GHANA/UAE. Among the highlight sessions of the Middle East & Africa Duty Free Association (MEADFA) Conference – which took place from 19-21 November in Accra – was a one-to-one interview with Dubai Duty Free Chief Operating Officer Ramesh Cidambi.

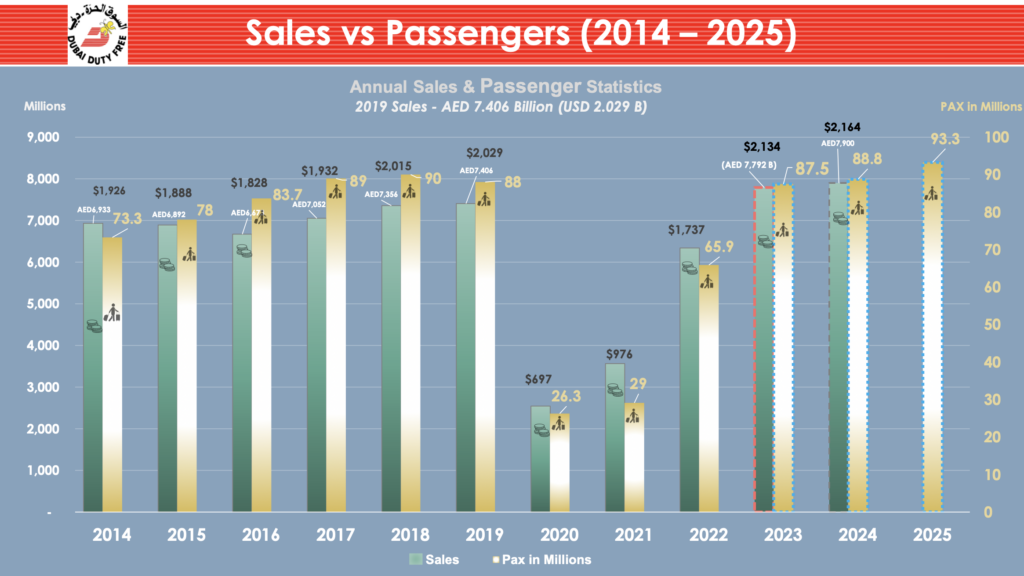

In conversation with The Moodie Davitt Report President Dermot Davitt, Cidambi discussed the company’s glittering 40-year history, its strategic priorities into a fifth decade, key spending and penetration trends plus concerns and challenges. For 2024 the retailer is budgeting a +1.38% rise in sales to US$2.16 billion.

