USA. Welcome to our rolling coverage of the IAADFS-organised Summit of the Americas in West Palm Beach, Florida, in which we bring you our choice of the week’s highlights in words and images.

The event runs from Sunday 16 to Wednesday 19 April at the Palm Beach County Convention Center, with over 70 exhibitors booked and around 1,000 delegates expected.

20 APRIL

We bring you exclusive video coverage from Day 3 of the Summit of the Americas featuring Barton & Guestier, Choya, Lea Trading, Latin Gin, Wonderful Pistachios, F1 Eyewear and Kroma Makeup

19 APRIL

Watch the YouTube video above for highlights from Day 2 of the Summit of the Americas featuring BeautyPro, Michael Malul, Candela Rum, FlyWithWine, Guatemalan Spirits, Aerocos, Smith Co Distributing and Arturo Fuente Cigars

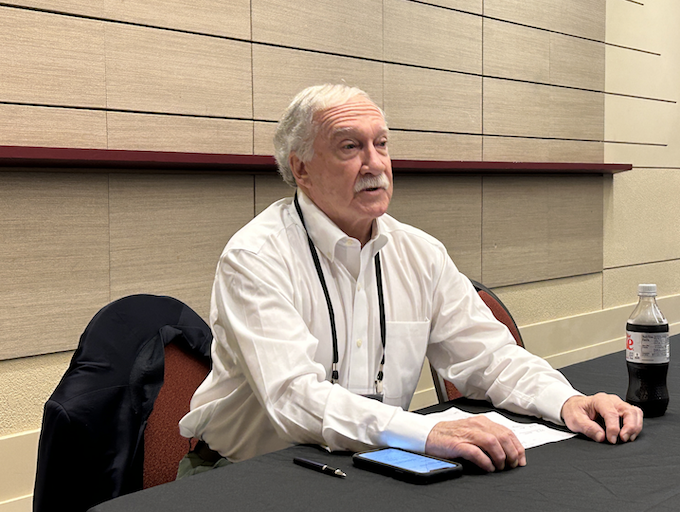

Michael Payne, President of Summit of the Americas organiser IAADFS, said today that the association was encouraged by the numbers that have attended the show as it enters its final day. Overall delegates climbed +34% compared to last year to 1,178. The key buyer attendance number was 389, up +45% year-on-year.

Payne said: “To have a ratio of around two to one suppliers to buyers is very positive. For us, over 1,000 delegates in total was a good number and we have gone above that. Within the buyer numbers there are many more Latin American and Caribbean visitors, as well as the major Canadian duty free operators.”

He said feedback from exhibitors has been broadly positive to date, with many saying they plan to return.

He said the format of having a limited number of suites alongside a main trade floor worked well, and awaited further feedback from members and those who attended.

“We will review all aspects of the show. The networking area inside the trade floor zone seemed to work well, though the back of the room did look sparse and we will address that. We also need to work on how we run the education sessions, some of which did not attract the attendance we want. We’ll consider the options and whether we run one longer series of sessions rather than over several days.”

Payne recognised that the show has become strongly reliant on categories such as wines & spirits and confectionery, and said talks continue with beauty brands to return.

“We have reached out and continue to communicate. We know that the major P&C players are missing and we want them here. But we don’t know if they will return. They do benefit as a category from the advocacy work that the association does, and we would like to them to be engaged.”

On the evolution of the show, Payne said that the business mix in the travel retail market would drive change. “We see other categories beyond duty free, such as duty paid, playing more of a part in the business. The show will have a different mix in future I’m sure beyond the core categories, and the event will evolve.”

Next year’s Summit of the Americas will take place on 14-17 April. The IAADFS has an option for 2025 at the same venue in West Palm Beach but has yet to exercise it.

18 APRIL

Building a resilient, sustainable future

The Moodie Davitt Report President & Editorial Director Dermot Davitt moderated the final session of the Summit of the Americas 2023 called ‘Building a resilient, sustainable future.’

The session featured AirProjects Associate Director and airport consultant Jim DeCock; International Shoppes Co-CEO Matthew Greenbaum, Motta Internacional CEO Erasmo Orillac and Airport Restaurant & Retail Association Executive Director Andrew Weddig. It explored how rent, concession, brand, labour and contract structures should evolve in the post-pandemic world.

Weddig gave an overview of the restaurant and retail landscape in the Americas. He said: “Many airports expect to reach 2019 levels in the summer of 2023 but that is still -15% behind where we should be this year [if COVID had not held back growth]. In the US, that shortfall represents 1.3 billion plane passengers and a substantial amount of lost revenue.”

