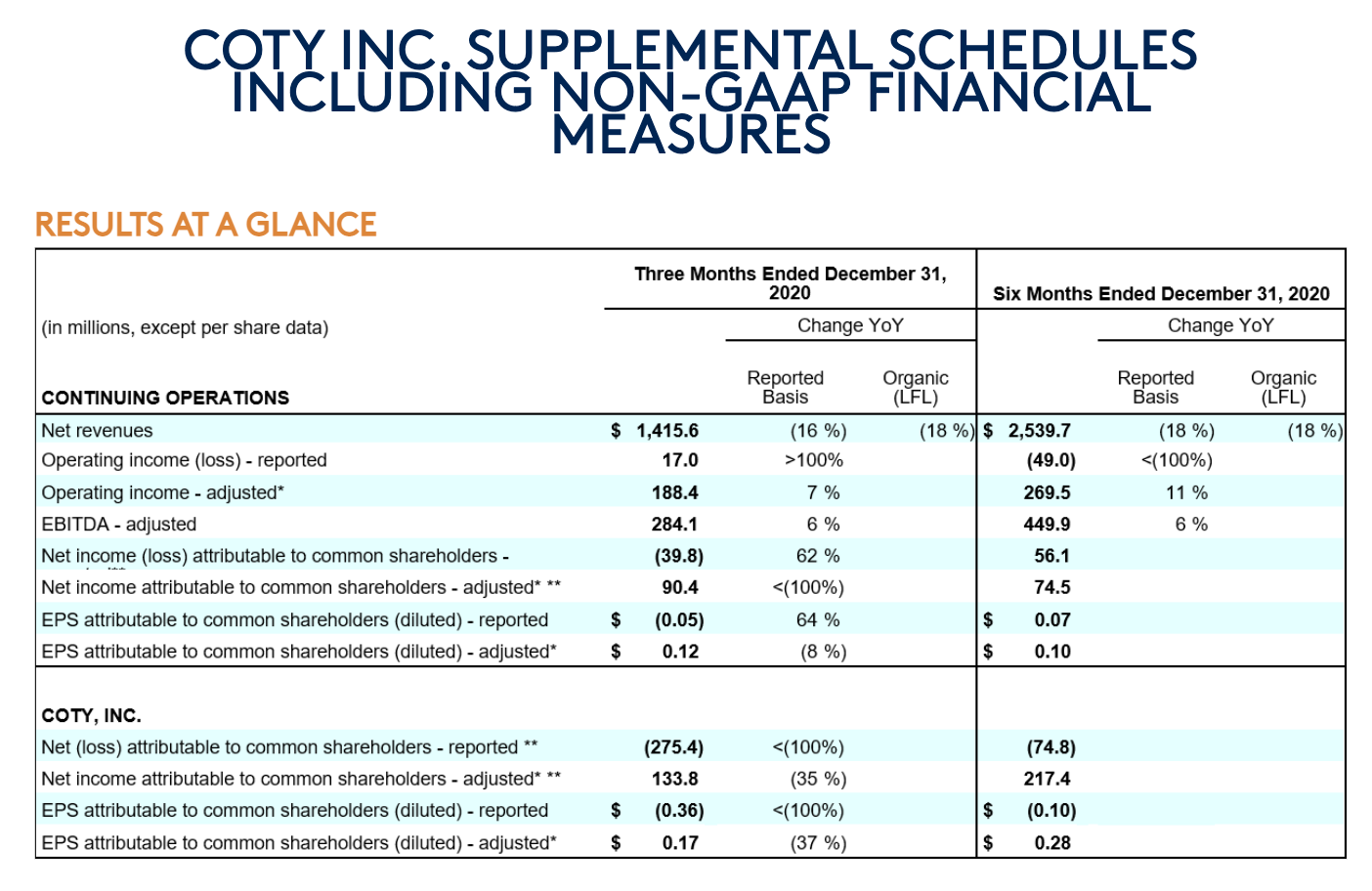

Coty has announced second quarter results for FY2021 (ended 31 December), with reported revenues falling by -15.9% year-on-year to US$1,415.6 million.

