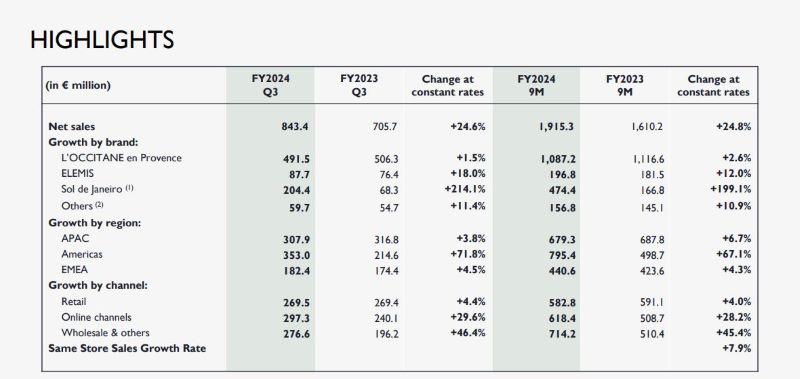

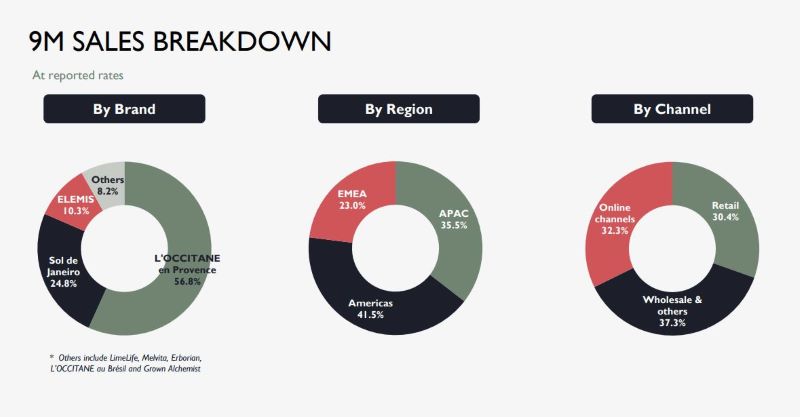

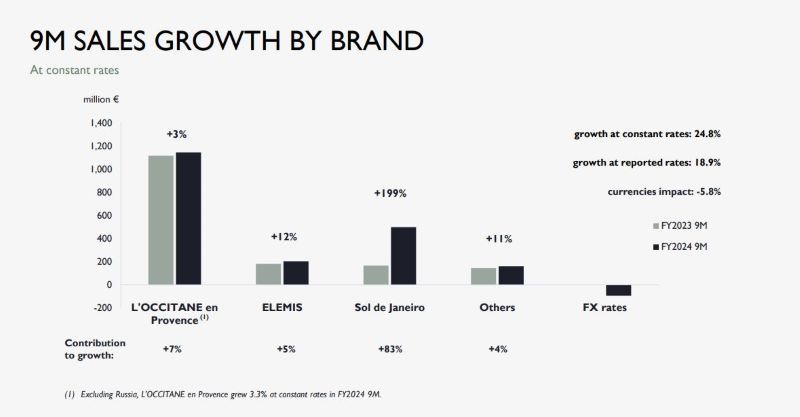

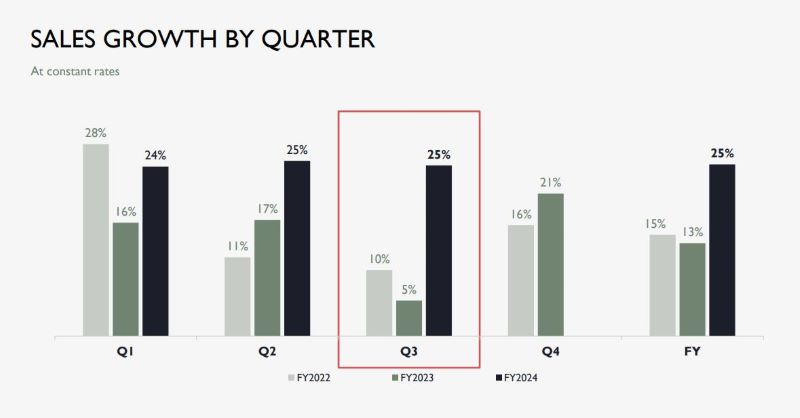

L’OCCITANE Group registered net revenues of €1,915.3 million in the nine months ended 31 December 2023, up by +18.9% year-on-year on a reported basis (+24.8% at constant exchange rates).

The beauty and wellbeing company attributed the increase to the strong sales momentum of its top-performing brand, Sol de Janeiro, as well as the encouraging result of Elemis and the stable growth of L’OCCITANE en Provence in China.

