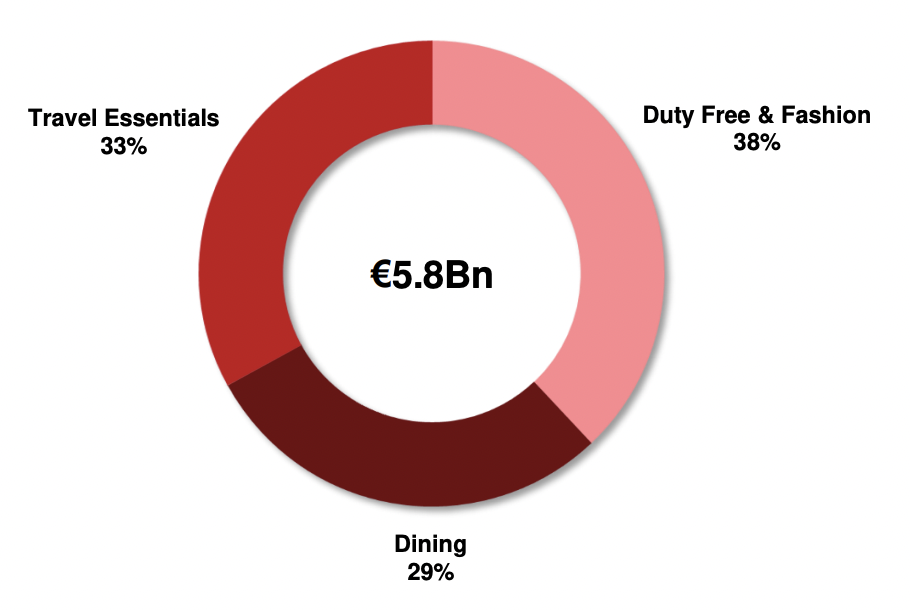

FRANCE. Lagardère Travel Retail posted €5,812 million in revenue in 2024, up +15.8% year-on-year and +12.5% on a like-for-like basis with profitability reaching a new high (see below). The news emerged as Lagardère Group announced its annual results today, with travel retail continuing to perform well in early 2025.

The difference between Lagardère Travel Retail reported and like-for-like revenue in 2024 was attributable to a €148 million positive scope effect linked to the acquisition of Tastes on the Fly (€132 million positive impact). The currency effect was virtually nil, the impact of the Polish Zloty being offset by the Czech Koruna, the Chinese Yuan and the US Dollar.

In France, business surged by +15% (like-for-like), supported in particular by an increase in air traffic, the success of the Extime Duty Free Paris joint venture with Groupe ADP, and network upgrades and sales initiatives rolled out across all networks and business lines.

The EMEA region (excluding France) recorded like-for-like growth of +20%, driven by excellent performances in Italy (increased traffic at Rome Fiumicino airport), Romania (opening of the duty-free concession in Bucharest), the UK (including duty-free activity on ferries) and Spain (extension of the network).

In the Americas, Lagardère Travel Retail maintained its growth trajectory, with revenue up +6% like-for-like from an already high basis of comparison, supported by the return to normal air traffic levels in the USA and strong momentum in Canada. Asia Pacific recorded a decline of -13% due to lower business levels in North Asia as a result of the economic slowdown in China and network streamlining.

Recurring EBIT for the travel retail division topped the €300 million mark at an all-time high of €305 million, a +24.5% increase compared with 2023. The recurring EBIT margin was 5.3%. This growth was driven by solid performances across all geographical regions, except for China.

EBITA came to €258 million, up €17 million year on year. The EBITA margin was 4.4%, including restructuring costs and asset impairment losses of €39 million in China, income from equity-accounted companies and impairment losses on certain concession agreements.

In Q4, Lagardère Travel Retail revenue hit €1,468 million, up +13.1% as reported and +11.6% like for like. The difference between reported and like-for-like revenue is attributable to a €3 million positive currency effect linked mainly to the appreciation of the Polish Zloty (positive €4 million impact), and to a €14 million positive scope effect in connection with the acquisition of Tastes on the Fly in November 2023.

Speaking to investors this evening about early performance in 2025, Lagardère Travel Retail Chairman & CEO Dag Rasmussen said that the year had begun well. January – traditionally among the weaker trading months – showed sales growth of over +9% at constant exchange rates and +12% at current rates.

He said: “The momentum continues to be very good and will also have the impact of our openings in Romania, Albania, some African countries and Amsterdam to come by early May.”

Asked about restructuring of the travel retail division in light of the challenging China market, Rasmussen said: “We are definitely considering restructuring our North Asian operation in 2025 but the costs are accounted for in 2024. So we don’t expect additional restructuring costs on that.”

For the full year, Lagardère Group revenue climbed by +10.6% (+8.5% on a like-for-like basis) to €8.94 billion, with record recurring EBIT of €593 million, up +14%. Group share of adjusted profit came to at €253 million, marginally ahead of the €252 million recorded in 2023.

Lagardère Chairman and Chief Executive Officer Arnaud Lagardère said: “2024 saw growth in all of Lagardère’s activities, with our Group posting revenue of some €9 billion.

“With like-for-like growth of 12.5% in 2024, Lagardère Travel Retail is benefiting fully from the growth in air traffic thanks to its three complementary businesses (Travel Essentials, Duty Free & Fashion and Dining) operated through more than 5,000 points of sale around the world.

“Lagardère Travel Retail continued to consolidate its position as a leading industry player with major tender wins during the year, including for Amsterdam Schiphol, Düsseldorf, Atlanta and Nice airports.

“Thanks to our businesses’ performance and disciplined cost management, recurring EBIT reached a record €593 million. For the first time, the Group’s two main divisions (Lagardère Publishing and Lagardère Travel Retail) contributed in almost equal measure to this result. These operating performances have driven a marked improvement in cash generation and furthered our objective of significantly reducing our debt.” ✈