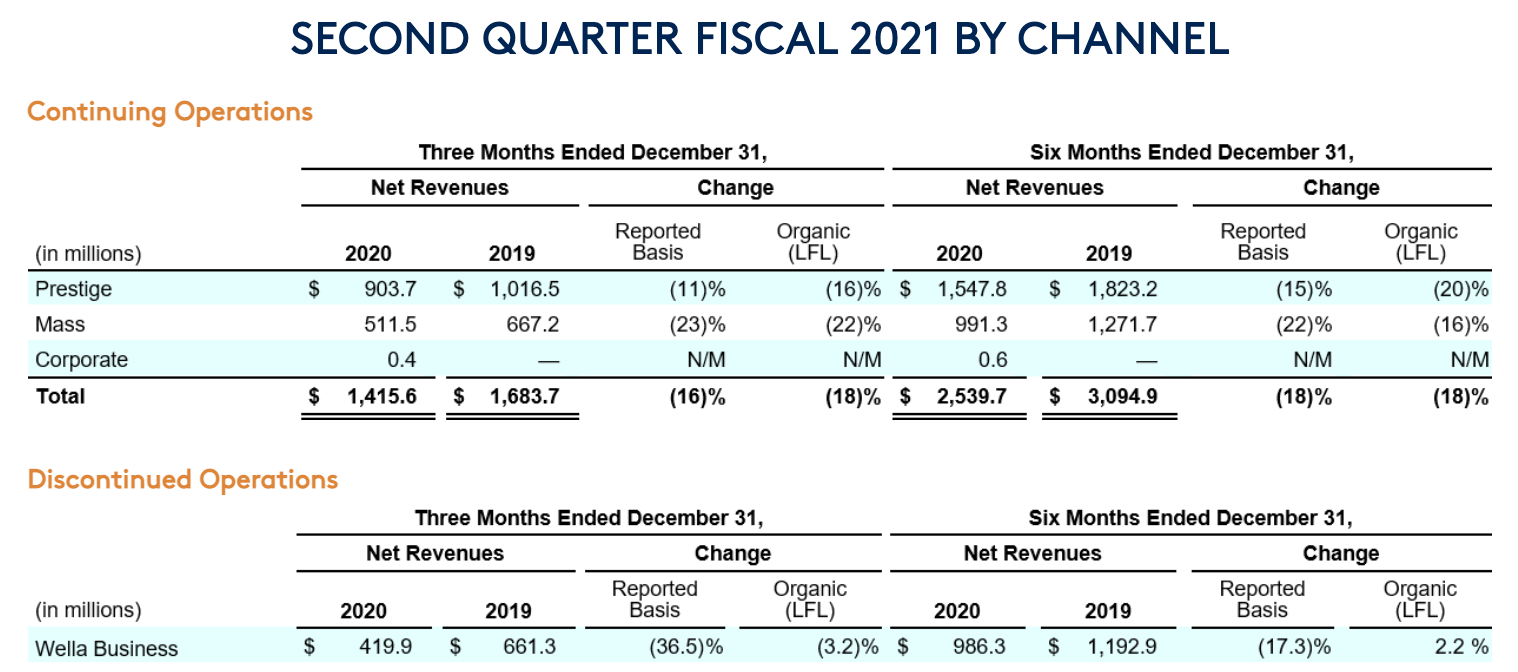

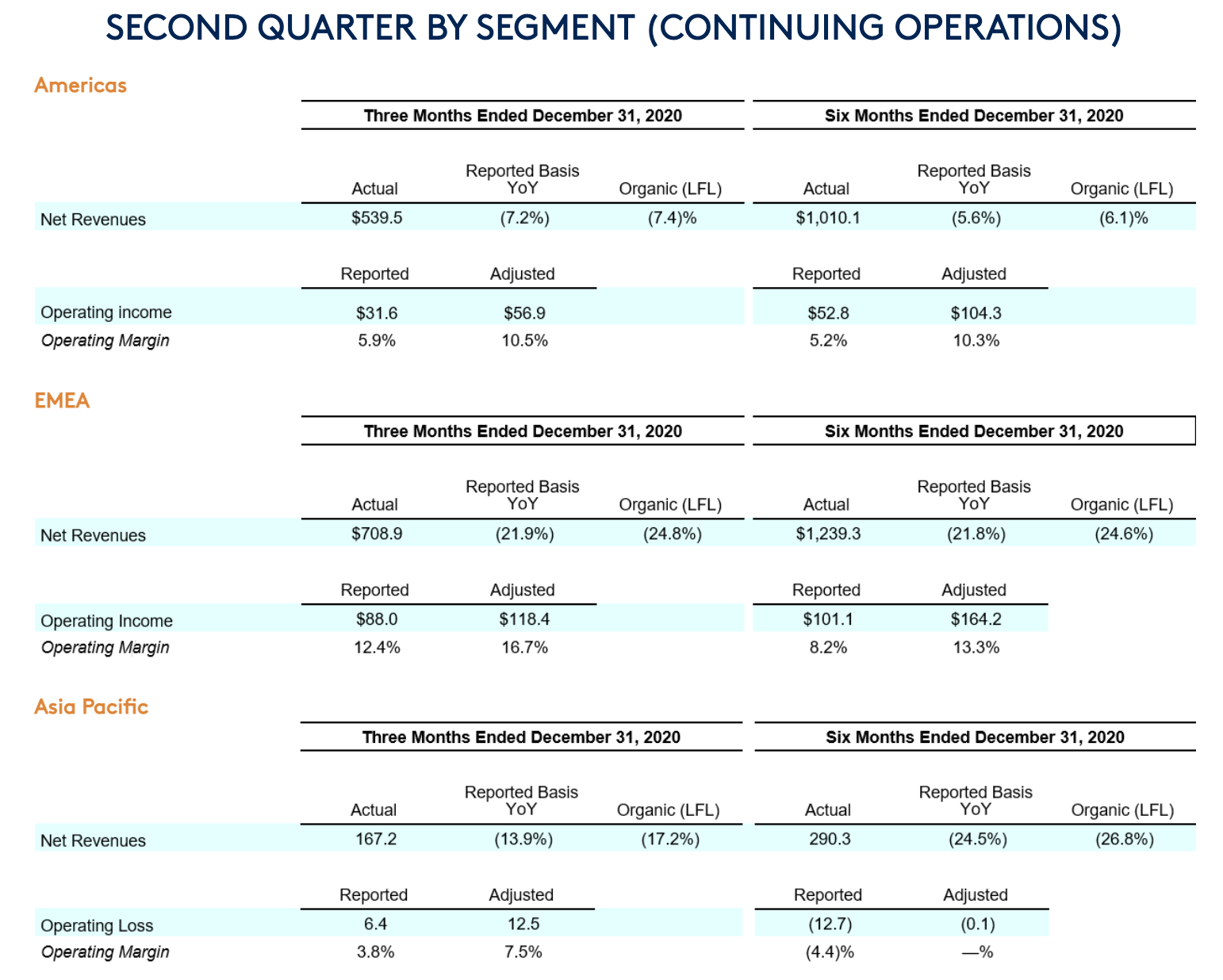

Like-for-like revenue fell by -17.9%, driven by decreases in the EMEA region of -24.8%, Asia Pacific (-17.2%) and Americas (-7.4%). By channel, the prestige business declined -15.6%, showing a significant improvement from -25% in Q1, while the mass business declined by -21.6%.

Prestige net revenues of US$903.7 million, or 63.8 % of Coty continuing operations, decreased -11.1% as reported and -15.6% LFL, reflecting an improvement from the mid-20s decline in Q1. Continued pressure on travel retail accounted for half of the decline in the prestige business, said the company.

Half-year reported net revenues were US$2,539.7 million, a decrease of -17.9% year-on-year.

The group reported adjusted operating income for Continuing Operations of US$188.4 million, up by +7% from a year earlier, while the adjusted EBITDA for Continuing Operations of US$284.1 million increased +6% from the prior year.

The marginal improvement in continued operating income was spurred by fixed cost savings, totalling US$80 million, the acceleration of ecommerce projects in the US and China and the continued performance of prestige brands. This has driven an increase in Coty’s savings targets for FY2021, which is now expected to be US$300 million, versus the previous target of US$200 million.

Adjusted EBITDA was US$284.1 million for the quarter, which brings the adjusted EBITDA for the first half of the year to US$449.9 million. This figure is expected to reach US$750 million at the end of the fiscal year with an adjusted EBITDA margin of 17.7%.

