SOUTH KOREA. Korean cosmetics and household goods company LG Household & Healthcare (LG H&H) yesterday posted a record-breaking fourth quarter in sales and operating profit but duty free sales in Korea fell short of expectations, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung

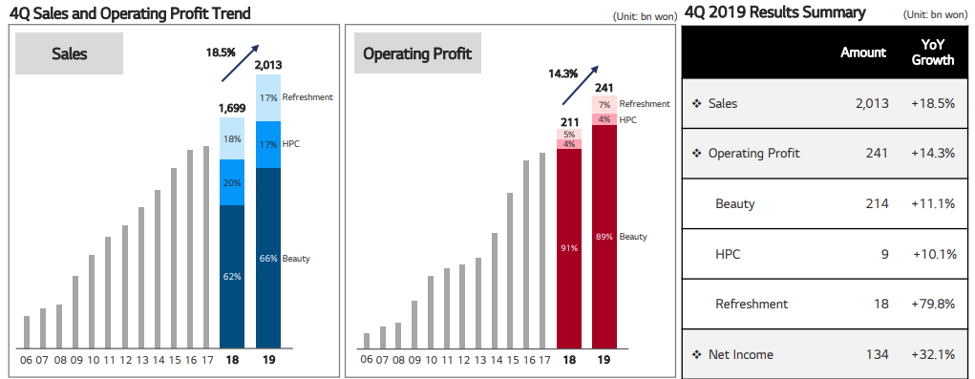

Group sales and operating profit grew +18.5% and +14.3% year-on-year for the period. The result maintains a remarkable run of consistent growth, with the owner of The History of Whoo and Ohui skincare lines having recorded sales increases for 57 straight quarters since 3Q 2005 – and operating profit gains for 59 quarters since 1Q 2005.

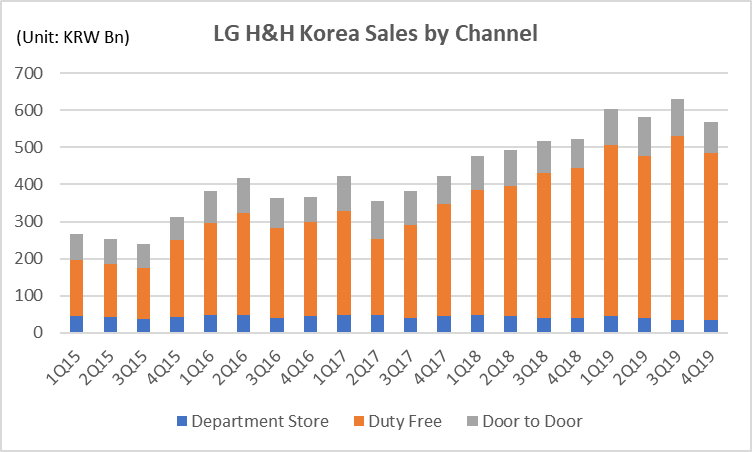

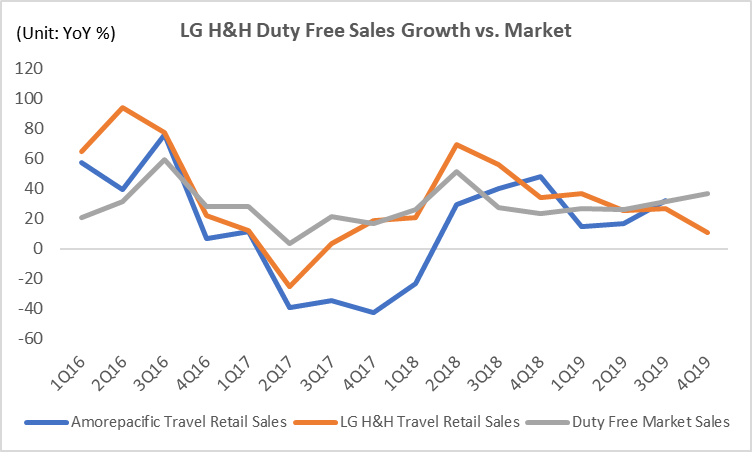

Q4 cosmetics sales in duty free rose +11.1% year-on-year to KRW449.1 billion (US$382.2 million), far lower than the total Korea duty free market which grew +36.7% in October and November

Despite concerns regarding China’s new ecommerce law heading into 2019, LG H&H recorded a stellar financial year. Sales increased +13.9% year-on-year for the 12 months to KRW7.7 trillion (US$6.5 billion), while operating profit rose +13.2% to KRW1.2 trillion (US$1 billion).

