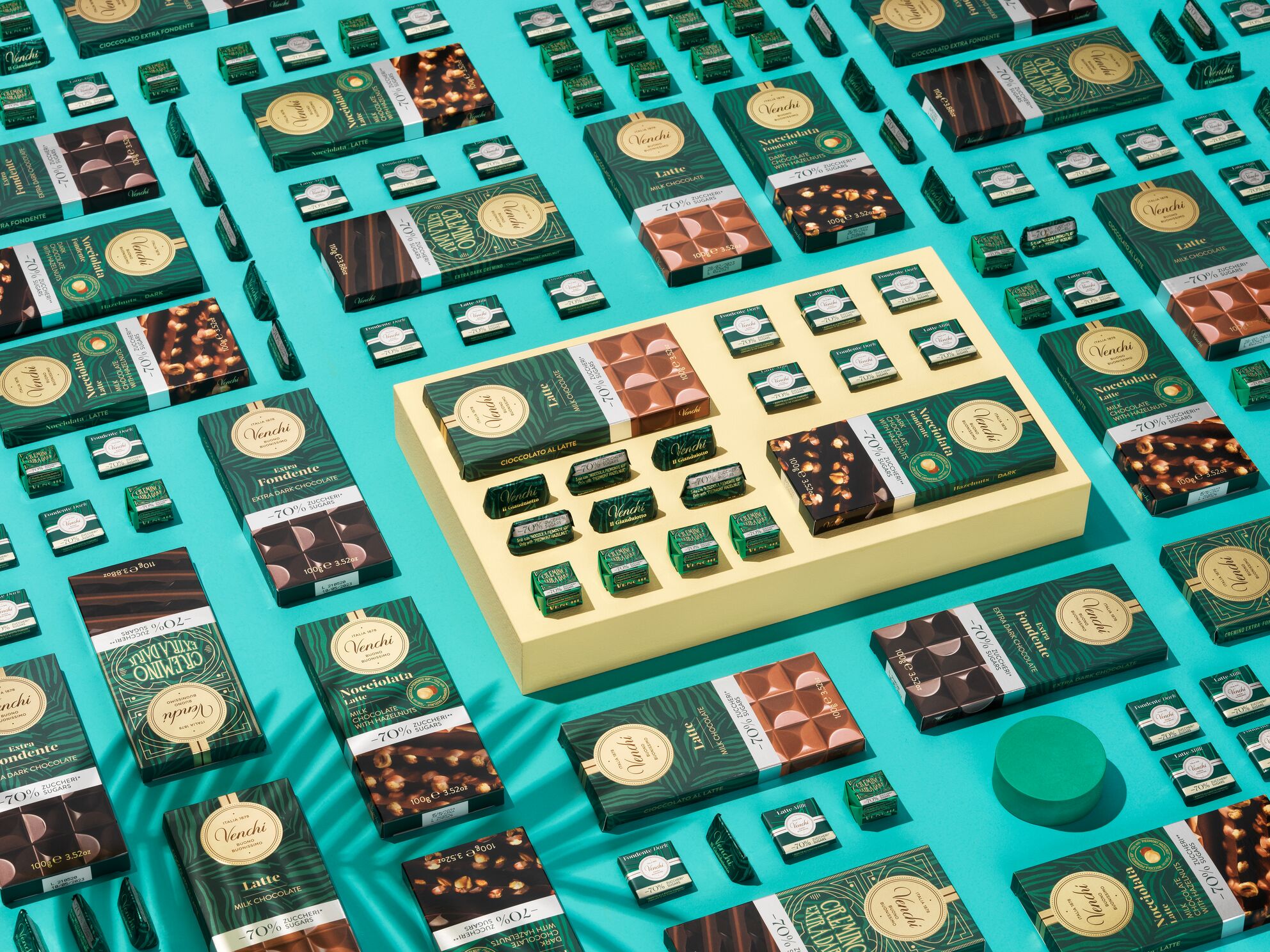

Introduction: Venchi is one of the oldest and most venerable names in the world of fine chocolate. The company’s story started back in 1878 when a chocolate-loving 20-year-old from Turin invested all his savings in two bronze cauldrons and began to experiment with chocolate making in his apartment. Within a few years the young entrepreneur was running Venchi Spa, dubbed ‘the most elegant chocolate shop in Piedmont’.

