Prologue: In mid-September L’Oréal Groupe announced that General Manager for Travel Retail Worldwide Vincent Boinay, one of the channel’s most-respected executives, had been appointed President of the French beauty group’s North Asia Zone and Chief Executive Officer of L’Oréal China.

The appointment, effective from the end of January 2024, will see Boinay move to Shanghai and bring down the curtain on an outstanding eight-year tenure. Emmanuel Goulin, a familiar and highly regarded face in the channel, will become President of Travel Retail and join the Group’s Executive Committee at the beginning of 2024.

L’Oréal CEO Nicolas Hieronimus paid fulsome tribute to Boinay, saying: “Vincent is a strategic leader with a genuine love for the culture and people of the North Asia region. He transformed our travel retail business, strengthening the Group’s global leadership in the sector and making it a major contributor to L’Oréal’s growth and bottom line.

“He is a generous leader and a great team developer, with an openness and curiosity that have enabled him to build strong and lasting relationships with employees, customers and partners alike. I am convinced that he is the perfect choice to continue to build on our success in North Asia.”

Martin Moodie caught up with Boinay at L’Oréal Groupe headquarters in Paris for a last hurrah interview before that building programme begins.

It’s the day of the opening Rugby World Cup match in Paris, a mouth-watering match-up between host nation France and three-time winners the All Blacks. Vincent Boinay is a passionate rugby fan, and with me a lifelong aficionado of the men in black, our conversation inevitably starts – and finishes – on discussing the outcome of the night’s match.

But first there’s business to deal with. At the end of January, Boinay will uproot from Paris to Shanghai to assume a critical role for the French beauty group as President of North Asia Zone and Chief Executive Officer of L’Oréal China.

That move will bring an end to an eight-year stint at the helm of one of travel retail’s biggest and most influential players. A near decade that has embraced sustained commercial success; a revolution in digitalisation; a constant flow of ambitious activations, innovations and launches; and the most severe crisis in travel retail history in the traumatic form of a three-year global pandemic.

“It’s very interesting being back [from the crisis] but I think we are back better,” says Boinay, asked to assess the state of the travel retail nation. “We are living in an industry that is so volatile and uncertain and with so much ambiguity. This is what’s fascinating in travel retail. It’s always moving so fast and it’s sometimes brutal as we have seen with COVID, which was probably the epitome of this brutality of change.

“But it’s also an industry like no other in terms of resilience. How many people were predicting in 2020 that the world of travel retail is dead, that it will never recover, that the world of [mass] airline traffic is behind us?

“Yet look at today. It’s far from being perfect but international traffic this year is probably plus 45-50% versus last year and minus just 10-15% versus 2019. And I’m only talking about international traffic. Yes, it is a tale of two stories between east and west [due to Asia’s later recovery -Ed], let’s make that clear. But the industry is back and when I say the industry, it’s not just the travel retail industry – it’s the airline, airport, and transport industries that are back.”

That re-emergence from darkness has brought many positives to the sector, Boinay believes. “One is sustainability. There is a concern worldwide about it,” he says. “The last time we had our Trinity panel in Singapore, it was great because we felt that the entire industry is behind that topic. It’s super important.”

Another positive is brand visibility. The pandemic meant that retailers and brands had to become ever more creative in reaching out to travellers that were in airports – and to consumers that were not. Some of L’Oréal’s activations during the pandemic years were not only thrillingly engaging and experiential in-store but through the powers of digital and live streaming reached vast audiences of millions, a reach that could never have been dreamed of a few years ago.

Boinay agrees. “Firstly, this distribution channel is an image builder for all categories and in particular for beauty because beauty is still the number one category by far in travel retail. And this is something we are doing right at L’Oréal. As you know, we are visible everywhere around the world; we have been travel retail players for years and that’s why we keep this leadership.

“Secondly – and this is what we and the industry are developing way better today – it’s about customer data recruitment and data acquisition. Why? Because today we have digital that we didn’t have ten years ago.”

