FRANCE/INTERNATIONAL. Lagardère Travel Retail has struck an agreement to purchase 100% of International Duty Free (IDF), Belgium’s leading travel retailer, for an enterprise value of €250 million. IDF, which generated revenue of €183 million in 2018, has operations in Belgium, Luxemburg and Kenya.

IDF is a 100% owned subsidiary of Compagnie Nationale à Portefeuille (CNP), itself owned by the Frère group. The completion of the transaction is subject to the customary conditions, including regulatory approval. Consolidation of IDF’s businesses would bring Lagardère Travel Retail’s annual revenue to €5.3 billion.

IDF holds long-term contracts and currently operates more than 30 stores, including 25 duty free, fashion and confectionery points of sale, at Brussels Airport; two duty free stores at Charleroi Airport; premium chocolate stores under the brand The Belgian Chocolate House at Brussels South Station, in downtown Antwerp and in Luxembourg; plus one store in Kenya.

Lagardère Group said: “This transaction once again illustrates the reinvestment of proceeds from disposals in activities that provide significant operating synergies. They are accretive to group recurring EBIT, and ensure solid cash generation.”

Xavier Le Clef, Managing Director of CNP and Chairman of IDF said: “IDF is special to us at CNP because we have supported its development since 1991. We’re now passing the baton to Lagardère Travel Retail, convinced that they will be a great partner in maintaining IDF’s growth over the long term while preserving its unique DNA as well as its strong commitment to its employees and partners. I’d like to thank the IDF teams wholeheartedly for their amazing work all these years as they built the company up to occupy the leadership position it now enjoys in the travel retail market.”

Lagardère Travel Retail Chairman and Chief Executive Officer Dag Rasmussen said: “The acquisition has cemented our position as the world’s third-largest operator of duty free airport points of sale and as the European leader in travel retail. We’re delighted to be entering both the Belgian and Kenyan markets, which offer wonderful development opportunities, and at the same time stepping up our operations in Luxembourg. Above all, we are confident that IDF’s operational expertise and entrepreneurial mind-set will ensure its successful integration into Lagardère Travel Retail and contribute to the achievement of our strategic objectives.”

The acquisition, valued at €250 million, is for around eight times IDF’s pro forma EBITDA for 2020, factoring in €7 million in recurring synergies expected to be unlocked through to 2022.

Lagardère Travel Retail said the move would “bolster its presence in the fast-growing international premium chocolate segment by leveraging IDF’s experience and privileged contacts with suppliers in this segment as well as the premium The Belgian Chocolate House concept, which can be developed in new markets.”

Besides The Belgian Chocolate House, IDF’s portfolio chiefly comprises its own brands, including Fashion Studio, The Luxury Hall, Summer Time and Precious Time (Fashion and Watches) and Epicure (Gastronomy).

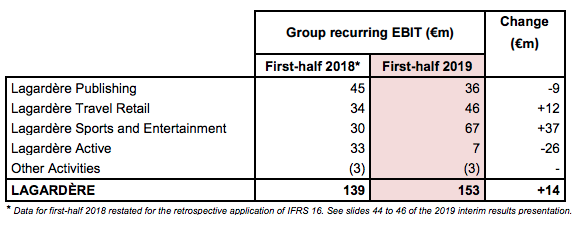

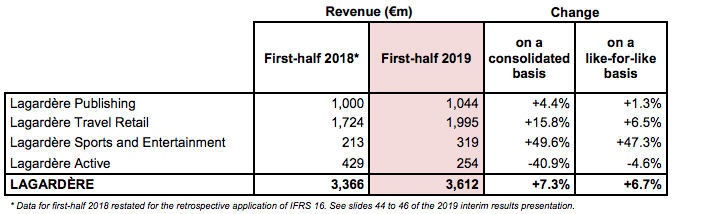

The move was announced by the group as it revealed first-half results, with Lagardère Travel Retail revenue hitting €1,995 million, up 15.8% on a consolidated basis and up 6.5% like-for-like.

The difference between consolidated and like-for-like data was attributable to a €134 million positive scope effect resulting mainly from the acquisition of HBF and of Smullers in the Netherlands, and to a €26 million positive foreign exchange impact chiefly resulting from the appreciation of the US Dollar.

Lagardère Travel Retail’s revenue growth was led by a good sales performance and by store openings in France and the EMEA region. Strong 11.0% revenue growth in France was driven by good duty free trading, especially in regional airports, and by growth in the foodservice and travel essentials networks (Toulouse Airport).

Revenue growth of 5.1% in the EMEA region (excluding France) was mainly attributable to (i) a good performance in Italy on the back of a positive network effect among other factors, (ii) growth in air traffic and a solid sales performance in Eastern Europe – particularly in Romania, and (iii) network expansion in the Middle East with the opening of the Daily DXB food court.

Business was up 4.4% in North America, propelled by sales initiatives and growth in the food service and travel essentials networks. Revenue growth of 6.5% in the Asia Pacific region essentially reflected good momentum in Asia, spurred in particular by sustained network effects and organic growth in China.

Business was down slightly in the Pacific region, with new openings at Christchurch airport not fully offsetting the “unfavourable network effect” in Australia.

Recurring EBIT amounted to €46 million, up €12 million versus 2018.

During the first half of 2019, Lagardère Travel Retail expanded into three new markets – Slovakia in foodservice, Gabon in duty free & foodservice (after a successful launch in Senegal), and Turkey in franchise.

During the second half of 2019, Lagardère Travel Retail will have major openings in Vienna (an 800sq m multi-fashion store to open early August), Beijing Daxing and Shanghai Pudong (to open in the Autumn), along with an expanded 500sq m concession in Geneva.

In foodservice the pipeline includes several openings in the US (Bourbon Pub with Chef Michael Mina) and in Hong Kong (The Kitchen with Chef Wolfgang Puck), as well as at Beijing Daxing and Shanghai Pudong.

Chairman and CEO Dag Rasmussen commented: “I am pleased with the superior growth we were able to generate throughout our network and confident for the months to come as the business dynamic continues to come fuelled by increasing pax and our ability to adapt our offer to their evolving needs. It is also satisfying to see that our three-business line [Travel Essentials, Duty Free & Fashion and Foodservice] strategy is paying off and that our investments on concepts, innovation, and customer services are being increasingly recognised by the industry and customers”.