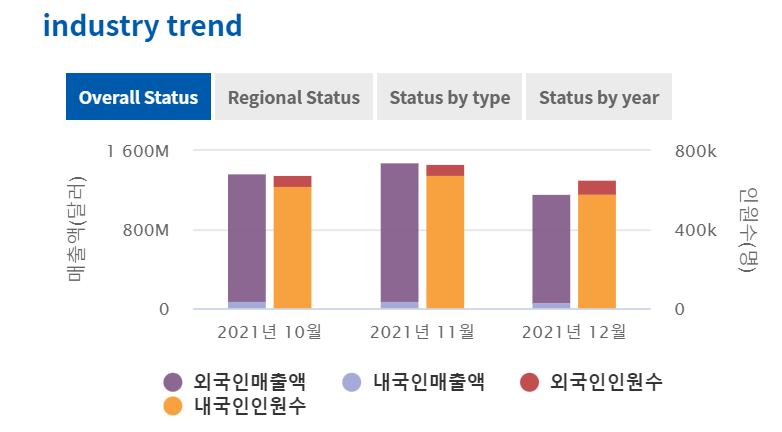

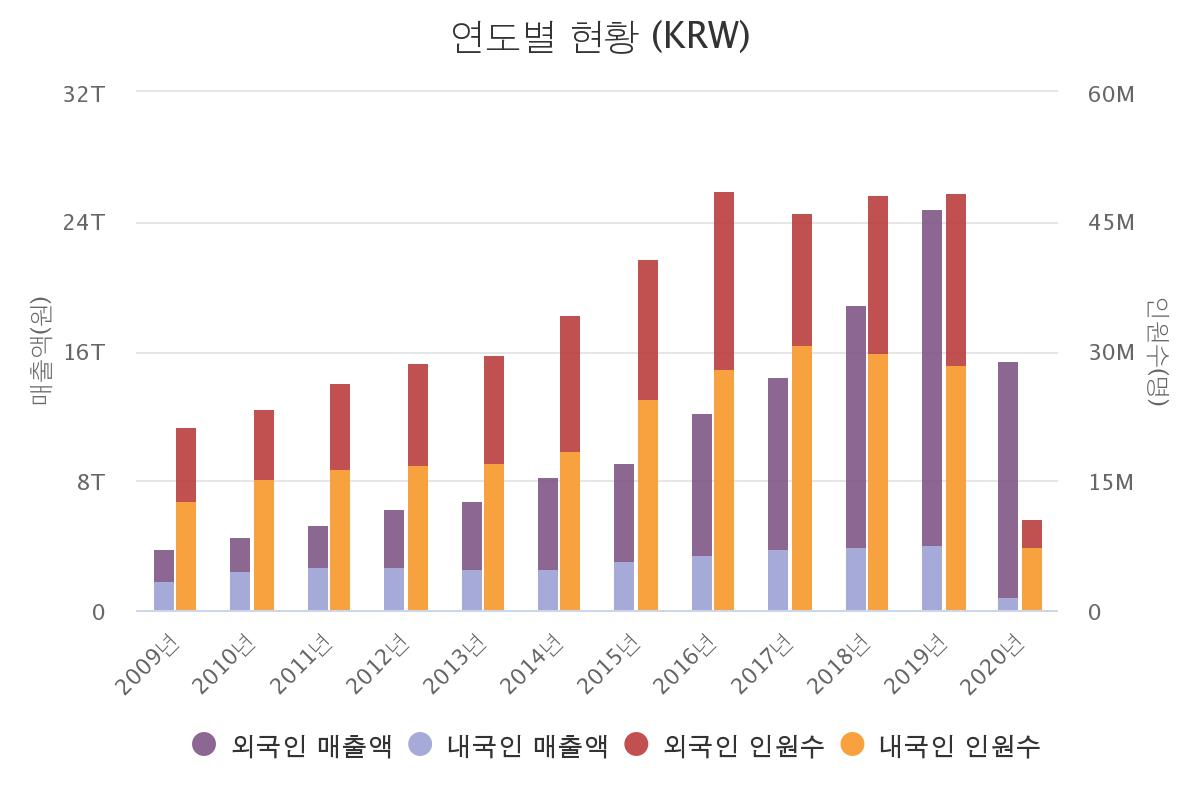

SOUTH KOREA. Sales in the South Korean duty free market – historically the world’s biggest – rose +15% year-on-year in 2021 to KRW17.83 trillion (US$14.74 billion), according to the Korea Duty Free Association.