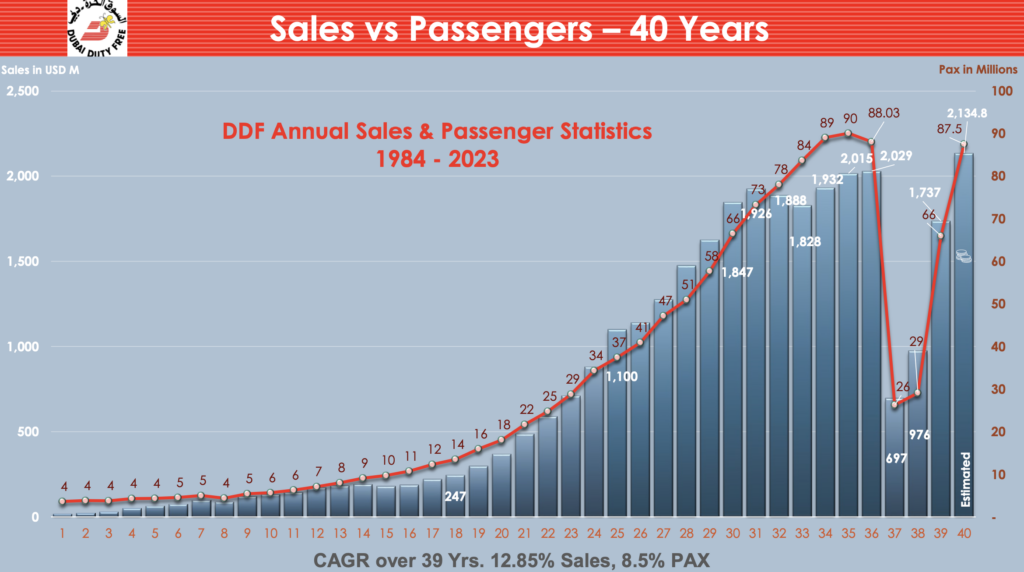

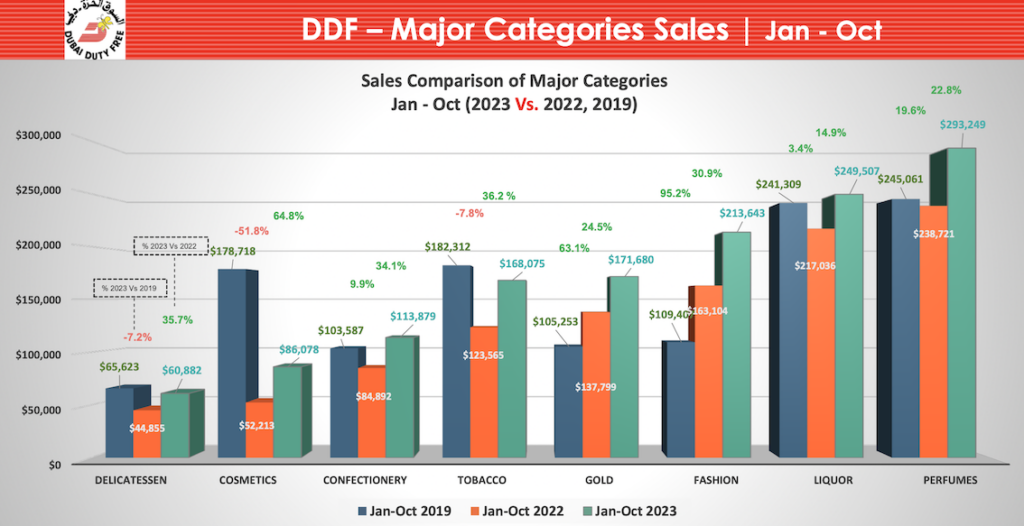

Leaning on a series of data-rich slides, Cidambi outlined the company’s growth trajectory over the past 40 years, from sales of US$20 million in year one to a projected US$2 billion-plus in 2023.

Cidambi said: “The key takeaway from our 40-year performance is that our compound annual sales growth was +12.8%, when passenger traffic growth was +8.5%. So the four percentage points is what we can take credit for. We did better than the passenger numbers, which is good.”

