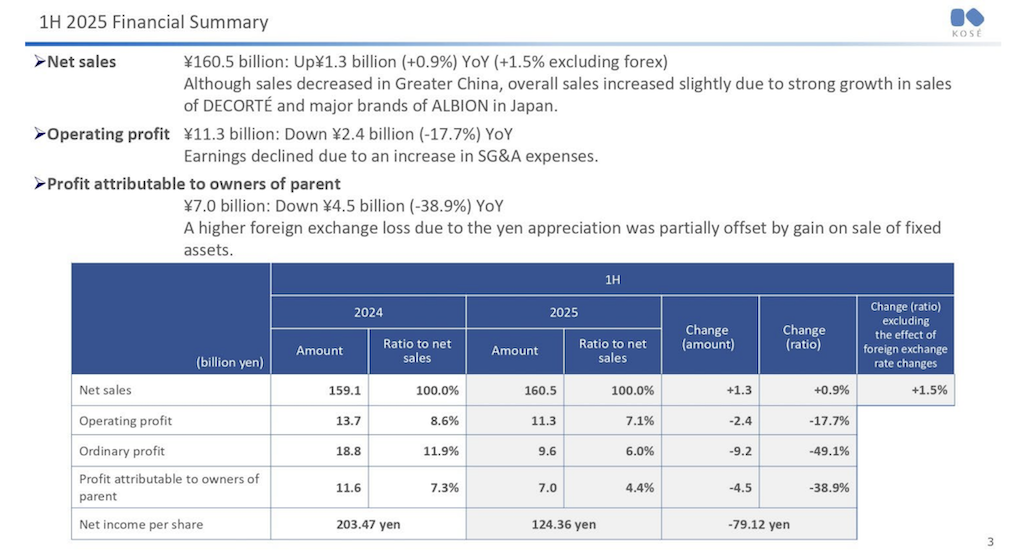

Japanese beauty group KOSÉ has reported consolidated net sales of ¥160.5 billion (US$1.09 billion) for the first half of FY2025, ended 30 June. This represents an increase of +0.9% year-on-year (+1.5% at constant exchange rates).

KOSÉ noted that sales growth for DECORTÉ and Albion in Japan offset weaker results in China and travel retail.

Operating profit declined -17.7% year-on-year to ¥11.3 billion (US$77 million) reflecting higher Selling, General & Administration (SG&A) and logistics costs, including goodwill amortisation and expenses related to newly consolidated Puri Co.

Ordinary profit dropped -49.1% to ¥9.6 billion (US$65 million), largely due to foreign exchange losses from yen appreciation, while net profit attributable to owners of its parent fell -38.9% to ¥7 billion (US$47 million).

