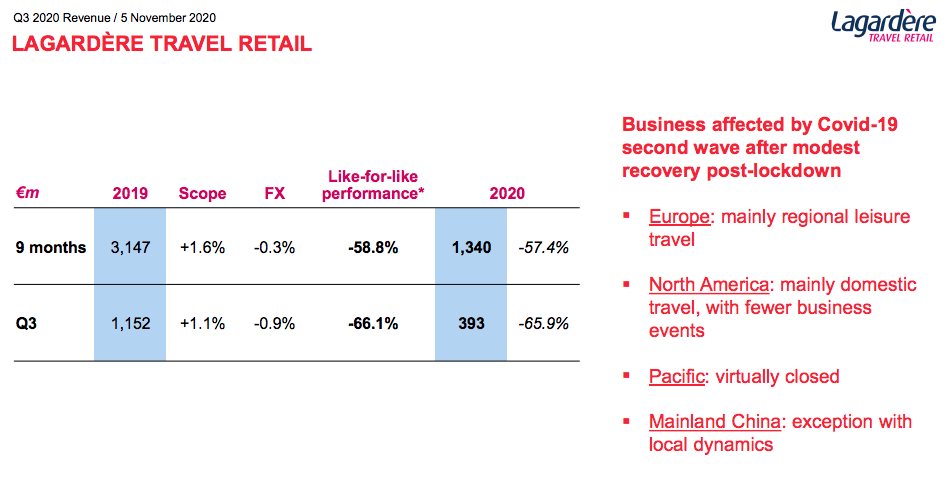

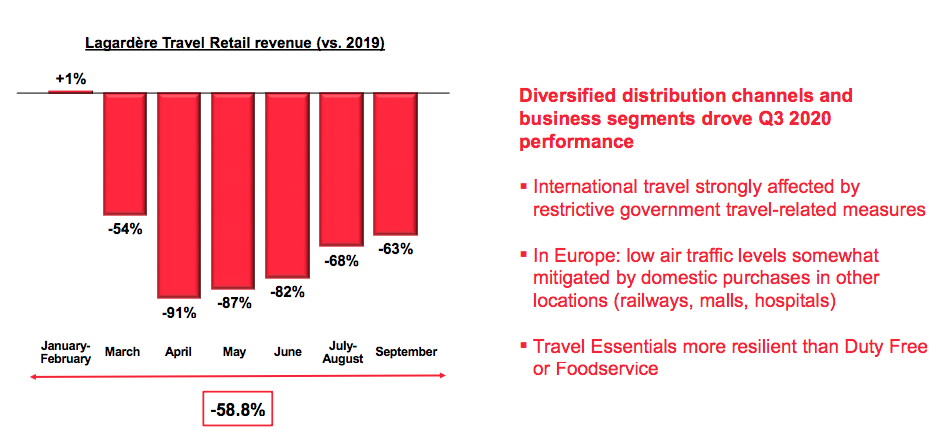

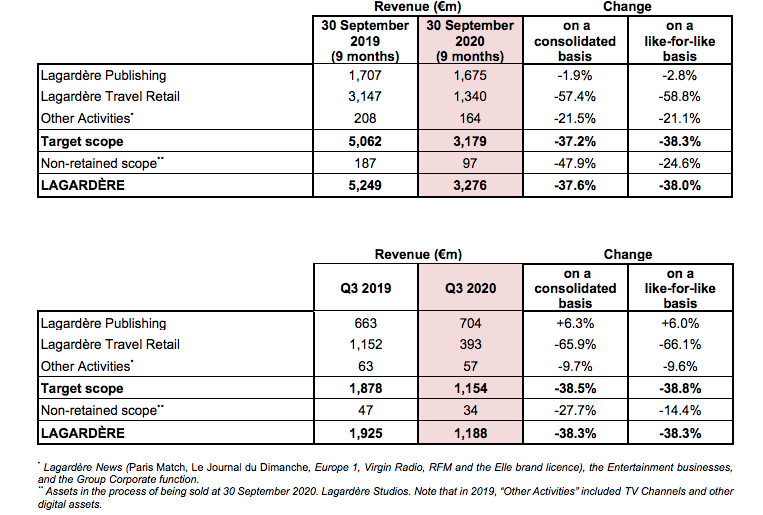

FRANCE/INTERNATIONAL. Lagardère Travel Retail revenue reached €1,340 million for the nine months to 30 September, down by -57.4% on a consolidated basis and down -58.8% like-for-like, reflecting the effect of the COVID-19 pandemic.

