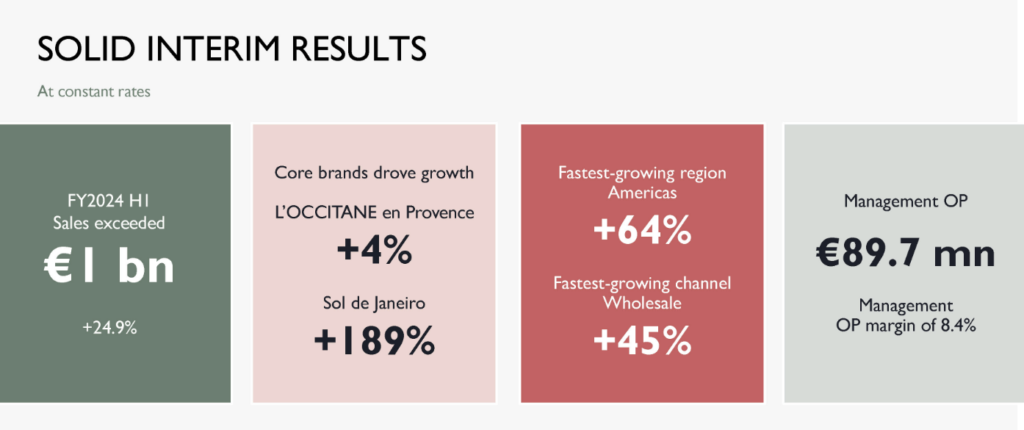

L’OCCITANE Group has posted an +18.5% year-on-year growth in net sales (reported) to €1.07 billion (US$1.17 billion) for the first half of FY2024.

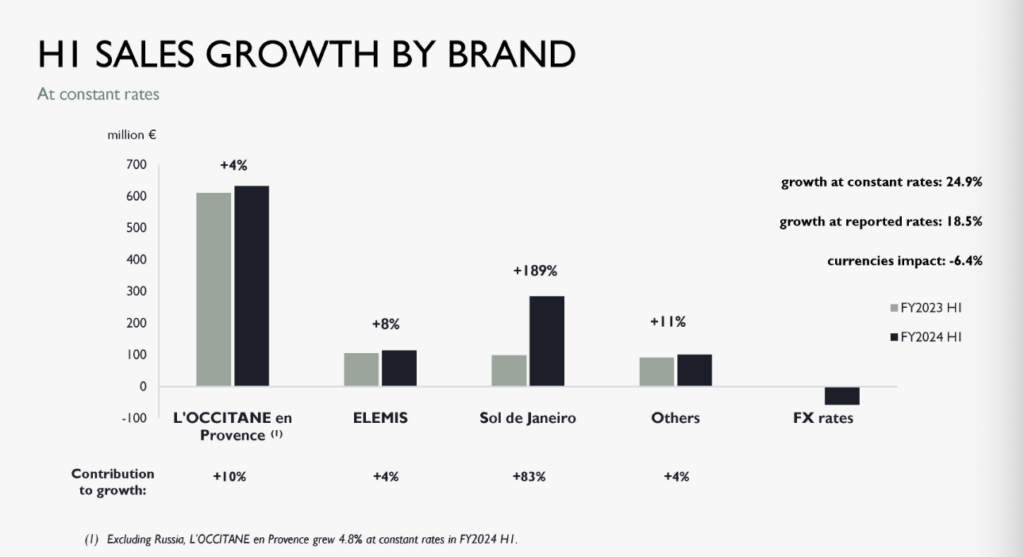

Sol de Janeiro’s sales in the first half of FY2023 were modified due to a reclassification of sales in the marketplace channel, which is why the group saw recorded sales growth of +18.5% at reported rates and +24.9% at constant rates.

