Key Takeaways (Jing Daily)

|

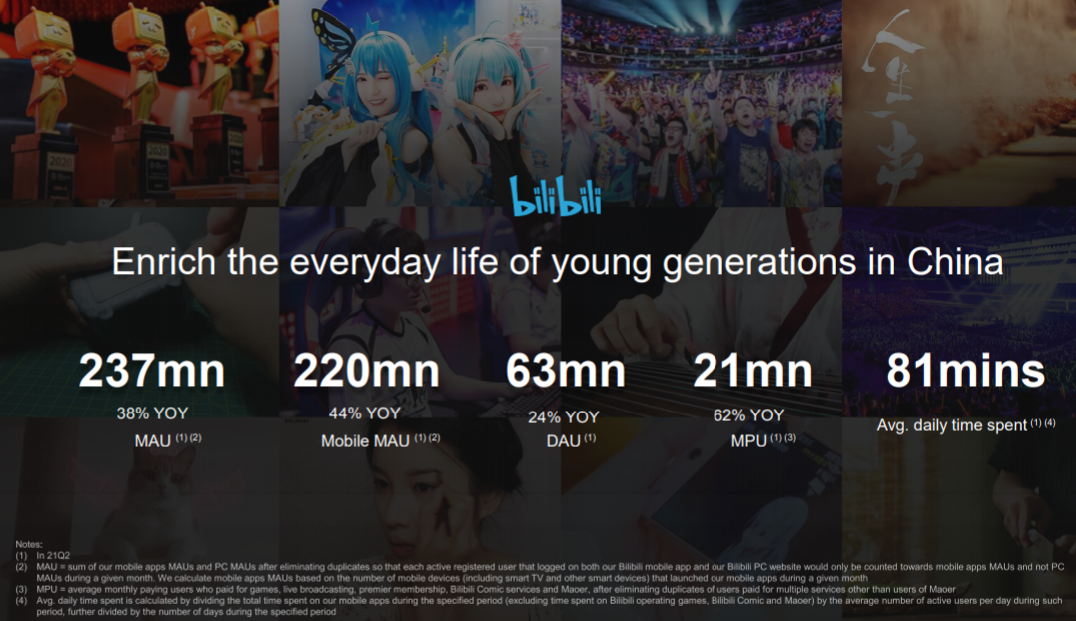

Introduction: Bilibili is a leading video community with a mission to enrich the everyday life of the young generations in China. It aims to create an outstanding community forusers and content creators and promote Chinese original content worldwide.

Following its website launch in June 2009 and official branding as ‘Bilibili in January 2010, the platform has evolved from a content community inspired by anime, comics and games (ACG) into a full-spectrum video community covering a wide array of interests from lifestyle, games, entertainment, anime and tech & knowledge to many others.

For the second quarter 2021 ended 30 June, total net revenues reached RMB4,495.3 million (US$696.2 million), a +72% increase year-on-year. Revenues from ecommerce and others reached RMB578.0 million (US$89.5 million), up +195% over the same period, driven by product sales on the Bilibili ecommerce platform.

Average monthly active users (MAUs) reached 237.1 million, and mobile MAUs reached 220.5 million, representing increases of +38% and +44%, respectively year-on-year.

Average daily active users (DAUs) reached 62.7 million, a 24% increase from the same period in 2020.

Average monthly paying users (MPUs) reached 20.9 million, a 62% increase from the same period in 2020.

The average user time spent on Bilibili rose to an impressive 81 minutes per user per day, the highest Q2 result in the company’s history.

The following article was originally published by the much-respected Jing Daily, a Moodie Davitt Report content partner.

During the COVID-19 pandemic, the cosmetics industry in China proved its resilience yet again. Major overseas beauty brands bet big on the China market this year and rode a growing wave of e-commerce and social media sales, thanks to the low price points and high consumption frequency of beauty products.

While most brands had already launched Douyin or WeChat channels, there is now another platform they cannot ignore: Bilibili.com, the video website famous for sharing ACG (Anime, Comic, and Games).

The site is favored by millennials and Gen Zers, who together account for 81 percent of the platform’s user base. In recent years, Bilibili.com has morphed into one of the biggest mainstream beauty marketing platforms by featuring vloggers’ makeup tutorials, cosmetics testing, unboxing videos, daily makeup tips, popular makeup copies, and more.

By June 2021, the number of beauty brands on the site had topped the list of all official account categories on Bilibili.com, up 2,050 percent year-on-year.

