CHINA (MACAU) The intense interest in the Macau International Airport duty free concession was underlined this morning as 11 travel retailers attended a pre-bid meeting and site tour.

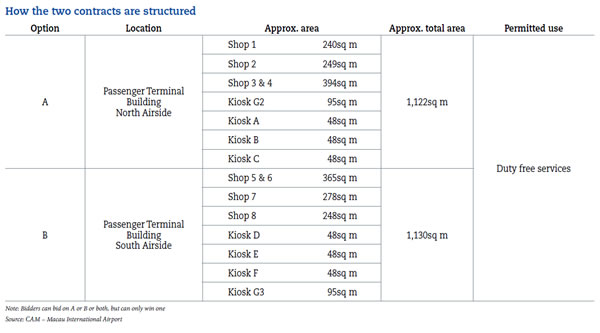

As reported, Sociedade do Aeroporto Internacional de Macau (CAM) issued a request for proposals (RFP) for the concession on 10 April, surprisingly opting to split the business into two like-for-like contracts.

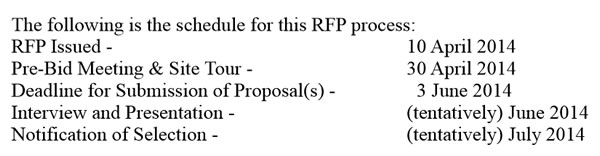

King Power Group (Hong Kong) has operated at the airport since 1995, rejuvenating the offer successfully in recent times. Its contract expires on 6 November 2014. Responses to the RFP are due by 12:00 noon on 3 June with an award set tentatively for July following interviews and presentations in June.

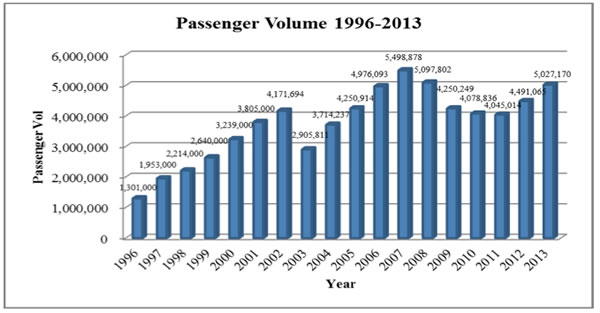

Macau International handled just over five million passengers in 2013 (and has total capacity of six million) and currently has 2,260sq m of shopping space. Non-aeronautical revenues rose by +15% in 2013, ahead of a +12% passenger increase.

|

CAM’s chosen concession model pitches two retailers against each other head-to-head |

CAM’s decision to split the business has led to concern in some quarters, with a number of suppliers and retailers believing the passenger traffic and physical space are insufficient to justify the move. DFS has indicated it will not bid as a result. Although it was represented at today’s briefing, its position remains unchanged and it will not bid under the proposed structure.

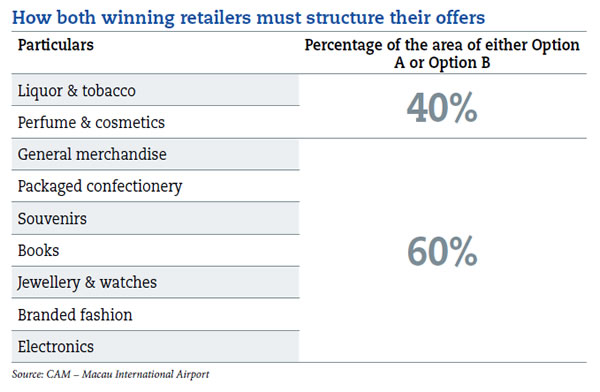

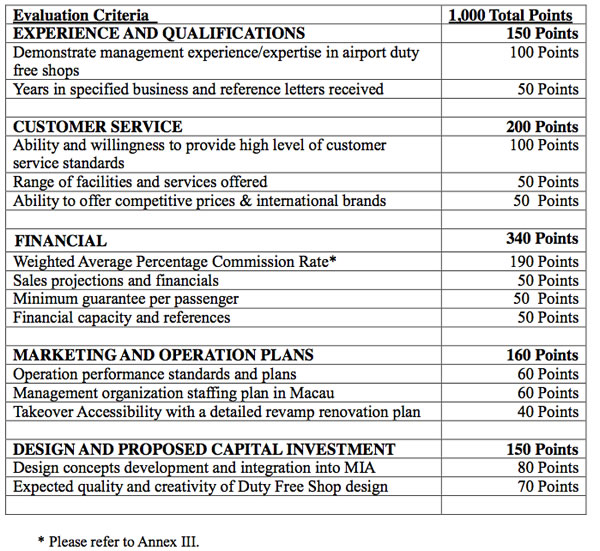

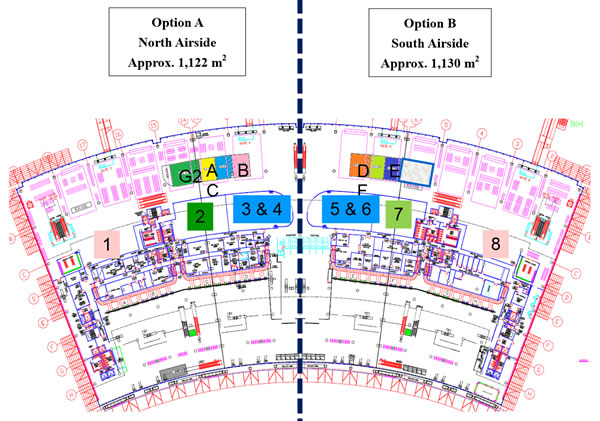

Bidders can make an offer for either or both concessions but no one company will be able to operate both. Each of the two retailers must dedicate 40% of space to the core categories of liquor & tobacco and perfumes & cosmetics, with the balance of 60% spread across other product sectors from jewellery & watches to confectionery (see table).