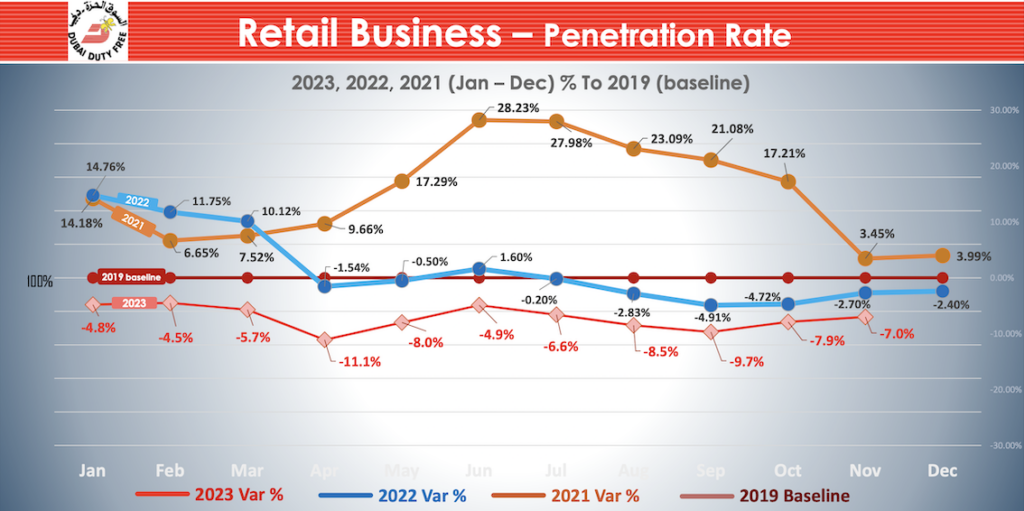

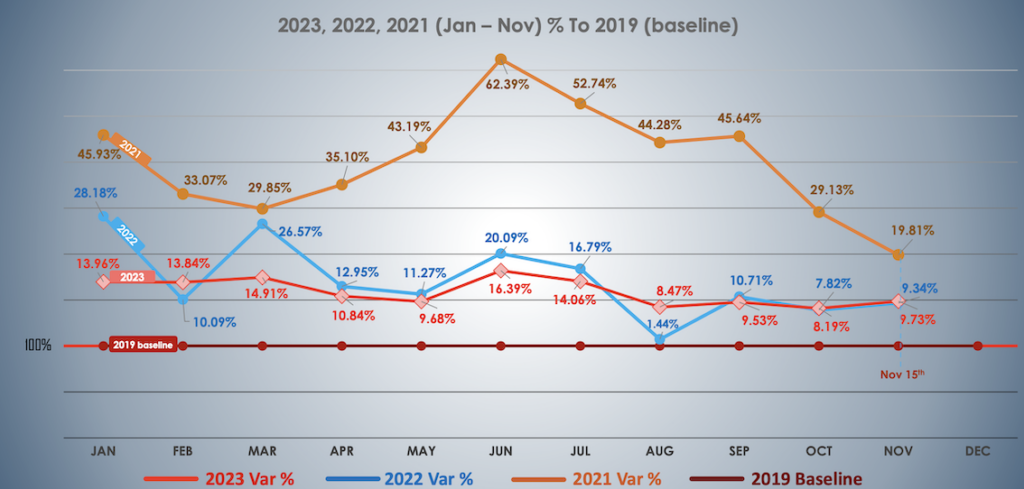

He noted that the 2023 passenger growth was steeper than anticipated. “We began the year around -9% down versus 2019 and it got better through the year. We knew we’d have months comparable to 2019 levels but did not anticipate being this close to 2019 and around 88 million passengers.” Offering further insights into the business, he tracked the latest data for spend and penetration levels. Cidambi said: “Penetration started to drop last year after being elevated in 2021 and has moderated since. Frequency of travel is a factor, and softer economic conditions and inflation play a role too. That’s the case even if spend remains elevated. We improved our fashion offer through the pandemic, opening a series of new outlets, which helps spending overall. My comment on all of this is to watch the moderation of spend and penetration as we move ahead.”

Offering further insights into the business, he tracked the latest data for spend and penetration levels. Cidambi said: “Penetration started to drop last year after being elevated in 2021 and has moderated since. Frequency of travel is a factor, and softer economic conditions and inflation play a role too. That’s the case even if spend remains elevated. We improved our fashion offer through the pandemic, opening a series of new outlets, which helps spending overall. My comment on all of this is to watch the moderation of spend and penetration as we move ahead.” Cidambi commented on the split of spend across locations at Dubai International Airport. “The traffic at the various DXB concourses would be entire airports elsewhere. The business should be examined through the individual locations rather than in aggregate. So for example Concourse B is 37% of our business, and sales are +20% higher now than in 2019, whereas Concourse A is two percentage points lower. Concourse D is higher by +5.8% than 2019. Terminal 2 is +30% higher than 2019 due to the performance of flydubai.

Cidambi commented on the split of spend across locations at Dubai International Airport. “The traffic at the various DXB concourses would be entire airports elsewhere. The business should be examined through the individual locations rather than in aggregate. So for example Concourse B is 37% of our business, and sales are +20% higher now than in 2019, whereas Concourse A is two percentage points lower. Concourse D is higher by +5.8% than 2019. Terminal 2 is +30% higher than 2019 due to the performance of flydubai.