Boinay recalls the annual L’Oréal Travel Retail dinner in Cannes in 2015, the year he returned to the business. “I remember saying to them, ‘Ladies and Gentlemen, I’m returning from domestic markets into travel retail and what strikes me is we don’t talk or leverage digital at all. We need to modernise.’ And that’s what we and the industry did, though we still have a lot to do.

“Thirdly, travel retail is a sizable business in the beauty industry, especially in the luxury part. This is very significant because at the end of the day the size of the business means the number of customers. And there are a lot of customers in travel retail to seduce, to serve, to please and that’s the challenge of the years to come.”

Hainan hiatus and Korean cool down

There are challenges, too, this year. Most notably in the much talked-about structural changes in the Hainan and South Korean duty free markets, where crackdowns on the daigou trade (from May this year in the former case and late 2022 in the latter) have led to overstocking and commensurate sell-in issues for all the major beauty houses. The changes came faster than anyone expected and in double-whammy fashion across the two markets that had done more to sustain the travel retail sector than any other during the pandemic.

Asked during an H1 earnings call whether South Korea and Hainan travel retail would see both negative sell-out and sell-in during the second half, L’Oréal Groupe CEO Nicolas Hieronimus said there were “lots of moving parts” in North Asia.

“On the one hand, you’ve got a change of paradigm in travel retail… in the first quarter, the Korean operators reduced their buying and particularly their trade with daigou. And in May the authorities in China decided to put a strong control over daigou.

“And of course, that has a strong impact on sell-out, particularly because during the years of lockdown where there was barely any real traveller that was going to travel retail [outside Hainan -Ed], that [daigou trading] was probably the way to keep the retailers in shape. So there is a change of paradigm.

“Short term, it will be negative. But mid term and long term, it’s very positive because in the end this is a market that’s going back to Mainland China and will contribute to the acceleration, I believe, of Mainland China, where we have both better share and lots of fuel.”

Hieronimus reiterated the rebalancing of offshore duty free and local market sales in China. He said this is particularly important for L’Oréal Luxe, which enjoys a close to 33% domestic market share. “Yes, it’s going to be a different profile for the months to come. So, yes, a slowdown in travel retail, probably a few months of destocking. But I guess there will be continued acceleration on the Mainland Chinese market.”

Later he added: “We have a specific working group… which includes our travel retail teams and our Chinese [local market] teams, managing to make sure that the level of prices and the type of promotions in travel retail are never detrimental to the Chinese business, and that’s why we’ve valorised so much our travel retail business.”

Asked for his read on the situation, Boinay responds: “In Asia Pacific travel retail for Hainan and Korea we’ve seen post-COVID a situation that has been a bit ambiguous in between travel retail and new regulations for both Korea and Hainan. What’s happening was expected and in a way awaited from our point of view. The issue was the sudden timing.”

Given his current role and the one he is poised to move into, few people are better placed to answer my next question. How does the L’Oréal Travel Retail division work with the China local market team to optimise that balance?

“Actually, it was a very important decision taken [formerly] by the L’Oréal management to say, ‘OK, we are at a time when COVID is blurring all boundaries and when regulations decided by government are changing, so what do we do? And what we do not want to do? So let’s all sit down together.’

“We are probably the strongest group in the world in terms of cooperation between all subsidiaries involved in the Chinese ecosystem. So it’s about travel retail and of course China domestic. But it’s also about Hong Kong and all North Asia, so all the intelligence we put together has been extremely powerful.”

I put it to Boinay that in his new role, he is well-placed to boost that cooperation, possessing as he does an intimate knowledge of the dynamics, pressures and opportunities facing both travel retail and domestic market channels.

“Yes, and I think that was part of the decision [behind my appointment],” he replies. “It’s about this knowledge of the Chinese ecosystem to make sure that at the end of the day we protect the Chinese customers and the equity of our brands.”

Travel retail is not just about China and the Chinese traveller of course. Hieronimus emphasised that point during the earnings call, noting: “Travel retail remains a fantastic channel, both for business and to showcase our brands and we’ll continue to use it as such. Right now, the worldwide traffic is at +56% versus 2022, very dynamic in Western Europe, and it’s beginning to pick up in North Asia with Chinese travelling to Thailand and to other parts.”