As reported, Coty closed the divesture of its professional Wella brand on 30 November, which delivered proceeds of US$2.9 billion. This — combined with free cash flow of US$389.4 million — helped decrease Coty’s financial debt to US$4,842 million at the end of the quarter.

Coty reported a net loss of US$275.4 million in Q2, which includes two months of contribution from Wella, compared to a net loss of $21.1 million in the prior year. This was due to the impact of the Wella transaction costs as well as additional restructuring accruals under the fixed cost savings plan.

“Our strong second quarter results build on the momentum of the first quarter, as the entire organisation continued to act with discipline, flexibility and creativity in an uncertain environment,” commented Coty CEO Sue Y. Nabi. “With revenues delivering on our objectives and profit, cash flow and debt all ahead of expectations, including +6% EBITDA growth, it is clear that a much stronger Coty is emerging, which we believe will weather any near-term market headwinds while simultaneously positioned strongly to capture the opportunities of the eventual global recovery. Entering Q3, January trends are starting in line with our expectations.”

Despite market challenges, Coty continued to progress strategic priorities which included digital and ecommerce acceleration. Coty grew its ecommerce business by +40% in Q2 by expanding its retail network in China, strengthening its prestige skincare and fragrance business and solidifying its share it the mass beauty market.

“We continued to progress on our strategic objectives during the quarter. Our ecommerce momentum, with 40% sales growth was broad-based, spanning the prestige and mass businesses, across key regions, and fuelled by success in pure-play e-retailers, brick & click retailers, and direct-to-consumer,” added Nabi.

The EMEA region recorded revenues of US$708.9 million, representing 50% of Coty’s continuing operations in Q2. This declined by -21.9% versus the previous year. However, EMEA ecommerce sales grew by +30%, recording an operating income of US$88 million.

Meanwhile, the Americas recorded net revenues of US$539.5 million, representing 38% of Coty’s continuing operations. On a like-for-like basis, Americas net revenues decreased by -7.4%, when excluding the impact of Coty’s depressed travel retail business.

Prestige beauty experienced high-single revenue growth due to Coty’s fragrance portfolio, while mass market beauty’s decline was softened by Coty’s growing ecommerce network. Ecommerce sales grew over +50% in the Americas region by the end of the second quarter.

“I am delighted to see Marc Jacobs Perfect ending the year as the #1 fragrance launch of CY20 in the U.S., U.K, Canada and Australia, while Hugo Boss delivered strong innovation behind Alive and Boss Bottled,” added Nabi.

“Meanwhile, we continued to build our prestige cosmetics footprint, with sales growing double digits in Q2. In mass, Rimmel’s revamped Lasting Finish 25H foundation helped strengthen its market share in the UK and Italy, while Cover Girl continued to strengthen its positioning as the brand leading on clean, vegan and cruelty free products, through its Clean Fresh line-up and the more recent launch of Lash Blast Clean mascara. Additionally, we are gradually stabilising market share in our mass beauty business, fuelled by the strong momentum of our brands online, including nearly a doubling of share on Amazon.”

Coty’s Asia Pacific business recorded US$167.2 million net revenue, contributing 12% of Coty’s total continuing operations. This represents a decrease of -17.25% like for like. The decline was due to significant pressures faced by its travel detail division and the active reduction of sales in low value channels.

