FRANCE/INTERNATIONAL. Global management consultancy Kearney today published its annual travel retail industry report to coincide with the TFWA World Exhibition & Conference in Cannes. It reveals a decoupling between the recovery in passenger air traffic across the world and growth in airport retail sales.

The report, named Travel retail’s next chapter: innovating beyond technology key to regaining market momentum and conducted for the Tax Free World Association, concludes that travel retail finds itself today at a critical juncture.

With consumer expectations continuing to shift, the industry needs to find a new, tech-savvy value proposition if it is to survive, the report finds.

In compiling the report, Kearney undertook a survey of 3,700 travelling consumers across ten countries and conducted in-depth interviews with more than 50 leading senior executives from global airports, travel retail brands and technology companies.

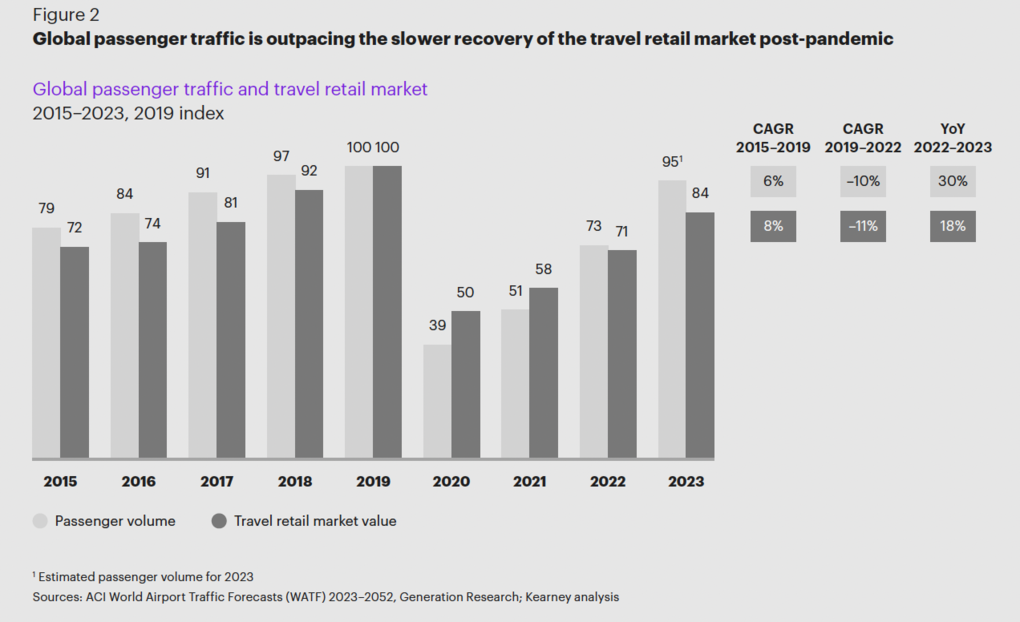

