GERMANY. Since it was launched in March 2020, Gebr. Heinemann ‘Vision Hub’ GHARAGE has been building and investing in start-ups within travel and retail under the company’s mission ‘to turn travel time into valuable time’ for travellers.

The GHARAGE currently has a portfolio of diverse ventures, including an on-demand airport delivery platform, a web3 community for whisky collectibles and a luxury airport retail experience that aims to appeal to a new generation of travellers.

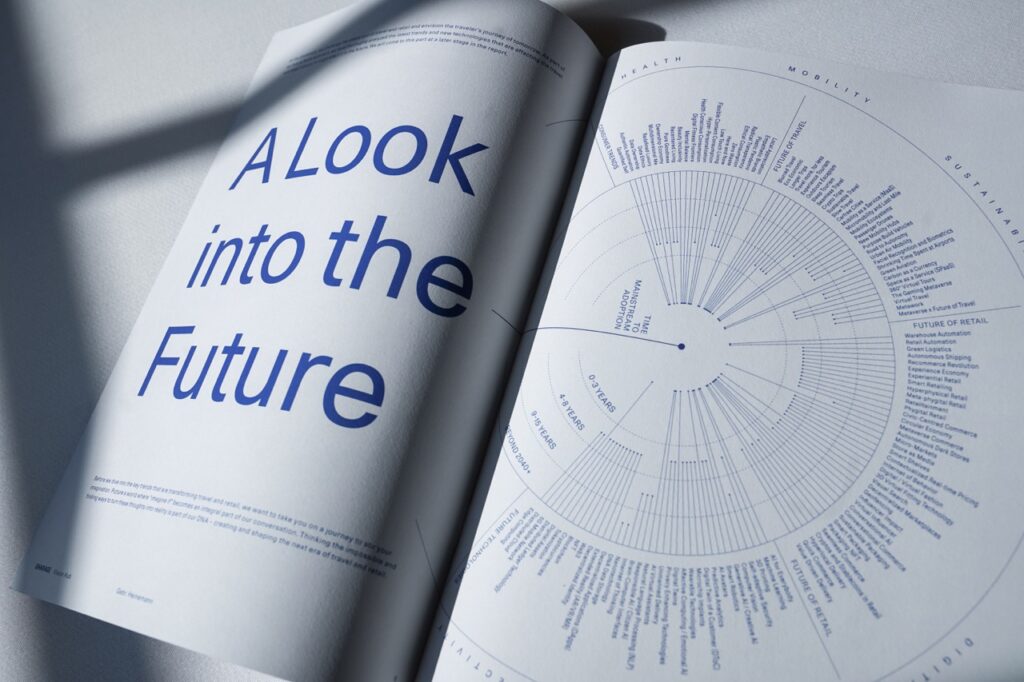

The GHARAGE is also looking into future business models, creating reports such as the newly released ‘Future Fields’ (available to download via the GHARAGE website). This frames some scenarios about how next-generation travel and retail will play out, what trends and disruptive factors will shape the industry, and how innovation can prompt new opportunities.

The GHARAGE Managing Director Lennard Niemann spoke to Dermot Davitt about the work of the ‘Vision Hub’ to date, and about the key messages in the Future Fields report.

Lennard, tell us about the genesis of the GHARAGE and the directions you are moving in with your projects?

Lennard Niemann (right): The GHARAGE was founded in 2019, but began its journey in March 2020, when travel stopped due to the pandemic and our agenda needed to change radically.

Lennard Niemann (right): The GHARAGE was founded in 2019, but began its journey in March 2020, when travel stopped due to the pandemic and our agenda needed to change radically.

At the same time, Gebr. Heinemann also created its vision of turning travel time into valuable time. We as the GHARAGE follow suit by building and investing in start-ups.

To manage all this, we developed our own approach. When it comes to venture building we create strategic, stand-alone ventures that can deliver new business models which can be validated directly with the global traveller. In our investment division we invest into early-stage start-ups and potentially implement those into the Gebr. Heinemann retail ecosystem.

Diversification is key. That means seeking out and targeting new groups and understanding how new technologies can play a part in moving the industry forward. So we look at travel services, such as the Duffle app or innovative retail concepts and new technologies. When it comes to investments we are also looking at consumer goods, like BoutiqueDrinks, to just name one of many examples.

So when searching for these ‘blank spots’ in the industry to build or invest into innovative solutions, we are looking at target groups, technologies and trends. And here, we are really noticing a new pace of acceleration. We see more diversified targets groups, driven by a behavioural component, added to other factors like e.g. demographics.

