European airlines being one of the fastest growing regions in terms of traffic this year. Yields have suffered and the base of strong demand grows more fragile as the sovereign debt crisis escalates.

North American carriers are in a much more “benign” environment, IATA said. They have seen yield and load factor improvements as a result of tight capacity management, which has improved profitability to US$2.0 billion (up from the previously forecast US$1.5 billion). The US economy has also grown at a faster pace than Europe. This gives the region the strongest EBIT margin of 3.2%. But the bankruptcy filing of American Airlines indicates that the region faces intense competitive challenges as well, IATA added.

Asia Pacific carriers also saw stronger though varied trading conditions in 2011. Japan’s domestic market still has not fully recovered from the March earthquake and tsunami, and load factors remain under pressure. By contrast airlines have improved load factors and profitability on China’s expanding domestic market. “We have upgraded our forecast for the region by US$800 million to a US$3.3 billion profit. This is the largest absolute profit among the regions,” said IATA.

Middle East carriers are expected to see profits of US$400 million (down from the previously forecast US$800 million) as high fuel costs squeezed profit margins on the more price sensitive long-haul traffic connecting over Middle Eastern hubs.

In a similar pattern Latin American profits will see a downgrade to US$200 million (from the previously forecast US$600 million) in 2011. Performance has been mixed across the region with much of the downgrade due to the impact of intense competition and falling load factors on Brazil’s domestic market.

African carriers are still expected to break-even. New trade lanes with Asia are developing and markets within the continent are reflecting the improvement in economic development in many African economies. However, competition has been fierce and the region’s airlines have struggled to keep load factors at profitable levels, noted IATA.

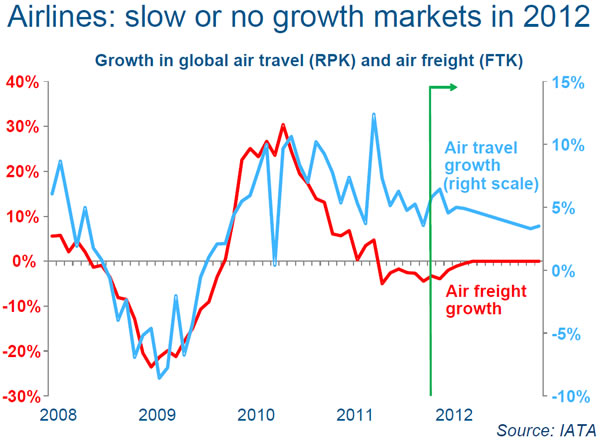

At the global level, passenger demand is expected to expand by +6.1% in 2011, which is stronger than the +5.9% forecast in September.

IATA said: “Air travel growth has persisted at a stronger pace than we had expected. This travel strength, along with tight capacity management, particularly in North America, has kept load factors high and is supporting a +4.0% increase in yields. This has helped a modest increase in forecast revenues, which we expect to total US$596 billion this year.

“This slightly stronger-than-expected passenger performance is offsetting worse-than-expected cargo performance and somewhat higher-than-anticipated oil prices. At an average oil price of US$112 per barrel, the industry’s 2011 fuel bill is expected to be US$178 billion (up US$2 billion from previous expectations). A downward trend in cargo since mid-year means that cargo likely will finish the year with a -0.5% contraction in volumes and flat yields.”

|

2012 forecast

IATA noted that even if government intervention averts a banking crisis it is unlikely that Europe will avoid a brief recession. “Business and consumer confidence has already fallen too far. Global GDP growth forecasts for 2012 have been revised downwards to +2.1%. Historically the airline industry has seen profit turn into loss whenever global GDP growth falls below 2%. This is driving the downgrade in the 2012 outlook.”

In 2012, passenger demand is expected to grow by +4.0% (down from previously forecast +4.6%), while cargo is expected to show flat growth (down from the previously forecast +4.2% expansion).

Passenger and cargo yields are expected to remain flat in 2012. While this is unchanged for cargo, passenger yields were previously forecast to grow by +1.7%.

|

Fuel costs are relatively unchanged from the previous forecast at US$198 billion. That is based on oil at US$99 per barrel (against a previous forecast of US$100 per barrel).

Industry revenues are expected to grow by +3.7% to US$618 billion. This will be outstripped by cost increases of +4.5% to US$609 billion.

All regions are expected to show profit deterioration from 2011. However, the regional differences in 2012 are stark, said IATA.

European carriers are expected to fall into losses of US$600 million, hit by the weakness of their home market economies and further increases in passenger taxes.

North American carriers are expected to generate profits of US$1.7 billion, maintaining the strongest EBIT margin of 2.4%, as limited capacity growth is providing some protection against the downward pressure on profits.

Asia Pacific carriers are expected to deliver the largest absolute profit at US$2.1 billion. This is weaker than 2011’s performance but the deterioration is limited by high load factors on markets such as China, where the increases in demand are structural and to some extent shielded from the cycle, IATA said.

Middle East carriers are expected to post a US$300 million profit, less than half the previously forecast US$700 million profit, as long-haul market conditions deteriorate, in particular those linked to the weak European economies.

Latin American carriers will see profits decline to US$100 million-a US$400 million negative swing from the previous forecast, partly a carry-over from the recent weakness of profitability in the large Brazil market.

African carriers will fall into losses of US$100 million, unchanged from the previous forecast. Economies and air transport markets continue to grow in the region, but load factors are not expected to be strong enough to offset the impact of weaker yields on profitability, said IATA.

“Even our best case scenario for 2012 is for a net margin of just 0.6% on revenues of US$618 billion. But the industry is really moving at two speeds with highly taxed European carriers headed into the red,” Tyler said.

|

IATA also developed a second scenario for 2012 taking into account the possibility of the Eurozone crisis deteriorating into a renewed banking crisis. Based on the OECD’s view that this scenario would cut global GDP growth to +0.8%, IATA estimates that this has the potential to cause global industry losses of US$8.3 billion.

IATA said: “In this scenario, all regions would fall into losses. Europe would be expected to post the deepest losses at US$4.4 billion, followed by North America at US$1.8 billion and Asia-Pacific at US$1.1 billion. The Middle East and Latin America would both be expected to post US$400 million losses, while Africa would be US$200 million in the red.”

Tyler said: “This admittedly worst-case-but by no means unimaginable-scenario should serve as a wake-up call to governments around the world. In a good year, the airline industry does not cover its cost of capital, much less in a bad one. But in a bad year, aviation’s ability to deliver connectivity and keep the heart of the global economy pumping becomes even more vital to initiating a recovery. Government policies need to recognize aviation’s vital contribution to the health of the economy.”