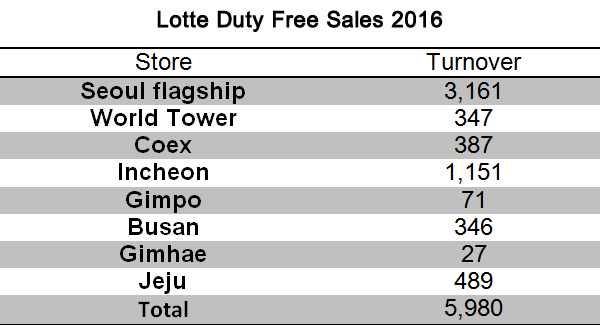

SOUTH KOREA. Lotte Duty Free’s stellar 2016 performance saw it generate revenues of KW5,980 billion (US$5.22 billion) – up from the preliminary KW5,973 billion (US$5.1 billion) stated by Korean Customs Service last month, we can reveal. Those figures relate only to the company’s Korean business, the company confirmed. International results will be published separately.

The local performance alone, ahead by over +26% on 2015 sales, is set to propel the Korean powerhouse into second place in The Moodie Davitt Report’s annual Top 25 Travel Retailers Ranking, due to be published later in the year. The retailer has stated its ambition to be world number one in the future, though it would appear a major acquisition will be necessary to overtake the current sector leader Dufry.

The result was especially impressive given that the retailer had to close down its Lotte World Tower Duty Free store in late June, following the controversial licence tender of late 2015

Lotte said that its online business continued to grow strongly last year, accounting for 24% of overall sales by year-end, up a full percentage point on the first half.

The retailer was boosted by booming Chinese arrivals in 2016, up +34.8% to 8,067,722. Japanese arrivals also rose sharply (+25% to 2,297,893) while Korean departures soared +15.9% in to 22,383,190.

Lotte says it drove business growth through enhanced Hallyu (Korean wave) marketing, pointing to the runaway success of its web drama ‘First Kiss for the Seventh Time’, which passed 100 million online views having only been released in late November (and which won Best YouTube Video/Campaign in The Moodie Davitt Digital Awards).

The retailer also hosted two highly successful Family Festivals, concerts featuring some of Korea’s biggest stars such as Kim Soo Hyun, Park Hae Jin, Hwang Chi-yeul, EXO and DEAN. The last Festival in October attracted some 20,000 Chinese tourists, plus 5,000 from Japan and Southeast Asia.

The retailer said it also put extra emphasis on directly attracting foreign tourists through extending its overseas office network to 12, each cooperating closely with local travel agencies. In an increasingly competitive Korean travel retail sector Lotte Duty Free also focused on extending its product range and leverage the company’s scale to drive a retail pricing advantage over competitors, it said.