NEW ZEALAND. Auckland Airport today posted a +41% increase year-on-year in retail income to NZ$184.5 million (US$113.4 million) for its financial year ended 30 June.

Retail income per passenger rose by an encouraging +21% year-on-year to NZ$10.16 (US$6.25).

Commenting on the current tender for a single duty-free retailer, the company said an announcement is expected in March 2025. The incumbent is Lagardère Travel Retail-owned Aelia Duty Free, which has been running a single-retailer contract since 1 June 2023, which replaced the former dual-operator (Aelia and ARI) model. Aelia’s extended concession expires in mid-2025.

The retail performance outstripped passenger growth – domestic traffic was up +5% year-on-year to 8.5 million, and international traffic (including transit) surged +29% to 10.1 million.

Car park income increased by +15% to NZ$66.4 million (US$40.82 million).

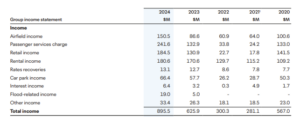

Total turnover rose +43% to NZ$895.5 million (US$550.5 million). Operating EBITDAFI was up +55% to NZ$614.0 million (US$377.5 million).

The company attributed the improved retail income per passenger and the overall surge in retail income to increased international traffic and improvements to the international terminal’s retail offering, which had prompted increased shopping engagement.

Improvements were seen in retail performance across a number of categories including duty-free, food & beverage, Strata Lounge and the international terminal’s Collection Point (TCP – the pick-up point for off-airport purchases from participating stores throughout New Zealand).

In addition, the retail proposition benefited from continued innovation during the year with new luxury and premium retail stores opening, expanded ranges and new brands in duty-free. Several new F&B operators entered the scene.

Auckland Airport Chair Patrick Strange said the FY24 financial year had been marked by the strong return of international airline capacity, including several new carriers and routes, with seat availability to international destinations at 91% of 2019 levels.

Auckland Airport Chair Patrick Strange said the FY24 financial year had been marked by the strong return of international airline capacity, including several new carriers and routes, with seat availability to international destinations at 91% of 2019 levels.

Chinese traffic boost but headwinds slow full capacity recovery

“The lift in capacity, particularly on North American routes with a +48% increase in available seats, has not only benefited Kiwis but led to a +40% growth in North American visitors – an important economic driver for New Zealand’s tourism industry,” he said.

“Connectivity with China has been another bright spot with the return of Sichuan Airlines in April. Six airlines now connect Auckland Airport to seven destinations in China, with seat capacity surpassing 2019 levels by +2% for the year while Q4 saw an +13% increase.”

In total, 27 airlines flew non-stop between Auckland and 42 international destinations, up from 25 airlines and 40 destinations in FY23.

“The Auckland Airport team has worked hard to bring back airlines to Auckland, supporting them to grow and relaunch services, and that has delivered choice and competitive fares for customers,” Strange said.

“Where there is less capacity and competition on routes, airfares remain stubbornly high, most noticeably across the Tasman. When you couple the higher cost of flying with increased competition from other tourism destinations and the economic climate globally, we’ve seen flow-on impacts for key inbound visitor markets. This is especially true for Australia, with fewer Australians choosing New Zealand as their destination.

“Looking ahead, a global backlog of replacement aircraft orders has seen airlines prioritising available fleet on high-yield routes and holding back on a full return to long-haul destinations. With these headwinds, we are anticipating a longer time frame for achieving a full capacity recovery to pre-2019 levels.” ✈