SOUTH KOREA. The country’s travel retail sector is once again under the legal microscope as the sector’s three giants – Lotte Duty Free, The Shilla Duty Free and Shinsegae Duty Free – all seek rent relief through the courts.

As reported, Lotte Duty Free (through Hotel Lotte and Busan Lotte Hotel, the respective parents of its Gimpo and Gimhae airport operations) is optimistic the Seoul High Court will rule in its favour regarding a refund of airport rent fees paid to Korea Airports Corporation in the pandemic-ravaged months of March to August 2020.

Its confidence follows a favourable Supreme Court ruling this month, the company told The Moodie Davitt Report.

Due to the South Korean government’s consolidation of all international flights at Incheon International Airport during the COVID-19 crisis, the company was compelled to suspend operations at its Gimpo and Gimhae Airport stores during those months.

As a result, the travel retailer filed a lawsuit against Korea Airports Corporation seeking a refund of rental fees. The Supreme Court of Korea this month ruled that because the Gimpo and Gimhae international terminals were effectively shut down, it was impossible for tenants to fulfill their contractual obligations and recommended a full refund. The Seoul High Court will now rule.

While Lotte Duty Free is not alone among Korean travel retailers in seeking rent relief, its case is markedly different in origin from those of its archrivals, The Shilla Duty Free and Shinsegae Duty Free.

According to influential business media Bizwatch, Shinsegae Duty Free filed an application for rent adjustment at Incheon International Airport to the Incheon District Court on 29 April, while The Shilla Duty Free followed suit on 8 May. The Moodie Davitt Report has verified these challenges through reliable sources.

Both retailers are understood to be requesting a -40% reduction in rent for cosmetics, perfume, liquor, and tobacco stores in Terminals 1 and 2.

The Moodie Davitt Report has sought a response from both retailers. The Shilla Duty Free declined to comment.

An informed source close to the matter told The Moodie Davitt Report, “The duty-free store retailer has made multiple requests to Incheon International Airport for rent reduction, but they were declined. As a result, The Shilla Duty Free was left with no choice but to seek mediation through the court.

“It is to be hoped that a shared understanding of the ongoing difficulties in the duty-free industry will help pave the way for a constructive path forward.”

Shinsegae Duty Free’s rent-to-revenue to increase

Bizwatch noted the high stakes involved in seeking relief. “Considering that the number of passengers at Incheon Airport is around 3 million every month, the monthly rent paid by Shilla Duty Free and Shinsegae Duty Free is KRW27 billion (US$19.5 million). This is well over KRW300 billion (US$217 million) per year.

“This is a huge amount of money, equivalent to 10% of Shilla Duty Free’s annual sales and 14% of Shinsegae Duty Free’s annual sales. The two companies posted operating losses of KRW75.8 billion (US$54.9 million) and KRW19.7 billion (US$14.3 million), respectively, last year, probably due to the burden of rent at Incheon Airport.”

Clarifying those numbers, Shinsegae Duty Free told The Moodie Davitt Report, “Our officially reported revenue for the 2024 fiscal year stands at KRW2.006 trillion. The figure compiled by Korean Customs is approximately KRW3.1804 trillion. The discrepancy between the two numbers arises from the difference in accounting methodology and scope.

“Regarding the Incheon International Airport rental rates, the oft-mentioned figure of 14% of revenue reflects the expected rental burden under full normal store operations.

“However, since a portion of our stores operated as temporary locations during 2024, the actual rent percentage was slightly lower. With the opening of the Louis Vuitton duplex store this June, virtually all of our Incheon Airport stores will be operating as standard stores. As a result, we anticipate the rent-to-revenue ratio to increase compared to last year.”

Lotte Duty Free raises “fairness concerns”

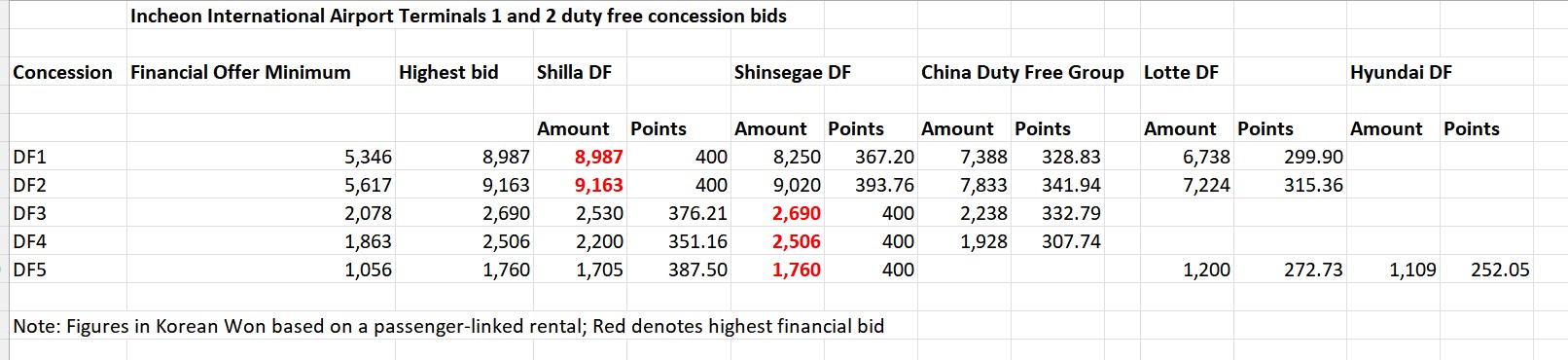

The biggest challenge to both retailers’ chances of success lies in the giant form of Lotte Duty Free, which has been out of Incheon International Airport altogether since its lowball bid on the 2023 mega-tender. That approach was based on a cautious view of existing and future market conditions and the potentially punitive cost of doing business at Incheon.

Lotte Duty Free had already exited its Incheon Terminal 1 cosmetics, fashion and leathergoods contracts on 31 July 2018, citing “the burden of rent increases” following the sharp downturn in Chinese tourists in 2017 amid the THAAD dispute with China. It was replaced by Shinsegae Duty Free.

Lotte Duty Free’s prudence in the 2023 bid, as the company implies to The Moodie Davitt Report, would almost certainly prompt it to challenge any relief given to its rivals.

The company told us, “It is important to clarify that our case is fundamentally different from the recent rent adjustment claims filed by The Shilla Duty Free and Shinsegae Duty Free [relating to Incheon International Airport Corporation rents].

“In Lotte Duty Free’s case, operations were entirely suspended due to the government-mandated closure of international terminals, making business activity impossible.

“In contrast, the other companies are seeking rent reductions on [Incheon International Airport] contracts awarded through competitive bidding. Granting such rent relief could raise concerns about fairness among other duty-free operators and commercial tenants at Incheon International Airport who participated under the same bidding conditions.”

Incheon International Airport was therefore faced with a dilemma of the sort that seems to periodically plague the duty-free retail sector in the so-called ‘Land of the morning calm’ where life is often anything but so.

Now the courts must decide. But whatever those decisions, they may not be the end of the matter. ✈