Weddig questioned what ‘the new normal?’ looks like in 2023. “Labour paradigms and pricing structures are undergoing a revolution,” he explained. “Many industries were built on the presumption of inexpensive labour – which is gone. How we address this determines how our industry moves forward.”

Orillac offered his views on the challenges faced by Motta Internacional and how the passenger mix has changed post-pandemic. “We need to leave 2019 as a benchmark to address the current challenges we are facing. Labour costs are going up, while supply chain issues continue. Our passenger demographic has changed, with business travellers being replaced by leisure travellers.

“The leisure passenger has different needs and while passenger spend has grown +5%, operation costs have increased substantially too. We’re getting squeezed, and how we manage that squeeze will determine our sustainability in the future.”

Echoing his sentiments, Greenbaum said: “Our passenger mix has changed. For us, Chinese travellers have historically been very important but until now they have not yet returned. We’re much better now than 12 months ago though. The biggest challenges we have now are challenges that I’m much happier facing than the challenge of having zero demand. Now, we have pressures on product and personnel – which is a result of high demand.”

Offering the airport view, airport consultant Jim DeCock said; “One thing that was positive about Covid was that it promoted good partnerships between airports, airlines and concessionaires. Everyone coming together to survive this crisis reinforced that there are fundamental problems that we need to talk about. Covid forced us to look at rent structure, MAG, pricing structures, capital investments and several other underlying issues.”

The session explored how MAG structures should change in the post-pandemic landscape. The panellists also discussed the viability of a progressive profit sharing model in the future. Greenbaum said: “Some progressive airports are open to percentage based deals where MAGs are less important. We’ve also been discussing how we can insert language for when the next catastrophe takes place, to see how we can work together proactively.”

Regional Recovery, Global Context

TFWA Managing Director John Rimmer moderated a fascinating panel on Day 2 of the Summit of the Americas 2023. The panel featured Blue Water Bridge Duty Free Vice President of Sales and Frontier Duty Free Association President Tania Lee; Frontier Duty Free Association Executive Director Barbara Barrett; Lagardère Travel Retail Peru CEO Cyril Letocart and Penta Group Managing Director Cameron Gray.

A David and Goliath battle

Lee and Barrett looked back at Frontier Duty Free Association’s ‘David and Goliath’ battle with government regulations and their advocacy to reopen borders and relax COVID restrictions between the US and Canada.

Lee said: “With only 32 land border stores, we may be small but our Canadian hospitality is large. The Canadian/US border, the longest unprotected border in the world remained closed for almost two years, with some of the most stringent restrictions put in place.”

Barrett added: “Our core advocacy effort became survival. We had 14 different campaigns and worked together with 100 tourism groups to form the Coalition of the Hardest Hit Businesses. The announcement of the coalition resulted in 1,200 major news stories, US$2.5 million in equivalent advertising and 274 million impressions. Thanks to this, the Liberal Government made a commitment to help hardest hit businesses with land border duty free securing highest level of support.”

Commenting on the lessons learned during Frontier Duty Free Association’s uphill battle of advocacy, Barrett said: “It’s important to have an advocacy plan but to be adaptable, leverage media and social media for advocacy, seek supportive stakeholders and not to take no for an answer.”

Lee added: “The duty free industry is strong and resilient. What other industry can be -95% down for 20 months and still be standing here today and talking about our future and the opportunities that lies ahead. As we emerge and rebuild, we’re already taking advantage of partnership and collaboration. Without meaningful collaboration this industry cannot exist.”

Lagardère Travel Retail looks back on a year of surprises and challenges in South America

Lagardère Travel Retail began operating in Lima and Santiago in 2022. Looking back, Letocart said: “We started with 10 employees in Sept 2021. In just a year, we grew to have 400 employees in South America.

“Now, we are operating 4,000 sqm of retail and F&B space, we have 13 shops and have a pipeline of 12 F&B units in Chile for 2023. We have secured 4,000 sqm of duty free and duty paid retail space for 2025 in the new Lima Airport Terminal – so it is very exciting.”

He highlighted customs, a constantly changing political landscape, and unforeseen crises in Peru as some of the biggest challenges faced in the last year. However, he also highlighted the region’s good forecast for GDP growth, tourism bounce back, low inflation and significant post-pandemic traffic recovery as some of the positive surprises Lagardère Travel Retail faced in the last year.