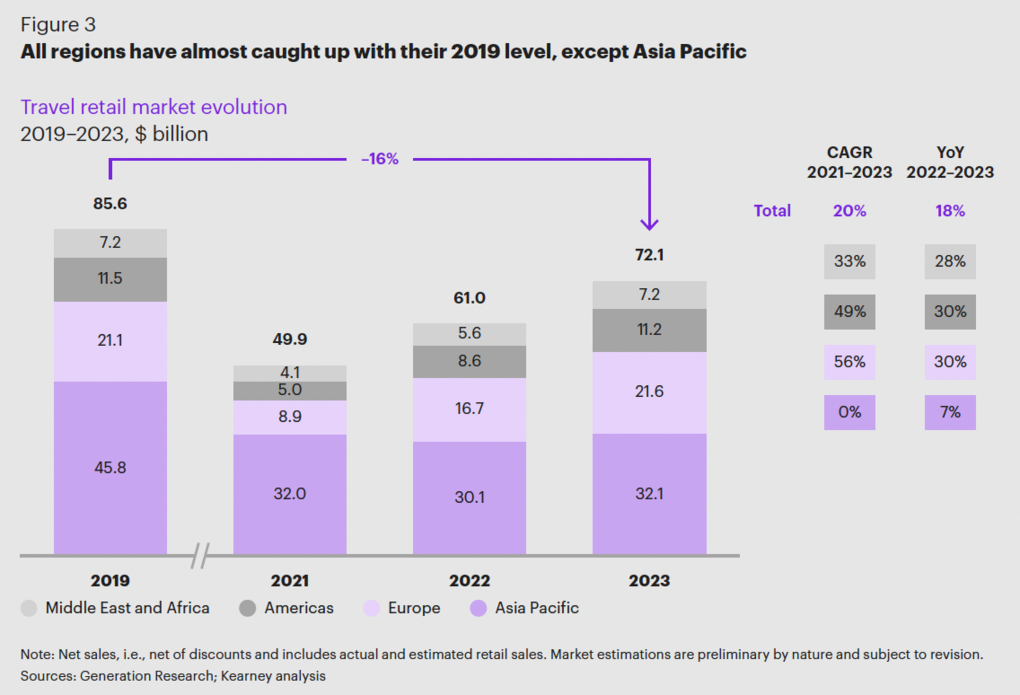

The report notes that while recovery trajectories for passenger volume and the travel retail market had been closely aligned between 2019 and 2022, year-on-year growth in air traffic between 2022 and 2023 was nearly double (+30%) that of the travel retail market growth (+18%, reaching US$72 billion in sales).

This highlights that despite air passenger traffic being back to pre-pandemic levels, consumption growth isn’t following suit. This trend could be the beginning of a sustainable pattern of decline, which can be explained by a range of factors, from economic slowdowns to regulatory changes, especially in North Asia, the report contends.

Traveller spend drops, but consumers still want to shop

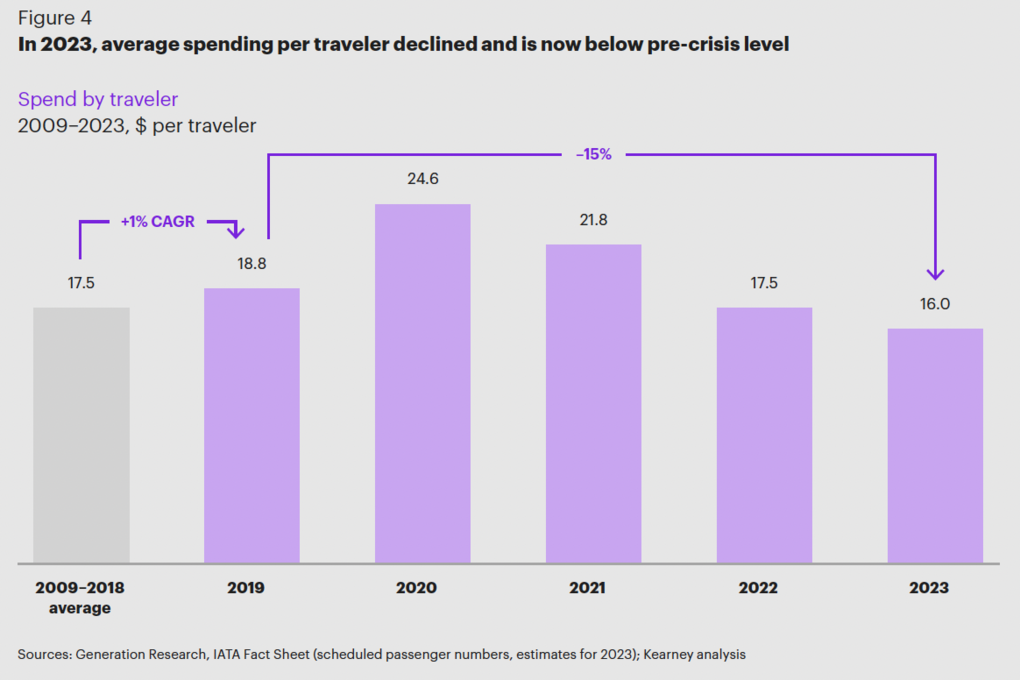

The report finds that spending by passengers has been steadily decreasing over time, and the average spend observed in 2023 (US$16 per passenger) is actually below pre-COVID levels.

