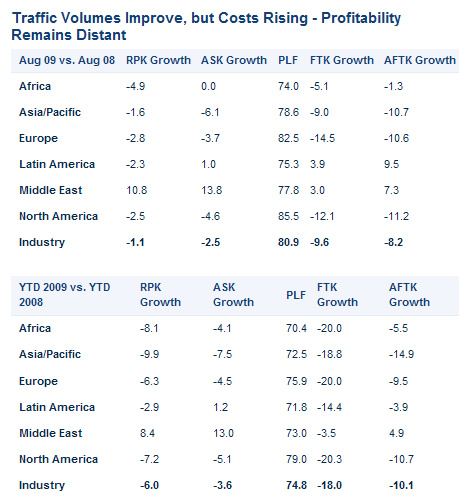

INTERNATIONAL. Global passenger traffic (measured in revenue passenger kilometres) fell by -1.1% in August compared to August 2008, the International Air Transport Association (IATA) said today. The figure was an improvement on the -2.9% decline recorded in July.

Compared to August 2008, passenger load factors improved by 1.2 percentage points to 80.9%. Despite the tighter supply and demand conditions average fares continue to be depressed (-22% for premium seats and -18% for economy), noted IATA.

|

To match capacity with demand, airlines have reduced daily aircraft use in recent months. For example, average daily hours for the global Boeing 777 fleet dropped by -2.7% to 11.1 hours per day through the first eight months of the year. Lower utilisation helps load factors, but spreading fixed asset costs over fewer hours in the air pushes up unit costs, said IATA.

“Demand continues to improve, but profitability remains ever distant,” said Giovanni Bisignani, IATA’s Director General and CEO. “Fares have stabilised, but at profitless levels. Meanwhile cost pressures are mounting from reduced aircraft utilisation and rising oil prices. The industry is not out of the woods yet,” said Bisignani.

Compared to the low point of March 2009, seasonally adjusted passenger demand has improved by +6%, but traffic levels remain -5% below May 2008 when the fall in demand began. All regions, except the Middle East, saw improved demand conditions in August compared to July.

Asia Pacific carriers recorded the most significant improvement, moving from a -7.6% drop in July to -1.6% in August. This improvement is somewhat exaggerated as August 2008 was the start of the steep decline in passenger demand for the region’s airlines. This region is where second and third quarter growth has been strongest, boosted by massive government and central bank stimulus packages and fewer problems with consumer debt and bank balance sheets, said IATA.

European carriers saw demand fall -2.8% compared to August 2008 (up from the -3.1% recorded for July). For North American carriers, the improvement was to -2.5% in August compared to -3.2% in July.

Middle Eastern carriers were the only region to show year-on-year growth with demand expanding by +10.8%. This is below the +13.2% recorded in July due to a distortion resulting from the earlier start of Ramadan compared with last year.

Latin American carriers saw demand improve to -2.3% in August (from -3.5% in July). Passenger confidence, dampened by Influenza A(H1N1) is returning with the end of flu season in the southern hemisphere.

African carriers showed the weakest demand at -4.9% in August. This was a slight improvement on the -5.5% recorded in July.

For 2010 IATA’s latest industry outlook anticipates average international passenger growth of just over +4.0%, compared to an expected full-year decline in 2009 of almost -5.0%.

Bisignani said: “Even with improving demand, there are few bright spots in the industry. This must point us to the need for some fundamental re-thinking. At the top of the list for change are the industry’s antiquated rules of the game which restrict access to markets and to international capital. This industry needs to operate as a normal business. Liberalisation of ownership rules could be a lifeline for airlines as we approach a difficult fourth quarter.”

MORE STORIES ON INTERNATIONAL PASSENGER TRAFFIC