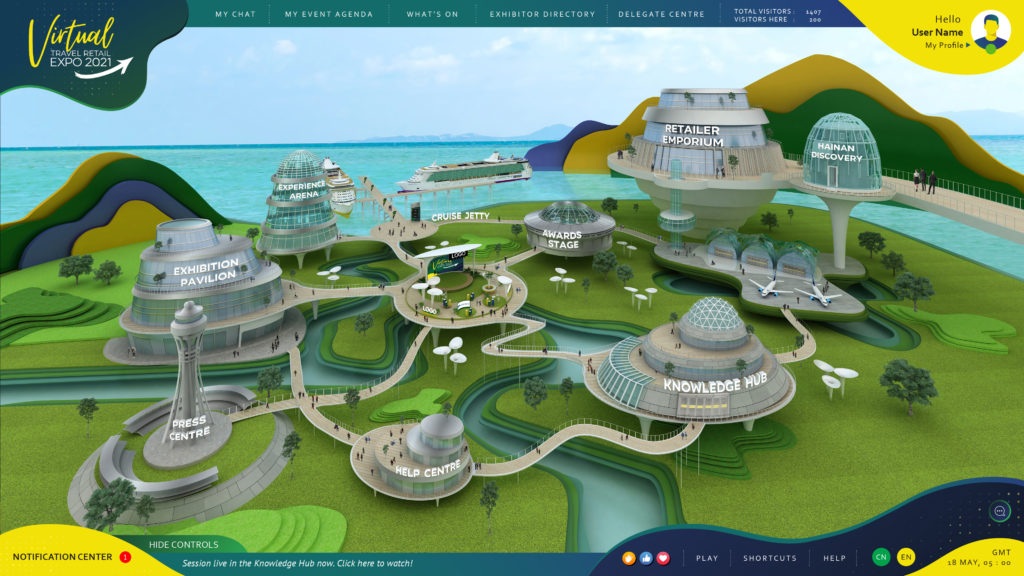

Introduction: In a major development for Hainan’s burgeoning offshore duty free channel, revealed by The Moodie Davitt Report in April, Star Brands Asia and Bluebell Group announced the launch of Star Brands Travel Retail, a venture designed to unlock the potential for global brands entering Asia travel retail’s modern-day hotspot.

Introduction: In a major development for Hainan’s burgeoning offshore duty free channel, revealed by The Moodie Davitt Report in April, Star Brands Asia and Bluebell Group announced the launch of Star Brands Travel Retail, a venture designed to unlock the potential for global brands entering Asia travel retail’s modern-day hotspot.