Since a rocky period in the 1990s when it went into bankruptcy, Venchi – privately held by Italian and French investors and management – has been resurgent. Led by President and CEO Daniele Ferrero, Venchi can be found today in over 70 countries, its colourful, tantalising products embracing some 350+ chocolate recipes and 90 gelato flavours, posting revenues in excess of €100 million in pre-pandemic 2019.

That global strength includes Asia Pacific where regional Managing Director Marco Galimberti leads Venchi’s direct operations in Mainland China, Hong Kong, Macau and Taiwan and indirect operations in Singapore, Malaysia and Indonesia, his remit encompassing a growing travel retail presence. Galimberti’s 400+strong team, operating out of three central offices in Hong Kong, Beijing and Shanghai, is accountable for over 50 stores and generates well over €30 million in turnover. The Moodie Davitt Report Chairman Martin Moodie caught up with him at Venchi regional headquarters in Hong Kong.

Martin Moodie: Let’s begin with travel retail Marco. How well is Venchi established in the channel?

Marco Galimberti: We started in our home market of Italy at Fiumicino Leonardo da Vinci International Airport in Rome with our traditional retail business model, selling chocolate and gelato. Today we have over 10 stores in Italian airports. We also have many stores across every major train station in Italy.

Our dream was to bring this strong identity in Italian travel retail outside of Italy. The domestic landlords in Japan, Hong Kong and China knew us from when they travelled to Italy and saw our airport stores.

I started looking after the Hong Kong territory in 2016 and relocated here in 2017. It was the place in Asia which had the highest concentration of Venchi stores in a single city. I came with the mandate of developing the business across China, where we had opened our first mainland store in Wuqing back in 2011.

We had started to prepare a product assortment and a pricing strategy for travel retail in Asia from looking at the big premium confectionery players, such as Neuhaus and Godiva, which I am very open and humble in saying are still way ahead of us in distribution terms in travel retail.

We had two successful TFWA events in Singapore, where we were able to get listings with China Duty Free Group, Lagardère Travel Retail, Dufry, Ever Rich in Taiwan and Shinsegae Duty Free in Korea.

We competed for many tenders at Hong Kong International Airport and I’m sorry to say, we lost all of them. The last one was in 2019; at that time I was pretty sad because I was really counting on securing a Hong Kong Airport location. Then unfortunately, COVID came.

We said we have to go for a store in Asian airport retail and got very good advice talking to friends in the industry like Dufry and Lagardère, which is a very strong operator in the mainland China domestic terminals.

We looked at Hongqiao Airport in Shanghai, bid for the location and won. The store is in the corner of a new shopping aisle at the airport; it’s beautiful. Hongqiao is a great business and domestic airport, and the domestic travel retail business in China has really restarted. It’s the first chocolate store serving freshly-made gelato in a Mainland China airport to date.

How has the store fared commercially?

The sales there have been completely beyond my expectations. I was expecting to turn over US$100,000 a month and we started running at double that figure, which is great for a 76sq m store. Usually [in our domestic stores] in China, we have a 50% gelato and 50% chocolate mix. In Hongqiao Airport we are doing 80% chocolate and 20% gelato.

There is a massive opportunity in the gifting business. I think our brand at the moment can fit well in at least seven to eight domestic terminals in China, for example in places such as Beijing, Guangzhou, Shenzhen, Chengdu and Nanjing. If the opportunities to tender come up we would like to explore them, either direct or maybe in partnership with some operators.

I want to seize this opportunity of COVID to get as many stores as we can in the airports all over Asia.

Traditionally in Italy, Venchi has been a self-operator, but here you’re clearly more flexible?

We are flexible on the model, provided that it’s our business. The model that works well is a management contract where the operator can run the store and we can build it and repay the capex and so on, because our capex is extremely intense. Our stores are very rich in the fit-out – they are very far away from being cheap!

That is always an issue for traditionally stand-alone brands when partnering isn’t it? You have a very hard-won brand image – put it in the wrong hands and it’s very easily lost.

Yes, especially on the gelato. You can see if the gelato is well-executed and equally if it’s badly executed. If it’s not properly done, it’s not attractive at all. Our gelato is very pure with no chemicals added. And therefore it’s not so flashy with the colours and so on. It’s very mild because it’s very natural. So if it’s not well-executed, it’s going to look very sad. That’s a key issue.

