CHINA. A well-researched Reuters article published last week, gives a fascinating insight into the man behind the little-known, mid-2011 purchase of a controlling stake in Sunrise Duty Free, the privately held operator of duty free shops at Shanghai Pudong, Shanghai Hongqiao and Beijing Capital International airports.

By implication the article also underlines the huge stakes at play in terms of the duty free contract at Beijing Capital International Airport, currently held by Sunrise Duty Free and due to expire in 2015.

The feature, ‘Meet princeling of private equity in China’, written in impressive detail by staff writers Stephen Aldred and Irene Jay Liu, focuses on Alvin Jiang, a founding partner at Hong Kong-based Boyu Capital, described as “one of the hottest firms in China”. Jiang is the grandson of former Chinese president and Communist Party leader Jiang Zemin.

|

The Reuters article paints a fascinating picture of the mid-2011 purchase of a 40% stake in Sunrise Duty Free by Boyu Capital |

The article says that investors were impressed with Boyu’s 2011 purchase of a controlling stake in Sunrise Duty Free, concluding “That deal, they believe, provided evidence that Jiang Zemin’s grandson could gain access to a strictly controlled state sector and convert those assets into a highly profitable investment.”

Reuters continued: “The Sunrise investment is expected to earn a substantial exit payout for Jiang, his Boyu colleagues and investors in the firm’s first US$1 billion fund, people in the private equity industry say.”

But will it? The Reuters story, and particularly its informed sourcing, suggests that Boyu is working hard to move some or all of its share in Sunrise soon, typical of the standard three to five year exit for private equity. But so much depends on what happens to the all-important Beijing contract, in particular.

Both Jiang and Boyu Capital declined to comment for the Reuters story. The article, citing three sources with “direct knowledge of the deal”, claims that Boyu agreed to pay around US$80 million for a 40% stake in Sunrise Duty Free, valuing the retailer at US$200 million in 2011. It claims this represents a controlling stake, with the balance, as has been well documented, in private hands, led by the low profile, much-respected, philanthropically minded Madam Fengyi Zhang.

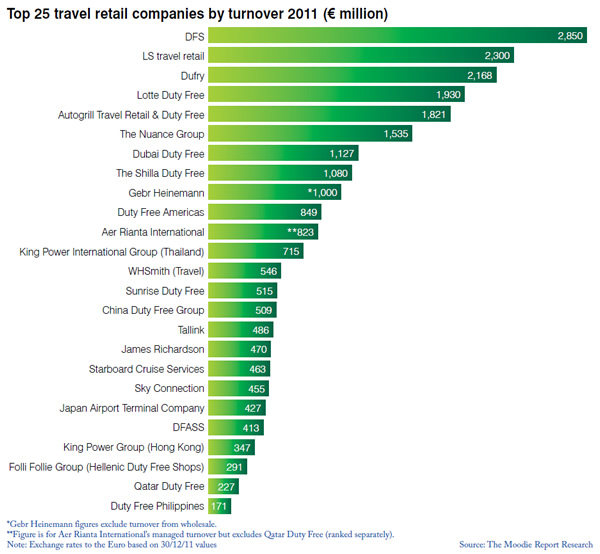

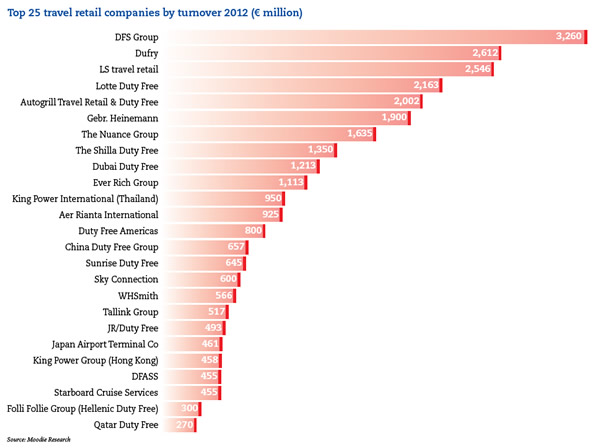

Citing The Moodie Report research, Reuters says that at the time of Boyu’s investment, Sunrise ranked 15th among the world’s top 25 travel retailers with annual revenue of around US$670 million.By early 2013, the article claims, Boyu had marked the Sunrise business on its books at a value of around US$800 million. It continued: “Bankers, however, value Sunrise at twice that amount – at around US$1.6 billion – based on 2012 sales figures the company filed with Chinese authorities, which Reuters reviewed.”Reuters notes: “Based on Boyu’s more conservative valuation of US$800 million for Sunrise, Boyu could be sitting on a paper gain of around four times its money in just under three years – an outstanding return in an industry where earning a multiple of two times over five years is considered a success. Boyu has already recovered much of its Sunrise investment through dividend payments, according to three people with knowledge of the matter.”