Boinay picks up on the point. “It’s really a tale of two stories. We have the Western world plus the Middle Eastern world showing double-digit growth – lots of passengers, almost back to 2019 international traffic. And there we have been reinforcing our position not only in terms of market share but visibility everywhere. We are building with our retail partners a strong momentum. And, yes, in Asia Pacific we have this change of paradigm, where we need to build back better. But it will take a few more months to be totally healthy.”

That offers a neat segue to another Hieronimus comment on the call. “Travel retail will continue to play its role, but now it’s being, I would say, normalised. And I think it’s a good thing for us,” the CEO said. I ask Boinay for his thoughts on this ‘normalisation’ now being played out across two all-important markets.

“It’s true that when we look at it from a distance, we are back to 2019 in terms of the global travel retail ecosystem,” he responds. “It’s healthier than before so the question for us is do we do it more efficiently than before? Do we do it better for all the customers? Do we create a better value proposition everywhere? The answer very often is yes, but not everywhere. And this is where we still have a lot to do.

“But all in all for the years to come, it’s very promising. And when you look at all the predictions in terms of air traffic, airport renovation and airport constructions, it’s fascinating. What’s going to be important, however, is to reconcile the duality of air transport with sustainability and defending the planet. And that’s going to be one of the key challenges of the years to come.”

Pre-pandemic, Boinay and I have spoken several times down the years – in interviews, informal conversation and on stage at The Trinity Forum, about the industry tender model and how exposed it was. Then, in the shape of COVID-19 and its savaging impact on travel, the mother of all crises emerged and really did provide the most painful exposure that some had feared all along.

Have lessons been learned? Does he think the Trinity is in better shape as a result of the pandemic? “You kindly invited me last year to The Trinity Forum and I could feel during this moment a real concern from all parties,” he answers. “This year is proving very interesting and what people are doing in terms of customer experience is proving that they – retailers, airports and brands – want to move in the right direction.

“Last year at Trinity I was talking with Nestlé and Pernod Ricard. We shared plenty of ideas and we had plenty in common. I think that’s a sign the industry is moving. Yes, we need to be cautious and not to fall into the trap of ‘Oh, it was good enough before the way it was. No, because long term what’s most important is customer satisfaction in airports. And to differentiate the offer in airports from offers in downtown.

“That is all the more important today now we have this gigantic digital business across the world,” Boinay continues. “It’s a challenge but one that will make you successful and win only if you bring added value in travel retail.”

How to bring such incremental value to the channel? “It’s very simple,” he replies. “You need to find the means to reach the consumer before, during and after travel, from digital to in-store activation, from image to pop-up, from service to customers to data.

“And for all that, we need to generate revenue for all parties. And that’s why we need to pay attention to the very old disease of high rentals, high concession fees and, therefore, never-ending discussions on margins and trading terms.

“Then instead we can spend hours talking about customers and the value we create for them in airports. Because travel retail is bringing something to the equity of an airport. If we all believe that, then we have a lot to do and the future is going to be extremely bright.”

Are the retailers and airports hearing that message? “Many of them,” Boinay responds. “When I look back, so many retailers are changing a lot. They are evolving. But the danger is to go back to what it was because of the ecosystem, because of the business model, because of the concession fees. And because of bad habits. We have to pay attention. The retailer that is not going to move forwards and only look backwards is going to disappear.”

Given that Boinay did an earlier stint heading travel for under two years from 2005, he has now led the company’s efforts in the channel for around a decade, albeit in two very different periods. The Hainan offshore duty free business hadn’t even been invented in 2005, digitalisation was still in its relative infancy and ESG principles such as sustainability were ‘nice to haves’ rather than atop the corporate agenda as today.

As he looks back on those years, particularly the last eight, what are the real standouts in terms of the company and the sector? “Well, it’s hard to have a hierarchy of things, but the very first one I would say is people – people in the company and people in the industry,” Boinay replies.

“I’m not going to give any names otherwise people are going to be happy or very unhappy,” he adds with a smile, “but I have met so many great human beings and great leaders from retailers and also internally.