Yes, especially on the gelato. You can see if the gelato is well-executed and equally if it’s badly executed. If it’s not properly done, it’s not attractive at all. Our gelato is very pure with no chemicals added. And therefore it’s not so flashy with the colours and so on. It’s very mild because it’s very natural. So if it’s not well-executed, it’s going to look very sad. That’s a key issue.

So, yes, we’re flexible on the model. I think our future development will see us becoming both a strong travel retail operator and a mono-brand distributor.

What about wider local market distribution?

We don’t want to go into supermarkets – we really want to keep the brand equity. We want to continue in the development of the retail stores, with 25% of our sales coming from travel retail in the future.

In Italy, it’s already like that, because out of 47 stores, more than 15 are in the travel retail environment. To achieve that in Asia will take time, but we have to be in airports and we have to be the operators. We need to keep continuously developing our range for B2B travel retail and our own stores.

How is Venchi structured on the Mainland, both for travel retail and the local market?

We have a management team of about 40, based across Shanghai and Beijing. To date we have 33 stores in Mainland China, 14 in Hong Kong, three in Taiwan and one in Macau, so 50 in total across Greater China, directly managed.

I suppose airports play a dual role for your brand – besides generating big volumes based on heavy footfall they are also a great showcase.

Absolutely, yes. I think I had been underestimating the power of the domestic airports in Mainland China for years until I really started travelling domestically there. As a foreigner, when I was going there in 2015 and 2016, I was arriving to Pudong International and the traffic volumes were not that exciting. But then you go to Hongqiao Terminal Two, and you realise that there is a whole world of domestic travelling in Mainland China.

Our product category is undersupplied in airports in China. I think there is a lot of potential for last-minute gifting for business meetings, for example.

Beijing Daxing would be a great airport for Venchi, I think.

Yes. Unfortunately they tendered the spaces more than two years ago and at that time we were not ready.

It’s always a matter of timing. Hongqiao came at the right time, at the right moment, and in the right location, and it was impossible to say no. And we bid to win. I keep chatting with the GM of Hongqiao and he’s super happy with us, and they’re giving great support.

With airports, from the day you open you can expect the same sales day after day. There is really no opening effect, because the travellers change – so it’s newness for everybody.

So you’ve only touched the surface in terms of Venchi’s potential in China?

Absolutely, we are a tear in the ocean in China. Airports are the perfect showcase for Chinese consumers to get to know the Venchi brand.

How about the Hainan market?

I was in Hainan, it’s very interesting. But we are not yet ready on a large scale. I know that the domestic business for luxury has been doing crazy numbers, but I think the infrastructure is still a bit behind in Hainan, especially for importing goods and so on. They need to catch up in terms of the supply chain and logistics. I’m sure we are not the only brand experiencing issues with that.

I’ve been to Haitang Bay in Sanya. The hotel was completely packed and hotel prices were skyrocketing. It’s the main place where Chinese now are going for holidays, so they are enjoying a great momentum. Even though Hainan was strong even before the COVID-19 outbreak, the numbers are still really going up big time.

For us, it’s a little bit wait and see, because we are not a leading category. Beauty and cosmetics are the leading categories in China for duty free at the moment and I think it’s right that they lead the way for the others. But Hainan is a great opportunity, with its beautiful landscape and beaches… it’s a beautiful island.

How about South Korea?

We were partnering with a strong, local chaebol [a large South Korean family-owned business conglomerate -Ed] but the partnership didn’t go well for many reasons. Now we are in discussions with several potential local partners to restart in the domestic market. We have a cooperation with distributor Bluebell in the Korea region for online duty free; in Singapore we are in a joint venture with them; and in Taiwan we are in a management contract with them.

Duty free in Korea is currently under pressure of course, so we are more interested in the domestic market, where we have to reshuffle our strategy from zero, and we are happy to do that. We’re happy to invest money and to go into joint ventures. We’re really looking forward to developing the business there.

You opened in Japan local market some time back. How is that developing?

We opened in the Japan market domestic in 2019 and now have ten stores there. They have been a success, over our expectations. We have a joint venture with Mitsui & Co Japan. They are a very entrepreneurial trading company, so they said let’s keep opening even during COVID. The Japanese are very long-term orientated. We have five new stores planned there for next year.