Regional performance

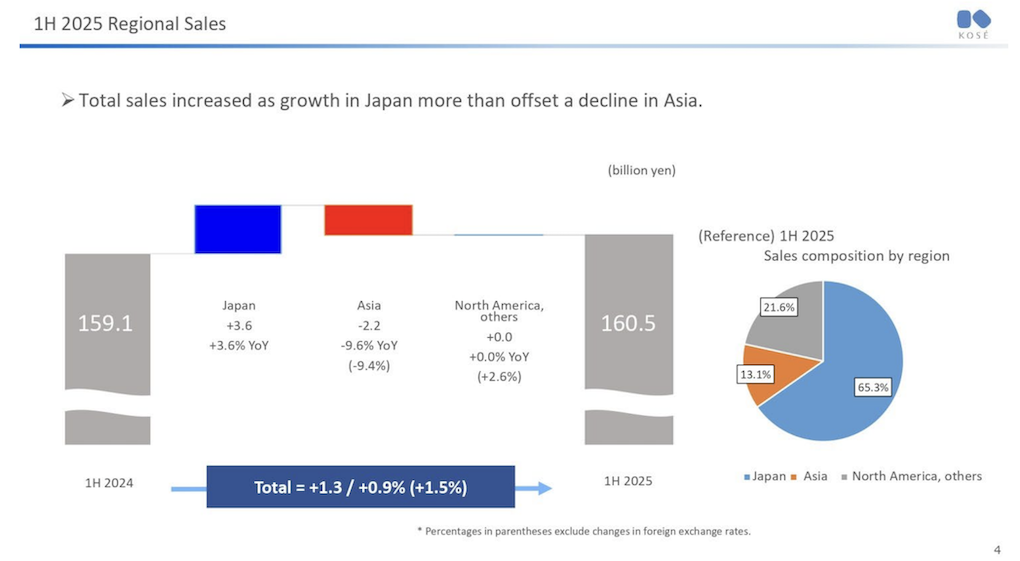

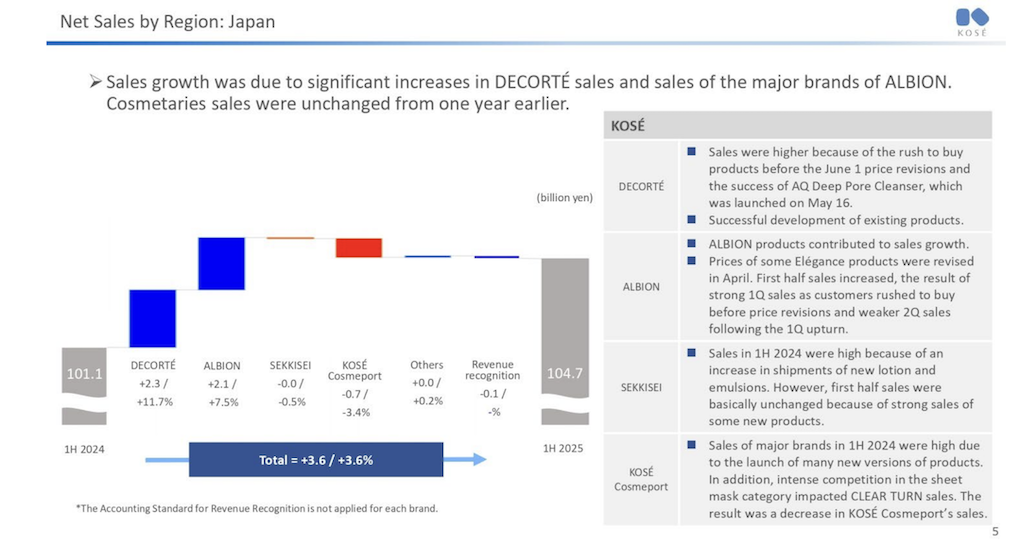

The company underlined a mixed economic environment across key markets. In Japan, the economy continued to recover but at a modest pace, constrained by inflation and weaker consumer spending. Growth in tourist-driven cosmetics sales also slowed in Q2 due to reduced per-customer spending and a deceleration in inbound visitor growth. Sales in Japan rose +3.6% year-on-year to ¥104.7 billion (US$71 million), underpinned by strong performances from DECORTÉ and Albion.

SEKKISEI maintained sales at prior-year levels, supported by the success of new products. By contrast, Cosmeport sales fell, with Clear Turn impacted by intensifying competition in the sheet mask category.

