CHINA. Independent online marketing and enterprise data solutions provider iClick Interactive Asia Group today hosted a launch event in Singapore for the release of its China Travel Shoppers 2022 Whitepaper. This edition of the Whitepaper was produced in collaboration with tax and transaction specialist Ernst & Young Hua Ming (EY). [More details of the Singapore event will follow.]

The Whitepaper offers critical insights into China’s travelling consumers’ trends and Hainan’s emergence as a duty free superpower.

The event at the Sofitel Singapore Hotel was attended by stakeholders from across the industry travel chain, marketing experts and media, including The Moodie Davitt Report.

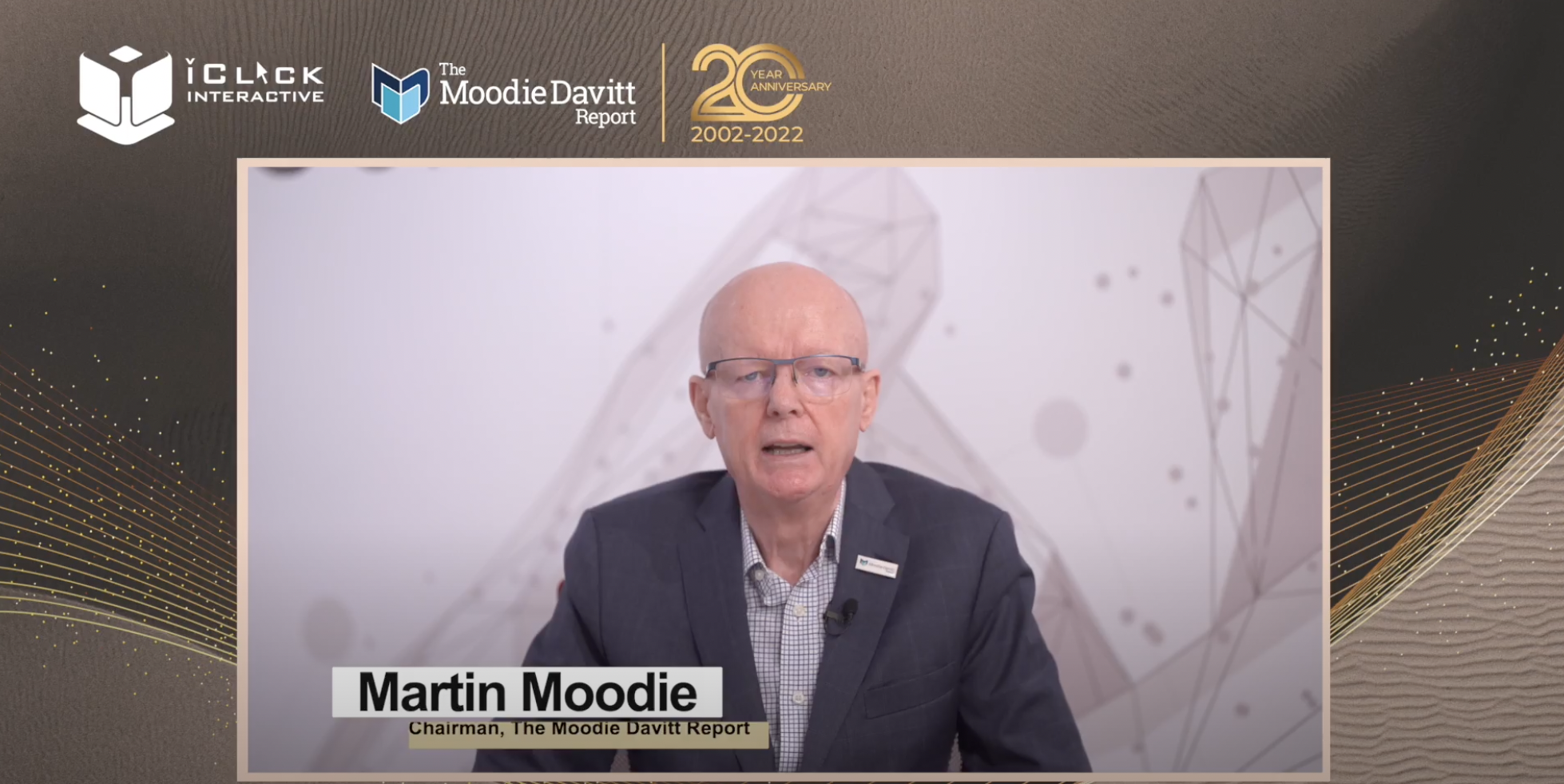

The in-depth, 68-page report – the second edition to a Whitepaper unveiled at the 2020 Moodie Davitt Virtual Expo – includes a commentary from The Moodie Davitt Report Founder and Chairman Martin Moodie. Moodie also contributed a video introduction, which was played at the event, while President Dermot Davitt also spoke to put the latest findings on the China market in the context of global market recovery.