Unlike Douyin and Xiaohongshu (Little Red Book), Bilibili.com is deeply rooted in youth culture shaped by the real-life experiences of Gen-Z bloggers and vloggers. Here, content style and sharing are both creator-centric. Beauty vloggers can lead trends through livestreams and paid-content generation, and followers love to take in this content. In fact, the videos are often no more than entertaining commercials.

According to Bilibili’s annual performance report, the amount of beauty-related content surged during 2020 as vlogger fanbases grew by 120 percent in that sector. The Bilibili branding manager states that “1.2 million beauty content posts [mainly videos] were created, and viewership grew by over 8.5 billion last year. We are happy to see these followers focus on more than just beauty content. Influenced by these vloggers, the platform’s crossover branding ecosystem has developed.”

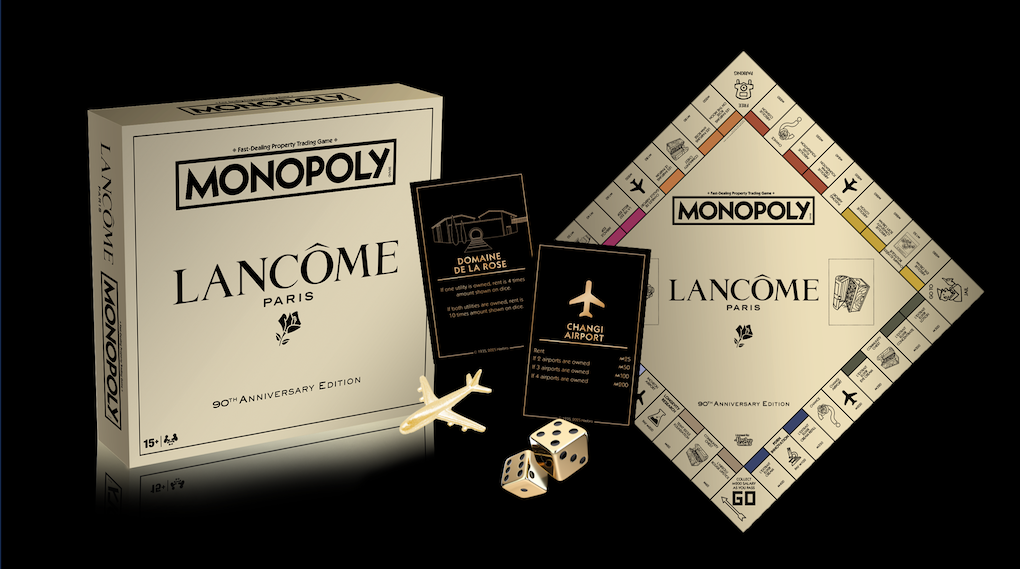

Big names like Estée Lauder, Chanel Beauty, and Shiseido are already serving their campaigns in this community. Shiseido strengthened its clout by launching a livestreaming session that engaged with celebrities while regularly inviting Gen-Z influencers and stars to create product-related content to gain online traffic. French beauty house Lancôme also jointly produced content with Bilibili KOLs to promote its iconic products through campaigns and online engagement.

Meanwhile, diversified content (ACG-featured vlogs in this case) can strongly drive beauty brands on the high-energy video platform. Young ACG fans continue to gain in beauty and cosmetic purchasing power, and ACG content will be necessary for brands to dive into this digital era. Yet, beauty brands have also found it difficult to maximize profits among Gen Zers by solely leveraging ACG resources. After all, beauty products fall into the category where user experience is primary.

The most effective content formats on Bilibili.com include beauty product testing, product seeding, and makeup tutorials. Over time, brands have adapted their content styles to fit with these and other popular formats on the site. In the way “tutorials” and “unboxings” mostly get thumbs-ups on beauty blogger YouTube channels, Bilibili.com aims to establish a real community with natural, humorous, and friendly promotions.

“It is a very exciting starting point to channel Chinese millennials and Gen Zers through Bilibili.com,” said Amanda Lee, director of the beauty and cosmetic branding team at Weber Shandwick. “It is always wise to keep an eye on the trends there. As online traffic and KOLs are becoming luxury brands’ good friends, Bilibili’s content marketing prepares brands with mature, in-video commercialization opportunities.”

According to Bilibili’s 2020 Q1 financial results, revenues from advertising were $32 million (210 million RMB). Meanwhile, the number of paying users jumped 130 percent to 13.4 million last year. Now the video website is vowing to build integrated and customized beauty marketing solutions in the future, which should help it realize sustainable growth and set a new standard.

Note: To subscribe to Jing Daily, click here.