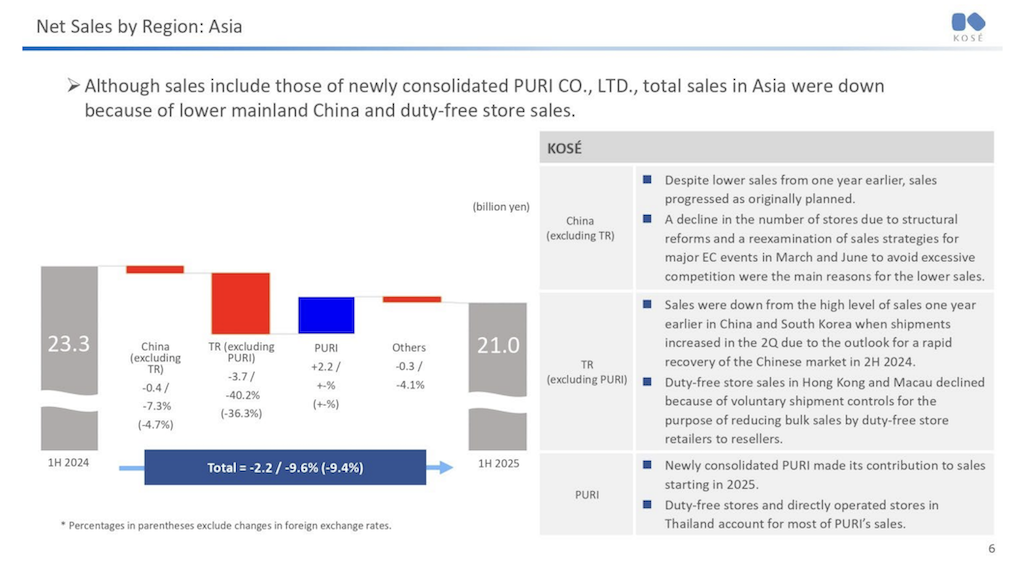

In Asia, and particularly China, conditions remained subdued amid trade friction with the USA.

In China and Korea, duty-free sales declined relative to increased shipments in Q2 of the previous fiscal year, which in turn anticipated a strongere China recovery at the time.

Regional sales in Asia fell -9.6% year-on-year to ¥21.1 billion (US$140 million). The company said this reflected voluntary shipment controls in travel retail and weaker demand in Mainland China during key sales events in March and June. These measures were designed to protect brand value amid excessive competition from ecommerce, said the group.

The decline was partly cushioned by the contribution from Thailand-based Puri Co., consolidated since H1.

In the US, demand was buoyed in March by pre-tariff purchases, but consumer sentiment deteriorated from April, with price sensitivity in the mid-to-high-end cosmetics market weighing on performance.

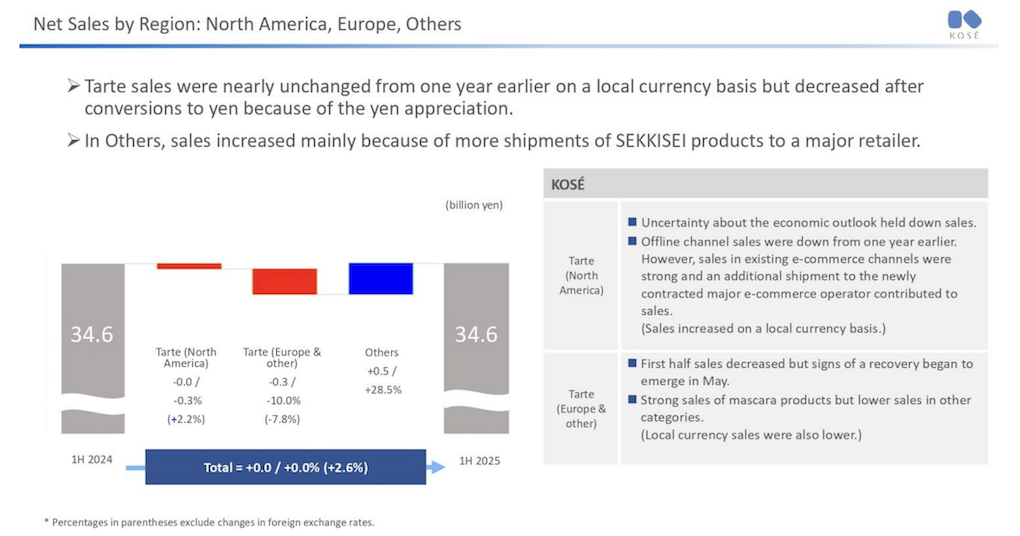

Sales in North America and other areas was ¥34.6 billion (US$230 million), nearly unchanged from the previous year.

Tarte – the group’s main brand in the region – returned to growth in Q2 after a weak first quarter, with solid ecommerce sales and new shipments to a major online partner offsetting declines in offline channels. Yen appreciation meant reported sales were flat despite stable local currency performance.