For technologies this gets even more obvious. Let me give you an example: Two years ago it was all about crypto, which turned last year into the big Metaverse discussion and now AI is talk of the town. We see the ‘hype cycle’ of innovations getting quicker and quicker.

To handle this complexity we record our knowledge to set it into a bigger picture and strategically position ourselves in the role we want to play as a company. It is important to say that reports like ‘Future Fields’ are not about predicting the future, but to help guide us in a period of profound change. And alongside, we hope they can also inspire.

When you entered this channel did you quickly identify opportunities for disruption? What were your early impressions of travel retail as a business?

The beauty of travel retail is that the physical space will keep playing a relevant role when it comes to disruption. Unlike other markets where we have seen digital-only innovations ahead of the curve. Still and obviously digital technologies enable a lot of new services and solutions.

But isn’t it beautiful to see at the same time the return of physical retail in many cities, after the pandemic-driven ecommerce fanciness? In the GHARAGE we believe digital and physical retail are coexisting or will even blend, but the rules have changed. This is the reason why we speak of ‘everywhere-commerce’.

Can you outline the main investments to date, what are the criteria and potentially the big winners in your current ventures?

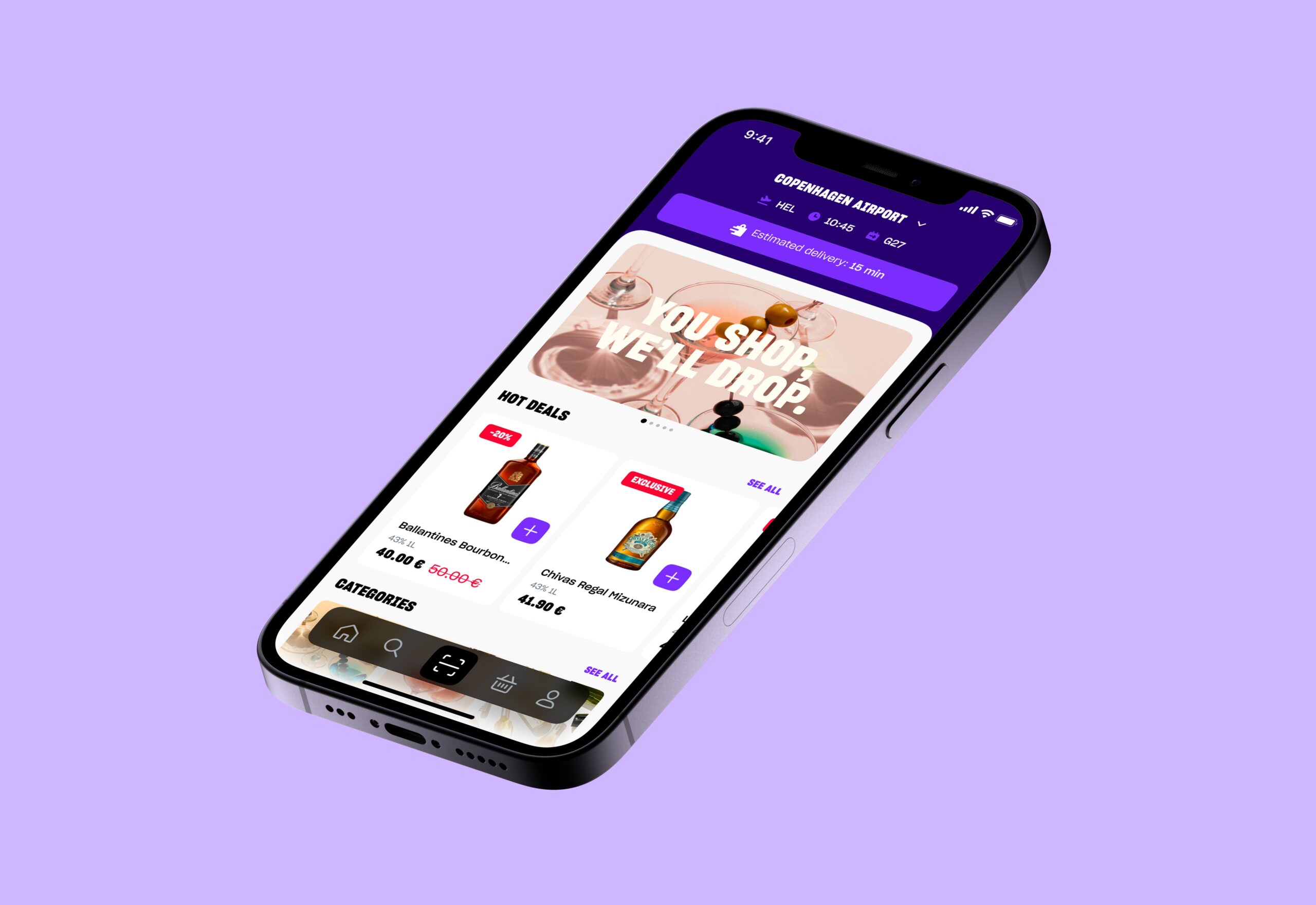

It is probably too early to talk about winners, but I can definitely say that our investment and active support in the digital commerce platform Duffle is something I highly believe has a disrupting element. Simply speaking it is a very consumer-centric product.