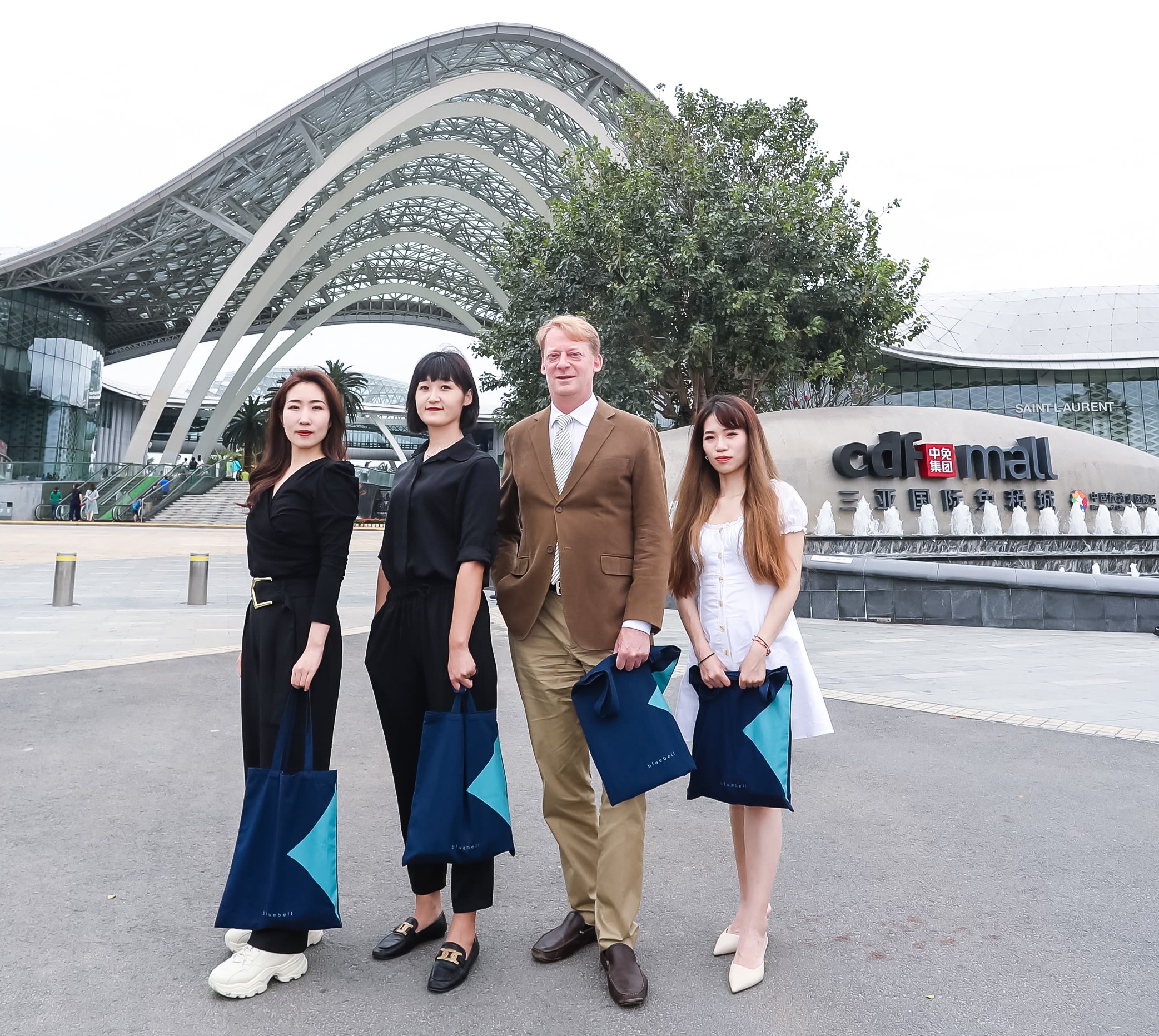

Star Brands Asia, headed by beauty products specialist Rob Robertson, was established in 2009 with a mission to become China’s beauty expert partner for global brands. Through Star Brands Travel Retail, works closely with Bluebell Group, which describes itself as Asia’s leading omni brand curator. Star Brands Asia has been Bluebell Group’s strategic partner in China for the beauty sector since 2018.

The partnership offers a range of operations and management services for brands already present or seeking to enter Hainan’s travel retail market.

With digital content and commerce integral to brand and retailer success in the unique Hainan commercial ecosystem, Starbrands Travel Retail Brand Manager Maya Wang plays a key role in helping sector stakeholders seize the opportunities and avoid the often expensive traps. She spoke to The Moodie Davitt Report Founder & Chairman Martin Moodie about how brands can best leverage the power and reach of digital.

The Moodie Davitt Report: Maya, when we last spoke, you talked about the critical importance of digital marketing and communication to Hainan’s offshore duty free sector. Why is it so important and how is Star Brands Travel Retail leveraging the opportunity?

Maya Wang: One important difference between Hainan travel retail and the traditional travel retail channel is that it allows for flexible ‘repurchase’ with the 180 days offshore online purchase mechanism.

Therefore, how to fully engage existing consumers and potential consumers throughout the six-month period so that they can use up their yearly quota after leaving the island is a gold mine waiting to be explored by brands. Digital amplification is one of the most efficient approaches to unlock this opportunity.

Star Brands Travel Retail goes beyond services of pure sales management. Having both social media and influencer marketing teams in-house gives us the ability to provide professional planning & execution, as well as provide insights for brands in either Hainan or within the Mainland Chinese market.

