INTERNATIONAL. In an investors’ call on Tuesday following the announcement of nine-month revenue performance, LVMH Moët Hennessy Louis Vuitton management reflected on market conditions for luxury goods and the outlook for the China business.

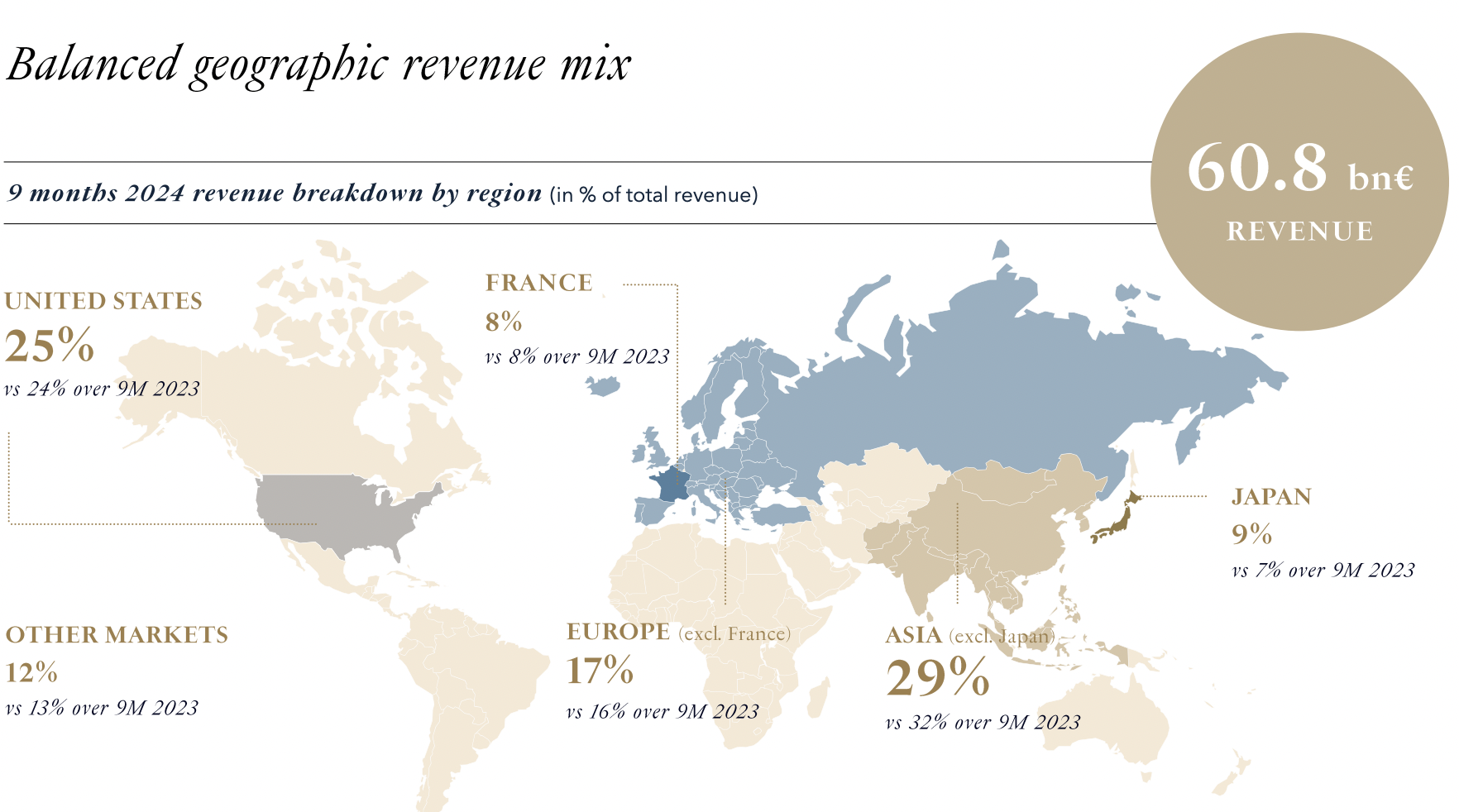

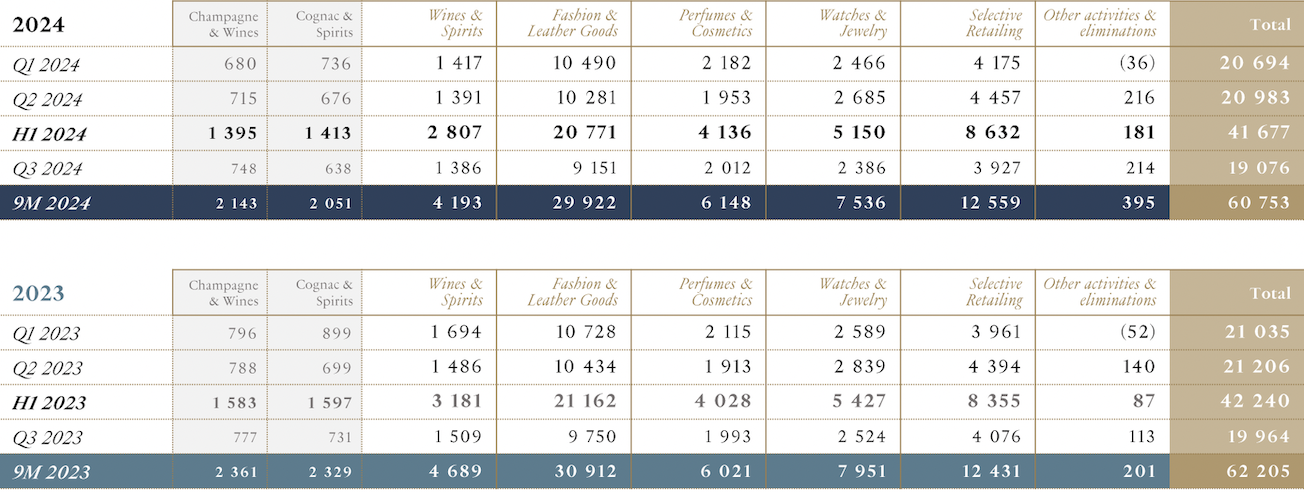

As reported, the leading luxury goods group posted revenue of €60.8 billion in the first nine months of 2024, down -2% on a reported basis and flat in organic terms.

By region, Europe and the USA posted slight growth on a constant consolidation scope and currency basis and Japan achieved double-digit revenue growth, buoyed by spending from Chinese visitors.

Assessing the big picture for the business over the nine months, LVMH Deputy Finance Director Cécile Cabanis said: “Overall, demand has been characterised by two opposing trends. On the one hand, demand from Chinese clientele remained fairly dynamic in the first half of the year. However, Chinese consumers are facing growing macroeconomic headwinds which obviously impacts their confidence and weighs on their discretionary spend.

“And on the other hand, demand from Western clientele shows a sequential improvement, this being very gradual given that inflation and interest rate remained high. So in a nutshell, the net effect of these two trends was slightly positive in the first half of the year and became slightly negative in the third quarter.”

The quarterly organic revenue performance showed the positive impact of Chinese spending in Japan, though this slowed in Q3.

Commenting on the performance by division, Cabanis said: “Wines & Spirits have historically proved to be more cyclical than average and are unsurprisingly more affected by current environment than the other divisions.

“At the other end of the spectrum, Perfumes & Cosmetics and Selective Distribution tend to be more resilient than the rest of the division, but are not totally immune to deteriorating consumer confidence in China.”

Elaborating on China, LVMH Chief Financial Officer Jean-Jacques Guiony said: “Most of our markets currently face economic challenges, including Mainland China. Against this backdrop it is not particularly surprising to see softer demand for luxury goods, particularly considering we were still growing double-digit in the second half of last year.

