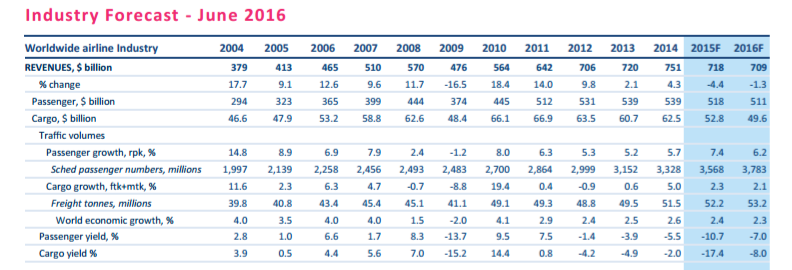

INTERNATIONAL. The International Air Transport Association (IATA) has revised its forecast for global air transport industry profits in 2016 to US$39.4 billion. This is up from the US$36.3 billion predicted in December 2015.

The figure is expected to be generated on revenues of US$709 billion for an aggregate net profit margin of 5.6%, which is up on the 5.1% previously forecast.

IATA said 2016 is expected to be the fifth consecutive year of improving aggregate industry profits.

In 2015 airlines generated a global aggregate profit of US$35.3 billion, which is a re-statement from the US$33.0 billion estimated in December 2015.

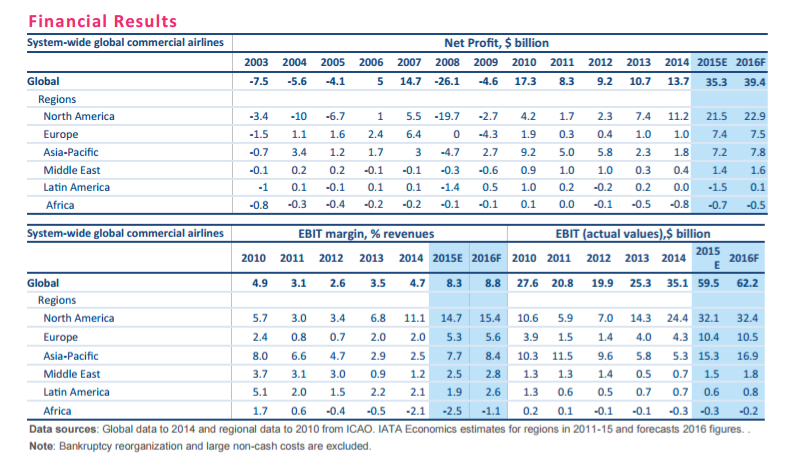

The association said all regions were making a contribution to the US$4.1 billion boost over 2015 profits with improved results. However, there are significant regional differences. Over half of the industry profits will be generated in North America (US$22.9 billion), IATA said, while African carriers are forecast to continue generating an overall loss (-US$0.5 billion).

IATA Director General and CEO Tony Tyler noted that lower oil prices were helping profitability but that the positive stimulus it was creating was “probably nearing its peak”. Lower prices are also tempered by hedging and exchange rates, he said.

“Performance, however, is being bolstered by the hard work of airlines,” he commented. “Load factors are at record levels. New value streams are increasing ancillary revenues. And joint ventures and other forms of cooperation are improving efficiency and increasing consumer choice while fostering robust competition. The result: consumers are getting a great deal and investors are finally beginning to see the rewards they deserve.”

IATA noted that airlines will make US$10.42 for each passenger carried on average. For the second year in a row, and only the second time in the airline industry’s history, the return on invested capital (9.8%) will exceed the cost of capital (estimated to be 6.8%). “This is the minimum expectation level for investors,” said Tyler. “The airline industry is beginning to generate profits that would be expected of any normal business.”

