GERMANY. In late April, Gebr. Heinemann senior management welcomed media guests to its annual press conference in Hamburg. There it revealed its annual results – turnover climbed +25% to €3.6 billion in 2023 – as senior management presented a series of telling insights into the shifting dynamics in travel retail.

Whereas a year earlier the focus was on post-pandemic resilience, management of risk and Heinemann’s contractual ‘red lines’ with landlords, in 2024 Co-CEOs Max Heinemann and Raoul Spanger homed in on Heinemann’s status today as a group of companies, its sustainability goals, and creating change and adding value to the industry.

In this exclusive interview timed to coincide with TFWA World Exhibition (the full interview can be accessed here, turn to page 202), Heinemann and Spanger return to some of those key themes and discuss performance, prospects and the power of travel retail within the wider aviation landscape.

To begin, Spanger offers an update on trading almost nine months into the year, saying sales are tracking budget targets after a strong start to 2024.

“We are satisfied and the performance so far is all the more remarkable considering the circumstances and challenges the entire industry is currently facing,” he says. “Several countries have to deal with economic challenges, including high inflation or currency devaluation. In addition, we are concerned about the increasing geopolitical tensions and the possible impact on the safety of our employees.

“Despite these challenges, we see positive developments across different regions and sales channels within the Heinemann Group. For example the Middle East & Africa (MEA) region continues its strong performance, [through] our Turkish joint ventures Unifree Duty Free and ATÜ Duty Free.

“In addition, the business of our subsidiary in Israel also developed extremely positively in the first half of the year despite the conflict in the region. And the outlook for this region is also promising as we took over operations at Jeddah Airport in August together with our partners from Jordan (Jordanian Duty Free Shops) and Saudi Arabia (Astra).”

The Jeddah Duty Free-branded stores will come fully to life across 7,000sq m once construction ends in early 2025, with an official opening expected in Q2.

A further recent highlight cited by Spanger is the expanded cruise portfolio at wholly owned subsidiary Heinemann Americas. That Miami-based business celebrated its tenth anniversary this year amid a period of growth that included a debut on each of Royal Caribbean vessels Icon of the Seas and Utopia of the Seas, with more to come.

“This is a great example of how strong partnerships can flourish and also plays into our diversification strategy,” he notes.

On how the year might close, Spanger is upbeat, saying that the company did well in the first half and is maintaining a “successful growth path”.

“Given that we have very promising projects in the pipeline, we are very optimistic for the rest of 2024 and also for 2025.”

Spanger acknowledges however that the consumer spending picture is mixed and depends both on macro-economic conditions and the traveller mix location by location.

“We know that Chinese travellers are not coming back as they did in previous times – in total number as well as in spend per passenger. Given this fact, we are satisfied with what we see, for example across our locations in central Europe.

“In other markets, especially in the MEA region, we see positive development in H1 2024 compared to previous years. This is also driven by a variety of factors. Several locations across this region benefit from more passengers with higher purchasing power. And this group is growing, which keeps us optimistic and supports us in putting an emphasis on further premiumisation in our assortment. Of course, we also see that core duty-free will remain key – especially where the share of travellers with high spending power is lower.”

The premiumisation drive is most visible in the €1 billion-plus sales operation at Istanbul Airport, now the largest single retail business for the group. Here, fashion & accessories represents a large part of the business, with Russians last year and Middle East visitors this year contributing strongly.

Diversification drive

2023 was a year in which Gebr. Heinemann made its biggest-ever investments outside the group – investments that are being consolidated in 2024.

These included the purchase of the remaining 50% of JR Duty Free in Israel from the Danos family, the move to acquire border shop business Travel Free Czech in full (adding to its existing 50% stake) and acquisition of a 50% stake in Nobilis Group, a leading distributor in the luxury/niche, prestige and lifestyle fragrances segment across the German-speaking region in Europe.

These allow the company to position itself, more than ever, as a global group, with expanded partnerships and strategic moves into new areas.

Spanger says this is complemented by diversification across channels (such as distribution) as well as across regions, notably in MEA.

“We are convinced that we have the right setup in place to leverage further growth opportunities in the MEA region. Business initiatives for this region are now handled by a strong team we set up in Dubai, where many existing and potential clients and partners have their offices. This year we are making key investments for a successful market entry into Saudi Arabia – a very promising market.

“We are also investing into strengthening our supply chain for this region. But we also continue to invest in other existing partnerships and locations to make sure we are always delivering state-of-the-art shopping experiences to travellers.”

