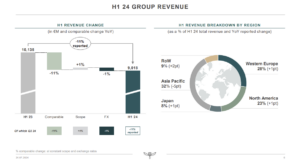

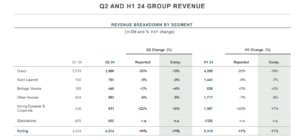

Luxury powerhouse Kering has posted an -11% decline in reported (and comparable) first-half sales to €9,018 million while recurring operating income plunged -42% to €1,582 million.

Recurring operating margin was 17.5%, significantly lower than in the first half of 2023, resulting from what Kering called negative operational leverage.

Flagship brand Gucci posted a -20% year-on-year decline in reported revenue (-18% comparable) to €4,085 million (see full details further down the page). Saint Laurent (-9% reported, -7% comparable) and Other Houses ( -7% reported, -6% comparable) were also down while Bottega Veneta was flat (+0% reported, +3% comparable).

Kering Eyewear was the star of the show, continuing its highly positive trend with a +6% rise (+5% reported) year-on-year increase in comparable sales to a record €914 million.

Kering Eyewear’s recurring operating income reached €196 million, driving a +61% year-on-year gain in recurring operating income for Kering Eyewear and Corporate (see panel below for full details).

In Q2, revenue also fell -11% (reported and comparable) to €4.5 billion. The reported figure includes a negative currency effect of -1% and a positive scope effect of +1% from the consolidation of Creed (as reported, Kering Beauté, the group’s beauty arm created in early 2023, acquired 100% of high-end luxury fragrance house Creed last October).

Q2 sales from Kering’s directly operated retail network fell by -12% year-on-year (comparable) adversely affected by lower store traffic.

Trends in the various regions in the second quarter remained broadly in line with the first quarter, apart from (see chart directly below) a sequential improvement in Japan (as also noted by luxury rival LVMH yesterday – a dynamic largely attributable to the weak Yen) and a deceleration in Asia Pacific.

Wholesale and other revenue fell -6% on a comparable basis in Q2, as the Group continued to enhance the exclusivity of its Houses’ distribution.

Chairman and Chief Executive Officer François-Henri Pinault commented: “In a challenging market environment, which adds pressure on our top line and profitability, we are working assiduously to create the conditions for a return to growth.

“Our Houses pursue their investments to enrich their offer, intensify the impact of their communications, and reinforce the exclusivity of their distribution.

“We make certain that every one of these investments creates value for the long term. While the current context might impact the pace of our execution, our determination and confidence are stronger than ever.”

Summarising the outlook in a deeply challenging luxury climate, the group said: “Considering the uncertainties weighing on the evolution of demand from luxury consumers in the coming months following the slowdown recorded in the first half of 2024, Kering’s recurring operating income in the second half of 2024 could be down by approximately -30% compared to the second half of 2023.

“The group prioritises expenses and initiatives supporting the long-term development and growth of its houses, while pursuing with determination the actions required in the current situation to optimise its cost structure.”

We’ll bring you more details after today’s earnings call. ✈

Kering Eyewear profits surge Kering Eyewear bucked the group’s negative trend, turning in a strong first-half performance marked by a +6% rise (+5% reported) year-on-year in comparable sales to a record €914 million. The Eyewear arm was integral to Kering Eyewear and Corporate posting a +52% year-on-year surge in H1 EBITDA to €287 million. In the first half, Kering Eyewear’s recurring operating income reached €196 million. Recurring operating income for the Kering Eyewear and Corporate segment was €101 million, after taking into account Kering Beauté’s recurring operating income along with corporate costs (€95 million). In Q2, Kering Eyewear’s sales rose by +3% both on a comparable basis and as reported, driven by solid progression of the brands in its portfolio.

|