Regional variation

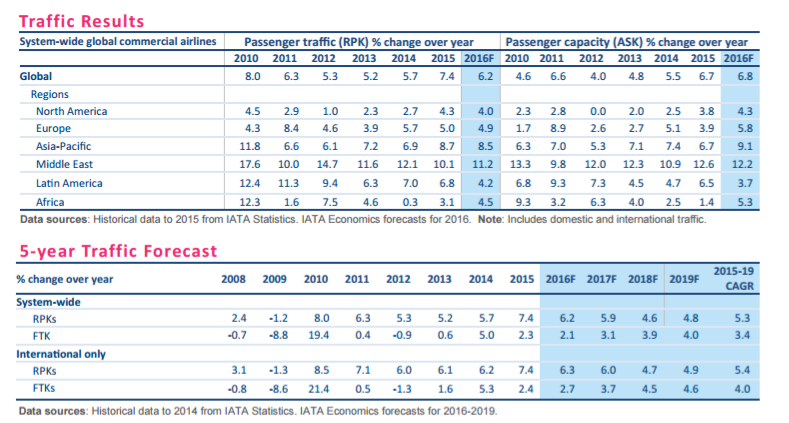

North American carriers continue to deliver the industry’s strongest financial performance, according to IATA. Their expected net profit of US$22.9 billion is an improvement on the US$21.5 billion reported for 2015. Passenger capacity is expected to expand by +4.3% in 2016, marginally outpacing an anticipated +4.0% increase in demand, but load factors are forecast to remain well above break-even levels. Cash flow has been sufficient for airlines in this region to improve balance sheets significantly by repaying debt, IATA reported, and return cash to shareholders through dividends and share buy-backs.

IATA expects European airlines to post a US$7.5 billion profit in 2016, which is up from US$7.4 billion in 2015. Passenger capacity is forecast to grow by +5.8%, ahead of expected demand growth of +4.9%. The association noted that terror incidents have had a dampening effect on demand in some key tourist centres in the region. “It is difficult to describe the state of European carriers as uniform,” it said. “The major groupings have seen solid improvement based on stronger long-haul markets, while many small- and medium-sized carriers continue to struggle. Competition is intense (particularly on intra-Europe routes) and the burdens of high taxes, onerous regulation and inefficient infrastructure (particularly air traffic management) have yet to be meaningfully addressed. Additionally, for many carriers there is a wide gap between the expectations of labour and management.”

Asia Pacific airlines are expected to post a US$7.8 billion profit in 2016, up from US$7.2 billion in 2015. Capacity is forecast to expand by +9.1% in 2016, ahead of demand which is likely to grow by +8.5%. Carriers in the region have a 40% share of global air cargo markets. As a result they continue to feel the brunt of stagnation in this sector, IATA said, which is holding back the improvement in financial performance. Challenges include intense competition as the budget sector expands, restructuring in the Chinese economy and continuing infrastructure and cost difficulties in the Indian market.

Middle East carriers are expected to post a US$1.6 billion profit, up slightly on the US$1.4 billion reported for 2015. Capacity is forecast to grow at +12.2%, outpacing an expected +11.2% expansion of demand. “Efficient hubs continue to gain market share on connecting markets for the region’s major carriers, although local markets have been weakened by the impact of falling commodity revenues,” IATA stated. “Economic changes in the region’s oil economies are manifesting themselves in a spate of increases of charges and taxes which could dampen the region’s cost competitiveness.”

Airlines in Latin America are expected to see a US$100 million profit in 2016 after a US$1.5 billion loss in 2015. Demand is expected to grow by +4.2% while carriers are forecast to add +3.7% to capacity. Two of the region’s major economies, namely Brazil and Venezuela, remain mired in a deep economic and political crisis, the association said. The region has been hit disproportionately by the fall in commodity prices and revenues, which led to foreign exchange crises to add to the economic difficulties, said IATA. “Such has been the falling of exchange rates in Brazil and other major commodity economies in the region that airlines have seen hardly any decline of fuel costs in local currencies, while outbound residents have suffered a dramatic decline in purchasing power overseas.”

African airlines are expected to post a US$500 million loss in 2016, a slight improvement on the US$700 million recorded in 2015. Capacity growth at +5.3% is anticipated to outpace demand growth of +4.5%. Challenges include intense competition on long-haul routes, political barriers to growing intra-Africa traffic, high costs and infrastructure deficiencies. Many major economies in the continent have also been hit hard by the collapse of commodity prices, and the impact that has had on revenues and the inflow of hard currencies. Unresolved foreign exchange crises are adding to the economic difficulties facing airlines in this region, IATA noted.