The focus on MEA growth includes the extensive Heinemann business in Africa. Spanger says: “We have successfully expanded our distribution business there and are open to extend our business further in both pillars – retail and distribution. Here also, strong and trustful partnerships will play a key role.”

Summing up the regional and channel priorities, he adds: “We are working hard to make our new market entries in Saudi Arabia and India [the latter following a tender win at Noida International Airport -Ed] a great success.

“The border shop channel is something we will also keep investing in and will present something new in 2025.”

Adding value to the travel experience

A key mission that Heinemann has articulated in recent years is to become a ‘valuable travel companion’ in its daily business. That means playing its part in lifting the airport experience, introducing unexpected elements of theatre and surprise, and ensuring more and better engagement with travellers, including through ‘physical first, digitally influenced’ activity.

Addressing the levers that can be engaged to power spending, Max Heinemann says: “We always aim to create unforgettable shopping experiences and we are convinced that we need to create added value for travellers. This can be achieved in different ways across sales channels and locations.

“We will continue to drive premiumisation further across all product categories as this resonates well at certain locations and with a certain group of travellers.

“Another focus is on identifying new trends and innovations across categories and bringing them to the shop floor to always surprise travellers. This includes for example ‘Test & Learn’ pilot projects for new brands entering travel retail for the first time.

“Beyond that, we are convinced that people make the difference. Our staff on the shop floor are many times the deciding factor in whether a traveller will have a positive memory of their shopping experience.”

Pulling together

Gebr. Heinemann has been a vocal proponent of industry partnerships that create not only win-win outcomes commercially, but that encourage travellers to view our sector through a more positive lens.

Assessing the sector’s ability to pull together, Max Heinemann says: “A good partnership is based on trust and close collaboration on eye-level. In the best-case scenario, the partners share a vision and an opinion on the way to achieve it; they share the benefits, but also the risks.

“We think that collaboration and partnership are key to jointly tackling the challenges that the aviation ecosystem especially is facing – for example, when it comes to a sustainable transformation or to labour shortages, which we face in several countries.

“But partnerships not only help to overcome hurdles but provide also great chances to further improve the traveller journey and the whole travel experience.”

Heinemann makes the case that only together can airports, retailers, food & beverage concessionaires and airlines create the best possible travel experience.

“To travellers, their trip is a product and an experience as a whole, from the moment of making a booking to arriving at their destination. Everything that happens on the way has a direct impact on how the whole trip will be remembered.”

Achieving closer working partnerships requires practical solutions and that means “more than tests and pilot projects”. Heinemann says: “We need to overcome the ‘silo’ mentality and be more open to learn from each other.”

One key aspect he cites is data-sharing, from which all partners in the industry could benefit.

“Processes could become way more efficient as planning for required staff would become more easy and precise and passenger flows would be easier to predict and handle. And travellers would be way more relaxed, which also impacts their willingness to spend time and to consume at the airport.”

Deeper trust and collaboration are also factors in developing the best partnerships with brands, he says.

“The next level is to develop joint ideas and visions in partnership, for example creating unique offers or experiences for travellers – but also joint business plans to achieve joint sustainability targets.

“Travel retail is and will remain a great opportunity for brands to present themselves to an international audience. This is true for well-established and globally known brands as well as for newcomers.

“We are very proud of both kind of partnerships. Some of our brand partnerships have an outstanding heritage and last for decades and in some cases even over a century. But we are also proud of our collaboration with several rising and new brands and how we have helped them to enter the travel retail market.

“In both cases, it is important that all parties are committed to the partnership and that there is a willingness to invest and to try out new things. This is key to keep on providing spectacular assortments and memorable shopping experiences to travellers.”

Co-creating change

Heinemann has for several years espoused the notion of ‘co-creating change’ in the industry – even alongside traditional competitors.

