|

“The passenger business is expanding robustly. But on average, airlines will only make a net profit of about US$5.94 per passenger in 2014.“ |

Tony Tyler Director General & CEO IATA |

INTERNATIONAL. The International Air Transport Association (IATA) has revised its industry financial outlook for 2013, and predicted an even healthier 2014, as the global economy recovers.

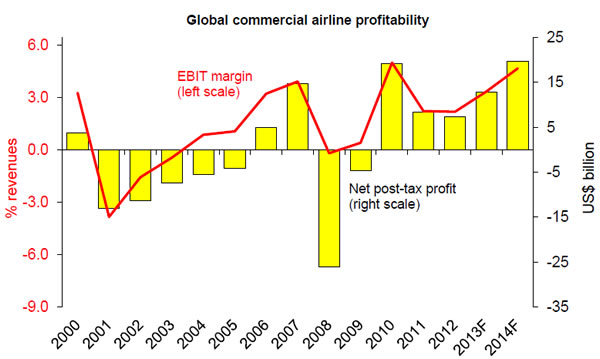

For 2013 airlines are expected to return a global net profit of US$12.9 billion. This is expected to improve to a net profit of US$19.7 billion in 2014. Both are improvements on the September forecast which anticipated an industry net profit of US$11.7 billion in 2013 increasing to US$16.4 billion in 2014.

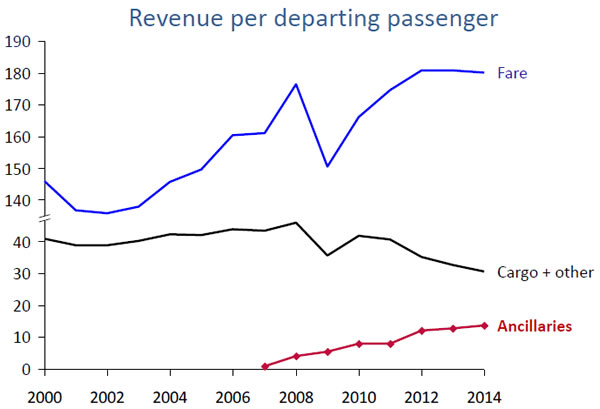

The upward revision reflects lower jet fuel prices over the forecast period as well as improvements to the industry’s structure and efficiency already visible in quarterly results this year. Passenger markets continue to outperform the cargo business which remains stagnant both on volumes and revenues.

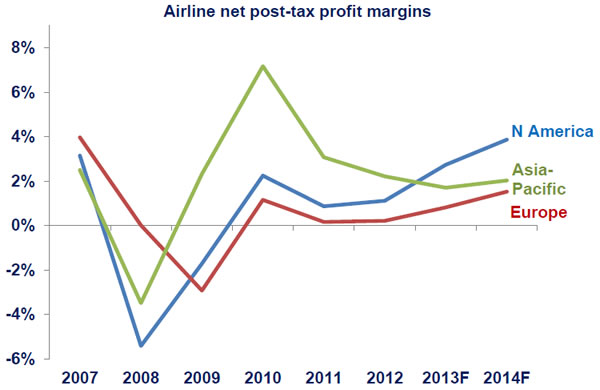

IATA expects 2014 to be a second consecutive year of strengthening profitability (beginning from 2012 when airlines posted a net profit of US$7.4 billion). Industry net profit margins, however, remain weak at 1.1% of revenues in 2012, 1.8% in 2013 and 2.6% in 2014. Within this aggregate forecast for the entire industry, performance of individual airlines and regions will vary considerably.

The anticipated US$19.7 billion profit in 2014 would come on projected revenues of US$743 billion. This would be the largest absolute profit for the airline industry in history, outstripping the US$19.2 billion net profit that the industry returned in 2010 But IATA noted that 2010 revenues were far lower at US$579 billion. The net profit margin in 2010 was 3.3%, some 0.7 percentage points higher than the 2.6% expected for 2014.

|

“Overall, the industry’s fortunes are moving in the right direction,” said Tony Tyler, IATA’s Director General and CEO. “Jet fuel prices remain high, but below their 2012 peak. Passenger demand is expanding in the 5-6% range-in line with the historical trend. Efficiencies gained through mergers and joint ventures are delivering value to both passengers and shareholders. And product innovations are growing ancillary revenues.”

“We must temper our optimism with an appropriate dose of caution. It’s a tough environment in which to run an airline. Competition is intense and yields are deteriorating. Cargo volumes haven’t grown since 2010 and cargo revenues are back at 2007 levels. The passenger business is expanding more robustly. Some airlines will out-perform our estimates and others will under-perform. But, on average, airlines will only make a net profit of about US$5.94 per passenger in 2014,” said Tyler.

|

Forecast drivers

Economic Cycle: Global GDP is expected to expand by +2.0% in 2013 and +2.7% in 2014. This is unchanged from IATA’s September forecast. The general trend of improvement in developed economies – particularly for the US – and relatively disappointing growth in the BRICS countries is expected to continue into 2014.

Passenger Demand: Passenger demand is robust and passenger numbers are expected to reach 3.1 billion in 2013 and rise by +6% to 3.3 billion in 2014. Nonetheless, competition remains intense and industry-wide average yields are expected to fall by -0.2% in 2013 and by -0.6% in 2014.