The statistics show people are flying more but spending less, with the notable exception of the luxury segment. According to the report, conservative buying behaviours are influenced by the end of post-pandemic ‘revenge buying’, residual inflation, less favourable exchange rates in some countries and high airfares.

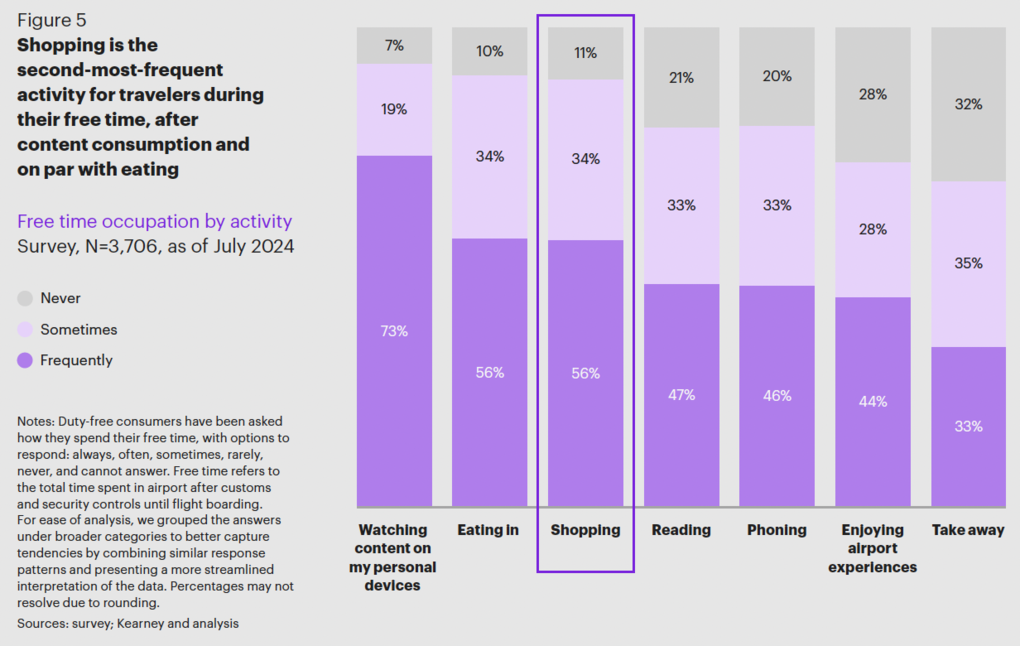

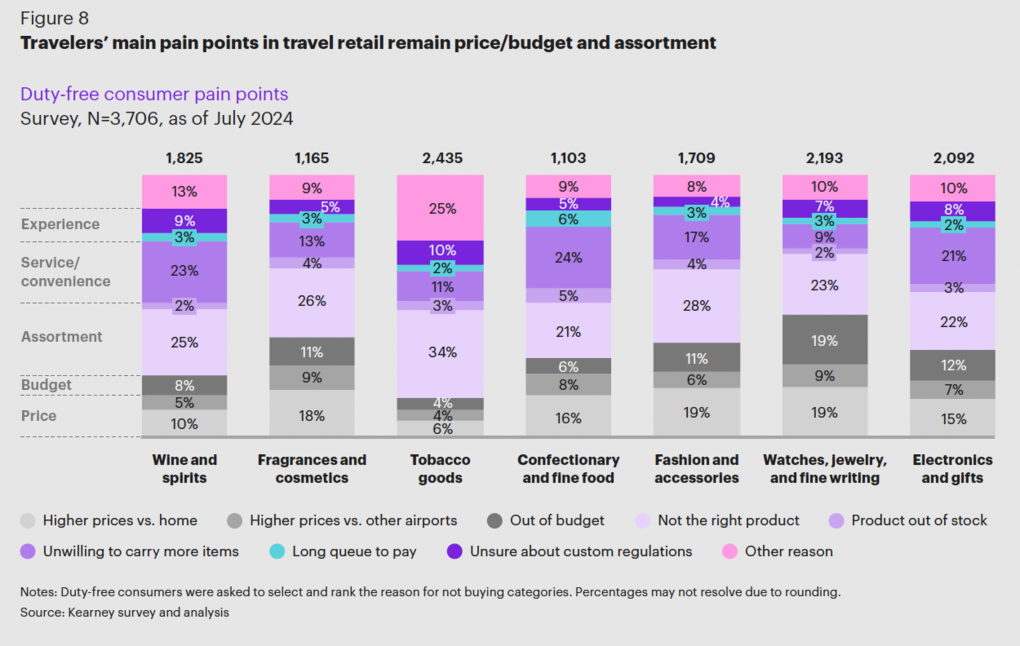

The report makes the key point that this pattern is all the more problematic as travellers are arriving at airports earlier than they did five years ago. It says that while a majority express interest in shopping as a free time activity while waiting for a flight, high prices – rather than the historically low ones found in duty-free stores – and disappointing assortments are cited as key barriers to sales conversion.