The 2022 Whitepaper is dedicated to revealing China’s travelling consumers’ trends and Hainan Free Trade Port’s role in stimulating China’s duty free market development.

In his introduction to the Whitepaper, iClick Interactive Asia Group President International Business Frankie Ho says: “The global travel retail market has been among the most impacted by the measures to contain the spread of the pandemic since 2020 and yet the Chinese market has shown great resilience and welcomed a fast recovery.

“In 2021, Chinese travel retail consumption shifted to domestic tourism and China’s duty free market achieved +66.8% year-on-year growth. China’s efforts to revitalise the sector, as evidenced by the massive growth of China Duty Free Group and Hainan Free Trade Port, are exceptional.”

Ho notes that by 2025 “China’s travel retail market is now foreseen to grow to US$24 billion”.

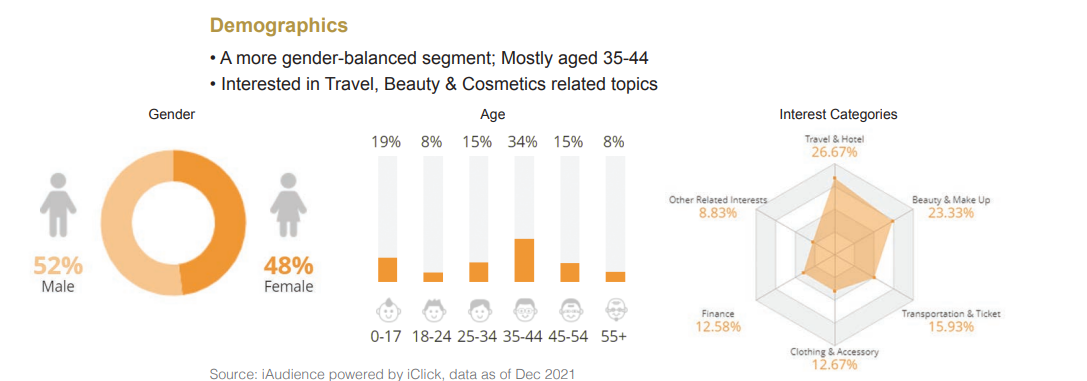

The Whitepaper leverages iClick’s proprietary ‘iAudience’ market intelligence platform’s data on ‘new’ Chinese travellers, shoppers’ outlooks and behaviours, and implications for marketers and brand owners.

“We are pleased to share our expertise, data and insights with EY, offering related stakeholders in the travel retail sector unparalleled audience insights to cultivate their own strategy to understand, influence, engage and convert different types of Chinese travel shoppers, confidently navigating the pandemic and preparing for the recovery,” Ho says.

EY Greater China Consumer Industries Leader Denis Cheng says in the report:“China has now become the world’s second-largest consumer market,” adding that the Hainan Free Trade Port is a “major national strategy to create Hainan as an international tourism and consumption destination”.

Cheng notes strong 2021 sales figures – up +84% year-on-year – from ten duty free stores and a +73% increase in the number of shoppers. “The Hainan market, with the continuous optimisation of the duty free policy, will further attract operators in the travel retail sector,” he comments.

In his foreword to the Whitepaper, Martin Moodie notes that the travel retail sector outlook “looks better than at any time during the pandemic”.

“In late February, Dag Rasmussen, Chairman & CEO of one of the world’s biggest travel retailers, France’s Lagardère Travel Retail, predicted a return to pre-pandemic 2019 revenues in 2023,” he said. “Many of his peers are seeing healthy year-on-year percentage gains in early 2022 as much of the world decides to ‘live with COVID’.

“Against such a backdrop, the US$64 million question for the global travel retail community outside China is ‘When will the Chinese return?’

“The definitive answer is uncertain… but two things are certain. Firstly, that they will return, and secondly, that in the intervening period they will remain a profoundly important shopping force thanks to the vibrancy of China’s ‘home’ travel retail market.

“So many western research companies, and even brands, talk about ‘targeting the Chinese consumer’. The reality, as this report reveals, is far more complex than that.”

