SOUTH KOREA. An independent analysis by advisory firm Samil PwC has concluded that if the T1 and T2 duty-free concessions held by The Shilla Duty Free and Shinsegae Duty Free at Incheon International Airport are rebid, fees offered will likely be around -40% below current levels.

As reported, the two retailers are in a bitter row with Incheon International Airport Corporation (IIAC) after the airport company’s refusal to agree to -40% fee reductions relating to their Terminal 1 and Terminal 2 cosmetics, perfume, liquor and tobacco contracts.

“Recent passenger numbers have rebounded, but far fewer visitors are actually shopping,” wrote Kim Kyung-Mi in Korea JoonAng Daily in a neat summing up of the dispute. “Major operators, burdened by high rent, have asked the airport operator to cut lease fees — but a deal looks unlikely. Industry watchers say the duty-free business model needs a complete overhaul to reflect changing tourism patterns.”

Despite facing heavy termination penalties of around KRW200 billion (US$144 million at current exchange rates), both companies have threatened to terminate their concessions if negotiations are unsuccessful.

Having failed to make progress with IIAC, they subsequently referred their request to the Incheon District Court. An an initial hearing the court appointed Samil PwC to assess ‘fair market rent levels’.

A second hearing was set for tomorrow (14 August) but has been postponed to 28 August. IIAC confirmed earlier this month to The Moodie Davitt Report it will not take participate in the second hearing.

“The rent structure was clearly outlined in the original request for proposals, and both retailers agreed to the terms,” a spokesperson confirmed to us late last month, echoing earlier comments made to Maeil Business, the influential Korean media title that broke the story.

Participating in any court-led arbitration could open the door to “legal complications,” IIAC said, noting rent reductions are only permitted under certain conditions set under national contract and lease laws.

KEY FINDINGS

The Samil PwC report, seen by The Moodie Davitt Report, draws the following conclusions:

1.

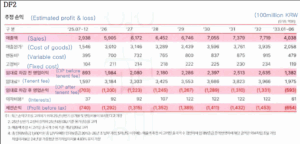

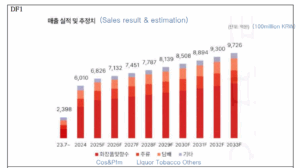

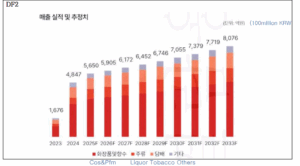

- The successful offer for any DF1 and DFS rebid is expected to be some -40% below the current fees. Revenue estimates for the disputed area, taking into account the estimated number of outbound passengers and average passenger price* at the current time.

- As the sales growth rate (+4.5%) exceeds the consumer price index (+1.5-1.8%), operating profit before rent deductions is expected to continue to increase throughout the period. However, losses are expected to increase when considering rent.

- Estimated rent levels for rebidding based on target revenue criteria: DF1 rent levels are estimated at 52-66% of current rents. DF2 rent levels are estimated at 52-69% of current rents.(Even if one or more duty-free retailers bid aggressively, such estimations represent a reduction of approximately -40% compared to current rates.)* The average passenger price for each item is calculated through dividing sales by the number of outbound passengers.

* The average passenger price for each item is calculated by dividing sales by the number of outbound passengers.

2.

- Korean and international duty-free operators are aware of the declining average unit price trend and its causes for Incheon Airport’s DF1 and 2 products. Therefore, it is unlikely that aggressive bids based on the assumption of future increases in average unit price will be feasible. Therefore, if any rebidding is conducted based on the current available passenger volume forecast, the current average unit price, and the company’s DF1 and 2 cost structure, bid prices are expected to drop by approximately -40% from current levels.

- The rental fees for DF1 and DF2 are calculated by multiplying the number of departing passengers by the per-passenger rental fee. The number of departing passengers recovered to pre-COVID-19 levels in 2024 and is expected to continue increasing in 2025. With the aviation industry also expected to continue growing, the rental fees borne by duty-free shops are expected to continue to rise.

- Despite the recovery in the number of outbound passengers, sales at Incheon Airport duty-free shops, especially those in DF1 and 2, are showing a clear decline compared to pre-COVID-19 levels. While sales of other items, such as fashion, accessories, and luxury boutiques, have recovered to 2019 levels and are showing growth, sales of DF1 and 2 items have decreased significantly compared to 2019, remaining at around 53% for cosmetics and perfumes and around 65% for alcohol and tobacco.

3.

