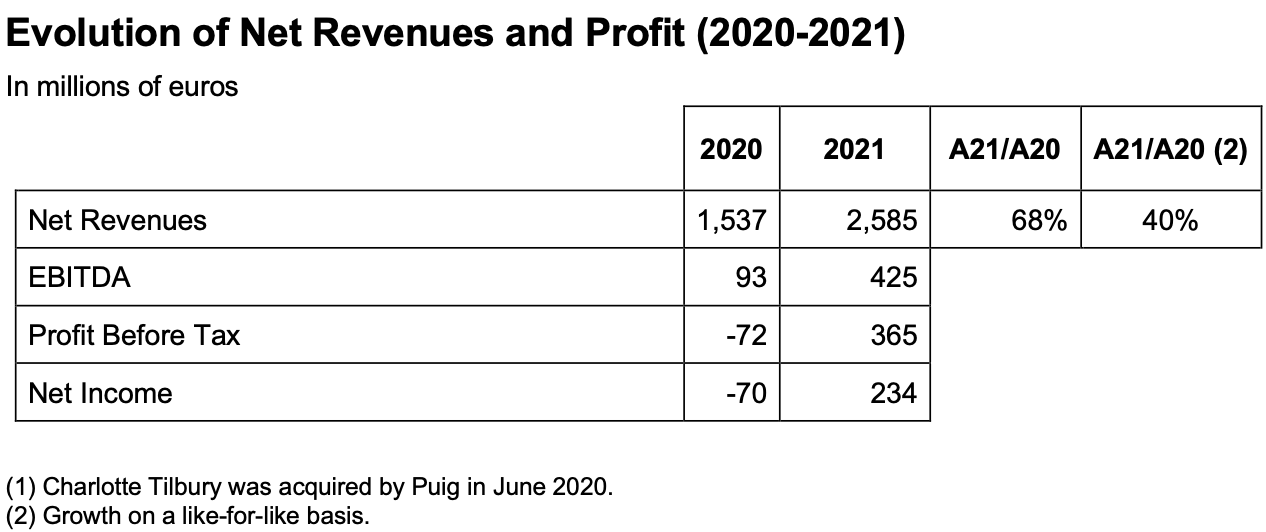

Family-owned beauty to fashion group Puig posted net revenues of €2,585 million in 2021, a leap of +68% compared to 2020 and up +27% compared to 2019. [Watch out for an interview with CEO Marc Puig, publishing shortly.]

On a like-for-like basis, had the Charlotte Tilbury division and the Derma division (including brands Uriage and Apivita) been part of the company throughout 2020, the growth in sales in 2021 would have been +40%. Travel retail “suffered major constraints due to year-round travel restrictions,” noted the company.

Puig said in a statement that the 2021 results reflect that it “has overcome the temporary impact generated by the pandemic”. It added that its target of €3 billion in revenues, originally to be hit in 2023, should now occur ahead of schedule in 2022. Puig is also targeting €500 million in EBITDA this year, also a year early. The company also reaffirmed its ambition to triple net revenues between 2020 and 2025.

Growth factors in 2021 included the incorporation of the Derma division and Charlotte Tilbury as part of the Puig portfolio. The recovery of markets in EMEA and the growth of the business in the US (now the largest single market) and Asia also had a positive impact on results.

Business profitability also returned to pre-pandemic levels. Puig recorded an EBITDA of €425 million euros, 16.4% of net revenues, which represents an increase of +357% over 2020, and +27% over 2019. Profit before tax grew to €365 million, 14.1% of net revenues, compared to a negative result (-€72 million) in 2020, an increase of +20% over 2019, while net income rose to €234 million.

2021 was the first year of operation under the new group structure. It was also the first of three years of the new 2021-23 strategic plan and the first year of recovery after the impact of 2020.