Ancillary Revenues: Ancillary revenues are a key driver of improved financial performance, noted IATA. Worldwide ancillary revenues have risen to an estimated US$13 per passenger. Airlines are underpinning their profitability with innovative products and services. On a per passenger basis, ancillary revenues are greater than the US$5.94 per passenger profit that airlines are expected to earn in 2014. Without ancillaries, the industry would be making a loss from its core seat and cargo products, said IATA.

Improved Industry Structure: Improved industry structure and efficiency gains should allow the industry to leverage the improving economic cycle to boost profitability significantly in 2014, IATA noted. Airlines in North America, where consolidation has progressed the furthest, are expected to generate the largest profits and best margins in both 2013 and 2014. European airlines, still suffering from the weak European economy, are expected to see some improvements in profitability from successful joint ventures over the North Atlantic.

Fuel: A slight reduction in jet fuel prices is a major driver of the improved outlook. Following easing of tensions in Iran, oil prices are expected to see a slight downward movement from US$108.2/barrel (Brent) in 2013 to US$104.5/barrel in 2014. This is US$0.80 and US$0.50 less per barrel than previously forecast in September for 2013 and 2014 respectively. This positive trend will be amplified by a reduction in the crack spread of jet fuel resulting in savings of US$2 billion in 2013 (to US$211 billion) and US$5 billion in 2014 (to US$210 billion) for the overall industry fuel bill compared to the September forecast.

|

|

Regional variations

All regions are expected to see improvements in profitability in 2014 compared to 2013. With the exception of Africa (which remains unchanged), all regions are expected to see better profitability in 2014 than previously forecast.

North America: North American airlines are expected to post a US$5.8 billion profit in 2013, increasing to US$8.3 billion in 2014. In both years North American carriers will outperform the aggregate industry to deliver both the highest absolute profits and the strongest EBIT margins (4.8% in 2013, 6.4% in 2014). Mergers on home markets and joint ventures on some international markets have helped to improve asset utilization to very high levels and generate efficiencies, as well as deliver benefits to passengers from the merged networks, IATA said. However, higher government fees on airlines and their passengers, as a result of the new Congressional budget deal (including a higher air passenger tax), risk damaging both airlines, investors and passengers, it added.

Europe: European airlines will see profitability improve in 2014 over 2013. Net profits for 2013 are expected to be US$1.7 billion, rising to US$3.2 billion in 2014. Efficiencies from joint ventures over the North Atlantic are expected to be a major contributor to this improvement, offsetting slightly the impact of the continuing economic slump across the Eurozone. Despite this near doubling of absolute profits, EBIT margins for the region’s airlines (1.3% in 2013, 2.0% in 2014) are the weakest next to those of Africa. The region remains burdened by high costs, cumbersome regulation and high taxes, said IATA.

Asia Pacific: Asia-Pacific airlines are expected to post a US$3.2 billion profit in 2013 which will be a third consecutive year of declining profits. The trend is expected to reverse in 2014 with a slight uptick to US$4.1 billion. In both years, the region is expected to deliver the second largest absolute profit. The region’s EBIT margin of 4.1% in 2013 is expected to improve slightly to 4.4% in 2014. The profitability of the region’s airlines is subdued by the ongoing weakness in cargo demand and the impact on supply-demand conditions of an expected delivery of 710 new aircraft next year.

Despite a shift to a lower economic growth trajectory, China’s domestic market continues to see strong growth in air travel. India’s domestic market had weakened sharply in line with the economy, but there has been a recent revival of air travel with growth rates back to low double digit figures. Japan, by contrast, has only seen a very low rise in domestic air travel and the size of the market is still not back to pre-tsunami levels.

Middle East: Middle East airlines are expected to return a net profit of US$1.6 billion in 2013, increasing to US$2.4 billion in 2014. EBIT margins also continue to improve-from 3.8% in 2013 to 4.7% in 2014.The region’s hubs, particularly in the Gulf, continue to expand in support of growing long-haul connectivity. Strong oil revenues-as oil prices stay high-continue to support travel generated by domestic activity and the development of the tourist industry. The Syrian crisis has not impacted traffic beyond its borders.

Latin America: Latin America is expected to return a US$700 million profit in 2013, increasing to US$1.5 billion in 2014. The region’s EBIT margin also continues to improve from 3.1% in 2013 to an expected 5.1% in 2014. Airlines in the region are burdened with infrastructure that is not keeping pace with the growth in demand, IATA warned.

While some countries, such as Chile, have worked hard to evolve a policy framework on which airlines can grow and drive economic growth, others have policies which are counterproductive. For example, Mexico has implemented a tax on jet fuel which adds to the industry’s number one cost in contravention of global agreements. Brazil’s import parity pricing for jet fuel has a similar impact. And Venezuela continues to block repatriation of some US$2.6 billion of the industry’s cash, IATA added.

Africa: The outlook for African airlines is unchanged from September with a US$100 million loss in 2013 switching to a US$100 million profit in 2014. It is the weakest financial performance of any region with an EBIT margin of -0.5% in 2013 improving to 0.7% in 2014. The region’s carriers face stiff competition on intercontinental routes while intra-African connectivity is underdeveloped as a result of market access restrictions. Additionally, high operating costs, heavy taxation and infrastructure deficiencies hamper the region’s airlines.

|