“I have seen so many great people at L’Oréal Travel Retail and beyond and it’s absolutely fantastic. And when I think of the number of people that will be taking great positions all over the world who came from travel retail, it’s a pride in a way.

“We see the people working in travel retail are international, truly into diversity, entrepreneurial, fast learners, quick, agile and with great personalities. It’s astonishing just how engaging and experiential they are and their reach is astonishing.”

I ask him, perhaps unfortunately (from my perspective) using a rugby analogy, whether there is one example of his team having really outshone themselves, like Les Bleus perhaps beating the All Blacks?

“Actually, there are many examples,” he comments. “Post-COVID, we’ve said and I’ve personally said many, many times that the success factors will be around digital, data and tech. And we’ve done a lot around those areas while still having so much to do.

“If I had to give examples, it would be around the strategy point of view – what we do before travel and what digital is bringing to us. And here I’m talking about the experiments we started this year with TripAdvisor and Uber in the US.”

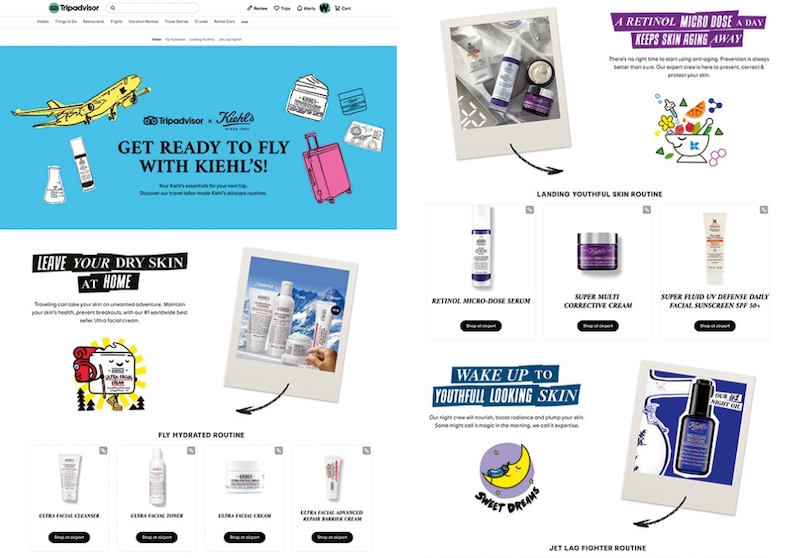

With TripAdvisor, the world’s largest travel guidance platform, L’Oréal Travel Retail teamed up in a breakthrough long-term travel retail-exclusive agreement for the beauty category under the theme ‘Beauty for all travellers’. The alliance is built around digital media activations, a strong data partnership and co-innovation in order to enrich the traveller experience.

The Uber programme saw Armani Beauty Travel Retail team up with the ride-sharing platform to launch the Armani Code O2O activation in New York John F. Kennedy and Los Angeles International airports. The partnership involved L’Oréal Travel Retail Americas offering Uber’s more than 130 million active users an integrated in-app media experience.

“This is only the beginning,” enthuses Boinay. “But it’s absolutely fascinating because at the end of the day, why are we doing it? Of course it’s for brand awareness and brand visibility, but above all it’s to create a greater penetration in stores because people will have a reason to go into them before they travel. And that’s going to be fantastic.

“This is only the beginning,” enthuses Boinay. “But it’s absolutely fascinating because at the end of the day, why are we doing it? Of course it’s for brand awareness and brand visibility, but above all it’s to create a greater penetration in stores because people will have a reason to go into them before they travel. And that’s going to be fantastic.

“We have seen some amazing results with TripAdvisor during the spring break in the US and summer in the UK and during a very great operation with Lancôme in Dubai. But also with Uber and Armani Beauty this summer to the people going to the airport in Los Angeles and in New York. It’s so interesting and this is why I’m very proud of the L’Oréal team’s ability to embrace these new digital capabilities.

“So when I mentioned earlier about telling the industry nearly ten years ago that we should bring digital way more into it… I’m very proud to see that we walk the talk.”

Travel retail has certainly come a long way from the days at industry conferences – including The Trinity Forum – in the early 2000s when a regular refrain of such events would be along the lines of ‘Digital – opportunity or threat?’.