That model, and by definition the limited returns, makes the necessary investment to run a high-quality operation difficult to justify, sources close to DFS believe. Other retailers today also questioned the dual-operator model. However CAM made it clear today that its decision was final.

When contacted by The Moodie Report, CAM could not comment on the tender before today’s meeting but we expect to bring you its comments soon on the concessions’ potential and structure.

King Power declined to comment on the splitting of the business, though its disappointment is a given, as it has essentially lost half of its business before the tender even begins.

The company is likely to face intense competition from China Duty Free Group, Lotte Duty Free, The Shilla Duty Free, Sunrise Duty Free, LS travel retail, Heinemann Asia Pacific, Nuance-Watson Asia, Sky Connection, all of whom attended today’s meeting. Duty Free Americas, already established in Macau is another likely candidate. Other possible contenders are Aer Rianta International, World Duty Free Group and Dufry, though the latter’s participation seems unlikely given its well-documented views on such crowded tender competitions.

|

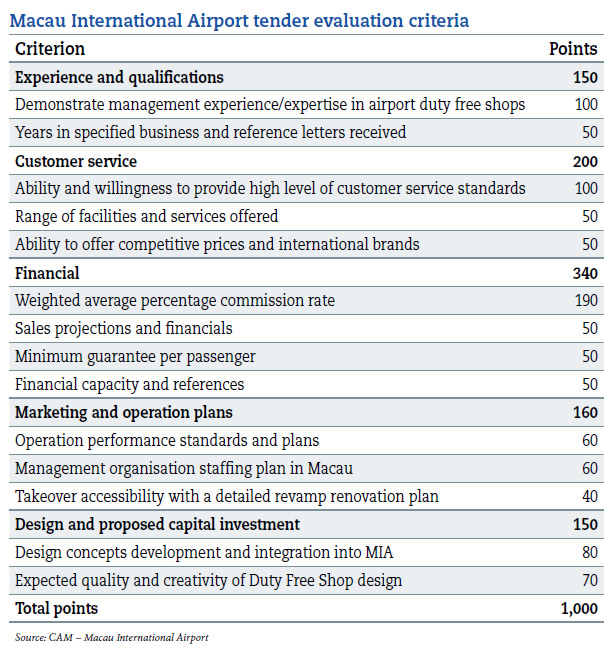

The airport operator is placing a greater weighting on non-financial criterion |

Despite any concerns over the contract model, the level of interest is understandable. Macau’s status as a booming gaming and leisure zone for mainland Chinese travellers, and its burgeoning high-end retail business of recent years led by DFS Group’s downtown operations, is justification enough for many. And of that 5 million passenger base, 1.7 million are from Mainland China, 1.4 million from Taiwan and nearly 900,000 from Thailand.

CAM also claims that its average passenger duty free spending rates are “substantially higher” than at other airports in Asia Pacific, Europe or the Americas. With considerable justification it will believe that these can be increased significantly in the future, especially given the emphasis on capital investment in the tender document (see table).

Whether the dual-concession model will generate a better return to the airport company or a better offer to the consumer is uncertain, however. Neither is a given, according to several seasoned industry observers, who point to the difficulties posed by mirror operations in other airports, including most notably (and currently) Auckland (DFS and JR/Duty Free) and Colombo Bandaranaike International Airport (World Duty Free Group and Flemingo).

One senior retail executive, highly experienced in various competitive bids and concession models said: “I just can’t imagine competing beauty and liquor/tobacco stores in a small airport. It will be worse than Auckland. I would understand splitting the concessions (i.e. each operator running different categories) but having two operators compete in an airport of this size doesn’t make sense.”

Some suppliers, too, are concerned. One of the liquor business’ leading travel retail executives, said: “The split concession means the passenger is faced with two store fronts the same size and simply decides which way to walk. Most go to the right (80%) according to some studies, which simply means that one of the two retailers is at a distinct disadvantage, despite paying what I imagine will be the same rental. We see this in Sri Lanka.”

|

Source: Sociedade do Aeroporto Internacional de Macau (CAM) |

The same source says that in such a scenario, suppliers are reluctant to invest in high-profile promotions as they know their potential return could be split in two.

Another leading Asia Pacific supplier of general merchandise and beauty products comments: “Splitting a relatively small business down the middle certainly makes it difficult for the supplier to decide what to do. Margins for the supplier go down whichever way they play it. Service levels will reduce as brands will have fewer sales assistants by location. Added to that, the competition between the stores will create many difficult scenarios which the supplier will have to resolve.”

We’ll examine the story in greater detail, with further industry reaction once we have obtained CAM’s comments.

|

|

|

King Power Group (Hong Kong) has operated at Macau Airport since 1995, successfully refurbishing its offer over recent times |

|

|

The timeline is tight but that clearly won’t deter several major regional and international retailers from bidding on the Macau International Airport duty free contracts |

|

|

Retailers can bid on one or both options but a single operator cannot run the two concessions |