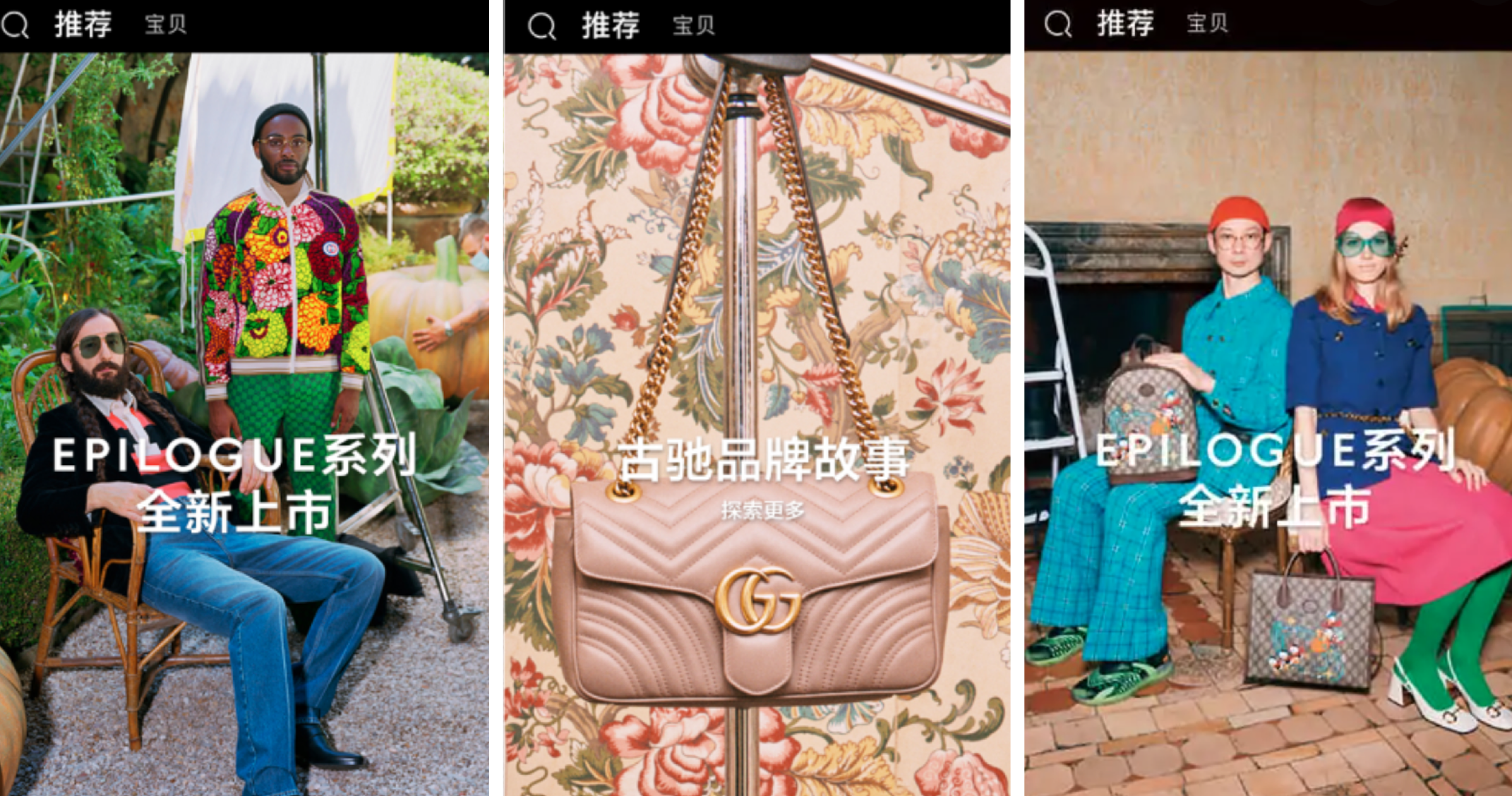

However, the company’s Asia Pacific prestige business recorded high single digit sell-out growth in the region, particularly in China. Chinese ecommerce revenues also grew by +20%. The growth was driven by prestige brands Gucci and Burberry with make-up category sell-out up +48% and +400%, respectively. Coty claims that Gucci makeup was ranked the second most popular makeup brand on leading Chinese social media platform WeChat.

Nabi said, “Our China prestige business continues to grow, with strong fragrance sell-out and the more than doubling of retail sales for both Gucci and Burberry cosmetics, speaking to the strong appeal of both brands to Chinese consumers. And we have continued building on Gucci’s momentum in China, with the opening this week of the Gucci Beauty flagship store on Tmall, for which we see tremendous potential in the coming years. And in our core business, we continue to deliver leading innovation in both prestige and mass.”

She added, “As we have finalised our strategic review, including new growth opportunities, brand equity mapping, and a repositioning plan for our core mass brands, we will share our strategic priorities around accelerating growth in mid-April, with a full Investor Day planned for Fall 2021.

“I am excited by the tremendous opportunities and exciting journey ahead for Coty and look forward to sharing this vision in the coming months.”