Some 30% of respondents to Kearney’s survey cite price as a barrier to purchase. The numbers show passengers are also more likely to use price-comparison tools and personal digital devices, which increasingly compete for traveller attention in the airport.

Shifting consumer expectations

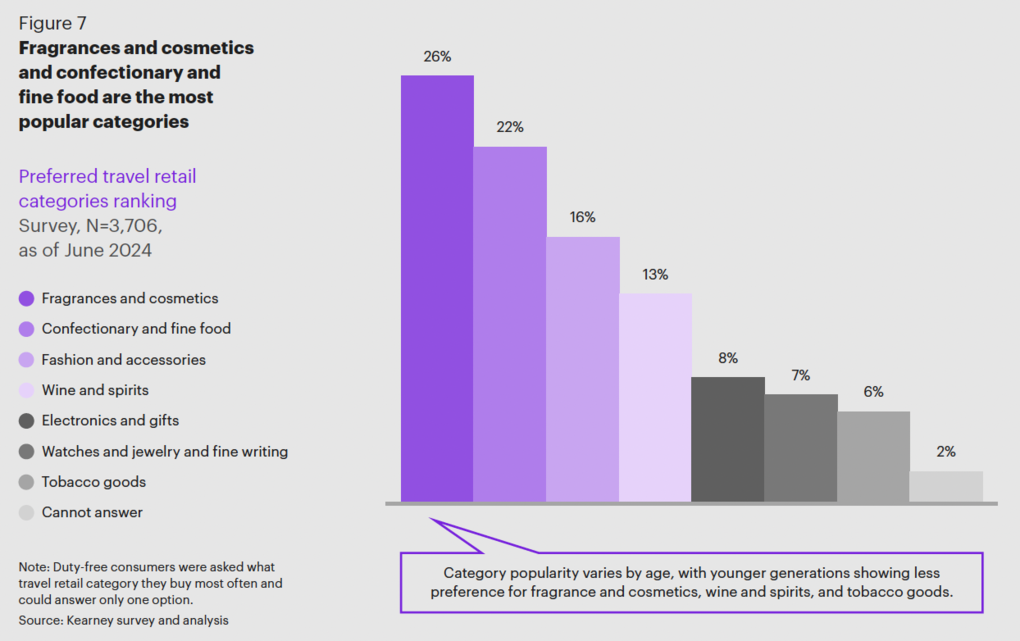

The report also notes a series of new dynamics among today’s travellers. Young travellers – Millenials and Gen Z consumers who tend to prioritise experiences over competitive prices in their shopping habits – are becoming the largest single demographic.

The so-called ‘free independent traveller’ is particularly autonomous and has a strong appetite for local immersion, the report finds. It offers the opinion that “emerging dynamics are not being sufficiently addressed by retailers, who continue to place too much of an emphasis on discounted transactions to the detriment of storytelling, innovation and personalised offers”.