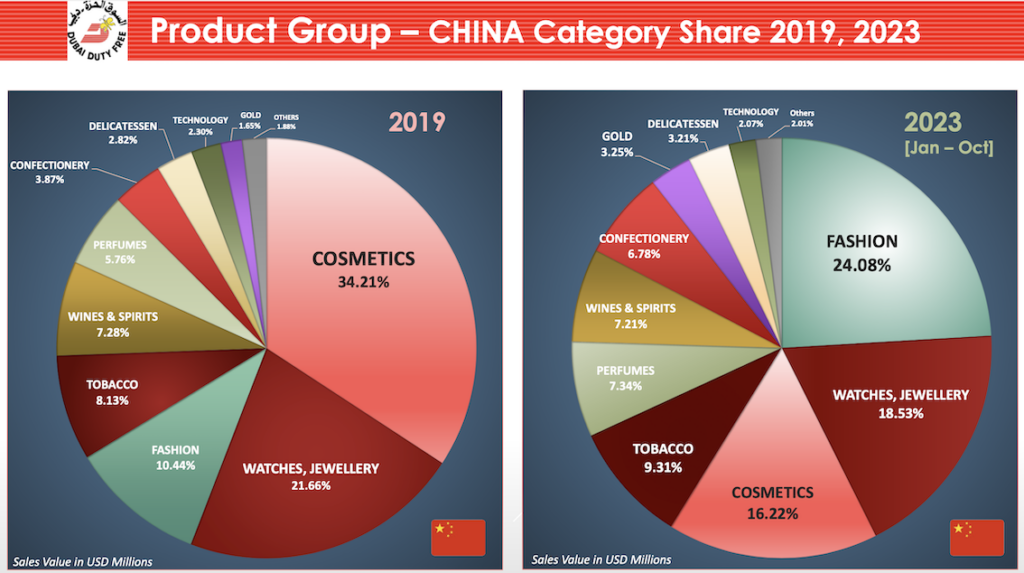

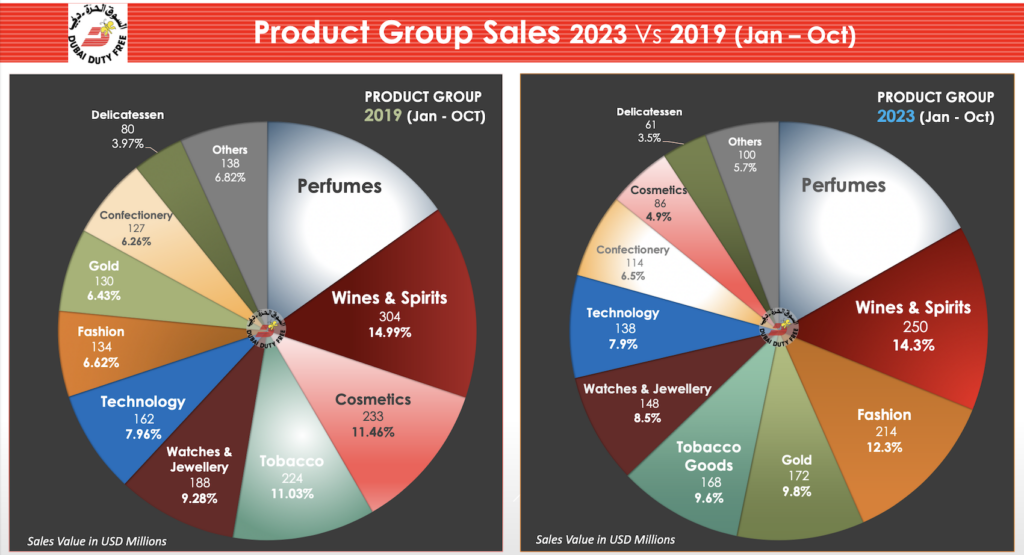

“So the growth is not uniform and that needs understanding if you are a brand owner. By category, the big shift from 2019 to 2023 is the growth of fashion, now 12% of our business after the many boutique openings. Cosmetics has suffered with the drop in Chinese traffic.”

