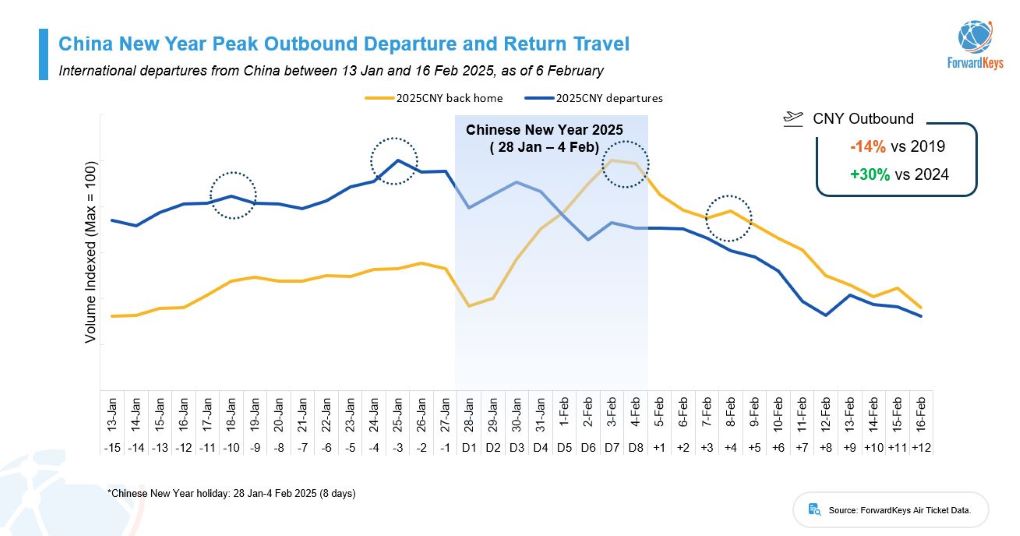

CHINA. Data from travel analyst ForwardKeys reveals a strong rebound in Chinese outbound travel over the Lunar New Year, now just -14% below 2019 levels and up +14% from the previous year.

The eight-day holiday (28 January to 4 February) has driven a sharp rise in travel bookings, with Southeast Asian destinations benefitting the most from relaxed visa policies and strong demand.

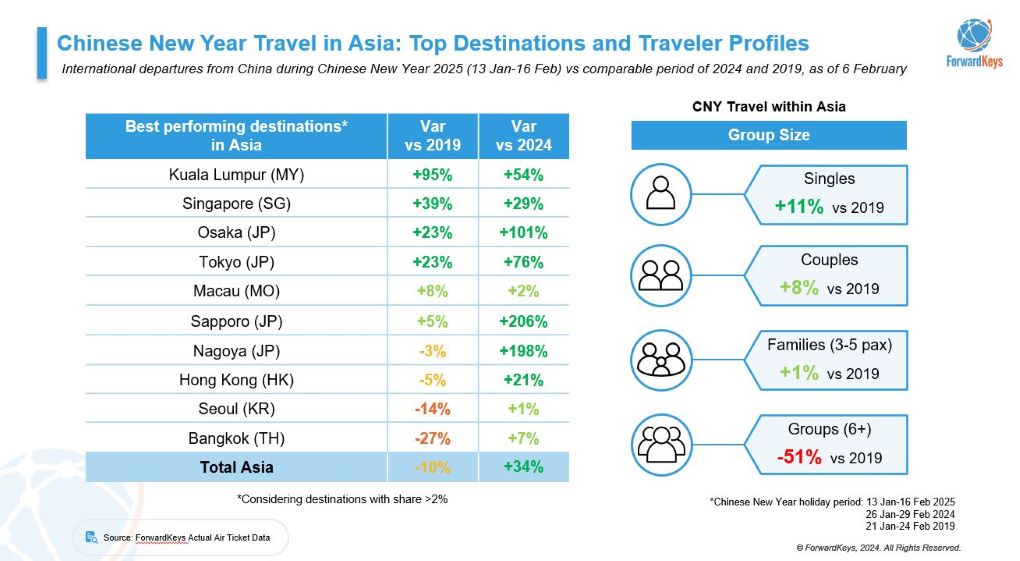

Visitor numbers in Kuala Lumpur soared +95% above 2019 levels, while Singapore recorded a +39% increase. Despite a +7% increase from 2024, Bangkok’s visitor numbers remain -27% below 2019 levels, largely due to ongoing safety concerns.

Japan has seen a surge in tourist arrivals with destinations such as Tokyo (+23% vs 2019) and Sapporo (+5% vs 2019) recording higher visitor numbers, boosted by stronger China-Japan relations, favourable visa policies and a weaker Japanese yen.

Macau has exceeded pre-pandemic visitor levels by +8%, while Hong Kong remains just -5% below 2019 figures. Air capacity recovery is slower, with Hong Kong’s seat availability still down and Macau’s up +6%

A notable shift in traveller profiles is also emerging, with solo travel up +11% and couple travel increasing +8% compared to 2019, highlighting a growing preference for intimate and independent travel experiences.