Duty Free: Trusted, Transparency, Secure

Penta Group Managing Director Cameron Gray talked about the global problem of illicit trade, counterfeiting and intellectual property theft and how that affects the global travel retail industry.

He discussed the Duty Free World Council’s ‘Duty Free:Trusted, Transparency, Secure’ campaign which mitigates these issues that cause both economic and reputational damage to the entire industry.

He said: “Our objectives are to collaborate with key stakeholders to stop illicit trade counterfeiting and intellectual property theft, and amplify our existing credentials as an authentic and trusted industry. We seek to demonstrate our commitment to combatting criminality wherever it occurs.”

18 APRIL

17 APRIL

We bring you footage from around the stands of the exhibition element of the event, discussing the travel retail offer of brands from numerous categories including Timeless Skin Care, Pādre Azul Tequila, Amazzoni Gin, House of Somrus, Hylux and Hempacco.

Delegates heard the voice of the region’s airports at the second conference session on day one at the Summit of the Americas, through Airports Council International (ACI) North America President Kevin Burke and ACI Latin America & Caribbean Director General Rafael Echevarne.

“The role of concessions is essential to airport revenues and profitability,” said Burke, “though relationships with retailers have been challenged due to shifting travel patterns through the pandemic.

“The relationship between airports and retailers is essential and retailers need to be fairly compensated for their work. We need each other.”

Echevarne said: “Many airports made adjustments to their relationships to allow retailers continue their trading, which we welcome.”

On the rebound in travel to date, Echevarne said: “Latin America & Caribbean has seen a spectacular recovery. In 2022 passenger traffic was only -7% down on 2019 in our region. Today some airports are running at +25% compared to pre-pandemic.

Scoping out the opportunity for commercial, Echevarne said: “There is still room to grow in our region. We remain below global averages for penetration or the proportion of retail within overall revenues. Just 28% of revenues today come from non-aeronautical sources in Latin America & Caribbean so that spells huge potential. But within those non-aviation revenues, duty free is over half. So most airports have a strong dependence on retail, which is important to the bottom line.”

Technology to smooth the travel journey is a key factor in enhancing consumer satisfaction and in boosting commercial revenues.

Burke said: “We have told TSA about the impact of long lines at security on non-aeronautical incomes. We need that investment in technology to improve the experience.

“Broadly speaking we have great 20th century airports in the US, but not so many great 21st century airports. With aviation and other revenues stable, the only number airports can improve is non-aeronautical. You can see what happened when airports such as New Orleans or Orlando took a longer term view and gave space to retail. We need money to help modernise the system.

“And that is not easy. We rely on government grants and operate in an industry carrying huge debt. US airports need US$150 billion over the next five years to modernise the airports system. We have to do a better job around infrastructure.

“You cannot build great retail at an old airport. You need to invest and restructure space and when you do that, it can create enormous opportunities for concessionaires.”

Echevarne cited the introduction of new technology as one challenge, alongside the inflexibility of many airport concession contracts with private operators in Latin America. “If we change this, it can represent opportunity. We also need to let air traffic flourish through liberalisation, which is also holding back growth.”

Speaking of US duty free in particular, Burke also criticised gate delivery as an “absurd” system. “If you were designing the model for duty free you would not be delivering to the gate with all of the people needed, the confusion, the clutter it creates.”

Looking ahead, both speakers underlined their confidence in the return of air travel in the years ahead.

Burke said: “We see tremendous growth ahead though it will be 2025/26 before international comes back fully in North America. Business travel is yet to come back and really demand is driven by leisure travel. We also have concerns about capacity, as there is a shortage of pilots and air traffic control staff, which is going to affect the system this Summer. But the long-term picture is bright.”

IAADFS President René Riedi welcomed guests to the first session of the Summit of the Americas 2023. He said: “Coming from where we started in March 2020, 2022 has been a good year. Following the removal of quarantine restrictions there has been an upsurge in demand in many markets. Global passenger traffic finished at 72% of 2019 levels in 2022. International passenger numbers are 60% of 2019 levels, while domestic passengers are at 79%. Recovery continues and global passenger traffic will reach 92% of 2019 in 2023 with a full recovery projected in 2024.

“The speed of recovery depends on several factors. These include the possible contraction of GDP, slowdown of growth in major economies, inflation, geopolitical conflict and high air fares due to expensive jet fuel and higher demand. Uncertainty on the recovery of the aviation industry is omnipresent. However, despite these clouds in the sky we have all reason to be optimistic about the future,” he concluded.

16 APRIL