Cidambi also addressed the importance of three key consumer groups: Chinese, Indians and Africans.

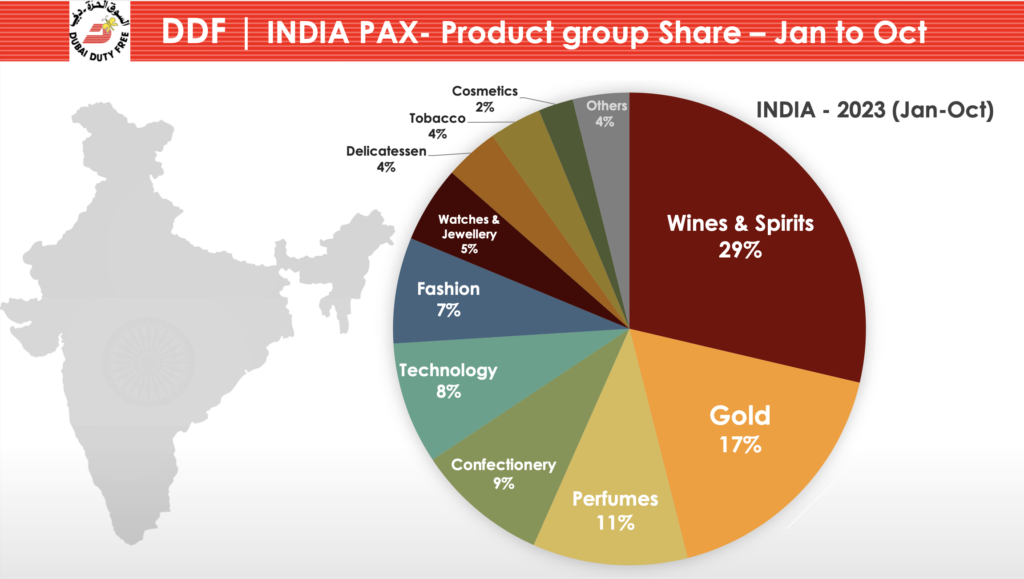

“India will contribute 12.6% of our total business this year,” he said. “Wines & spirits contributes around 30% of that business. We watch it closely especially as the Indian airports are highly aggressive on wines & spirits, and the quality of retail has improved a lot at Indian airports. That adds competition for us. “What we need to do to compete is to continue investing in our offer. We need to get better on retail, on pricing and use our relationship with the brands to differentiate the offer. We have to accept the fact that in wines & spirits there is aggressive competition, and that also in fashion, the major brands are focusing on the domestic market in India.”