Mixed reaction

LG H&H’s earnings were met with a mix of relief and disappointment from the financial market.

Investors were relieved that sales and operating profit were in line with market expectations but disappointed that duty free sales significantly underperformed the overall market.

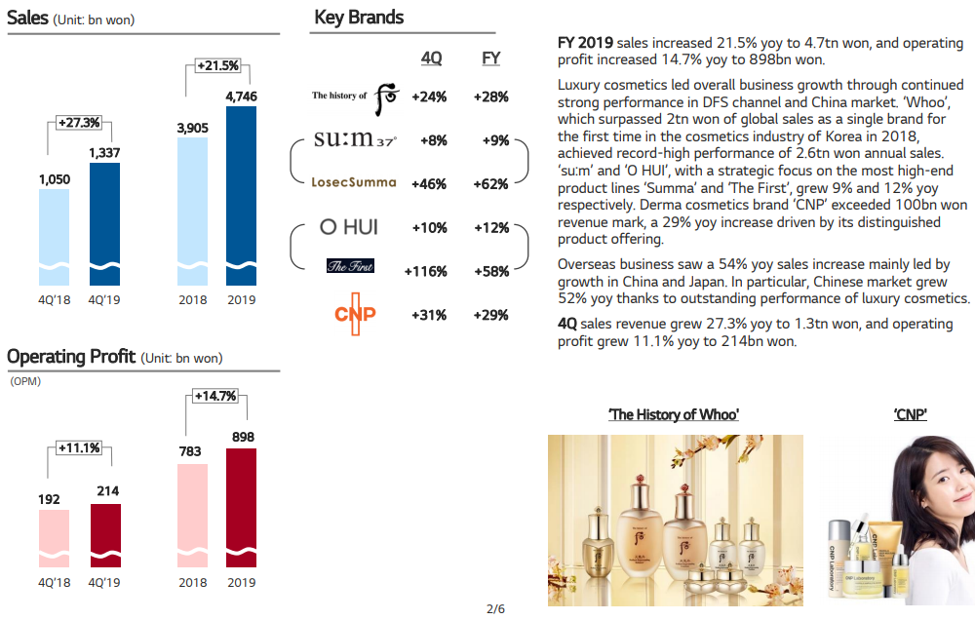

Q4 2019 cosmetics sales increased +27.3% to KRW2.013 trillion (US$1.715 billion), breaking the KRW 2 trillion mark for the first time in the company’s history. Operating profit grew +11.3% to KRW213.8 billion (US$182.0 million) but losses from the New Avon business in the US, lower duty free sales and costs from growing the China business weighed on the profit margin.

– Company IR presentation on Beauty (cosmetics)

Cosmetics sales in duty free rose +11.1% year-on-year to KRW449.1 billion (US$382.2 million), far lower than the total Korea duty free market which grew +36.7% year-on-year in October and November combined. The Korea Duty Free Association has not yet released the results for December, but expectations are for robust growth to continue.

Department store and door-to-door sales recorded -11.9% and +10.1% growth.

LG H&H’s duty free performance suggests that foreign brands are continuing to gain market share in the channel ahead of their domestic counterparts. The widening spread between total market duty free sales and LG H&H’s showing suggests this trend accelerated in favor of foreign brands during Q4 2019.

