FRANCE. LS travel retail sales climbed by +8.1% on a reported basis, and +4.3% like-for-like in the first half of 2014, parent group Lagardère has reported.

The performance was driven by growth in passenger traffic, consolidation of acquisitions, development of the duty free and food services divisions, new concessions and the deployment of new concepts, said the company. The second quarter in particular delivered a strong showing within travel retail, with +13.4% growth on a reported basis (+5.2% like-for-like).

Lagardère Services (of which LS travel retail is a key element) delivered net sales of €1,852 million in the first half of 2014, up on a reported basis (+2.1%) and stable on a like-for-like basis (-0.1%). The difference between these two figures was due to the effect (€71 million) of the acquisitions made in travel retail (Gerzon in Amsterdam and Airest in Italy, primarily), but partly offset by a negative exchange effect (-€30 million).

|

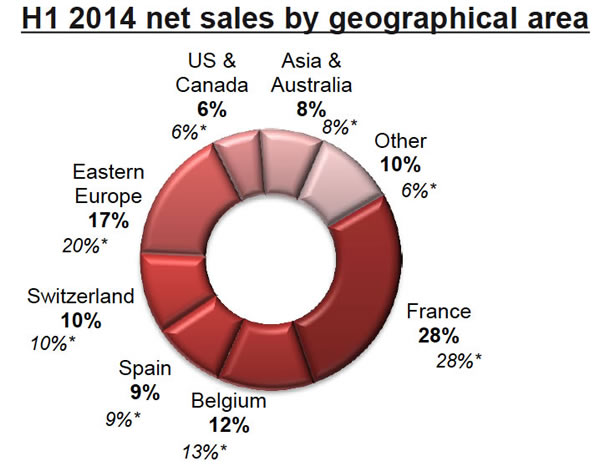

Lagardère Services’ regional breakdown (above) and sales by division (below) |

|

Travel retail now accounts for 63% of the total Lagardère Services business (four points higher than H1 2013), versus 37% for LS distribution (Press Wholesale Distribution and Integrated Retail).

In France, travel retail activity was “stable” with good performances in duty free and food services offsetting the decline in print products and the impact of the SNCF rail strikes in June.

In the rest of Europe, sales rose, especially in Italy (+26%) with the ramping up of business in Rome. Here, there has been a positive impact from the refurbishment of the Fiumicino stores, and the performance of the Rome business was strong despite the weak economic environment and the impact of construction at Ciampino.

Three new stores will open in Rome during the second half of the year: Luxottica, Victoria’s Secret and Montblanc.

|

Lagardère Services’ profitability improved in the half |

In Germany sales grew by +5.7% mainly due to food services expansion (+5.2%), which benefited from the growth of the Frankfurt train station food court and of the Coffee Fellows and Burger King stores added in 2013.

In the UK sales grew by +4.2% with good airport contributions. Luton Airport sales grew +9.4% thanks to new commercial initiatives, the openings of a MAC pop-up store and an arrivals store; at Glasgow business climbed by +12.4% thanks to the improvement of the gastronomy and liquor offer and to the extension of the shop in April.

In Central Europe the business grew thanks to traffic growth and network expansion: Czech Republic (+5%), Bulgaria (+18.5%) and Romania (+4.2%).

In Poland business grew by just +1.5%. A decline in the duty free business (-3.6%) was due to the transfer of Ryanair flights from Warsaw airport to Modlin Airport since its reopening in October 2013. But this was compensated by the development of food services activities (+12.3%) and the growth of travel essentials (+2.0%), driven by the resilience of newsstand concepts in non-travel retail and the growing convenience stores network, said the group.

In North America, activity was buoyant (+9.7%), driven by new stores, as well as in ASPAC (+10.7%) with a strong duty free performance (fashion & specialty).

At Aelia, the company’s 100% managed net sales rose by +3.1% attributable to:

‒ an increase of +3.6% at Parisian airports thanks to the improvement of Fashion activities (+6.4%) and a favourable traffic impact that compensate the negative foreign exchange rate impact on the high spenders passengers (Russia).

‒ sales outside Paris increasing versus 2013 by +3.2%.

At Relay, 100% managed net sales fell by -1.7% due to an unfavourable environment including a decrease in consumption and SNCF strikes in June, plus the dip in sales of print products (-6.6%) and tobacco (-3.3%).

These were partly compensated by other commercial initiatives, such as the new Relay concept roll-out and the development of food concepts (such as the start-up of the exclusive franchise agreement with Marks & Spencer’s Simply Food).

Recurring EBIT for Travel Retail rose by €8 million, with continued improvement in the product and segment mix (mainly the development of duty free and food services).

As reported at a recent Investors’ Day, LS travel retail is forecasting sales growth of +5% to +10% a year through to 2016, and plans to lift EBITDA margin by one percentage point in the same period (from 4.9% in 2013).