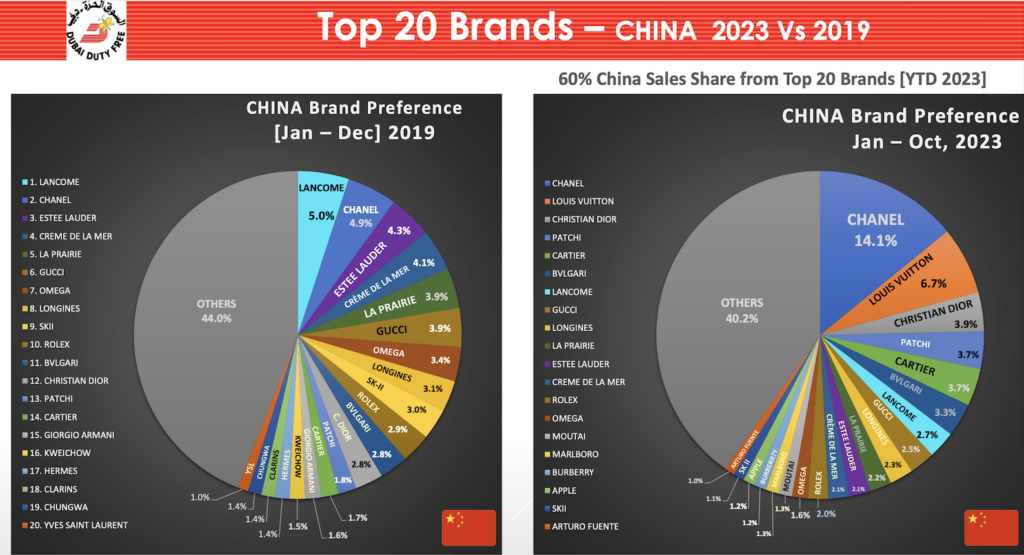

“What we need to do to compete is to continue investing in our offer. We need to get better on retail, on pricing and use our relationship with the brands to differentiate the offer. We have to accept the fact that in wines & spirits there is aggressive competition, and that also in fashion, the major brands are focusing on the domestic market in India.” China also remains key, although that nationality’s share (7.2%) of Dubai Duty Free’s business is currently well down on the 15% it accounted for in 2019. Passenger recovery has outpaced sales growth in 2023, which Cidambi said could be related to competition on beauty both in Hainan and the domestic market in China, plus macroeconomic factors in China.

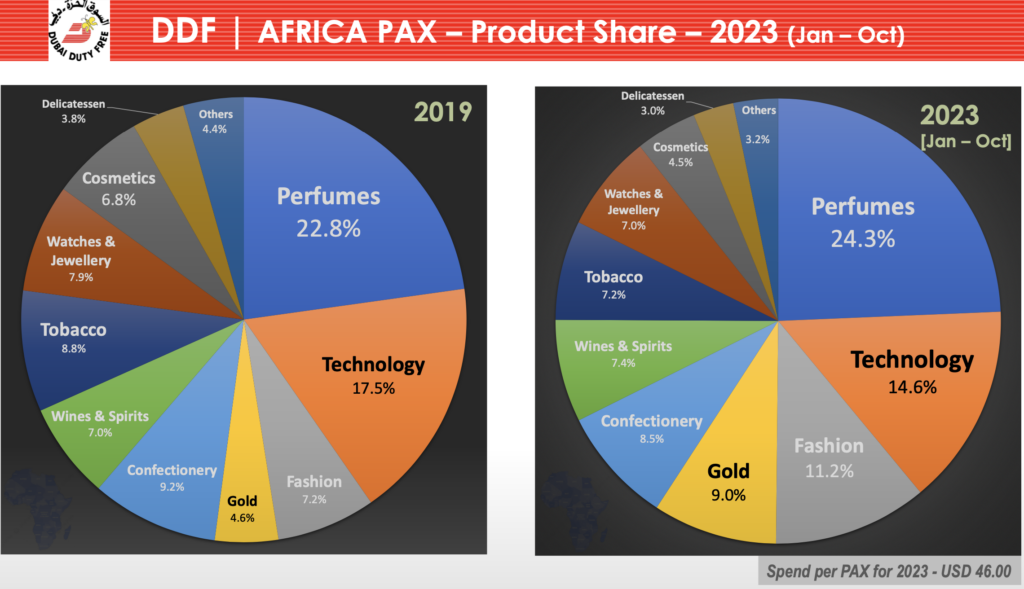

China also remains key, although that nationality’s share (7.2%) of Dubai Duty Free’s business is currently well down on the 15% it accounted for in 2019. Passenger recovery has outpaced sales growth in 2023, which Cidambi said could be related to competition on beauty both in Hainan and the domestic market in China, plus macroeconomic factors in China. Africa represents about 8.9% of Dubai Duty Free’s business, with one quarter accounted for by Egyptian routes. P&C leads the way here, with technology also important.