The juggernaut that is Whoo

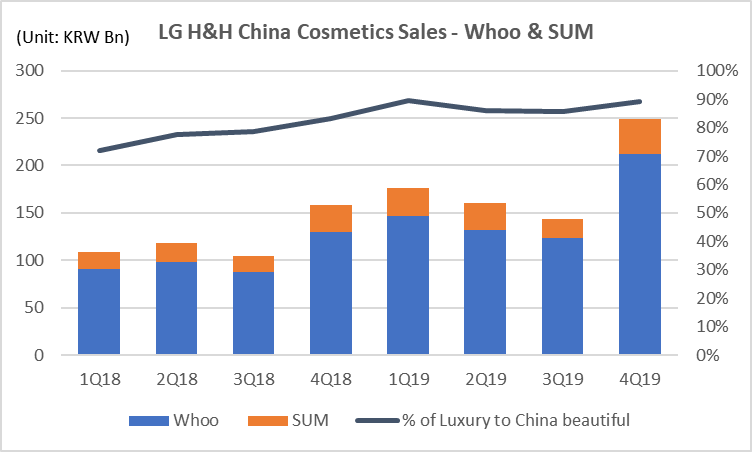

Premiumisation continues to drive growth and the flagship luxury brand The History of Whoo maintained robust growth in the final quarter. Whoo has come a long way since the brand’s conception in 2003. It broke the KRW100 billion sales mark for the first time in 2009 and burst through the KRW1 trillion barrier in 2016; KRW 2 trillion in 2018 and recorded impressive sales of KRW2.6 trillion (US$2.2 billion) in 2019.

Expectations are for the brand to exceed KRW3 trillion (US$2.5 billion), which would require a minimum +16% growth in 2020.

Whoo sales grew +23.8% to KRW704 billion (US$599.2 million) in Q4 2019 alone, despite slower sales in duty free. Sales in China offset the shortfall by growing +64% year-on-year. China’s total cosmetics market grew +13% year-on-year in the quarter and LG H&H’s result outlines the strong growth rate of luxury brands in Korea’s near neighbour.

Natural skincare line SUM was slightly slower at +7.7% year-on-year to KRW118 billion (US$100 million) for Q4, underlying the difficulty in replicating the success of the Whoo juggernaut.

Boosted by Whoo and SUM, group sales in China grew +58% year-on-year in the quarter to an estimated KRW250 billion (US$212 million).

