SOUTH KOREA. Duty free retailers are urging Korea Customs Service (KCS) to extend the temporary scheme that allows them to offload unsold duty free stock (after paying import taxes) in domestic channels. The scheme is scheduled to end on 29 October, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung* in Seoul.

The offer of unsold duty free inventory has provided much needed liquidity at a time when the Korean duty free market has been heavily hit by COVID-19.

KCS told The Moodie Davitt Report that the extension is under review. Major retailers contacted by us said that they expect the extension to be approved because trading conditions have not improved and inbound travel has not resumed.

KCS allowed the sale of unsold duty free inventory through local channels such as ecommerce, department stores, outlets and others on 29 April. While there is no official data, all three of the major retailers have ramped up their offering since Shinsegae Duty Free began its sale process on 3 June. Despite KCS permission, it took some time for the retailers to negotiate sales with brands and agencies.

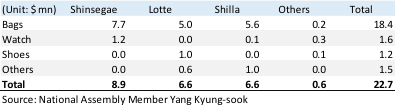

KCS estimated at the time that the duty free industry could sell around 20% of undepleted inventory, delivering around KRW160 billion (US$132 million) in revenue. According to National Assembly Member Yang Kyung-sook, total sales from the start of the period until 10 July were US$22.7 million.

The KCS measures allowed duty free retailers the option of: a) direct sales of unsold inventory into local channels (department stores, home shopping, ecommerce and others); b) wholesale of unsold inventory to local third parties; and c) international shipping of unsold inventory outside South Korea.

Another key area affected was sales to daigou, the anchor of Korean duty free. As early as February, KCS had already implemented measures that aided the reseller trade. Due to the impact of COVID-19, KCS accepted measures requested by the duty free industry to abolish purchase limit restrictions and deregulate constraints regarding departure gate pickup counters.

The latter allowed duty free retailers to ship any purchases from daigou operators via air cargo to their required destination (usually Hong Kong for onward movement to the Chinese Mainland). This meant that daigou operators and agencies were no longer required to carry their purchases back in luggage but could receive their items via logistics solutions supplied by each retailer.

This measure allowed daigou sales to continue and as a result sales per foreign customer soared +1,575% year-on-year in July – with foreign shoppers on average buying US$14,275 worth of goods.

Despite concerns that this practice would come to an end on 29 October, KCS confirmed to The Moodie Davitt Report that deregulated use of export pickup counters will continue until otherwise notified. The message is clear: travel retailers will continue to rely on daigou sales until normalisation of international travel occurs.

*Note: Korean national Min Yong Jung, formerly based in London and now in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a previously unseen level of research and analysis for the travel retail channel.

Do you have research needs related to the Korean and Asia Pacific travel retail and luxury markets? Min Yong Jung can be contacted at minyong@moodiedavittreport.com