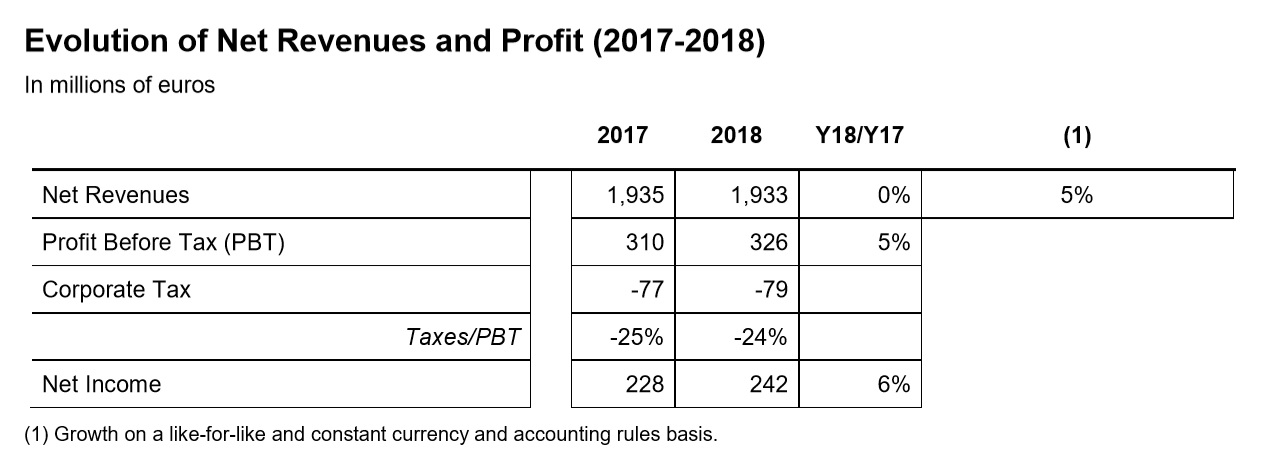

Family-owned fragrance and fashion group Puig generated revenue of €1,933 million in 2018, almost flat compared to the year before (€1,935 million) due to a fall in reported sales in its home market of Spain and in emerging markets. On a like-for-like and constant currency (and accounting rules) basis, the company noted growth of 5%.

The Barcelona-based third-generation fragrance-driven business – whose owned brands include Carolina Herrera, Nina Ricci, Paco Rabanne, Jean Paul Gaultier, Dries Van Noten, Penhaligon’s and L’Artisan Parfumeur – remains committed to a sales target of €3 billion by 2025.

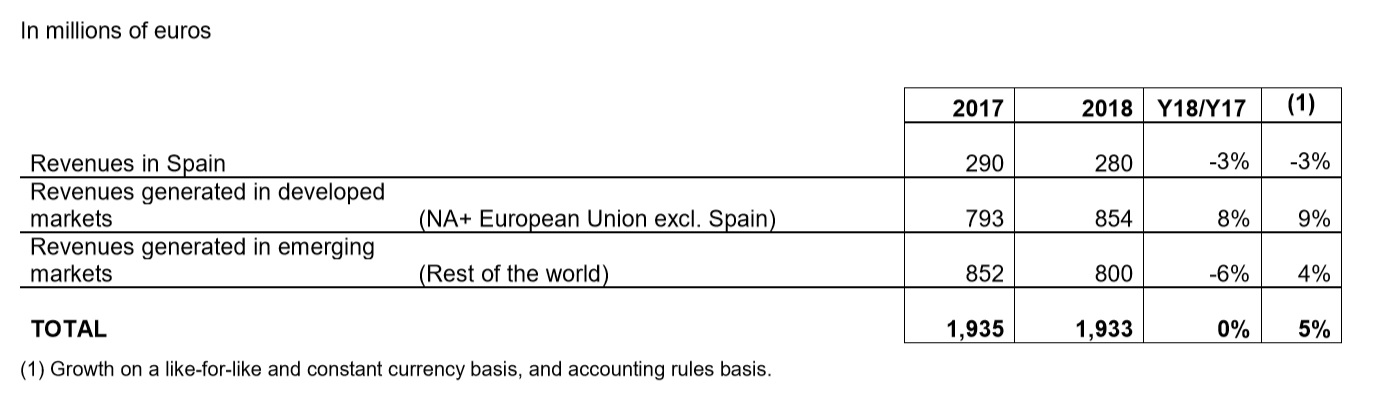

Last year, 14% of revenue was generated in Spain; 45% from developed markets (North America and European Union (excluding Spain)); and 41% from emerging markets (rest of the world).