“Secondly, consumer confidence in Mainland China today is back in line with the all-time low reached during COVID. Again, we cannot expect discretionary consumption to expand in this context. However, the strength of Chinese demand in the first half of the year provides recent evidence of the enduring appetite of the Chinese customer for luxury, which makes us very confident that demand will recover.”

Comparing Chinese shopper demand within and outside China, Guiony said: “Obviously, offshore is doing better than onshore but that is not entirely new. We have seen that for the last five to six quarters. The level of offshore business for most of the brands is between 40% and 45%. It was between 30% and 35% for the same period last year.

“So there is a dynamic on its own which is connected with Japan, but not only Japan. We see an increase all over the world with the exception of maybe Hong Kong and Macau. Otherwise all the offshore destinations are capturing a bigger share of the Mainlanders’ business as they used to.”

On the longer term outlook for China and luxury, Guiony said: “We are still very, very strong believers in the future of luxury, in the future of the emergence of upper middle class in China and elsewhere. We see absolutely no reason why, after a cyclical downturn such as we are experiencing today, we shall not be in a position to recover.

“It is normal that people are asking the question whether this is structural and will never come back exactly the same way, but we are still very hopeful that the luxury industry will continue to develop and we will continue to ride the wave of the emergence of the upper middle class.”

Asked about the Chinese Ministry of Commerce move to slap heavy ‘temporary anti-dumping’ measures on imported European brandies, effective 11 October, and their potential impact, Cabanis said: “To frame the question, China is a bit less than 20% of Hennessy’s business. The tariffs are not good news, especially in a market where the demand is weakened. And we need to remember as well that we are collateral damage, a consequence of the trade war on electric cars.

“As far as our business and impact is concerned, probably the mitigation factor is that we carry more stock and inventory that we would do usually. So we won’t face any concrete impact in the next few months.

“And as far as the impact overall and on a running basis is concerned, it will depend on different frames and decisions we can take. It may be through substitution in duty free, especially on XO, and whether we would be inclined to pass on price increases and lastly, what the competition response is. We will know more in the next quarter.” ✈