Boinay nods ruefully at the memory and adds: “Ecommerce was perceived by some short-sighted people as a threat but ecommerce is not the topic. The topic is how to digitally enable people to access products in the best and most convenient way for them. That’s it. Research online, purchase offline. But this requires intelligence, capabilities, skills and budget. Therefore, we need to adapt, we need to change.”

The other great advance during the Boinay years at L’Oréal Travel Retail has been in the increasing prominence given to the ESG agenda. It’s front of line at his annual media conference in Cannes and high on the agenda when CEO Hieronimus is presenting to analysts. So where both as a travel retail division and as a company is L’Oréal on that journey?

“For many years, L’Oréal has been working to reduce its impact on the environment,” Boinay comments. “We have made a positive contribution at all levels of the company and that’s why we are very committed to travel retail. Whether its greenhouse gas emissions or CO2 or plastics, we have very precise objectives. By 2025 all our factories and sites are going to be carbon neutral. By 2030, 100% of the water used in our industrial processes will be recycled. I’m not going to list everything, but I mean there is a real commitment from L’Oréal.

“We are a company that is one of the best in the world on the ESG front. And as far as we at L’Oréal Travel Retail are concerned, we are very much part of it. For example, in terms of CO2 emissions I can tell you that with the support and the cooperation of many of our retailers around the world, we have moved to almost half of our former air shipments becoming sea shipments.

“It was not easy, in fact it was brave for some of them to say, ‘OK I’m in the airline transportation business but we are going to use sea shipments because it makes sense.’

“It’s also about curbing plastic usage in the product development, for example with all our travel exclusives.

“It’s about the construction of our stores to make sure that they are eco-designed and they are LEED certified. It’s also about the way we travel, something that could be perceived as very simple, but it’s also very symbolic. We travel less and we are more efficient. We have modern tools, via Teams and Zoom, where we can interact with people on the other side of the world without travelling.

“Of course, we are still travelling as nothing will replace a visit in a store, but it’s super important and almost an everyday battle [to achieve a better balance].”

Our time is nearly up and both our minds, I suspect, are now racing to the evening and the sporting showdown ahead. As this outstanding contributor to our sector reaches towards the final days of an exhilarating period of leadership in travel retail, does he have any final message to the industry?

“My wish is for the industry to keep flourishing. I truly believe that the travel retail industry – a distribution channel that I like so much – will keep blooming and go from strength to strength. But for that to happen, everybody within the industry has to look forward. It’s almost as if they should stop themselves from saying, ‘OK, I’m looking backwards to when times were great.’

“No, no! Change. Look forward and ask what we must change to make airports and travel retail more differentiated from downtown. What should we do to create greater satisfaction for customers? Do we have enough knowledge of our customers?

“Because let’s be honest, in the past decade we have probably been too dependent on the Chinese global shoppers. We’ve seen post-COVID that it’s more complicated but also extremely interesting to be more involved with other regional and national shoppers.

“And that’s fantastic. This is where knowledge lies. But my wish at the end of the day is to see travel retail doubling in size, doubling in importance, doubling in pride in the coming ten years.”

It’s the perfect note to end an enriching and typically candid interview with a man who has led one of travel retail’s most powerful and innovative forces with deep ambition and much grace over the past eight years. Well, not quite the end. I have one more question, of course. Very much on the record. Who will win tonight’s game and what will the score be?

“So, it will be the French, of course,” Boinay replies with, I admit, unnerving confidence. “I can’t say otherwise. First, because my national pride is so big. And second, because I strongly believe it. We have a unique opportunity, as you [New Zealand] had in 2011 in your home country.

“They are one of the greatest teams in the world and they have a fantastic manager. They will be supported by millions of French people. I will be one of them. And the score tonight is going to be something like 25-13 for France.”

Postscript: And so it came to pass. France duly delivered, winning 27-13. If Thomas Ramos had missed that final conversion, Vincent Boinay’s prediction would have been spot-on. Under the leadership of such an accurate predictor, the future of L’Oréal in China and wider North Asia seems in very good hands indeed. ✈