|

FRANCE/INTERNATIONAL. Lagardère Travel Retail sales hit €1,640 million in the first half of 2015, down by -11.4% on a reported basis and up +3.5% on a like-for-like basis.

The reported fall in sales was due to a negative scope effect of €306 million, broken down as follows:

• deconsolidation of Relay activities in train stations in France (now consolidated using the equity method through the creation of a joint venture with SNCF in September 2014) for €159 million, as well as high-street Retail activities in Poland (now consolidated using the equity method after disposal of 51% of Inmedio capital in December 2014) for -€55 million;

– the disposal in Switzerland of Distribution activities in February 2015, with an impact of €107 million, and of Payot book stores in July 2014 with an impact of €25 million.

• Acquisitions for €54 million, essentially the Airest Group activities (notably at Venice Airport) starting in April 2014.

Against this, the division benefited from a favourable exchange rate effect in the latest quarter of €42 million (rise of the Swiss Franc and the US, Australian, Canadian and Singaporean Dollars).

The division is continuing the strategic transition of its activities with travel retail now accounting for 70% of revenues (seven points higher than H1 2014) and 30% for Distribution (Press Distribution and Integrated Retail). The latter division is being sold off market by market.

|

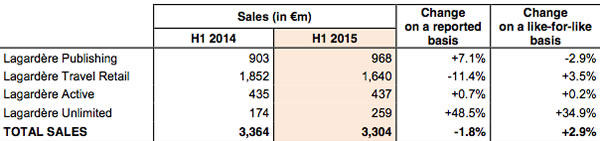

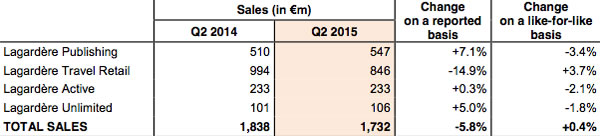

Lagardère Group’s H1 and Q2 results by division, including Travel Retail |

|

Travel retail sales climbed by +7.3% in the half. This was driven by “growth in passenger traffic, the strong performance of acquisitions, expansion of networks and rollout of new concepts,” said the group. Growth in the second quarter (+7.8%) was higher than in the first quarter (+6.7%).

In France, activity grew considerably over the first half (+8.7%), due to the Duty Free arm (increase in traffic and average spending per passenger), in addition to the solid performance of Travel Essentials and Foodservice segments.

Europe (excluding France), posted a strong performance (+7.9%). Increased traffic and new stores led to significant growth in Poland (+11.8%), Italy (+7.3%), where the ramping-up of activities in Rome Airport continued (+13.9% despite the fire in May), as well as Romania (+15.5%) and Spain (+10.6%).

Sales were also up in North America (+5.7%) due to expansion at airports and a solid level of underlying activity.

The Asia-Pacific region is also growing (+3.2%), due to the development of fashion activities in China and Singapore.

LS Distribution activities declined by -4.0%, with market diversification not completely offsetting the decline in the print press market.

In the division recurring EBIT (of fully consolidated companies) was at €30 million, down by €5 million, due to disposals in Switzerland and the US, which had a negative impact of €4 million.

In travel retail alone recurring EBIT grew by €3 million, though the integration of Airest activities had a negative impact (unfavourable seasonal effect in the first quarter).