NORDIC REGION. The Nordic Travel Retail Seminar 2015 took place in Copenhagen on Wednesday, attracting a record audience of over 130 delegates to the regional event. The theme for the conference, which was held at the Scandic Copenhagen Hotel and chaired by The Moodie Report’s Dermot Davitt, was “˜Keeping the Magic Alive: A Differentiated Experience in Travel Retail’.

The event focused heavily on the consumer and what they want from travel retail, notably in the Nordic region; with speakers asking how the industry can better engage with them.

Key topics included leadership in business and how to generate and sustain passion among staff, plus there was a strong emphasis on the airports market – with contributions from the three leading airport companies in the Nordics.

|

Nordic Travel Retail Chair Eva Rehnström welcomed guests to the event |

The programme began with two superb and memorable, though very different presentations, one by Lars Liebst, CEO of Denmark’s leading tourism attraction, Tivoli Gardens, and another by Swedish Air Force Lt Colonel Robert Karjel.

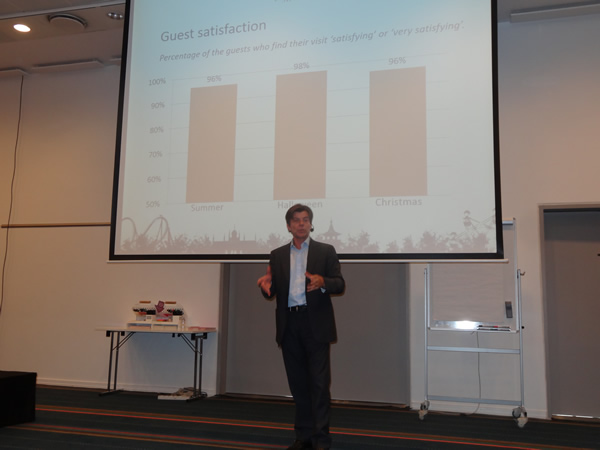

Liebst spoke of how he turned around an ailing Tivoli since 1996 through the introduction of new seasons, events and themes – but with an emphasis on improving the guest experience. Ensuring that staff buy into the delivery of that experience is the only way to succeed, he said, as is ensuring that their voice is heard in the decision-making process. Guest satisfaction levels at Tivoli today are consistently over 90%, he said, adding that the future would be reliant more and more on overseas visitors, citing the USA and China among the key contributors to growth.

|

Lars Liebst: Balancing tradition and modernity at Tivoli Gardens, a Copenhagen institution |

|

Robert Karjel delivered a brilliant presentation on the subject of leadership |

Inspirational speaker Robert Karjel made an enthralling contribution, citing his time leading a Swedish mission to protect food supplies (destined for 4 million starving people in Africa) from the reach of pirates in the Gulf of Aden. He noted how teamwork and success was about providing a context that all members of the team could buy into – and stressed how organisations that are small and nimble (such as the Swedish Air Force in this instance) could match or exceed the efforts of larger, unwieldy organisations.

|

The 2015 Nordic Travel Retail Seminar attracted over 130 people |

M1nd-set Project Manager Clara Perez offered the results of a recent major study into the Nordic travelling shopper at the region’s airports – with the data collected in Q4 2014 and Q1 2015.

Among the key purchase drivers, she noted, was price savings (cited by 32% of those surveyed as their main motivator to spend). This was the key factor across almost all categories, except for confectionery, where the largest share of shoppers said they were motivated by finding items they could not find at home.

Among those who did not shop, they said that knowing they would find guaranteed savings over their local market would encourage them to spend in duty free stores – underlining the importance of communicating the savings message at regional airports.

Importantly, when rating the least satisfying elements of shopping in the Nordic states, travellers cited promotions, the availability of local products and the availability of more affordable or inexpensive items.

Among the key conclusions was that retailers should home in on the importance of price as a driver – communicating savings more effectively – and enhancing the local flavour of the stores and offer.

|

Clara Perez: Emphasised the key role of price in the Nordic market |

|

Andrea Rudolph: Championing a ‘local hero’ |

Participants also heard from Andrea Elisabeth Rudolph, a former TV personality in Denmark who left her job six years ago to create a new natural skincare brand, Rudolph Care. She reflected on her life journey and on the journey for the brand from start-up (it remains small at just seven employees) to a presence around the country and at Copenhagen Airport.

She was refreshingly candid about the costs and barriers to entry to the airport marketplace for smaller brands, noting just how big a risk it was for a company with marginal profitability – but said the move had paid off with enhanced visibility and a strong partnership with the airport company and Gebr Heinemann. “Travel retail offers a unique consumer experience, but it’s an expensive environment. The challenge is that when you’re a small company that produces only in Denmark, you have less volume so it becomes expensive to play in that market. But we made the move into the airport in 2013 and it has helped us tell our story as a proud local brand that is natural and Nordic.

“We’d like to see other airports take a chance on smaller brands. We can take decisions quickly, we are flexible and we can fit well with other brands in the mix. Retailers need to give visibility to local brands and help them on pricing, but it is worth it and they get a lot in return.”