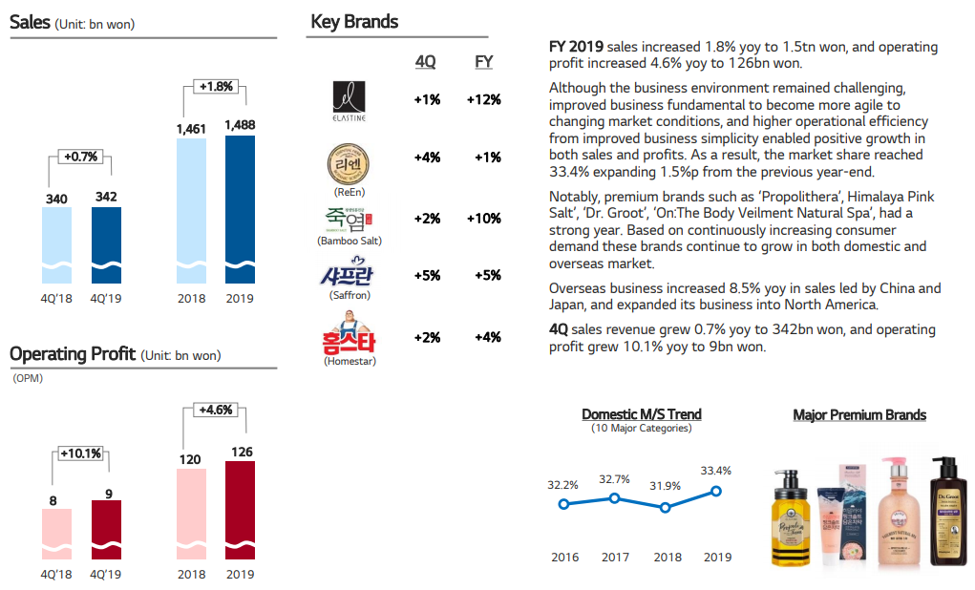

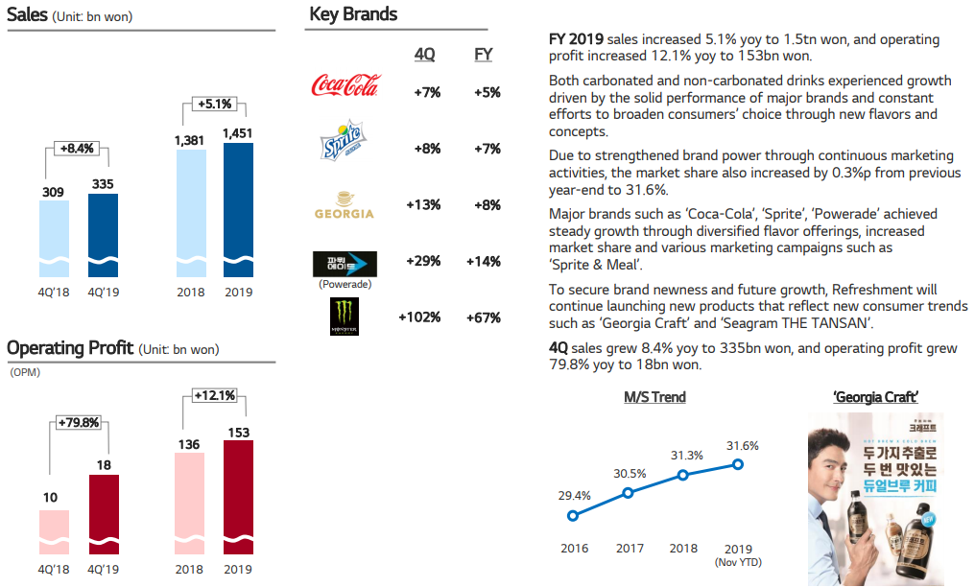

LG H&H’s healthy (household goods) and refreshing (beverage) sales grew +0.7% and +8.4%, respectively. Despite beginning as a household goods company, selling Korea’s first liquid detergents in 1967, LG H&H’s businesses other than cosmetics have gained less attention with sales and operating profit from the cosmetics business garnering the headlines.

Cosmetics accounted for 66.4% of group total sales and 88.8% of total operating profit in 2019.

– Company IR presentation on Healthy (household goods)

What’s after China? LG H&H’s investment in the US market

While LG H&H still has much left to do in China, the company’s announcement this week suggests the next strategic focus for expansion may be the US. LG H&H announced a merger of two existing corporate entities (LG Household & Health Care America and New Avon) and a fresh cash injection amounting to KRW58.8 billion (US$50 million) into the US subsidiary.

New Avon, the leading social selling beauty company in North America, was acquired by LG H&H in April 2019. LG H&H CEO Cha Suk-yong remarked at the time, “We look forward to building on Avon North America’s success to drive customer engagement and long-term growth in this market.”

While China’s consumer market is sure to grow, LG H&H wants to diversify its business outside the key markets of China and Korea. The US, the world’s largest cosmetics market, looks too good to miss out on while business ventures in Japan have yet to bear fruit.

2020 Guidance – Sales KRW8.1 trillion (US$6.9 billion) – +5% year-on-year growth); Operating Profit KRW1.24 trillion (US$1 billion) – +5% year-on-year growth)

LG H&H issued its guidance for 2020 for sales and operating profit to each grow +5% year-on-year. Stripping out the effect of the New Avon acquisition, the target is to grow existing business by +3%.

LG H&H has a history of issuing conservative earnings guidance but a prolonged impact from the coronavirus in China could result in the company underperforming for 2020. Like its peers at home and all around the world, the Korean powerhouse is watching events out of Wuhan with intense concern.