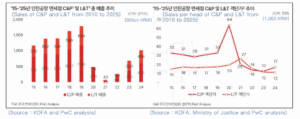

- Reasons for decrease in DF1, 2 sales: The proportion of consumption at duty-free shops is decreasing significantly as the consumption pattern of Chinese people, which contributed to the high growth of the duty-free market in the past, is changing to a practical and experiential pattern.

- Specifically, the proportion of duty-free shop sales among total sales to Chinese tourists fell significantly from 63.1% in 2019 to 35.9%.

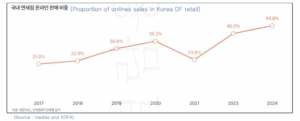

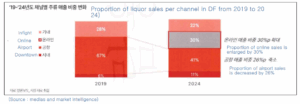

- The July 2023 introduction of online duty-free liquor sales has fragmented liquor retail channels, negatively impacting Incheon Airport duty-free sales. Since the National Tax Service introduced the change customers from existing airport duty-free shops have shifted to inflight and downtown online liquor channels, significantly eroding airport spirits and wine sales.

- In particular, inflight duty-free liquor sales increased +76% from KRW8.7 billion (US$6.3 million) per month in 2019 to KRW15.3 billion (US$11 million) in 2024. This appears to be the result of the increased convenience, which has attracted a significant portion of existing airport duty-free shop customers.

- Furthermore, Incheon Airport duty-free operators are engaging in price competition to compete with discount sales from online channels with lower fixed costs, resulting in increased margin losses. ✈

Is Lotte Duty Free poised for action?As reported, Lotte Duty Free (through Hotel Lotte and Busan Lotte Hotel, the respective parents of its Gimpo and Gimhae airport operations) is embroiled in its own legal challenge over airport rent fees. But the company insists the scenario is very different to that of Shinsegae and Shilla at Incheon Airport. Lotte Duty Free is optimistic the Seoul High Court will rule in its favour regarding a refund of airport rent fees paid to Korea Airports Corporation in the pandemic-ravaged months of March to August 2020. The company told us in late May, “It is important to clarify that our case is fundamentally different from the recent rent adjustment claims filed by The Shilla Duty Free and Shinsegae Duty Free. “In Lotte Duty Free’s case, operations were entirely suspended due to the government-mandated closure of international terminals, making business activity impossible.” Even before its cautious 2023 bid (see table) Lotte Duty Free had already exited its Incheon Terminal 1 cosmetics, fashion and leathergoods contracts on 31 July 2018, citing “the burden of rent increases” following the sharp downturn in Chinese tourists in 2017 amid the THAAD dispute with China. It was replaced by Shinsegae Duty Free. Lotte Duty Free would certainly welcome a rebid and the opportunity to re-enter Incheon at a sustainable price. Equally as certainly, it would not simply stand back and accept any rent reduction for its rivals. |

Given the impasse between the parties, mediation appears destined to fail and the prospect of both retailers exiting their contracts is becoming ever more likely.

IAAC finds itself, to quote an English idiom, caught between a rock and a hard place (translated locally as 진퇴양난: 이러지도 저러지도 못하는 상황).

Not only does it insist the rental terms were legitimately agreed through a transparent open international tender and cannot be retrospectively adjusted but it is also aware that any such reduction would likely prompt a legal challenge from competing firms which bid more conservatively than Shilla and Shinsegae, notably Lotte Duty Free.

The Korean travel retail powerhouse has been out of Incheon International Airport altogether since its lowball bid on the 2023 mega-tender. That approach was based on a cautious view of existing and future market conditions and the potentially punitive cost of doing business at Incheon. Why should its rivals benefit from being less prudent, Lotte Duty Free may – and almost certainly will – ask?

South Korea’s duty-free market, the world’s largest, finds itself in disarray. While the downtown sector has experienced most of the pain in recent years (see table of recent closures), the malaise appears to be spreading.

Downtown duty-free closures in South Korea over recent years2016 WalkerHill Duty Free (SK Networks), Seoul, May 2019 Hanwha Galleria Duty Free, Seoul, September 2020 Doota Duty Free (Doosan Corp), Seoul, April SM Duty Free – Seoul, September Entas (Kyung Bok Kung) Paradise Complex, Yeongjong Island, Incheon, November 2021 Shinsegae Duty Free, Gangnam, Seoul, July 2022 Lotte Duty Free COEX, Seoul, September 2025 Shinsegae Duty Free, Busan, January Hyundai Duty Free Dongdaemun, Seoul – July Source: ©Moodie Davitt Research Also read: Guest editorial – The past, present and future of the South Korean duty-free industry |

TENDER ALERT

The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply email Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty-free and other retail, food & beverage, property, passenger lounges, art and culture, hotels, car parking, medical facilities, the internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.