In Q3, revenue for the division hit €393 million, down -65.9% on a consolidated basis (-66.1% like for like), with the company citing government measures to restrict travel amid the pandemic’s second wave as a factor undermining growth. The airport business was hit harder than rail stations and town centres, said the retailer.

Mainland China stood out for its strong performance, with revenues leaping by +35.6% like-for-like in the quarter, buoyed by rising domestic travel and healthy online business (see below).

In France, the travel retail division reported a -71.3% fall in like-for-like trading, due mainly to restricted international air traffic. Non-airport trading declined to a lesser extent (down -53.6%), with rail traffic (mainly domestic) less affected by the travel restrictions.

Revenue for the EMEA region (excluding France) fell -61% like-for-like in the quarter. After increasing slightly at the start of the summer compared to Q2 2020, passenger traffic fell during August due to the introduction of more stringent travel restrictions in most countries in the region.

North America reported a -69.6% drop in like-for-like revenue, as passenger traffic remained sluggish due to the lockdown measures put in place in various states.

Asia Pacific revenue slid by -66.8% like-for-like. Australia and New Zealand (Pacific region) kept their borders closed during the period, resulting in virtually zero passenger traffic in these countries (revenue was down -92.5%). This was partly countered by +35.6% revenue growth in Mainland China spurred by increased domestic travel, new store openings and a good online and social media sales performance.

Commenting, Group Chief Financial Officer Sophie Stabile said that the China performance was influenced by the rise of “domestic travel and booming luxury spend”. She noted that “China revenues are not significant overall but it shows that our concept remains relevant. It also shows the capacity of the business to rebound in a normalised traffic environment.”

Lagardère Travel Retail Chairman & CEO Dag Rasmussen said that Chinese domestic traffic is currently down by around -10-15% in the domestic market year-on-year, adding that the performance was buoyed by new openings (including recently at Shanghai Hongqiao and Shenzhen airports) and digital sales.

Looking past the nine-month period, Lagardère Travel Retail revenue in October is estimated to have fallen by around -65% year-on-year.

Commenting on the remainder of the year, Dag Rasmussen told investors: “If the result of the lockdown [in France and Europe] is the same as April and May we might lose ten points in November and December compared to October, so the result would be around -70% [year-on-year] for Q4.”

The company said: “Trading volumes for the last quarter of the year remain uncertain in light of travel restrictions recently being strengthened by governments as the pandemic spreads once again. The division is continuing to implement cost-cutting measures, with major impacts on rents and payroll costs in particular. These initiatives enable Lagardère Travel Retail to maintain the assumption of an adverse impact on full-year 2020 recurring EBIT in the region of 20% to 25% of the decrease in its 2020 revenue.”

Lagardère Group posted a year-on-year revenue decline of -38.3% (like for like) in the third quarter, hit hard by the impact of the pandemic on its travel retail business. This decline was partly countered by a +6% rise in revenue for Lagardère Publishing over the same period.

Commenting briefly on French media speculation about the future of the company, Managing Partner Arnaud Lagardère said: “There has been no negotiation on a disposal of the group or about the limited partnership structure. We will not comment any further.”

This follows a recent move by Bernard Arnault, Chairman and CEO of LVMH Moët Hennessy Louis Vuitton, to acquire around 25% of Lagardère Capital & Management (LC&M), the holding company of Arnaud Lagardère. In October, Vivendi, controlled by Vincent Bollore, raised its stake to become the largest shareholder in Lagardère Group (with around 27%), ahead of Amber Capital (19.5%).