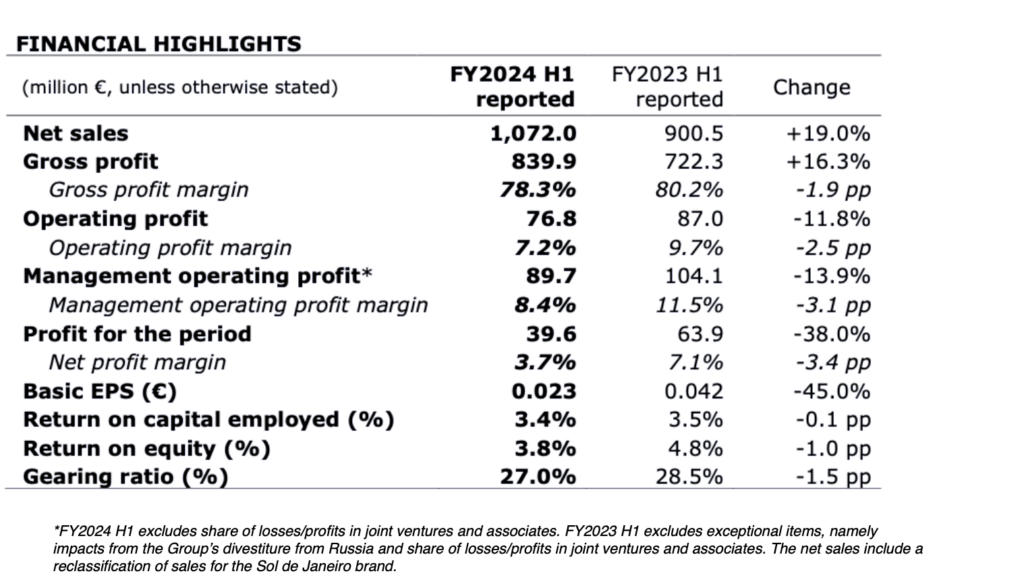

Gross profit margins remained high at 78.3% but fell by 1.9 points compared to the same period in 2023. This is due to higher sales contribution from brands such as Sol de Janeiro and Elemis, which have a higher wholesale mix.

Operating profit decreased by -11.8% at €76.8 million (US$84.4 million), while operating profit margin decreased to 7.2% due to a significant increase in marketing expenses and other non-operational expenses. However, on a management basis, the group delivered an operating profit margin of 8.4%.

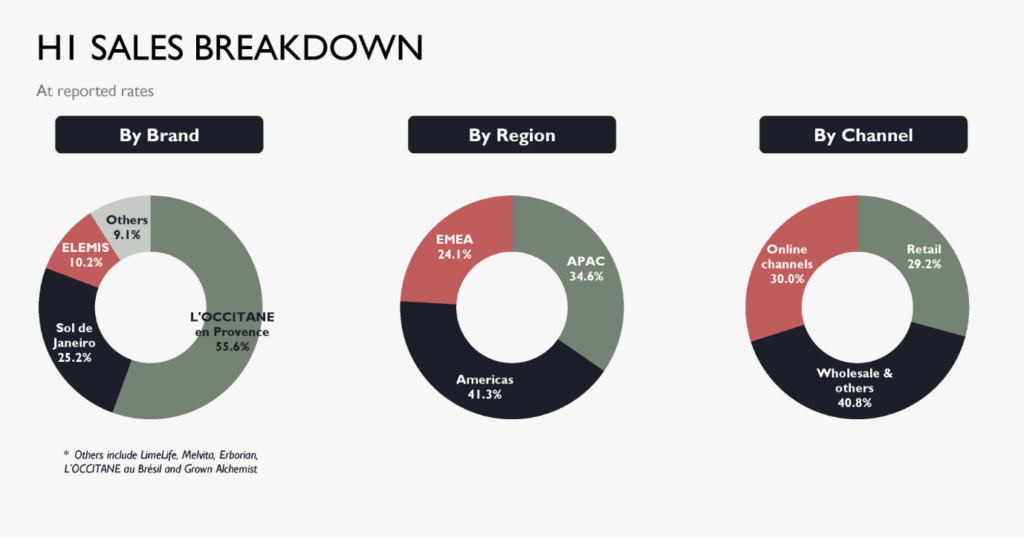

In the first half of FY2024, the group’s sales mix has evolved significantly. L’OCCITANE en Provence contributed to 55.6% of overall sales, due to the continued growth of Sol de Janeiro, which now contributes 25.2% of the group’s overall sales. These two brands drove growth for the group, with L’OCCITANE en Provence increasing by +4% and Sol de Janeiro by +189%.