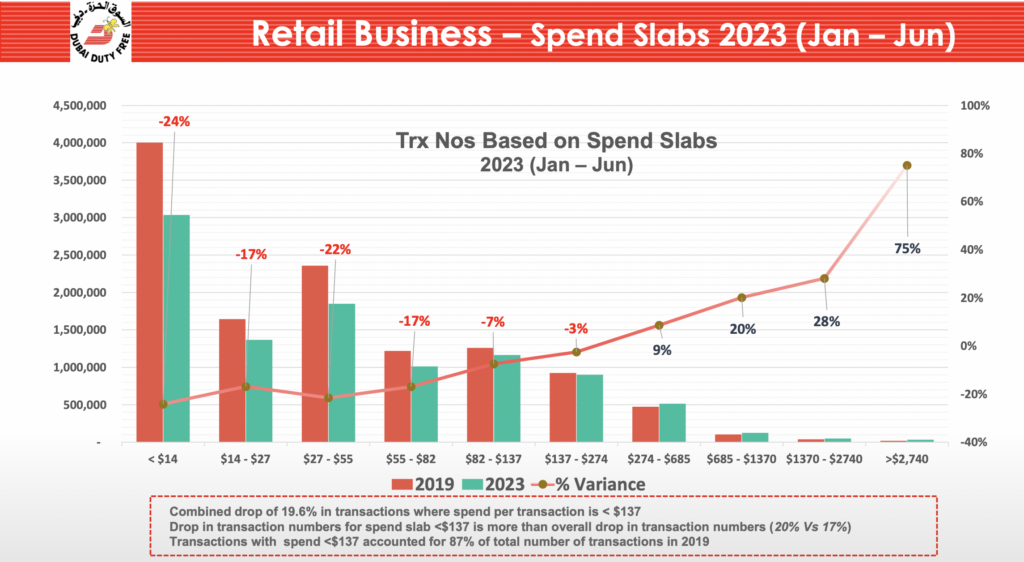

Africa represents about 8.9% of Dubai Duty Free’s business, with one quarter accounted for by Egyptian routes. P&C leads the way here, with technology also important. Addressing what challenges that Dubai Duty Free will face alongside its brand partners into 2024, Cidambi said: “We face several issues. In our core categories, one thing we see is that we are losing spend on items under AED500, even if we are gaining more at the higher end, US$500, US$1,000 and so on. Margins are mostly higher on these lower-priced items, which is a concern for us if sales at these price points is dropping.