Best-performing destinations outside Asia during Chinese New Year

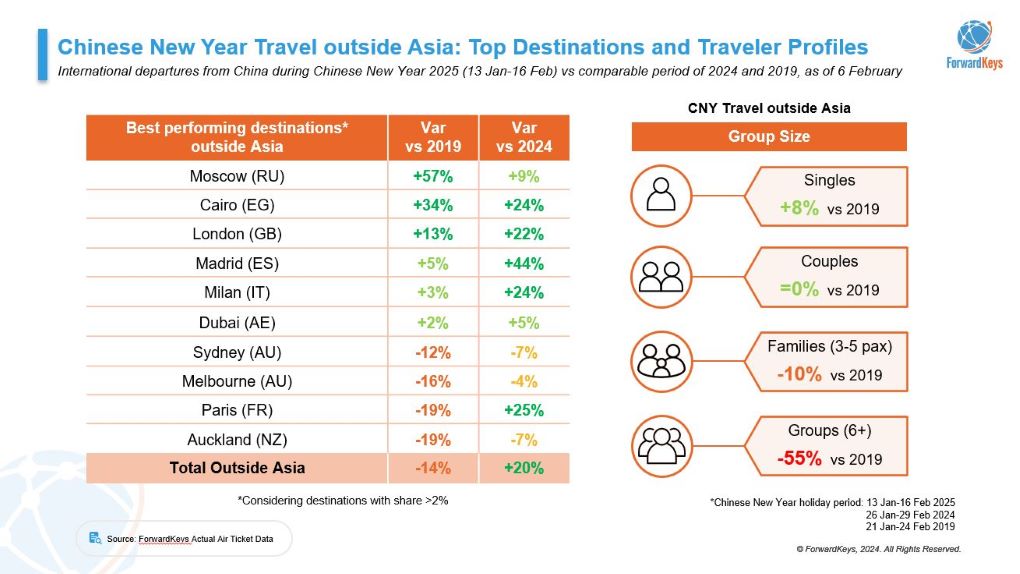

Beyond Asia, Chinese outbound travel has rebounded strongly, with Moscow seeing a +57% rise in visitors from 2019, driven by its strategic location and flexible entry policies.

Chinese visitor numbers to European cities have also exceeded pre-pandemic 2019 levels, including London (+13%), Madrid (+5%) and Milan (+3%), while Paris has jumped +25% from 2024, likely driven by the build-up to the Olympics.

In the Middle East, Cairo has emerged as the most popular destination, with travel up +34% from 2019, fuelled by its exotic appeal, affordability and simplified entry process.

Dubai, a key transit hub with luxury tourism, saw Chinese visitor numbers rise +2%.

A key trend in long-haul travel shows solo travellers now representing 37% of passengers, climbing +8% from 2019, underscoring a growing preference for independent travel among Chinese tourists.

Key transit hubs for Chinese travellers over the holiday period

Chinese New Year fuelled a sharp rise in transit traffic, with Tokyo’s Haneda Airport up +45% from 2019 and Istanbul Airport up +35%, reinforcing their role as key stopovers.

Singapore Changi Airport’s transit traffic surged +49% compared to 2024, underscoring its importance as a global travel hub.

Domestic destinations remain in high demand

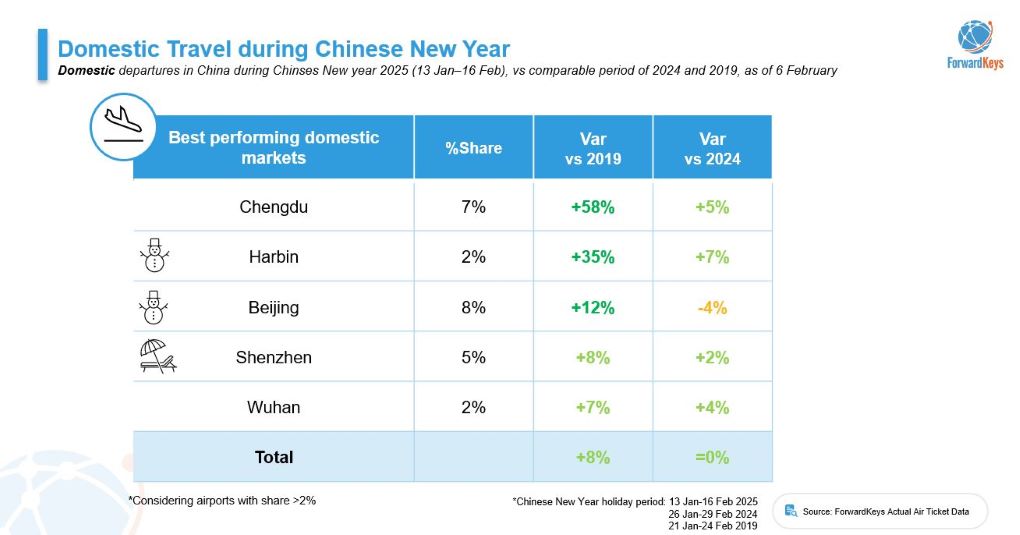

China’s domestic travel boom has continued, exceeding 2019 levels by +8% and on par with last year, with social media playing a key role in shaping travel trends and boosting several cities as top destinations.

Chengdu and Wuhan remain top choices for travellers, driven by their status as ‘internet-famous’ cities on Chinese social media platforms.

Known for their winter attractions, Harbin and Beijing have seen a boost in visitor numbers, fuelled by the anticipation for the 2025 Asian Winter Games and extensive promotion on platforms such as Rednote.

Shenzhen, with its mild climate and southern location, remains a popular pick for travellers seeking warmer getaways during the holiday season. ✈