By region, the Americas contributed to 41.3% of overall group sales, driven by Sol de Janeiro. The US is the company’s largest single market contributing to 36% of overall sales, followed by China at 13% and the UK at 7.6%.

The group significantly increased investments across key priorities such as marketing, improving CRM capabilities, data security and upgrading factories to become more sustainable in line with its ‘triple bottom-line’ ‘For People, Planet and Profit’ strategy. These investments are aimed at securing the group’s status as a multi-billion-euro company in the years to come.

L’OCCITANE Group Vice Chairman and Chief Executive Officer André Hoffmann commented: “In June we announced that we were going to significantly increase our marketing investment to allow all our brands to capture growth opportunities and increase market share amidst a highly competitive market. I’m pleased to report that we are seeing positive early results as evidenced by our core brands’ growth of +22% in China, outpacing the growth of the overall beauty market.”

L’OCCITANE en Provence received the largest share of the marketing budget to invest in key markets, particularly China, travel retail, the US, South Korea and Japan. Additional investments in China focused on the key facecare, bodycare and haircare categories. These included high-profile marketing campaigns for the Almond Shower Oil, the launch of White Lavender and the relaunch of Immortelle Divine Cream.

“This strong marketing push built awareness and engagement,” Hoffmann explained. “The Almond range campaign resulted in a +36% in sales increase from January to September.

“For White Lavender we launched an omnichannel campaign to bring a Provence lavender field to life. This campaign resulted in 430 million online impressions and over 100% growth in Tmall and Little Red Book’s search index. From July to September, the Immortelle Divine Cream campaign drove 200% sales growth in China.”

Sol de Janeiro continued to enjoy strong momentum delivering operating profit margins of 28.9%. The brand’s performance was boosted by a strong summer campaign, both in domestic and travel retail channels, and in particularly in its home market of the US. The brand also demonstrated its year-round appeal with the autumn launch of its limited-edition fragrance mist, After Hours.

Commenting on the brand’s continued growth and its high-impact summer campaign in travel retail, Hoffmann said: “Sol de Janeiro made a big impact in travel retail. In the summer we were able to secure best-in-class podiums in key airports including Paris, London, Frankfurt, New York and São Paulo. We’ve also launched in Australian travel retail, supported by booming domestic market business.”

Elemis grew at +7.6% as the brand continues to premiumise and focus on streamlining its ecommerce business. In the UK, the brand redirected traffic to its own website where it delivered double-digit growth. In China, ecommerce sales for the brand grew by over +200% as it continued to accelerate investments in Chinese social media, and particularly KOL-led livestreaming on Douyin, which helped boost sales for its hero Pro-Collagen Cleansing Balm.

In FY2024, L’OCCITANE Group doubled down its focus on its triple bottom line. In August 2023, the Group achieved B Corp certification underlining its commitment to becoming a sustainable leader in the beauty and wellness industry.

“Delivering a healthy profit is only one of the Ps of our three Ps model of ‘For People, Planet and Profit’. We are extremely proud of achieving B Corp as this covers the company’s entire social and environmental performance ensuring transparency and accountability,” said Hoffman.

Looking ahead, he added: “We are cautiously optimistic about our prospects in the second half of FY2024 as we head into the holiday and gifting seasons.

“Despite its near-term impact on our margins, our expanded marketing investments are already bearing fruit in boosting brand awareness and engagement and remain vital in supporting our ability to outperform the overall premium beauty market in China and other key markets.

“Through our portfolio of strong and distinctive premium beauty brands and our commitment to investing for the long-term, we are well-positioned to continue driving sustainable growth and profitability for our shareholders and stakeholders.” ✈