And here in Hong Kong?

One of the big reasons for success in Hong Kong is the quality of the chocolate itself and the gelato. Hong Kong has been the battlefield for chocolate makers for many years – many came and left. Pierre Marcolini, Ladurée and Maison du Chocolat are still here, and Godiva, of course, has been the leading chocolate brand in Hong Kong for many years and still is.

Back in time, we didn’t have good packaging, we didn’t have nice stores, but we had a very good product – one of the big reasons for success is the quality of the chocolate itself and the gelato.

Italian chocolates are free from cream, free from ganache, free from butter, and free from all of what the French chocolatiers use in abundance. This comes to the roots of Italy – we don’t have many cows, but we have a lot of hazelnuts, pistachios, almonds and olive oil. The biggest confectionery company in Italy is Ferrero, which is the biggest hazelnut consumer in the whole world.

So our chocolate is low on sugar, but very intense in hazelnuts and in cocoa mass. And traditionally, Asians are not sugar freaks. That’s because they don’t have cane sugar plantations – sugar was not in their diet. They never had cultivation of sugars, they never had cultivation of cocoa mass.

For Asians, chocolate is a luxury product because it’s purely imported and doesn’t belong to their cultivation norms. Cocoa beans from Asia are practically zero, it’s all from South America and West Africa.

Our chocolate is truly hazelnut, with some sugar, cocoa mass, pistachios, and that’s it. It’s extremely natural. So the people who started buying Venchi in Hong Kong and Mainland China were really enjoying the chocolate from the start.

And then you take the gelato, which of course is made the Italian way. In Italy we are like an integralist in gelato and chocolates; we are really product guys. We have a lot to learn from the Americans and the British on marketing, but we spend our life improving products. With the gelato that is made in Hong Kong there’s absolutely no difference from the one that we make in Italy.

I think that’s the reason for the success in China. When we did our market survey there, the customers said the gelato was like what they had when they went to Rome.

So I think that’s the secret in the end. But with the help of friends, shareholders and executives we have also really improved our packaging, and improved our store concept.

We’ve put a lot of our Italian heritage and expertise into the store concept. Using gold and flower patterns on the walls, and with the great floorings they are really nice-looking stores. But it all comes back to the product in the end.

Do you have exclusive products for travel retail?

Yes, we do exclusive chocolates and an exclusive packaging range only for travel retail. That was one of the great suggestions that we got from friends in the travel retail industry. We need to have a range which costs a little bit less and which is a little bit smarter than the domestic range.

Tell us about your personal philosophy to business Marco.

In the end, it all comes down to one word for me, and that is consistency. Consistency and in the end, being extremely meritocratic. I was raised by my parents with a very meritocratic approach which was so different from some of my friends.

Venchi really gave me a boost in terms of that. I was 27 or 28 when I started at Venchi. My boss is Italian but was raised in Switzerland, grew up and graduated in the UK and worked there for McKinsey. He has this very strong, extremely decisive, meritocratic and fair approach, so I had this great opportunity.

I have to say that professionally, I wasn’t really raised by typical Italian managers, and in the end, I really cherish the values of consistency and fairness. If I look at the business, our future will be extremely consistent in what we do. We will keep the promises and the values of the brand very strong, without compromising.

We had many different discussions on having a second, cheaper range with different ingredients and so on. In the end, we came up with the answer that the key to our success and our continued success will be the consistency.

We have seen across all the successful brands, all around the world, and the great entrepreneurial stories that lasted through many generations, that they were ultimately consistent. Consistent but adaptable to the new generations of consumers.

So we are consistent… but we have to face the fact that the new generation is much more health-conscious, much more environmentally-conscious, much more ingredient-conscious and much more fairness-conscious. We are already moving into that direction with a new range of products which is going to have a low-sugar content product, and I think we are doing it before our competitors.

What I really stress to my team on is that we need to be like a dragon boat team. There is one guy running the drum, but then everybody has to go at the same pace with the same energy and with the same passion.

I’m far away from being a micro manager. I want the team to be extremely collaborative, I want to empower them in talking openly about the problems and so on. In the traditional Chinese culture, speaking up about problems is either losing face or facing a backlash. I’m totally the opposite. I have the spirit of the Italians, who are great problem-solvers. That’s the one thing about the Italians that you can say. We will solve anything!