“We firmly believe that all aspects of China’s travel retail market will grow strongly in the future,” Moodie adds.

“For brands and retailers to maximise the opportunities that such a diverse range of channels represents, they need an intimate knowledge of Chinese consumers. So many western research companies, and even brands, talk about ‘targeting the Chinese consumer’. The reality, as this report reveals, is far more complex than that.

“Both for the rigour of its methodology and the quality of its insights, I find this Whitepaper a report of rare intelligence and insight into the evolving habits, needs and desires of travel retail’s most important consumer audience of the 21st century.”

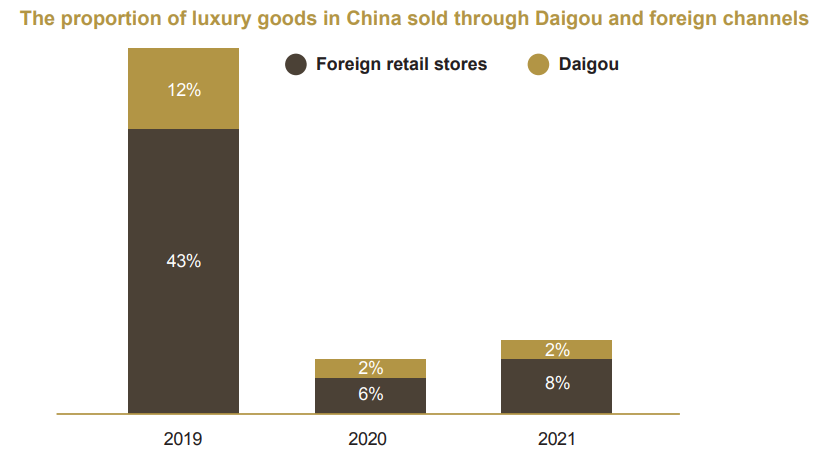

The Chinese Travel Shoppers 2022 Whitepaper offers an overview of the travel retail market in China, with a spotlight on Hainan, noting changes in Chinese luxury consumers’ buying patterns and daigou shopping.

“It is imperative to sell through Chinese duty free channels to make up for losses in Korean and Japanese duty free stores,” the report states.

The Whitepaper features a macro-view of shoppers’s trends and behaviours. iClick collaborated with Daxue Consulting to analyse travelling Chinese consumers using iAudience data, with a focus on demographics, interests and internet behaviour to provide strategic recommendations to retailers on how to attract, engage, and convert Chinese travellers.

The report’s overview considers the impact of the COVID-19 pandemic on China’s travel retail sector, the “birth of China’s new travel retail market” and Hainan’s rise as a travel retail destination. Revenge spending is also detailed, along with the major role pop-ups play in China’s ‘hunger marketing’.

The Whitepaper notes the power of digital advertising as “one of China’s key marketing strategies”. It indicates that digital marketing spending in China increased +130.8% between 2016 and 2020 and is projected to reach approximately RMB963 billion (US$151 billion) in 2024.

It also underlines the “extraordinary expansions and development in its domestic duty free market”. “As a result, China’s travel retail market is currently foreseen to grow to RMB150 billion (US $24 billion) by 2025.”

Shanghai’s future as a new duty free retail hub is detailed. “According to the Shanghai Municipal Commission of Commerce, the city plans to usher in 50 new designated tax-refund stores, support 20 local brands, attract 30 international mid-to-high end brands, add 800 more new stores, and build a venue for new global launches,” the Whitepaper states.

Looking to the future, the whitepaper considers the emergence of smart travel, highlighting iClick’s cross-border smart retail SaaS solution, iSmartGo, and the implications for retailers.

The full Chinese Travel Shoppers 2022 Whitepaper can be downloaded here.

Coming soonThe Moodie Davitt Report is delighted to announce the launch of 穆迪达维特中国旅游零售报告 – The Moodie Davitt China Travel Retail Report, a digital magazine dedicated to our industry’s hottest market. The new digital title will be published in Mandarin and English four times a year across multiple platforms.  This exciting new digital magazine from the world’s leading travel retail publisher will focus on all aspects of China’s travel-related ecosystem, including:

To subscribe, please email Kristyn Branisel at Kristyn@MoodieDavittReport.com For advertising and sponsorship enquiries please contact Irene@MoodieDavittReport.com or Sarah@MoodieDavittReport.com. For all editorial enquiries please contact Martin Moodie at Martin@MoodieDavittReport.com |