To have it live in Copenhagen is a big step, and there we not only have Heinemann as partner but also F&B partners so we offer the assortment of multiple retailers at one touchpoint. We have some very nice delivery methods already live, but imagine adding services and further fulfilment solutions – it has a lot of potential.

Our investments in consumer goods – which we mainly do from our European office in Hamburg – are simple but good examples. Here, innovation is driven by supporting brands and products that are relevant to younger, potentially new target groups who haven’t had access so far to the typical duty free assortment.

And this is really the crucial point. It is the major goal behind finding an offer, finding services, finding products for target groups who are credible enough, and who are potentially underserved today.

With all of these developments, they require a combination of parties in the industry eco-system to succeed. Are you having conversations with the other parties – even competitors – on this? What is your view of say, joint investment and how do you see this changing relationships within the travel retail eco-system?

Collaboration is key. Part of the reason for a lack of disruption within our industry has been a lack of collaboration. We have seen innovation in travel retail, in design or assortment, but we have not seen the same level of transformation as in other industries. I believe that it is the right time to see more collaboration and with the GHARAGE we are open to that.

Tell us a bit more about the Future Fields report and why now is an opportune time to publish this to the wider industry? What are the core messages?

‘Future Field’” is our reflection at a point in time where we are summarising our findings from research and foresight as we look into ventures and start-ups. It’s important to talk about and follow trends as they go live to make them relevant.

Within that process, we have identified and discussed some core areas that we feel will help shape the next era of travel retail: Smart Technologies; Phygital Environments; Personalised Services and Decentralised Solutions. We have already addressed some of these through solutions, whether it is Duffle as a personalised service or Amber Island as a decentralised solution. And we will become more active in others.

When you consider the premise behind these new concepts or dynamics, partly you are talking about travel hubs not just as spaces for people to come and go, but as living, breathing spaces for human and other interaction – what does the airport of the future represent in your view?

At the moment, we see a two-fold set of developments. One is that airports become hyper-efficient, with automation being an increasing element in streamlining the flow of passengers. On the other hand we see airports as the perfect place for memorable experiences and for inspiration. So there are these different dynamics that are the driving forces shaping these places in the future.

With the customer will we see a very different relationship taking shape in future?

I believe this different relationship is happening already. If you ask people why they buy at airports, there are two major replies. One falls under the heading ‘appreciation’ of oneself, of one’s family or friends, having a good day or a bad day. The other is all about ‘sparking new perspectives’ – that they see new products, exclusivity, differentiation. There is a lot of customer engagement behind this as it’s very sensual.

Beyond today, if you factor high-speed internet coming onto aircraft and the overall extension of technology, there is big potential for the whole customer journey to be extended too. Therefore, we aim for new digital touchpoints and we need to consider new trends like for example social commerce, buying or being inspired by (virtual) influencers or engaging with brands in new ways.

You also highlight decentralised solutions – how might these become relevant for the industry’s future?

Decentralised solutions open up radically new solutions to existing pain points. In future, it might change how we trade products, such as plane tickets, and it might evolve how we treat identification and ticketing in its bigger picture. We imagine that the whole identification process could be put on a digital chain, which is a really interesting field.

We have our insights here among others from a start-up in that field called NeoKe. On the other hand, web3 and decentralised solutions will stay relevant for the travel industry after all since it revolutionises the tracking and ownership of physical goods as we currently experience in our venture Amber Island.

Finally, I could imagine that the redefinition of travel will occur through new technologies and that we should keep this in mind, even though it’s super small today.

We have spoken about the current view of GHARAGE and its projects. Do you have a view of where you’d like to take GHARAGE longer term?

The GHARAGE grew up in the pandemic. So the first thing we did was to learn how to change the GHARAGE. I do believe that this shaped this hub and influenced us positively in terms of agility. The GHARAGE will most probably be a constantly changing element.

Change will also be addressed by external factors so I cannot say where we see the GHARAGE a few years from now. But so far the journey has been a very good one. In any case I would love to see the GHARAGE being an inspiration for the industry – pushing for collaboration to turn travel time into valuable time. ✈