The article also offers a fascinating and largely accurate insight into the early days of Sunrise, attributing its foundation, development and part sale to well-known and charismatic industry executive Fred Kiang, described as “a Chinese-American businessman with close ties to the Jiang family” [Kiang told The Moodie Report in 2005 that he was born in Kunming to parents originally from Shanghai, then raised in the US].Sunrise was founded in 1999, the year that central government under Jiang Zemin opened up the operation of duty free shops to international bidders at the then-new Shanghai Pudong International Airport. That liberalisation led to the selection of three private companies to operate the various concessions – Sunrise (liquor & tobacco, for ten years), World Duty Free (perfumes & cosmetics) and Orient King Power (a subsidiary of King Power Group Hong Kong) for general merchandise.

As reported, World Duty Free later pulled out of the business (to be replaced by Sunrise), calling it a “strategic withdrawal” – one it now might well bitterly regret making.That success was followed by Sunrise’s success in landing the ten-year duty free contract at Beijing Capital International Airport. As The Moodie Report revealed, in a rare interview with Fred Kiang, the company offered CNY190 million (then US$23.5 million) as a minimum annual guarantee (MAG), beating China Duty Free Group’s CNY168 million and Orient King Power’s CNY120 million.At the time, the MAG was considered onerous.

The Moodie Report wrote: “Putting those figures in context, last year’s sales reached an estimated CNY250 million (US$30.9 million). This means that, to make any serious money, Sunrise will have to grow revenues tremendously. But it is confident of doing just that, and of boosting sales to as much as CNY400 million (US$50 million) in the near future.”Those numbers have been left far, far behind (and Sunrise’s investment rendered inspired) as Chinese outbound travel – and duty free spending – has soared.

Reuters picks up the story: “Today, business at Sunrise is booming. According to the company documents seen by Reuters, Sunrise had revenue of US$1.08 billion in 2012. The Moodie Report ranks Sunrise just behind state-owned China Duty Free, which controls nearly all of China’s other duty free shops.”

In 2007, as revealed by The Moodie Report, Sunrise was awarded a further ten-year concession to operate an extended range of duty free stores at Shanghai Pudong Airport, adding a range of fashion, accessories and food products to its existing portfolio of liquor, tobacco, fragrances and cosmetics.

While Sunrise has looked for expansion elsewhere (it bid unsuccessfully on all three core category concessions during the Hong Kong International Airport mega-tender in 2012),its current value lays in its core Mainland China duty free concessions in Shanghai and Beijing, with the latter due to expire next year. And it is the latter that holds the key to any exit by Boyu.According to reliable sources, Sunrise is now well into its second ten-year concession in Shanghai, which is due to end in 2019.

More critically, the retailer is nearing the end of its ten-year extension at Beijing Capital International Airport. An extension, or retention by tender, of that contract will clearly be critical to the valuation of Boyu’s stake – and Sunrise as a whole – going forward.Recent reports by another travel retail media title that Beijing Capital Airport Commercial and Trading Co (ACT), the commercial arm of state enterprise Capital Airports Holding Company, is planning to bring the business in-house are wholly wide of the mark (and strongly denied) at this stage and caused deep concern in China, The Moodie Report can reveal.

No decision has yet been made on the future of the concession, a matter of deep sensitivity that is garnering attention at the highest level. China Duty Free Group, the state-owned retailer, is also keen to secure the business going forward. Discussions with government are likely to be held early next year to resolve the matter, The Moodie Report has learned.Until 2005 Beijing Capital International Airport ran the business (through ACT) in-house, supplied by China Duty Free Group and China Power Duty Free Group.However one values Sunrise, at around US$1.6 billion as touted or Boyu’s more conservative valuation of US$800 million, any realistic valuation would seem to hinge entirely on the Beijing Airport duty free decision. Noted one leading international retailer: “Sunrise needs an extension [in Beijing] if these investors want to generate any value out the company.”