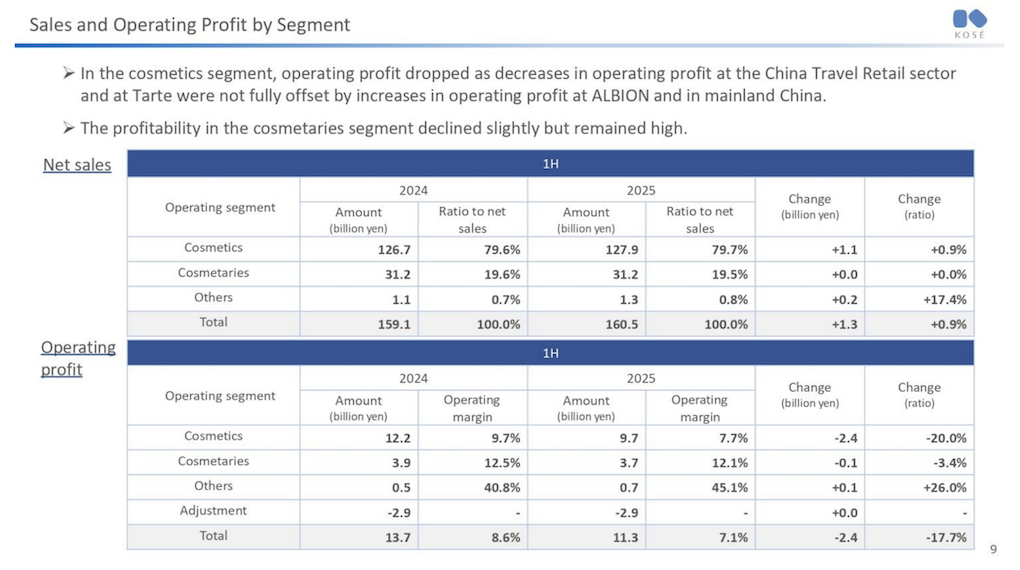

Performance by segment

Cosmetics sales rose +0.9% to ¥127.9 billion (US$87 million) though operating profit fell -20% to ¥9.7 billion (US$66 million). Notably, gains from Albion and profitability improvements in Mainland China were outweighed by declines in China travel retail and at Tarte, where higher marketing and logistics costs weighed on earnings.

Cosmetaries sales were broadly flat at ¥31.2 billion (US$21 million) with operating profit down -3.4% to ¥3.7 billion (US$25 million).

Sales in the ‘Others’ category rose +17.4% to ¥1.3 billion (US$8.8 million), with operating profit up +26% to ¥722 million (US$4.8 million), supported by stronger amenity product sales and improved margins.

Outlook and Vision 2030

KOSÉ reiterated its full-year forecast of ¥336 billion (US$2.27 billion) in net sales and ¥20 billion (US$140 million) in operating profit. The company revised down Tarte’s sales plan by ¥3.4 billion (US$23 million) and its operating profit forecast by ¥3.9 billion (US$26 million), citing continued marketing investment, but said this would be offset by robust performance in Japan and cost reductions.

Cost savings of ¥4.8 billion (US$32 million) are targeted for FY2025, focused on SG&A, with further scrutiny of investment efficiency planned from FY2026.

The company reaffirmed its medium- to long-term strategy, Vision for Lifelong Beauty Partner – Milestone 2030. Phase I of this plan prioritises structural reforms, profitability improvements in Japan and investment to build a sustainable growth platform in Asia.

In China, profitability was maintained in H1, supported by the 6.18 e-commerce campaign. Efforts will now focus on improving sales outside major shopping festivals while ensuring promotional efficiency.

In Southeast Asia, KOSÉ is pursuing growth through the PAÑPURI brand, with an emphasis on strengthening domestic demand in Thailand and expansion into wider Asia, including Japan.

KOSÉ said it would continue to respond to changing global conditions with structural reforms designed to underpin profitability and lay the foundation for sustainable growth across international markets.

KOSÉ President and CEO Kazuto Kobayashi commented: “At last, the market environment and the competitive environment in each region of operation are currently changing, requiring all kinds of measures to be taken. We will respond speedily to changes in the environment and steadily work to complete the structural reforms and rebuild the foundation in Phase I of our medium- to long-term vision to lay the groundwork for sustainable growth.” ✈