Innovating through and beyond technology

While the Kearney report finds that some aspects of the outlook appear bleak, such challenges present opportunities for growth.

Some 69% of respondents see the waiting time in an airport as an opportunity rather than a waste, which the report authors say should encourage industry players to focus on how to better cater to evolving preferences, especially given the structurally ‘captive’ nature of airport users.

The travel retail industry can rely on positive demographic trends, the report notes, with fast-growing passenger populations in formerly emerging markets such as India and Indonesia, as well as the construction of new airports and the large-scale renovations of old ones, which will optimise points-of-sale.

The report also finds there is now a market consensus around tech: airport stakeholders have been busy automating and digitalising every step of the travel journey, from smart gates to passenger applications, which will help maximise retail opportunities.

Meanwhile, more and more passengers are tech enthusiasts, and 45% of the consumers surveyed say they frequently use in-store tools to enhance the shopping experience.

All this heightens the appetite for in-store tech solutions, such as smart mirrors, augmented/virtual-reality experiences and AI-powered personal shoppers, all of which are capable of driving conversion, the report suggests.

Although it notes care should be taken to preserve a quality, human service experience, particularly in high-end categories, it says technology can be deployed to bring a greater level of customisation to sales offers.

According to the report’s authors, WiFi portals in airports, screen time on streaming platforms and shopping apps could be better utilised to engage customers through targeted marketing offers or game-linked discounts, leveraging passenger screen time throughout the sales process.

It also contends that data sharing between airport stakeholders can lead to well-adapted solutions.

Giving an example, the report says one could imagine an AI-powered journey that begins before the passenger even arrives at the airport and extends beyond the flight. A personalised virtual assistant could guide the traveller through the entire experience, leveraging past purchases and personal preferences.

In the meantime in stores, augmented advisors would provide a highly personalised, client-focused approach, ensuring that every passenger receives tailored recommendations and top-tier service.

Technology can definitely be a game changer, the report states, enabling the travel retailer to reinvent the consumer’s journey; yet, tech is only part of the solution and all the industry’s actors must collectively reimagine the way they operate – on their own as well as together – to successfully transform the passenger’s experience and unlock value.

Reaction

Kearney Partner Vincent Barbat commented: “This year’s report for the Tax Free World Association focused on the travel retail market is another reminder that the industry needs to move away from being price-centric to being more traveller-centric.

“The fact that revenues are no longer correlated with air passenger growth is further proof that new consumer dynamics resulting from a rapidly evolving travel retail landscape remain inadequately addressed. While technology alone will not guarantee blue skies and future prosperity for the industry, it does hold real promise.

“Some of its tools will allow for enhanced customer experiences and greater product personalisation; the true challenge lies in striking the right balance between high-tech and high-touch, keeping the industry both efficient and human.”

Kearney partner Filip Bourée said: “With the immediate impacts of the COVID pandemic having now faded and air traffic volume back to 2019 levels, the travel retail industry is at a crossroads. It needs to turn more of passengers’ dwell time into shopping time and respond to expectations expressed by today’s flyers.

“With more than 90% of consumers claiming personalised offers could encourage them to spend more, opportunities are rife. The industry needs to boldly innovate and prioritise efforts to address critical issues in North Asia, a key region which has seen significant change recently.

“This will help accelerate roll out of advanced, tech-based offerings, including walkthrough, immersive experiences and online marketplaces common in other industry areas (click-and-collect services, etc).

“Retailers must also fast-track data-sharing initiatives to pivot toward what we call a ‘pentarchy model’ of strategic partnerships; pilot projects in this space between industry stakeholders have demonstrated positive results for customer engagement.”

Tax Free World Association Managing Director Franck Waechter commented: “Upon reflecting on the findings of this comprehensive study on the evolution of travel retail, it becomes clear that our industry is at a pivotal moment.

“The landscape, once dominated by traditional shopping experiences, has shifted toward a more dynamic and multifaceted environment, where technology, personalisation and immersive experiences are reshaping how we engage with travellers.

“This transformation, though complex, offers a wealth of opportunities for those willing to innovate and adapt.”

Download the full report via this link. ✈