Luxury goods group Kering has agreed to acquire a 30% shareholding in Valentino for a cash consideration of €1.7 billion. The transaction is part of a broader strategic partnership between Kering and Valentino parent Mayhoola For Investments, which could lead to Mayhoola becoming a shareholder in Kering.

The deal comprises an option for Kering to acquire 100% of the share capital of Valentino no later than 2028 from the powerful Qatari company Mayhoola.

Valentino has 211 directly operated stores in more than 25 countries and has recorded revenues of €1.4 billion and recurring EBITDA of €350 million in 2022.

Kering Chairman and CEO François-Henri Pinault commented: “I am impressed with the evolution of Valentino under Mayhoola ownership and very delighted that Mayhoola has chosen Kering as its partner for the development of Valentino, a unique Italian house that is synonymous with beauty and elegance. I am very pleased of this first step in our collaboration with Mayhoola to develop Valentino and pursue the very strong strategic journey of brand elevation that Jacopo Venturini will continue to lead.”

Rachid Mohamed Rachid, CEO of Mayhoola and Chairman of Valentino, added: “Valentino is one of the ultimate Italian luxury authorities and we are very happy to welcome Kering as a strategic partner for the future development of the Maison de Couture. Under our stewardship, Valentino has strengthened its foundations as a highly desirable luxury brand and we will keep reinforcing the brand in the next chapter with Kering. We look forward to our partnership with Kering in Valentino and also in other potential opportunities to explore investments together.”

Mayhoola’s portfolio also includes luxury houses Balmain and Pal Zileri and leading Turkish luxury department store Beymen.

The move was announced as Kering revealed first-half results, with group revenue amounting to €10.1 billion, an increase of +2% both as reported and on a comparable basis. Net income attributable to the Group was €1.8 billion in the half.

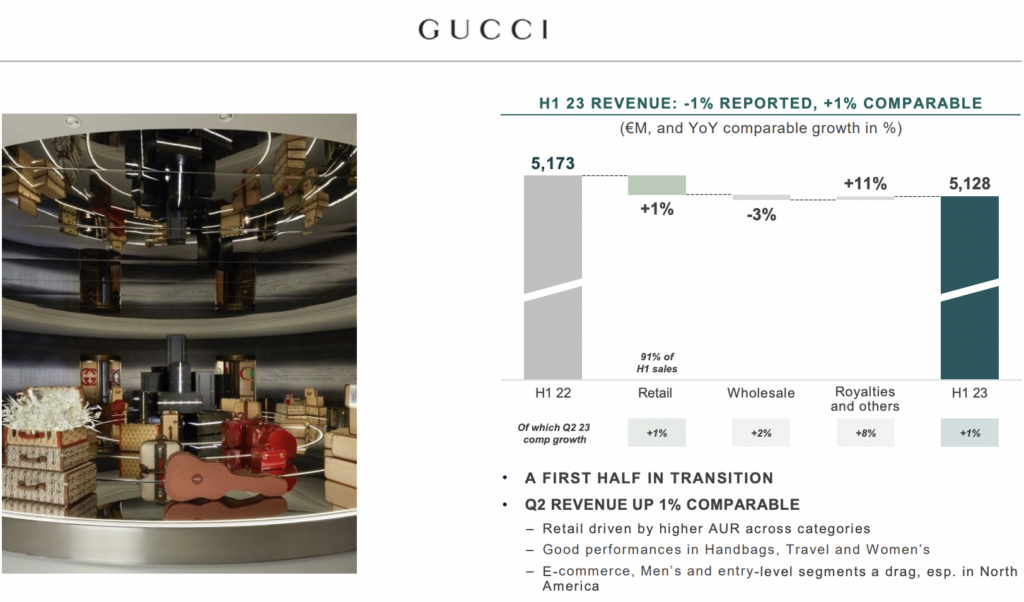

Kering Eyewear turned in a record performance, with revenue hitting €869 million, an increase of +51% as reported, driven partly by the significant contribution of recent acquisition Maui Jim and up +16% on a comparable basis. H1 recurring operating income rose sharply to €186 million. After taking into account Corporate costs of €123 million during the period, the Kering Eyewear and Corporate segment’s recurring operating income amounted to €63 million. Among the major houses, Gucci’s first-half 2023 revenue amounted to €5.1 billion (down -1% as reported and up +1% on a comparable basis). Sales in the directly operated retail network grew +1% on a comparable basis.

Among the major houses, Gucci’s first-half 2023 revenue amounted to €5.1 billion (down -1% as reported and up +1% on a comparable basis). Sales in the directly operated retail network grew +1% on a comparable basis.

Yves Saint Laurent’s first-half 2023 revenue amounted to €1.6 billion, up +6% as reported and up +7% on a comparable basis. Bottega Veneta’s first-half 2023 revenue hit €833 million, unchanged as reported and up +2% on a comparable basis. Other houses had sales of €1.9 billion (down -5% as reported and on a comparable basis), with a significant improvement between the first and second quarters.

François-Henri Pinault said: “In the first half, we pursued our investments in our Houses’ desirability and exclusivity. While engaging in critical forward-looking initiatives, we maintained a high level of profitability. We also took some decisive steps to expand our footprint in the luxury universe, notably with the acquisition of the famed Creed fragrance house to accelerate the lift-off of Kering Beauté.

“Together with the major organisational changes we announced last week to enhance stewardship of our Houses, as well as the many projects we have already launched over the past few months, the developments of the first half strengthen my confidence in Kering’s future prospects.” ✈