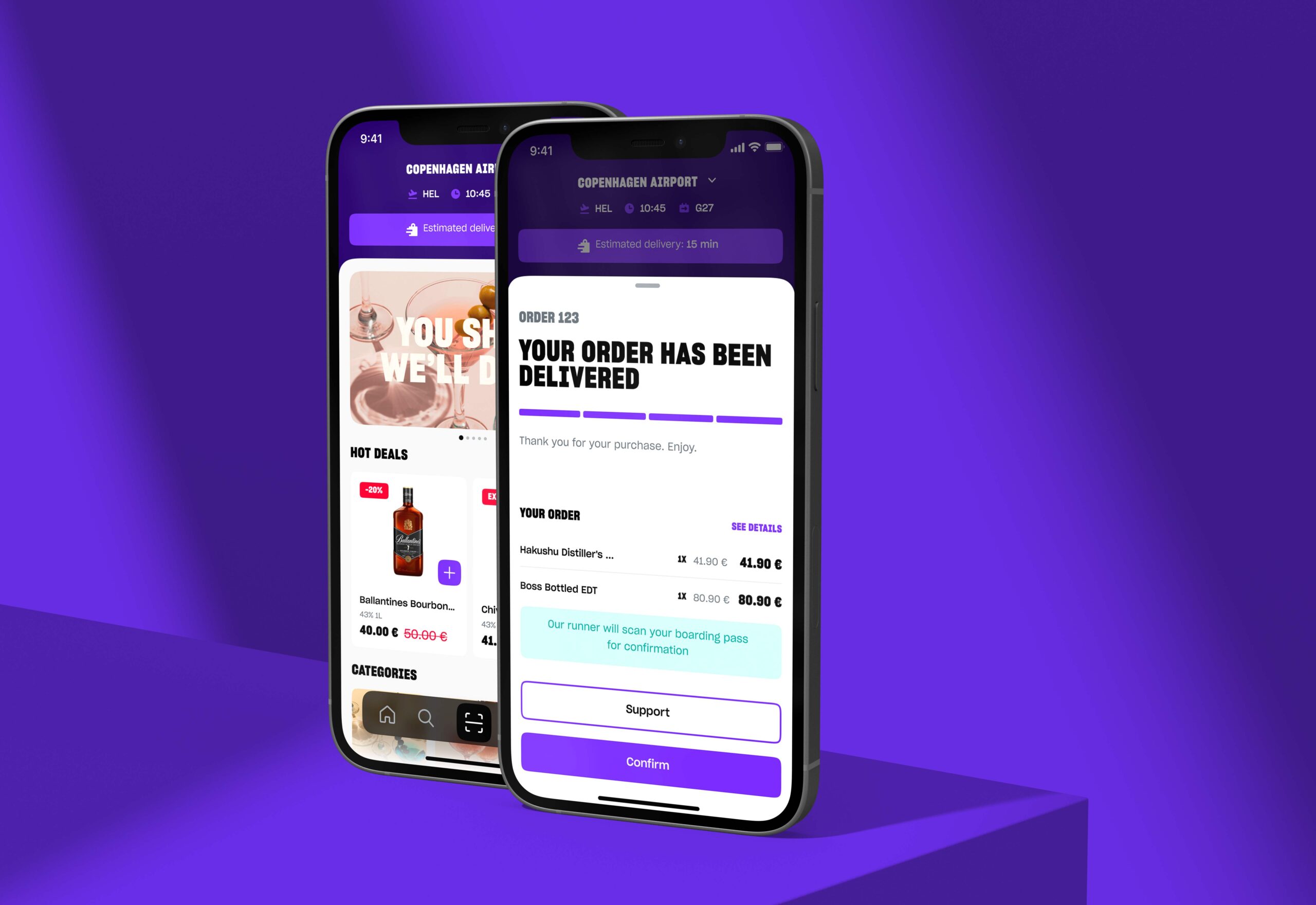

Its vision hub GHARAGE aims to foster innovation and challenge the status quo, and in an important signal last year, Avolta joined Heinemann (via GHARAGE Ventures) as an investor in the Duffle start-up, whose mission is to digitise the travel retail and F&B sector at airports.

It is one of a number of ways in which the Hamburg-based company is intent on influencing the direction of travel retail. Another is by being a progressive force not just within but also beyond the industry community, at representative level.

Max Heinemann says: “Our engagement in trade associations is a key element to drive dialogue within the industry, but also with political stakeholders and the civil society. We take an active role in travel retail industry associations such as the European Travel Retail Confederation and other regional and national associations of our industry. Our engagement is not only limited to financial investments in these memberships. In many cases we also take active roles on the boards of the respective organisations.

“As we see ourselves as part of the overall aviation industry, we are also taking the responsibility to foster dialogue with the wider industry community and other stakeholders via memberships in aviation industry associations such as Airports Council International or the German Aviation Association.”

For Heinemann, it is about the big picture and adding value both behind closed doors with regulators but also on a wider public stage where the voice of travel retail should be heard loud and clear.

“I am convinced that this exchange within the wider industry and beyond with political stakeholders and the civil society is needed if we want to overcome the challenges of our industry and make it future-proof,” he concludes. ✈

*This article first appeared in The Moodie Davitt Magazin; click here for access (page 202).