Meanwhile, our profound experience in ecommerce and offline retail enables our team to quickly react to potential changes in Hainan travel retail such as upgrading the current duty free operator (DFO) social accounts or WeChat stores to content ecommerce or creating a more efficient livestreaming ecosystem etc.

Where do you see the key opportunities and pitfalls?

Let’s start with the opportunities.

Online-Offline Integration: O2O marketing is an old topic but it will multiply a brand’s traffic to the travel retail store, as well as building awareness online, which is to be implemented with the right marketing approaches. For example, the Douyin regional contest etc.

CRM system of DFOs: The impact of digital actions will be improved if brands can cooperate with DFOs and leverage their large consumer databases to generate consolidated digital campaigns aiming accurately at target consumers

Livestream actions to build awareness and convert to sales: Though the performance of the current livestream shows by DFOs can be improved, it still shows the potential as a major tool to recruit traffic and convert to sales.

Now to the pitfalls.

Homogeneous content: Current digital content building by DFOs focuses mainly on the price gap and discounts, which is fine as this is what consumers look for. However, focusing purely on pricing will not bring long-lasting attraction to this channel from consumers, especially the younger generation who nowadays tend to seek for ‘meaning’ behind a brand.

Absence of local management teams: Many brands have their travel retail teams located outside China and work with marketing agencies on a project base, which impairs the quality of marketing activations.

Chinese social media is an extraordinary, ever-evolving and unique ecosystem but it’s also hugely complex. How do you advise brands when it comes to investing in social media?

They should build a sound communication strategy for the travel retail social media elevation that is in line with the brand’s national marketing message But importantly, the tone of voice and content should be more specifically tailored to their TR audience.

Look more at indicators which are related to building brand loyalty, such as rate of repeated mentions of the brand per KOL, relevancy of keywords mentioned in comments etc., rather than only focusing on the amount of exposure, viewership and likes.

There is always the need for a reliable local team to manage the social media planning, execution and tracking of the brand, who are closer to the market and are equipped with abundant KOL and media resources.

How do you best assess return on investment?

If it’s a marketing activity linked to sales, e.g. livestream or an inserted product link in the purchased KOL content, then the return on investment will be measured based on the actual sales generated.

If it’s an awareness building campaign, the return will be assessed on multiple indicators. Those include

- The overall growth in brand search index and social media awareness index.

- Indicators related to efficacy of marketing message conveyed such as the ‘brand keyword cloud’;

- And indicators related to content quality and individual KOL performance, such as engagement per follower (vs previous comparable post) etc.

You mentioned KOLs. They have become an integral element of the landscape. Again, what are the key challenges and desired outcomes here?

In terms of desired outcomes, for established big brands the goal is to create new excitement around the already well-known and established brand image/story through KOLs and enforce its dominant impact on consumers.

For uprising niche brands, the goal is to create curiosity and excitement to therefore drive sales and pave the way for the brand’s next step in business development in the Chinese market.

The key challenges include the absence of consolidated KOL campaign planning. Most of the campaigns we see in the Hainan market are still just ‘independent or ad hoc’ activations (e.g. a KOL store visit vlog, PR event etc.), without integrated efforts to maximize the impact.

You told me before that you would not be surprised to see a comprehensive digital market ecosystem evolve in Hainan travel retail. How do you see that ecosystem taking shape and how does Star Brands Travel Retail plan to play its role to help brands within it?

I think it might be a content ecommerce ecosystem built around the offshore solutions and the future residential duty free solutions [the long-awaited residential duty free regulations are expected to be announced soon -Ed].

In this ecosystem, User-Generated Content will lead the way to build the heat and convert to sales using tools such as livestream, fission links, and of course KOLs, which are most likely to be leveraged to complete the consumer journey.

If this to take place, brands will need partners who are experienced in both digital marketing and ecommerce operations. These are both strengths Star Brands Travel Retail possesses through its years of building successful brands in the Mainland market.

Footnote: Every fortnight The Moodie Davitt Report publishes Hainan Curated, in association with Foreo, a selection of all recent stories from the offshore duty free sector in Hainan province. Click here to subscribe free of charge and to view all back issues.