UK. London Gatwick Airport has reported strong 2023 first half results, with net retail income rising by +42.2% year-on-year to reach £88.3 million (US$112.4 million).

The strong retail performance contributed to overall revenues of £423.3 million (US$538.6 million), up +45% year-on-year. The total includes £212.7 million aeronautical income and £210.6 million from non-aeronautical sources.

EBITDA in H1 stood at £235.7 million (US$300 million), up +59% on 2022, with net profit for the period of £79.1 million (US$100.6 million), up +56%.

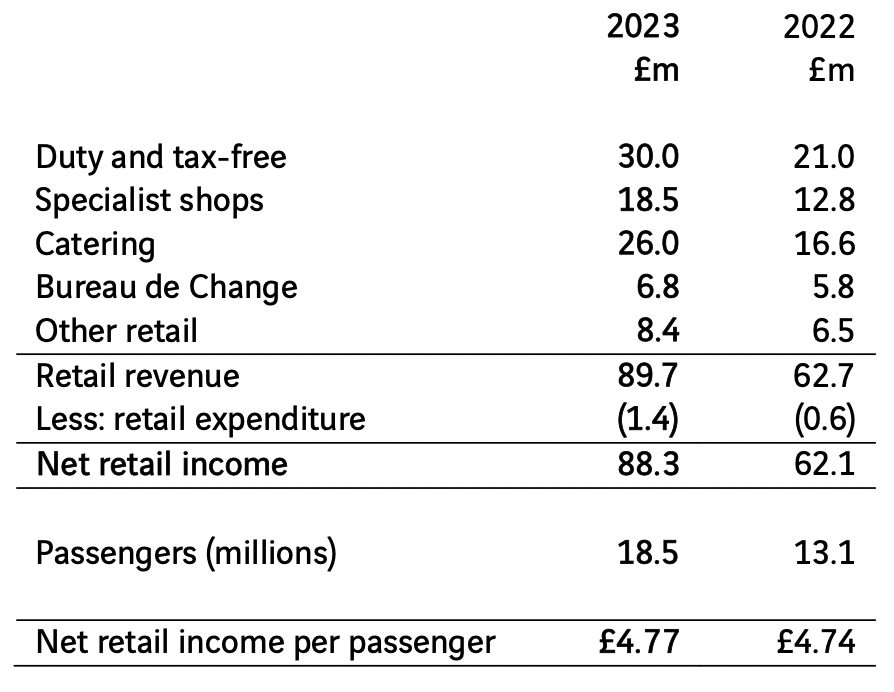

Retail analysis

The airport said the significant rise in net retail income was largely driven by the limited number of units open in 2022, along with restricted operating hours for some units where concessionaires experienced staffing issues.

Gatwick said it worked closely with all operators to ensure a smooth start to 2023 and a successful summer operation. This has included supporting concessionaires with the recruitment of more than 500 people.

In the first half of 2023, a number of new food & beverage venues and specialist shops opened.

Within net retail income, catering (F&B) experienced the highest growth (+56.6%).

Net retail income per passenger was £4.77 for the six months to 30 June 2023, compared with £4.74 in 2022. This equates to headline growth of +0.7% but Gatwick noted this masks several factors.

F&B has continued to perform strongly with income per passenger growth of nearly +11%, but other categories experienced lower levels of growth (such as specialist shops and duty and tax-free). This, the airport observed, reflects the challenges concessionaires face in passing on rising prices.

Gatwick also noted that last year some bookshop and pharmacy units benefited from higher demand due to reduced onboard catering provision.

However, it said the main reason for a relatively small overall increase in retail income per passenger was due to Bureau de Change. The airport said it minimised the impact of adverse market trends in this category by changing provider to the ChangeGroup (see our story here) in April 2022.

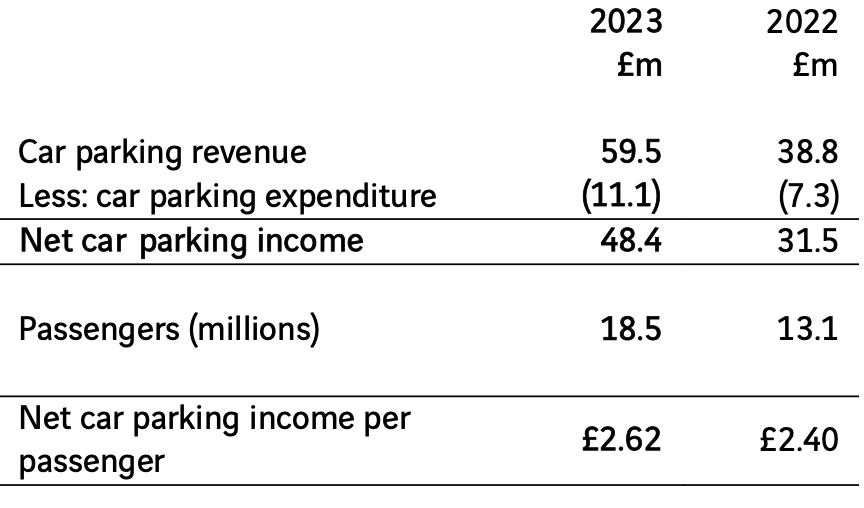

Car parking analysis

Car parking revenue was generated from short stay, long stay and valet operations, together with revenue from forecourt charges for passenger drop-offs.

For the six months ended 30 June 2023, car parking revenue was £59.5 million, an increase of £20.7 million on the same period in 2022. This represents revenue growth of +53.4%.

Key to this, the airport observed, was the differing mix of parking products on offer in the first half of 2023 compared with 2022 when the South Terminal was closed for the first quarter. In that period last year, there were also challenges with local market dynamics and operational constraints, it added.

Gatwick highlighted that car parking continues to see a higher proportion of UK-originating departing passengers than pre-COVID. Net car-parking income per passenger for the six months ended 30 June 2023 was £2.62, an increase of +8.8% compared with the same period in 2022.

Reaction

Reflecting on the overall results, London Gatwick Airport Chief Executive Officer Stewart Wingate said: “We worked closely with our partners to make sure the airport was well resourced ahead of the summer. This and the hard work of our frontline colleagues helped us provide passengers with a good level of service, despite a challenging operational environment across much of Europe.

“We will continue working closely with our airport partners to improve punctuality, supported by projects in our new Capital Investment Programme to build airport resilience and long-term sustainable growth.

“In this respect, I’m pleased that our planning application to bring our existing Northern Runway into routine use has moved forward to the examination stage.

“It’s also promising to see the airport’s recovery continue, as we once again provide passengers with more choice. Forty-nine airlines now fly from the airport to over 200 destinations, including 50 long-haul routes.”