Both Spain and emerging markets saw revenues decline in 2018. In Spain, while retail sales of selective fragrances increased by over 1%, significant retailers closed some of their doors which had a negative impact resulting in a net sales reduction of 3%.

In emerging markets, reported revenue fell by 6% to €800 million (but up 4% on a like-for-like and constant currency basis). Puig said: “The drop in the exchange rate in countries like Argentina and Brazil has had an impact on our reported sales.”

As a result – and due to strong growth of 8% (reported) – the developed markets segment overtook emerging markets, generating revenue of €854 million.

“More support to our owned brands”

Puig – whose licensed beauty brands include Prada, Christian Louboutin and Comme des Garçons, plus a number of lifestyle fragrances – admitted it had faced challenges in its core business of selective fragrances in 2018 “owing to the mutual decision of Valentino and Puig to terminate the licensing agreement under which Puig has developed and distributed fragrances for the Valentino label”.

The company said: “This made us shift our strategy, giving more support to our owned brands, with which we will be much more ambitious. We want to make Paco Rabanne and Carolina Herrera into brands generating revenues over €1 billion by reassigning resources previously dedicated to supporting licensed brands.”

In fragrances, Paco Rabanne has ranked number four globally since 2015, with two lines in the top 10 for men. The 1 Million line holds fourth place a decade after its initial launch, and continues to grow according to Puig.

Meanwhile, Carolina Herrera has moved up the global rankings for fragrance and reached 11th position despite the contraction of its key markets. The brand maintained its leading position in Latin America thanks to the success of Good Girl which was the fastest-growing feminine line in the industry in 2018, said Puig.

The company added: “At Paco Rabanne and Carolina Herrera, there are plans to enter new categories in the near future.” There has also solid growth for Jean Paul Gaultier – another key fragrance line especially in duty free and travel retail. It “has reached a historic sales record in its third year after joining the Puig range of fragrances” said the company.

Strong focus on expanding niche fragrances

Puig is maintaining its portfolio of of wider distribution lifestyle brands such as Antonio Banderas, which allow the company to tap growing middle classes, particularly in emerging markets.

Puig is also continuing to back the growing niche segment. “We are very selective in distribution of these brands, which are aimed at sophisticated consumers,” the company said. “In 2018 we acquired a majority share in Dries Van Noten, which we will extend to the fragrances category with very selective distribution.”

Existing Puig house, Penhaligon’s, has enjoyed double-digit growth above market rate. The brand’s 35 owned stores, together with digital sales, generate more than 70% of its sales. L’Artisan Parfumeur, currently only present in Paris is set to be scaled up to the international market. “We have also completed a majority acquisition of Eric Buterbaugh Los Angeles, a small niche brand with very limited distribution,” said Puig.

In 2018 Puig reached an agreement with shoemaker Christian Louboutin to develop its beauty business. “This strategic alliance affords entry into the colour cosmetics category and offers a source of learning for knowledge transfer to the owned brands,” noted the company.

Geographical and digital investment

After taking a minority shareholding in Granado in Brazil, in early 2019 Puig acquired a minority share in Loto del Sur, a Colombian company with a premium beauty positioning, and in Kama Ayurveda, an Indian company making beauty and personal care using Ayurvedic principles. Both agreements are the first step towards a majority holding by Puig in the future.

In April 2018, Puig launched Puig Futures, a platform to promote digital innovation. The vision is to lead the transformation of the fragrance category through innovation.

Six pilot projects have been launched to allow brands and markets to experiment with new and innovative technologies in the digital sphere and examine new business models, in collaboration with selected start-ups, in the process. So far, partnerships have been built with tech companies such as AirParfum to improve the olfactory experience at the point of sale.

All Puig fragrances are manufactured in the company’s production centres in Spain and France and sells them in more than 150 countries, of which it has affiliates in 26.