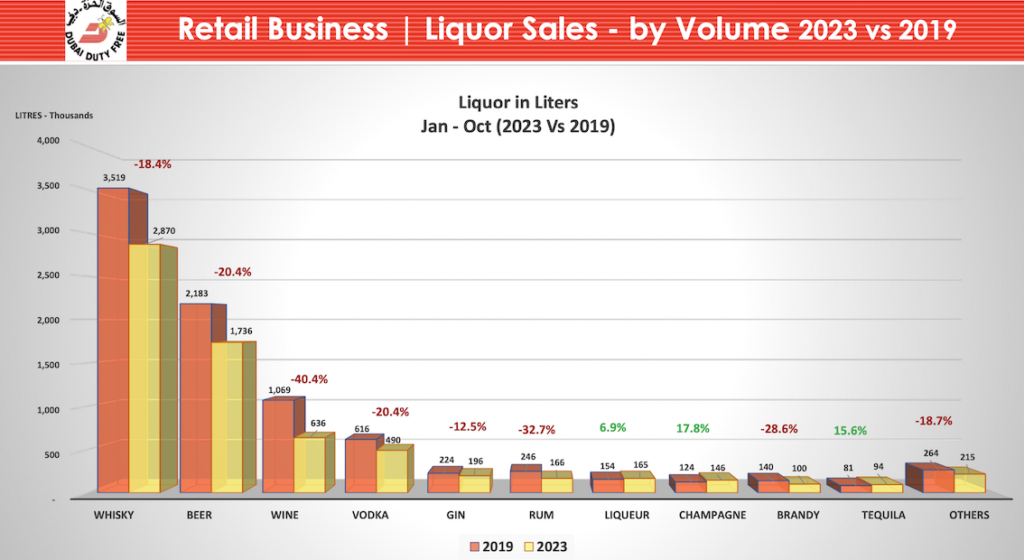

Addressing what challenges that Dubai Duty Free will face alongside its brand partners into 2024, Cidambi said: “We face several issues. In our core categories, one thing we see is that we are losing spend on items under AED500, even if we are gaining more at the higher end, US$500, US$1,000 and so on. Margins are mostly higher on these lower-priced items, which is a concern for us if sales at these price points is dropping. “Another factor is price increases. We analysed prices from 2019 to 2023 and we have seen big disparities, which is a concern if you take onboard inflation, high air fares and the cost of living for our customers. We feel customers have started pushing back. The challenge for brands is to react to that. We think there is a softening. If you take liquor, which grew +3% in value versus 2019, volume has fallen by -20% this year. The only sub-categories to increase are Champagne, tequila and liqueurs.

“Another factor is price increases. We analysed prices from 2019 to 2023 and we have seen big disparities, which is a concern if you take onboard inflation, high air fares and the cost of living for our customers. We feel customers have started pushing back. The challenge for brands is to react to that. We think there is a softening. If you take liquor, which grew +3% in value versus 2019, volume has fallen by -20% this year. The only sub-categories to increase are Champagne, tequila and liqueurs.

“The liquor brands might say that points to a move towards premiumisation but that’s not the whole story. There is enough supply so demand is the challenge. You can see this in the rankings of the brands in 2023 versus 2019.

“For 2024, we want the brands to be realistic about the growth potential. We will see a small rise in passenger traffic next year, and are budgeting just +1.38% in sales growth for the year. So we don’t see big increases across the categories. Caution is advised for 2024.”

On the opening of Abu Dhabi International Airport Terminal A, and its potential to compete with Dubai International, Cidambi said: “We are all well able to compete. It is fantastic news for the region. Anything that improves the experience for passengers in the UAE is good news.”

On the opening of Abu Dhabi International Airport Terminal A, and its potential to compete with Dubai International, Cidambi said: “We are all well able to compete. It is fantastic news for the region. Anything that improves the experience for passengers in the UAE is good news.”

Dubai Duty Free is also investing heavily in stores and processes that are ageing. “The priorities for us are people – what gaps do we need to fill in our organisation? We would like very much to increase the number of Emiratis working in the company. That is number one. “Number two, technology is vital and the landscape is changing fast. The reality is that AI is changing many occupations. Whether it’s purchasing, finance, HR or customer service, AI will have an impact. We need to look at processes and how we need to tweak them. My sense is that 80% of what we do is robust and fit for purpose, but there is that 20% we need to address.

“Number two, technology is vital and the landscape is changing fast. The reality is that AI is changing many occupations. Whether it’s purchasing, finance, HR or customer service, AI will have an impact. We need to look at processes and how we need to tweak them. My sense is that 80% of what we do is robust and fit for purpose, but there is that 20% we need to address.

“The third element is our 40,000sq m of retail space. Of this, 10,000sq m is over eight years old, 20,000sq m is between four and eight years old and it needs a refresh. Next year we’ll renovate the arrivals shops in terminals one, two and three. We are renovating perfumes & cosmetics and Gifts from Dubai in Concourse A next year too. We will do a significant amount of work but we have to accept that we can lose up to 20% of potential sales amid renovation periods.” Assessing the wider vision for the company as it enters a fifth decade, Cidambi said that a key advantage was that Dubai Duty Free remains closely aligned with the government’s goals for aviation infrastructure, allowing it the ability to plan years ahead.

Assessing the wider vision for the company as it enters a fifth decade, Cidambi said that a key advantage was that Dubai Duty Free remains closely aligned with the government’s goals for aviation infrastructure, allowing it the ability to plan years ahead.

“A central part of our success over all these years has been that we are 100% owned by the government. During COVID, this was demonstrated as the airport did not need to have a single conversation with us about MAG, contracts or any of those things. In June 2020 we had 105,000 passengers but we opened as part of our alignment with the airport regardless of the level of business.

“We would like to see that same alignment and ethos going forward. We can improve in certain areas but fundamentally the model works and we continue to argue for this model, and for Dubai Duty Free to continue to be the principal retailer at Dubai Airport.” ✈