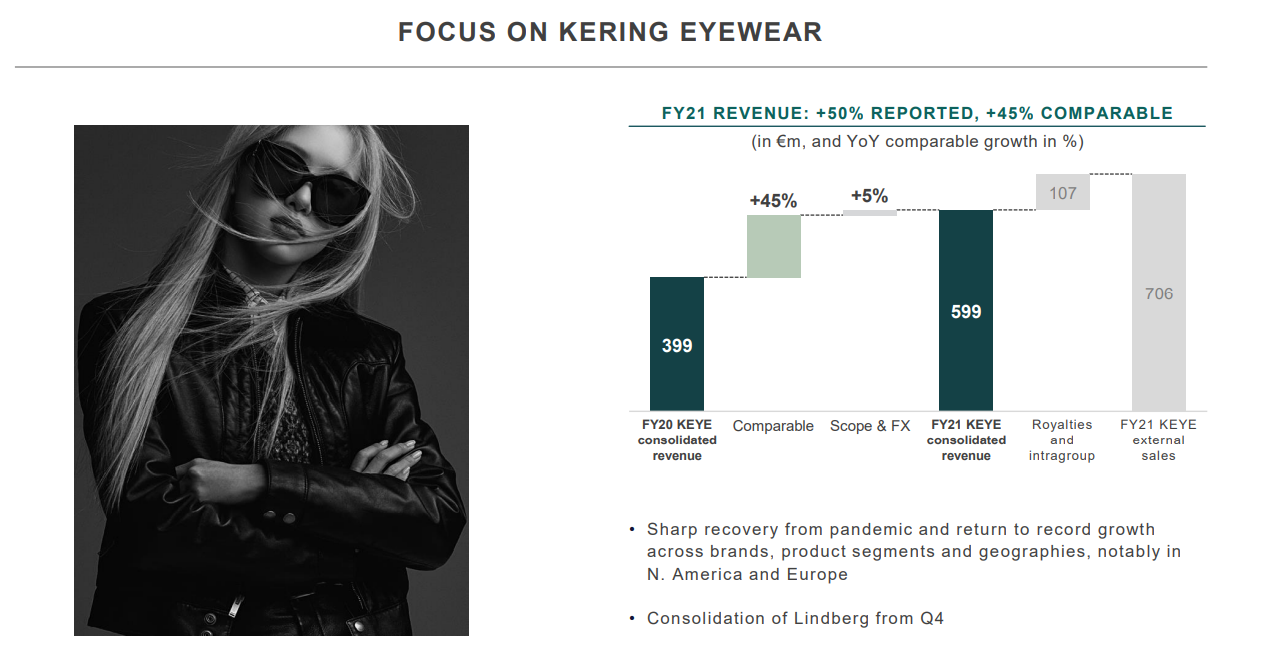

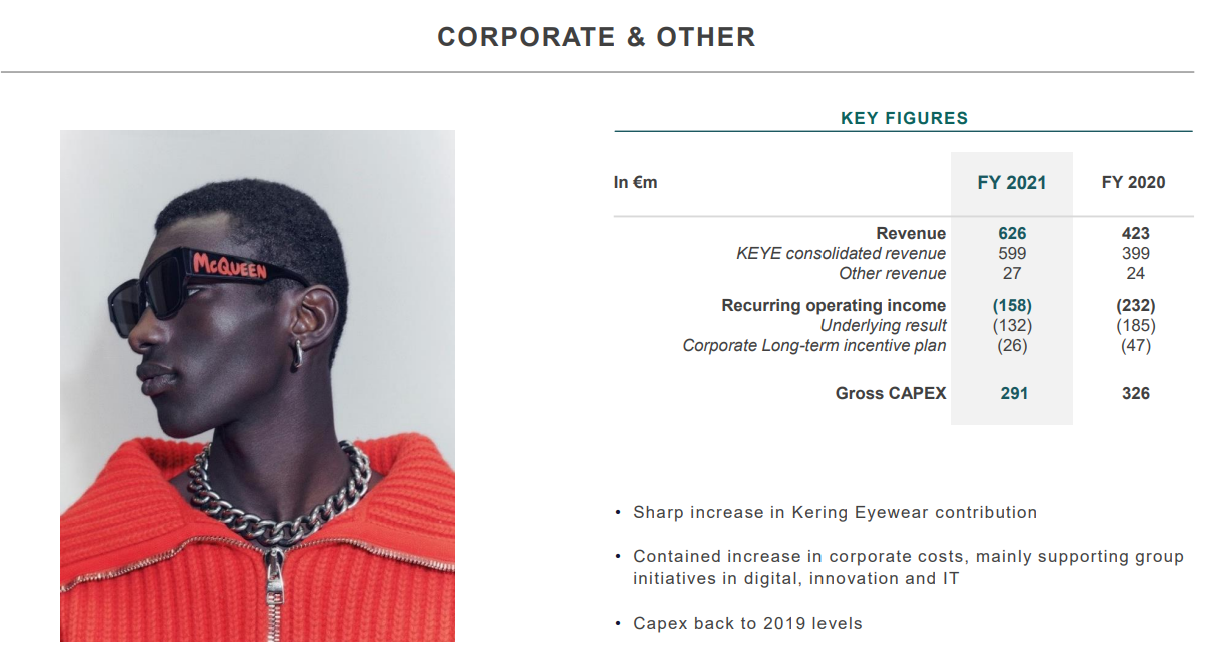

Kering Eyewear posted a strong performance in 2021, with total revenue reaching €706 million. The result included three months of revenue from Danish luxury eyewear brand Lindberg after its acquisition was completed on 30 September, 2021.

Kering Eyewear posted a strong performance in 2021, with total revenue reaching €706 million. The result included three months of revenue from Danish luxury eyewear brand Lindberg after its acquisition was completed on 30 September, 2021.

Kering Eyewear’s sales rose by 45.0% (reported) and by +40.8% at

constant scope and exchange rates relative to 2020. Notably, they were

+16.9% higher than in pre-pandemic 2019 at constant scope and exchange

rates.

Parent company Kering pointed out that the increase in the number of eyewear licenses, with the addition of Chloe and Dunhill in the early part of the year, made only a marginal contribution to this growth. The performance stemmed mainly from Kering Eyewear’s excellent management, its agility and its capacity for innovation, Kering said.

Announcing its groupwide results, parent Kering noted a return to record growth for its eyewear division across brands, product segments and geographies, notably in North America and Europe.