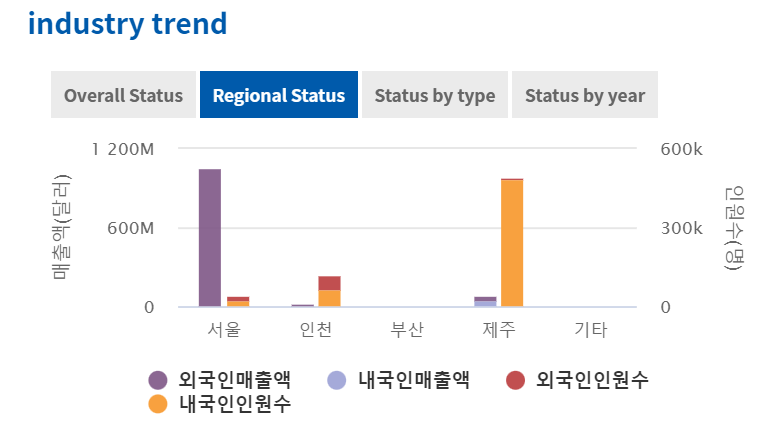

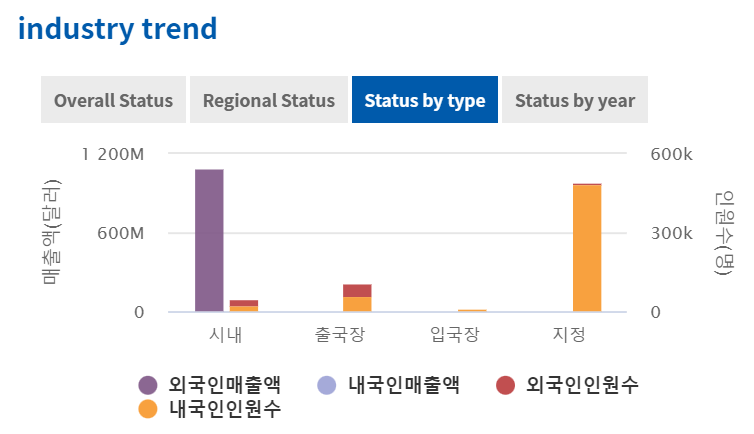

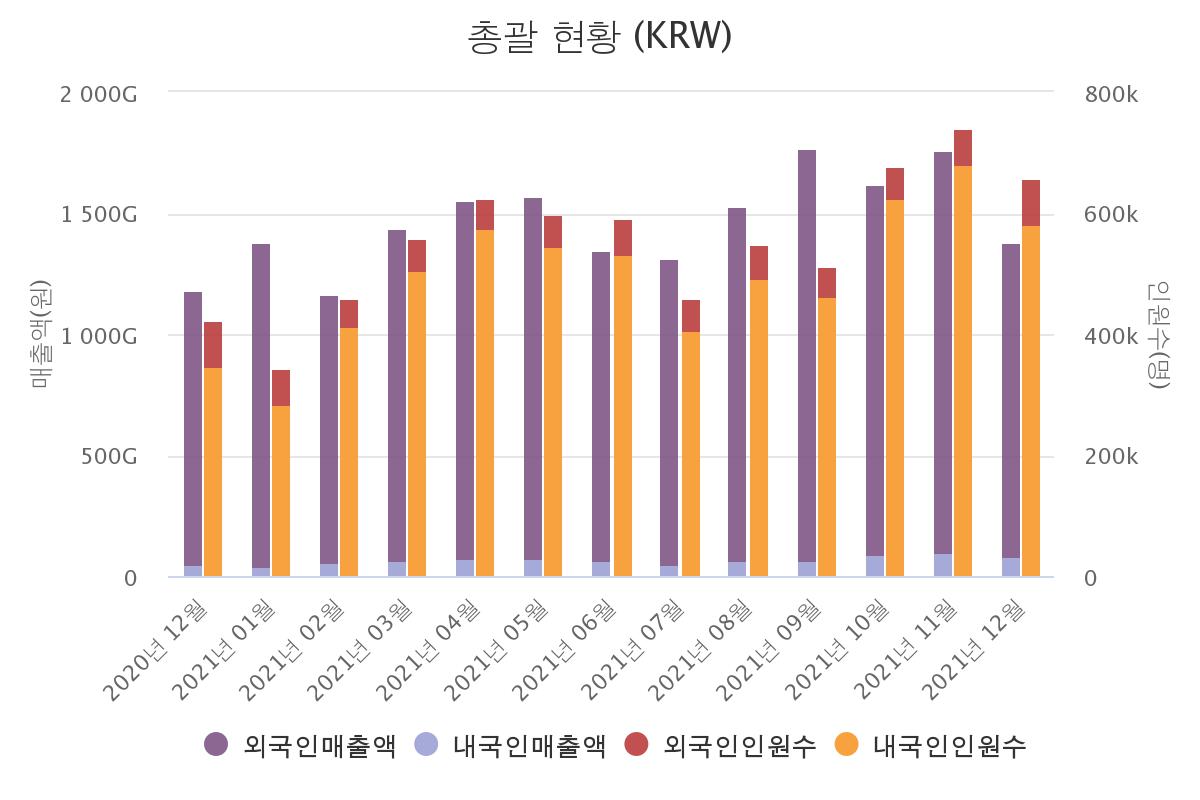

The pandemic-hit channel was once again driven by sales to foreign customers who generated 95.4% of total revenue (up from 94% in 2020). Almost all of that activity was through reseller activity. The results and the graphs below underline how, accentuated by the pandemic and the resultant restrictions on outbound and inbound travel, the Korean duty free market has evolved into essentially a trading market.

“It is not a duty free channel for now, just a trade business with a price advantage,” one experienced Korean travel retail executive told The Moodie Davitt Report.

The market served some 6.77 million customers in 2021. While most of them were Koreans, sales to nationals paled into insignificance compared with the Chinese spending.

December sales reached KRW1.3779 trillion (US$1.138 billion).