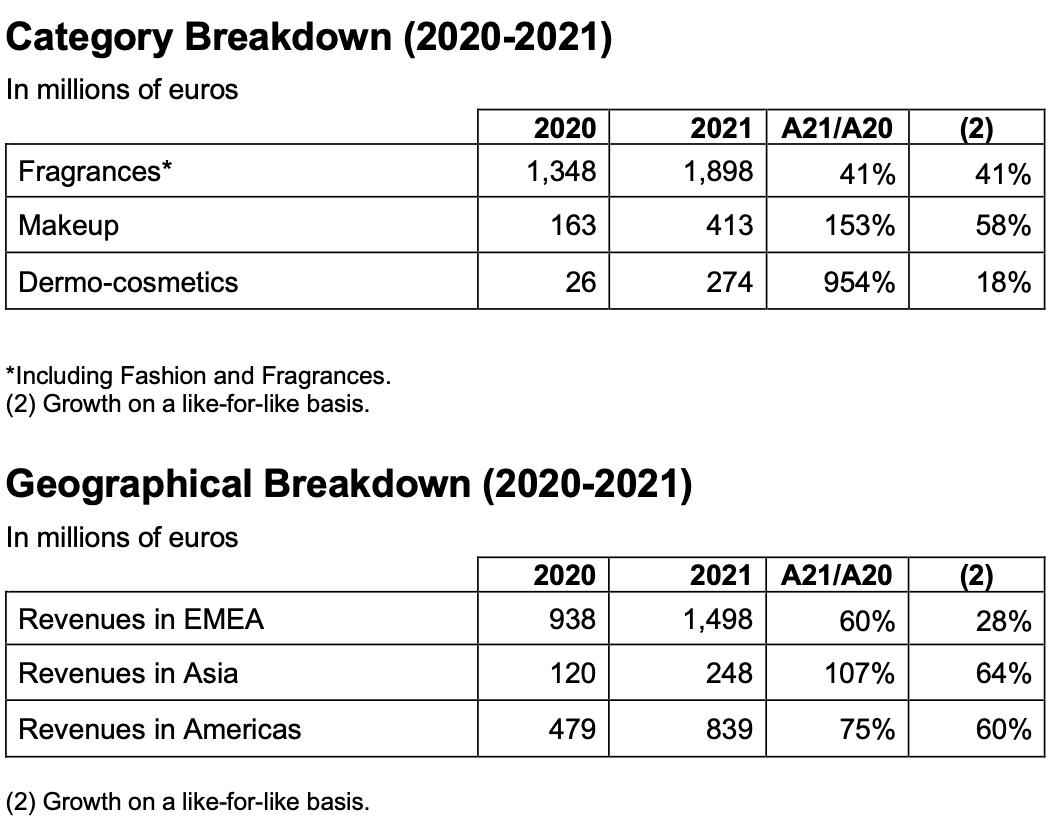

Performance by category

In the beauty and fragrance category, Puig recorded a +41% increase in sales compared to 2020. These positive results were boosted by the recovery of fragrance in markets such as EMEA, with key launches for Phantom by Paco Rabanne and Scandal pour Homme by Jean Paul Gaultier. In the US, the company’s fragrances experienced strong growth, with “excellent results” from Carolina Herrera’s Good Girl.

The Niche segment, with Penhaligon’s, L’Artisan Parfumeur and Christian Louboutin, also grew substantially.

In makeup, Puig increased sales by +153% compared to 2020. Charlotte Tilbury, with its luxury makeup line and its focus on digital business, is still the main driver of growth in this category, together with Christian Louboutin.

In the dermo-cosmetics category, Puig achieved an increase in sales compared to 2020. With Uriage, Apivita and Charlotte Tilbury, the category grew its presence in Europe, while continuing its international expansion in Asia, achieving double-digit growth.

Puig grew net revenues by +104% in the US, which has now become the company’s number one market, as noted above. In China, revenues more than doubled, increasing +212% compared to 2020. The company also increased sales by +60% in EMEA, thanks to that market’s recovery.

Digital business, a priority for Puig, represented 28% of total net revenues in 2021 and was once again a source of growth for the company.

Looking ahead and leading in ESG

The growth levers to 2025 (and a tripling of net revenues from 2020) will be the expansion of the digital business; the growth of the company in Asia, especially in China, thanks to Charlotte Tilbury and the Niche brands. The increased diversification in the makeup and dermo-cosmetics categories will contribute, as will the gradual recovery of the travel retail channel, said Puig.

In 2021, the company also launched its 2030 ESG Agenda which redefines the roadmap for the coming years.

The 2030 ESG Agenda is based on identifying the five material areas with the greatest impact on the planet, people and development: emissions; materials, ingredients and waste; biodiversity; water; fair sourcing.

Aware of the magnitude of the challenges that the company faces, Puig has created several governance mechanisms to guarantee the success of the 2030 ESG Agenda: the ESG committee, which reports to the Board of Directors; the position of CSO (Chief Sustainability Officer); and the ESG Team, in charge of the monthly monitoring of strategy and the fulfilment of objectives.

In June, Puig joined the United Nations Global Compact, ratifying the company’s commitment to the ten universal principles of the United Nations, which address human rights, social, anti-corruption and environmental issues, and which are aligned with the Sustainable Development Goals (SDG).

The company is also aligned with other relevant international standards: the Paris Agreement on climate change, the EU Action Plan for the Circular Economy, the United Nations Sustainable Development Goals, the Science Based Targets initiative (SBTi) and the Carbon Disclosure Project (CDP) in which it achieved an A-rating. This places Puig among the top 6% highest-rated companies out of more than 13,000 worldwide.

In 2021 Puig also submitted its ESG performance for evaluation through EcoVadis, a renowned provider of corporate sustainability qualifications. It obtained a score of 67/100, equivalent to a Gold Medal, which places the company among the top 5% out of the more than 90,000 companies evaluated.

Meanwhile, the Invisible Beauty Makers social action programme, in cooperation with the Puig Foundation, continues its work. For seven years, the programme has supported the entrepreneurial excellence of people who are already implementing social initiatives focused on fostering gender equality, empowering women and girls, reducing inequalities within and between countries, and developing sustainable and responsible production and consumption systems.