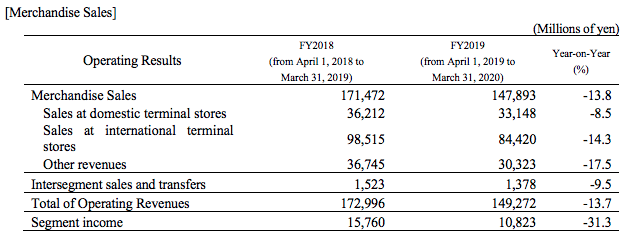

JAPAN. Airport company and travel retailer Japan Airport Terminal Co (JATCo) recorded merchandise sales of ¥147,893 million (US$1.38 billion) in the financial year ended 31 March 2020, down by -13.8% year-on-year. The figure includes retail and wholesale activity at domestic and international terminals in Japan, led by JATCo’s principal location, Tokyo Haneda Airport, which is run by subsidiary Tokyo International Air Terminal Co.

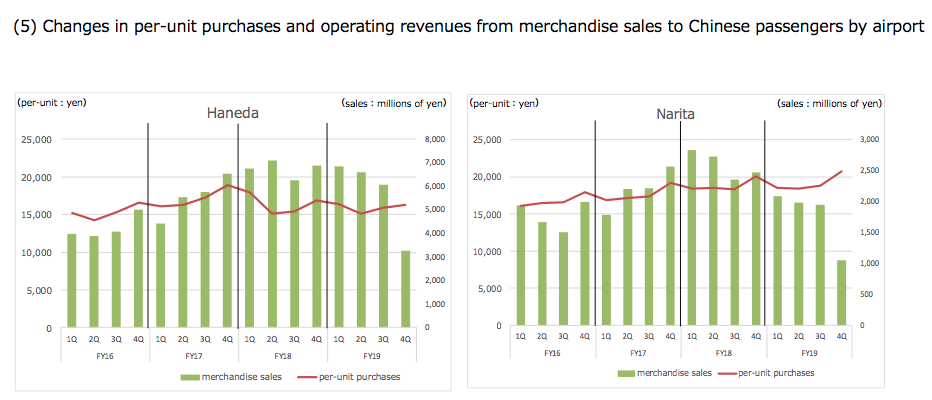

The decrease in sales of merchandise reflects the impact of COVID-19 in the final quarter, as well as the temporary closure of some stores for renovation, along with a slowdown in spending among Chinese visitors to Japan during the year.

Commenting on the store performance, JATCo said: “Sales at domestic terminal stores fell from the previous year because of the closure of stores such as Isetan Haneda Store due to construction work on the international facility at Terminal 2 and a decrease in passenger volume from the impact of COVID-19.

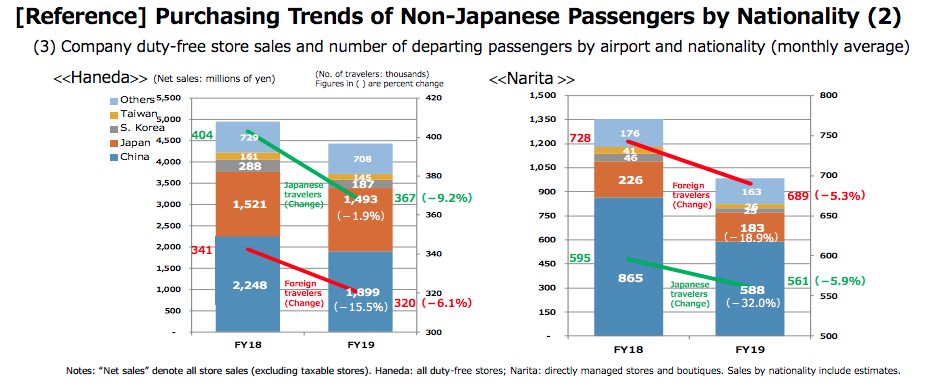

“Sales at international terminal stores at Haneda Airport slightly exceeded the same period of the previous year until December 2019. Since February 2020, the impact of COVID-19, especially the decline in the number of Chinese passengers due to flight cancellations in China, was significant.”

At downtown duty free store Japan Duty Free Ginza, in which JATCo is a shareholder, sales fell sharply from February with lower inbound travel numbers and in particular the decline in Chinese visitors. The store closed on 1 April and opened again on 14 June with a limited offer of mainly duty paid goods.

The wholesale business at regional airports decreased partly because of fewer inbound tourists from Korea since July 2019 amid the continuing trade dispute between the two countries. The spread of COVID-19 also resulted in lower sales in the wholesaling business, said JATCo.

Operating income from the merchandise sales division fell by -31.3% year-on-year to ¥10,823 million (US$101 million). Along with the factors noted above, this was also due to one-off costs for renovations at Narita Airport and downtown duty free shops, plus the costs associated with opening new stores at Haneda.

Separately, JATCo’s airport food & beverage division posted sales of ¥11,514 million (US$107.6 million), down by -8% year-on-year. The decline was blamed on reduced operating hours due to COVID-19 in the final months of the financial year.

Total group revenues (including airport operations) reached ¥249.7 billion (US$2.34 billion) with operating income of ¥9,892 million (US$92 million). JATCo said that the direct effect of COVID-19 on revenues was about ¥21 billion, with a ¥7 billion effect on net income (profits).

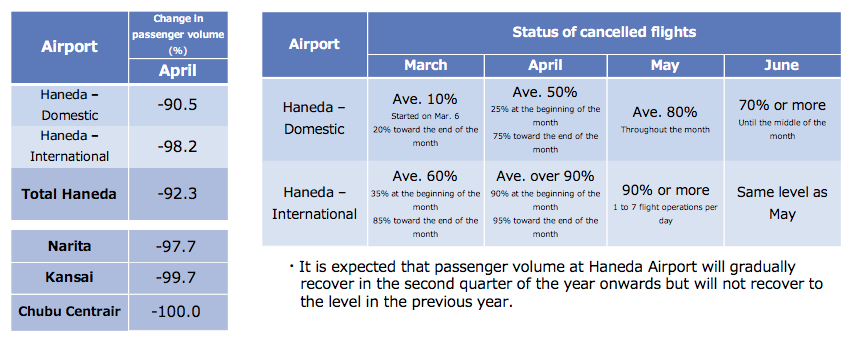

The Japanese government imposed a state of emergency on 7 April in response to the pandemic, lifting it on 25 May. At Haneda Airport domestic flights were around 20% of 2019 levels in May, and the figure was about -70% down on last year in the first half of June. International traffic remains about -90% down on 2019 levels.

Looking ahead, JATCo said it could not provide accurate forecasts for the year ended 31 March 2021 due to the uncertainty around COVID-19. As well as cutting personnel costs and limiting operating areas at Haneda, it secured a short-term borrowing facility of ¥20 billion from several banks in April, in addition to an existing credit line of ¥9.0 billion, to avoid a risk of insufficient funds caused by the revenue decline.

JATCo said: “The impact of COVID-19 is expected to significantly change the course of society as a whole including more people working outside of their offices, and the outlook of the airline industry remains uncertain.

“However, in the medium- to long-term, we expect a further increase in demand for air travel, and we will continue to work towards increasing the value of Haneda Airport by improving the convenience, functionality and comfort of the terminal buildings as the sky gateway to the Tokyo metropolitan area.”