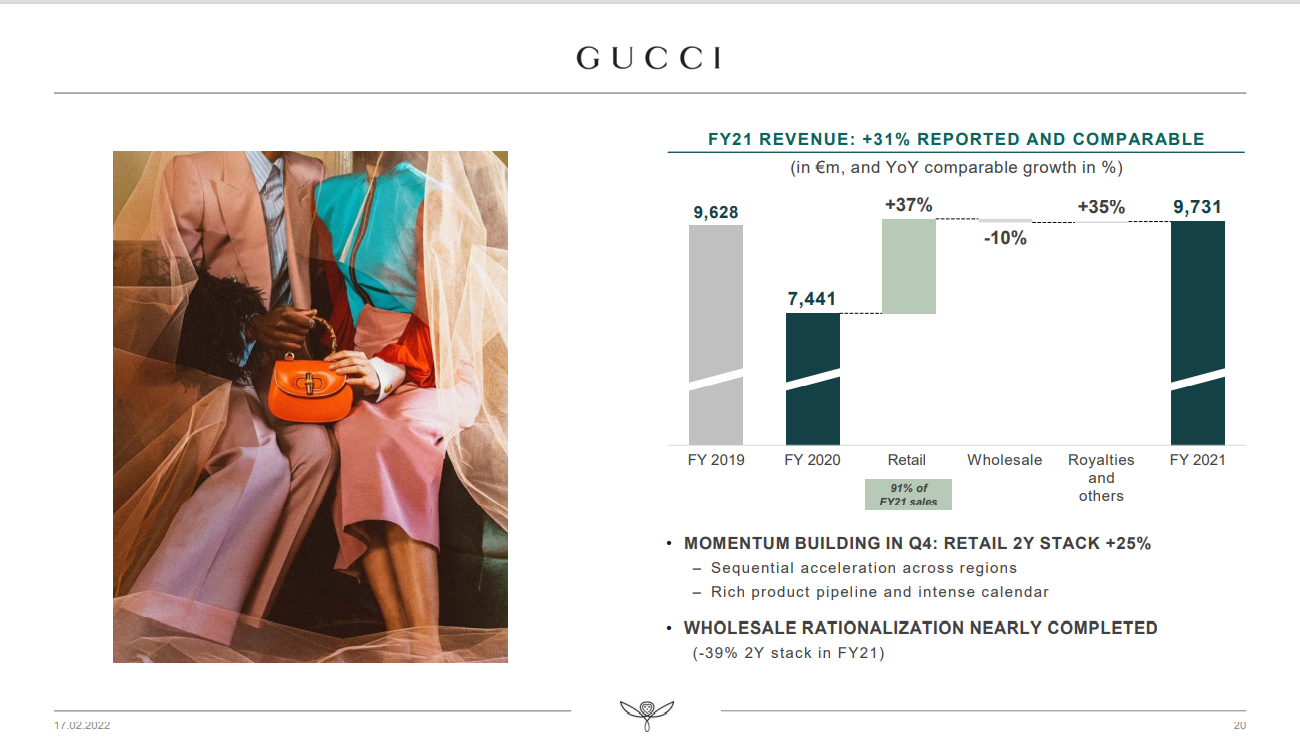

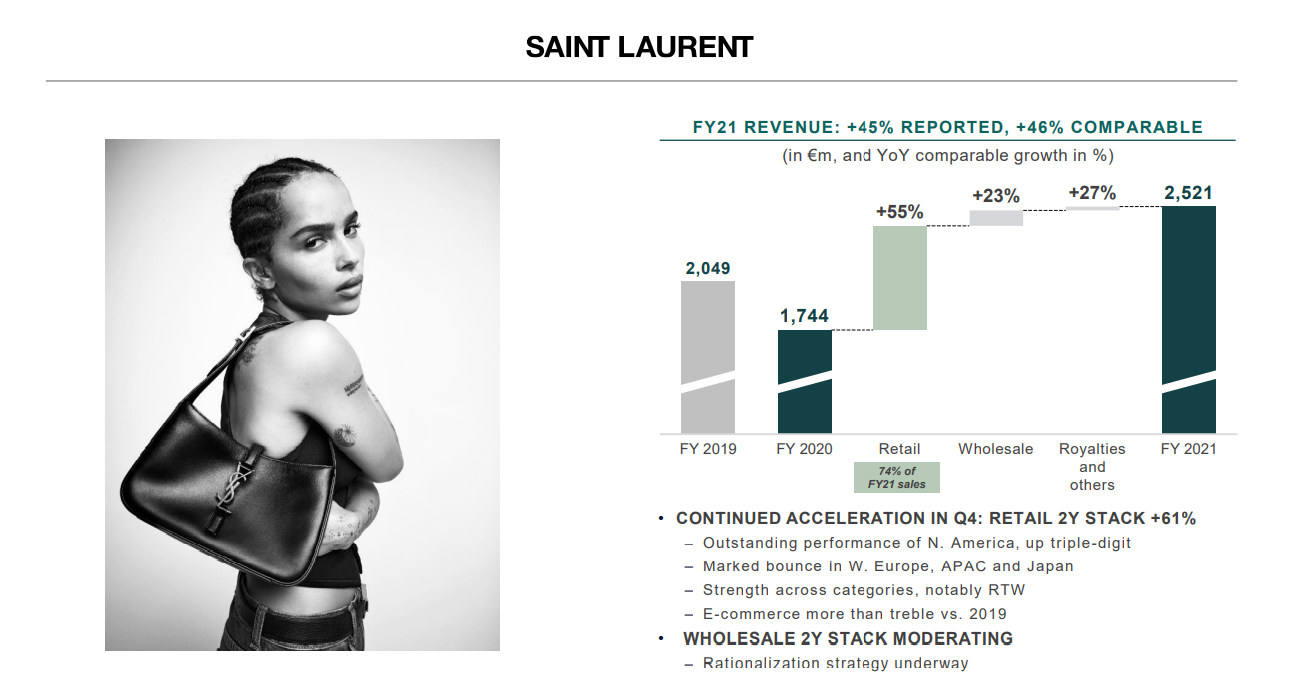

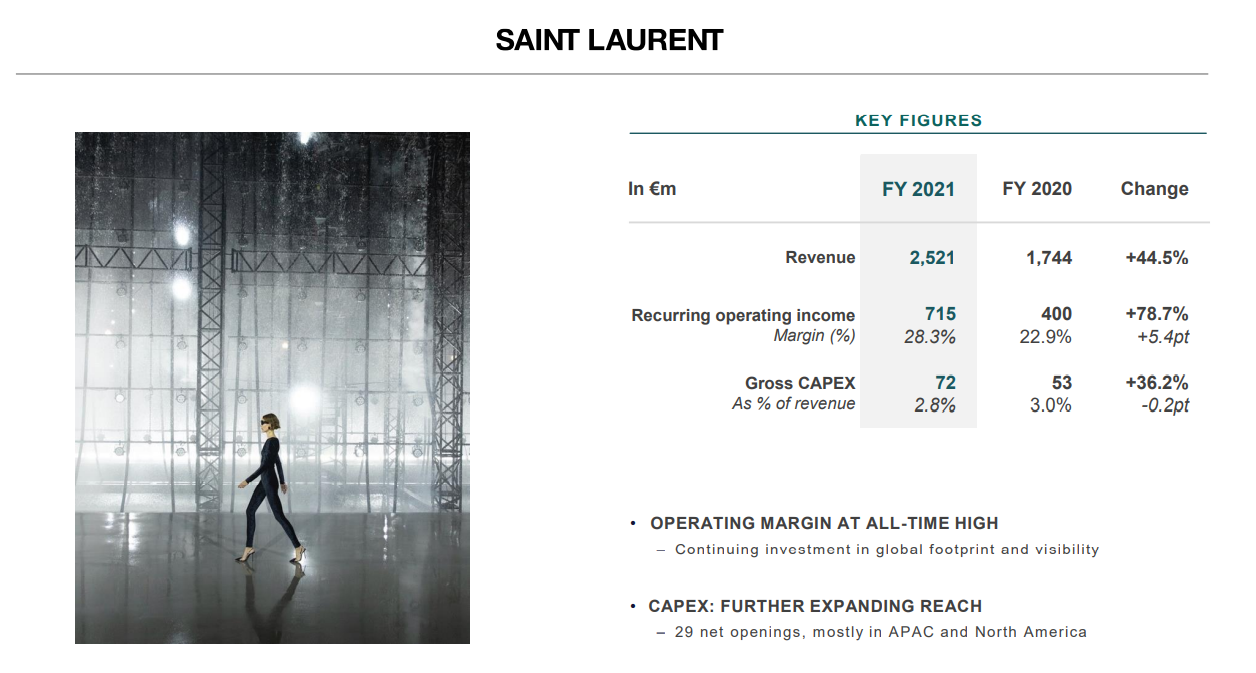

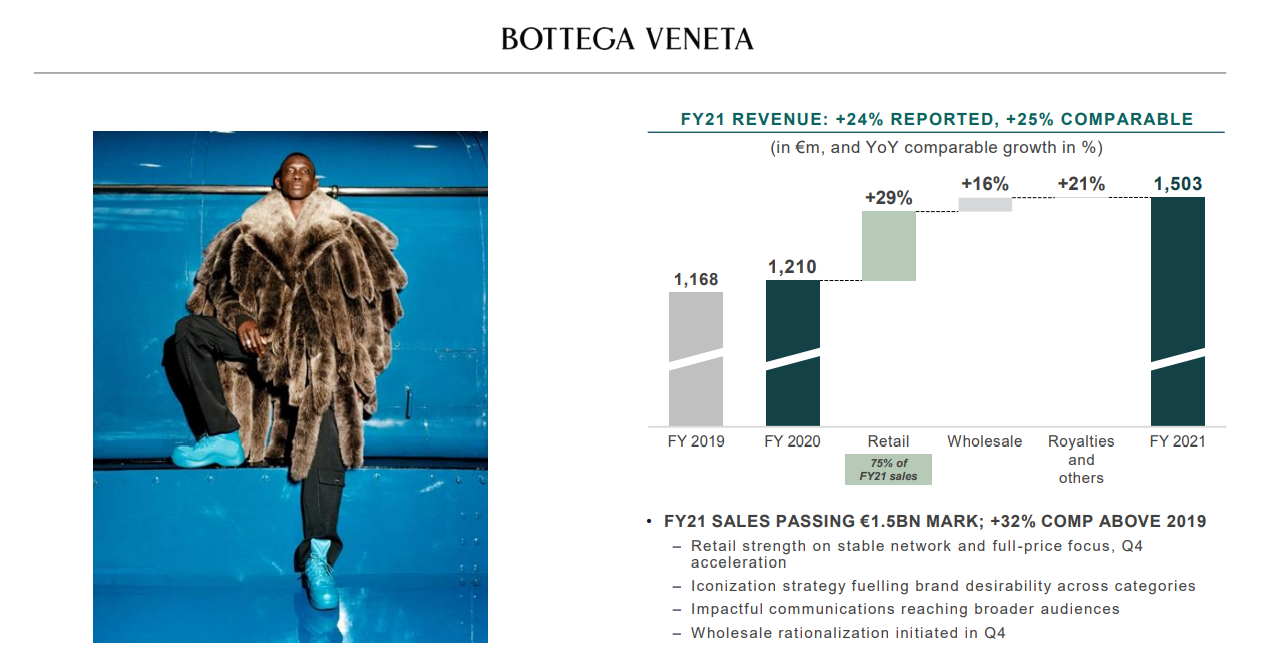

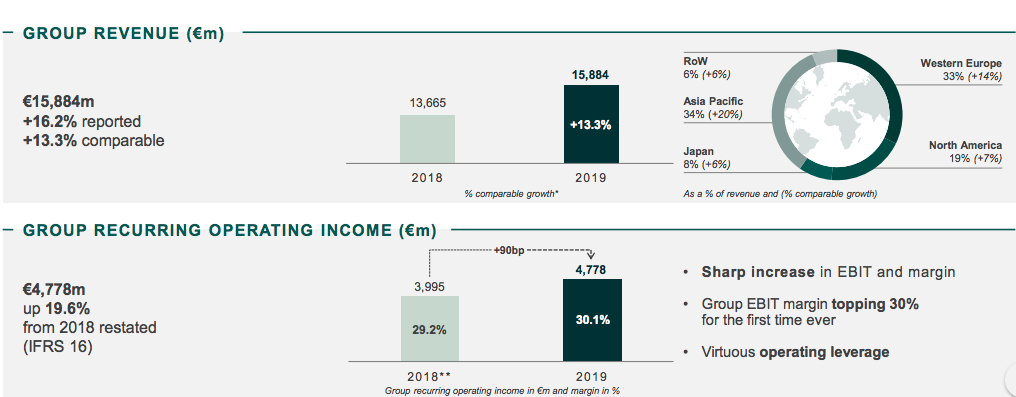

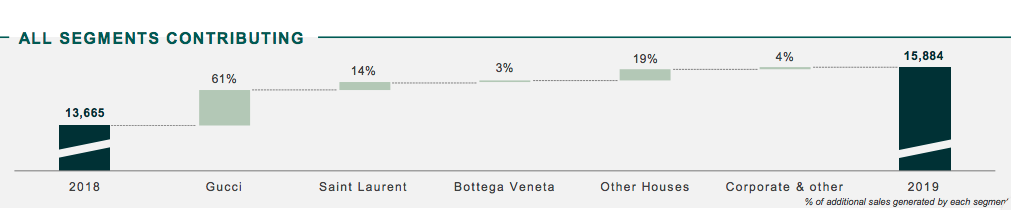

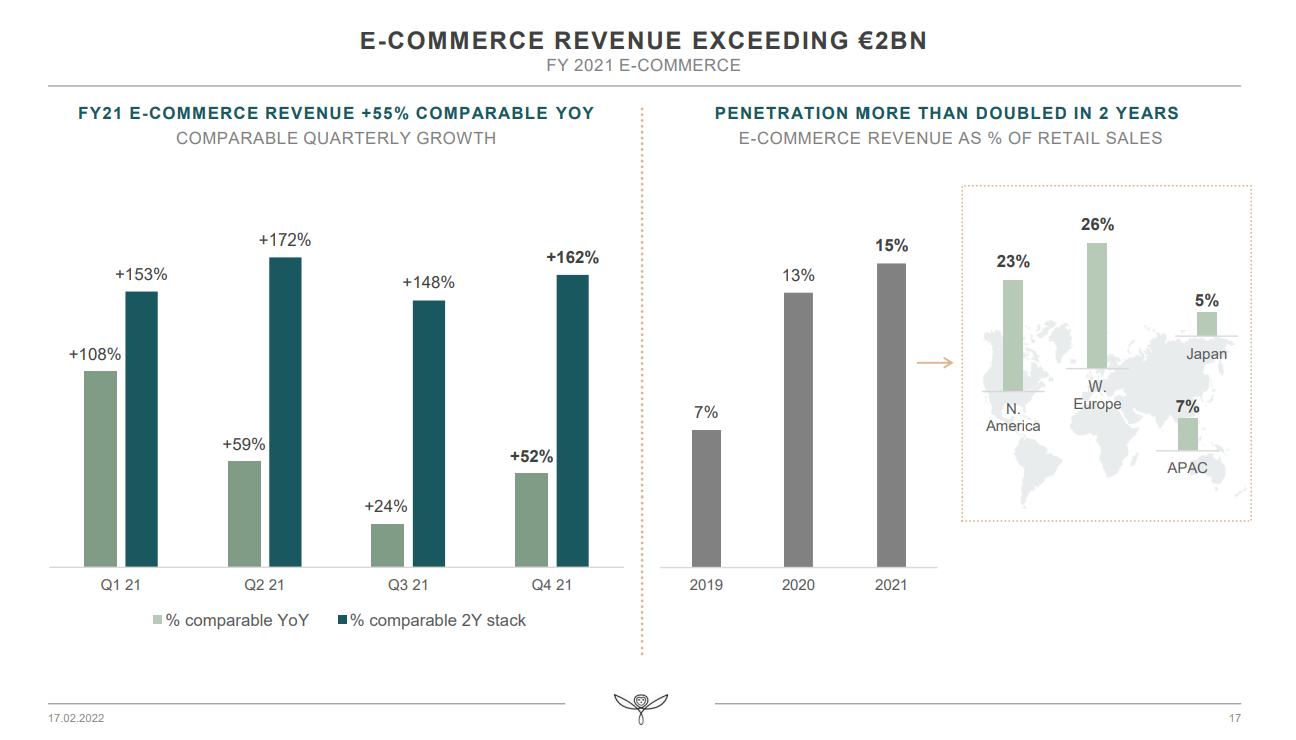

In total Kering Group posted a +35% increase in revenues to €17,645 million on a comparable basis, a notable +13% gain over pre-pandemic 2019.

Record recurring operating income of €5,017 million represented a +60% surge while net income attributable to the Group reached €3,176 million.

Chairman and Chief Executive Officer François-Henri Pinault said: “Kering realised excellent performances in 2021, further consolidating its prominent position in the luxury of the future.

“Thanks to their ability to blend authenticity with bold creativity, all our Houses achieved sharp sales rebound, way beyond their 2019 levels, while reinforcing the exclusivity of their distribution and further enhancing their brand equity.

“All our Houses are stronger than ever before, and we are confident we will extend last year’s momentum in 2022 and in coming years.”

GROUP HIGHLIGHTS

BRAND AND DIVISION HIGHLIGHTS