In the third quarter of FY2024 ended 31 December 2023, net sales stood at €843.4 million, an increase of +19.5% at reported rates (+24.6% at constant rates).

Across its brand portfolio sales growth for the core brand, L’OCCITANE en Provence, slightly weakened to +2.6% at constant rates during the nine months.

The brand’s sales growth was led by the double-digit sales increase in China and the strong holiday sales in the US and the UK, partly offset by a lower sales decline in EMEA and a “low-teens per cent” sales decline in travel retail.

Excluding Russia due to the group’s divestiture in June 2022, the brand registered a sales increase of +3.3% at constant rates during the nine-month period.

Elemis was back to double-digit sales growth, up by +12% at constant rates. The brand turned in a “solid” holiday sales performance, executed with a reduction in value offering in line with its premiumisation strategy, the company noted.

The brand’s Q3 sales in the UK and the US increased by +23.2% and +19.4% respectively at constant rates. Excluding the maritime channel, Elemis’ domestic sales in the US jumped by +24.9% during the three-month period.

Sol de Janeiro continued to be the highest growth contributor, with sales up by +199.1% at constant rates in the nine months. Sales across all geographic markets increased to triple-digits, boosted by what the company described as a record-breaking holiday season.

The strong growth was also aided by the launch of a new body cream brand Delicia Drench Body Butter and an accompanying fragrance mist, and a strategic expansion of its distribution with a significant multi-brand partner in the US.

Other brands contributed a “healthy” growth of +10.9% at constant rates during the nine-month period. Erborian and L’OCCITANE au Brésil posted significant sales increase of +32.8% and +36.8% respectively at constant rates.

Melvita also delivered a positive performance, up by a mid-teens per cent in Q3, and registering a flat growth in the nine months of the fiscal year. LimeLife continued to perform below expectations, declining by -21.9% in the April-December period.

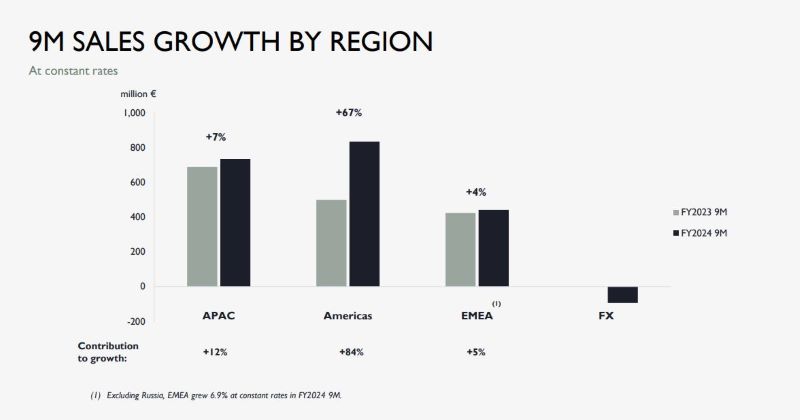

By region, the company registered the strongest performance in the Americas, where sales climbed by +67.1% at constant rates in the nine months, thanks to the popularity of Sol de Janeiro.

Sales in Asia Pacific increased by +6.7% at constant rates in the nine months, led by the strong +21.9% growth at constant rates in China thanks to the continued development of L’OCCITANE en Provence and Elemis.

EMEA grew +4.3% at constant rates from April to December, mainly driven by the positive performance of Erborian and Sol de Janeiro, as well as Elemis in the UK. Excluding Russia, EMEA grew by +6.9% at constant rates.

In terms of channel performance, wholesale and others saw the highest growth, up by +45.4% at constant rates, with “dynamic” growth in wholesale chains and international distribution.

Strong growth in online channels was also reported in the nine-month period, up by +28.2% at constant rates, led by the sales of Sol de Janeiro, Elemis and the recent launch of L’OCCITANE en Provence on Douyin in China.

Retail sales maintained a steady growth of +4% at constant rates, mostly driven by the performance in China.

L’OCCITANE Group Vice Chairman and Chief Executive Officer André Hoffmann said: “We delivered a decent holiday season, which enabled us to maintain our growth momentum and relative outperformance in the premium beauty market in China and other key markets. It was also pleasing to see Elemis return to growth in light of our ongoing premiumisation strategy to support its long-term profitability.”

Hoffmann added: “We will continue to build on the accelerating growth of Sol de Janeiro as we steadily expand its product and category range, and the scale and reach of its distribution. We will also further build on the healthy growth of other brands, including our recently acquired luxury home fragrance brand, Dr. Vranjes Firenze, to round out our portfolio.” ✈