Delegates also heard from Viking Line Vice President Head of Sales and Marketing Kaj “˜Tico’ Takolander on passion in the business, He explained how the cruise & ferry company had changed from a logistics group to a customer-facing company that was now about “the experience”.

“You need to be relevant, genuine and original and to differentiate yourself in this market,” he stressed.

|

Kaj ‘Tico’ Takolander: Bringing passion to the service onboard Viking Line |

|

Anna Szentivanyi: Harnessing the power of confectionery |

In a strong presentation on the role of confectionery in the channel, Mondelez World Travel Retail Customer Marketing Manager Anna Szentivanyi underlined how the category can be a footfall and spend driver, with strategic relevance to the total store.

She noted that the industry faced the challenges of not enough travellers entering the stores, due to lack of appeal and barriers such as stress, while once inside not enough of them made purchases due to lack of appeal in the offer and environment.

Mondelez and its retail partners have addressed some of these challenges, she noted, citing several case studies. One was at Schiphol, where confectionery was moved to become a more strategic and core part of the store, with conversion climbing by +7% as a result.

She also noted that confectionery can play a greater role if it can generate emotion and surprise, citing examples such as Mars International Travel Retail’s M&Ms store at Paris Charles de Gaulle. With examples such as this, and other from Mondelez itself at Changi (with LS travel retail) and Frankfurt (with Gebr Heinemann), “functional shopping can be turned into an exploration”.

Confectionery too can help drive last-minute purchases, with better use of the cash till point. Mondelez put this into practice with Schiphol Airport Retail, with cash till revenue climbing from 1% to 3% of total store sales.

In addition, she added, best sellers from confectionery can drive incremental sales if the location and offer are harmonised according to passenger behavior. An example was better location of confectionery close to liquor at Delhi Duty Free, with a strong sales uplift resulting.

Navigation is key within the store, she noted too, and signposting from leading brands can remind shoppers to top up their basket. An example of this was at São Paulo with Dufry, where the retail surface was increased and engagement with shoppers improved through the use of confectionery in strategic locations.

|

Claus Brix: A new voice in the digital media space at airports |

The day concluded with a strong session devoted to the airports channel, featuring advertising specialist Air-magine CEO Claus Brix, as well as the three leading airport companies in the Nordic region.

Brix explained how his company has transformed marketing at Copenhagen Airport (from analogue to digital) through the installation of nearly 600 screens over an eight-week period. He also cited the coming of individually tailored messages from brands at particular consumer groups through face recognition technology – a platform that could dramatically change how advertisers talk to a relevant audience.

Swedavia Executive Vice President Karl Wistrand outlined his group’s plans to develop commercial and property at Stockholm Arlanda and beyond, citing the importance of the Airport City model to the future of the business.

He noted: “We see that customer satisfaction is a key in strengthening our competiveness, and with this lies improvements in the commercial offer. We have also strengthened the commercial organisation, after acquiring remaining shares in the former Arlanda Schiphol Development Company (ASDC) from Schiphol Group.”

He hailed the role of local brands in the commercial mix, saying that they added flavour to the mix. He also outlined plans to develop T5 at Arlanda, with a goal to add 5-6,000sq m of commercial by 2020 on top of the existing 20,000.sq m

Noting the fragmented nature of the terminals at Arlanda, he said: “We want to concentrate the passenger flow so we can attract international brands plus more local brands. The airport is a way of entering a new region or continent for brands – Bath & Body Works has opened at Arlanda, its first airport location in Europe, for example.”

Work continues at regional airports too. “Swedavia has invested in increased capacity and atmosphere at several of our airports, Kiruna, LuleÃ¥, UmeÃ¥, as well as Gothenberg Landvetter and Arlanda. We will continue to invest, and the rate of investment will be twice as high as in previous years.”

|

Karl Wistrand: Swedavia’s vision for retail and commercial and the Airport City model |

|

Roar Ødegaard: Outlined plans for the new T2 at Oslo, where tender bids are due soon |

Avinor Business Development Director Roar Ødegaard outlined the plans to develop a new T2 at Oslo (which will increase commercial space by +40% there) as well as a new T3 at Bergen Airport (doubling commercial space at that location).

Tender are due next week for a range of retail and food & beverage tender for Oslo T2, which he said had attracted the interest of 100 companies in total. He also said that Avinor expected commercial to grow from 50% of revenues to close to 60% by 2030.

Wistrand and Ødegaard were joined by Copenhagen Airport Business Development Driver (Retail and F&B) Anni Thøgersen for a panel discussion with Dermot Davitt on the challenges to the airport commercial market, where they covered issues such as brand-airport relationships, the future of travel retail, the airport commercial model and the impact of retailer consolidation. [We’ll feature more on the airport presentations and Q&A in The Moodie Report soon].

The focus of guests in Copenhagen later shifted to the magnificent Tivoli Gardens, offering a further chance to socialise and network.