Italian eyewear house Safilo is focused on a turnaround plan having revealed 2018 net sales of €962.9 million, a 4% slide (at constant currency) this week. The company released its preliminary results in January.

Italian eyewear house Safilo is focused on a turnaround plan having revealed 2018 net sales of €962.9 million, a 4% slide (at constant currency) this week. The company released its preliminary results in January.

The decline was due to the weak performance of sunglasses in the fashion luxury segment and the exit of Céline which accounted for half of the sunglasses contraction.

Positive performances of Safilo’s own core brands, driven by Polaroid and Safilo – plus licensed brands in the contemporary and premium segment – helped to partially offset the fall. Polaroid has also become a driver in the travel retail channel which has been the best performing division in the company.

CEO since April 2018, Angelo Trocchia, has reset 2018 overall targets as the base of a two-year plan to revive growth and recover a sustainable level of profitability.

Trocchia told analysts: “We intend to shape a new commercial organisation for all our key geographical markets… with the aim of improving our go-to-market and brand execution. Even more important will be to recover a strong customer relationship and put the customer at the heart of what we are doing.”

A refinancing agreement of €150 million was also signed in October 2018 and matures in 2023 while a share capital increase of €150 million was successfully completed on 2 January 2019 helping to cut debt levels.

Other positives include the renewal of key licences. Kate Spade has been extended until 2020, Fossil and havaianas renewed until 2023 and 2024 respectively, and Tommy Hilfiger and Banana Republic renewed until 2025. Deals with Missoni and the Levi’s jeanwear brand were also signed in December and January respectively.

Trocchia described 2018 as “an intense year” but added that there was even more to do in 2019 as the company aims to rekindle top-line growth. As well as bringing in key regional management last year, Safilo is stepping up service and customer care in North America and Europe, and strengthening partnerships and its business organisation in Brazil, China, Japan and IMEA (India, Middle East and Africa).

Safilo said that its production business with Kering will halve this year, with the bulk of orders/deliveries occurring in the first half. However, it expects the positive performance of its own core brands and contemporary and premium segment expected to continue, while also expecting an improvement in fashion luxury brands and the stabilisation of Dior.

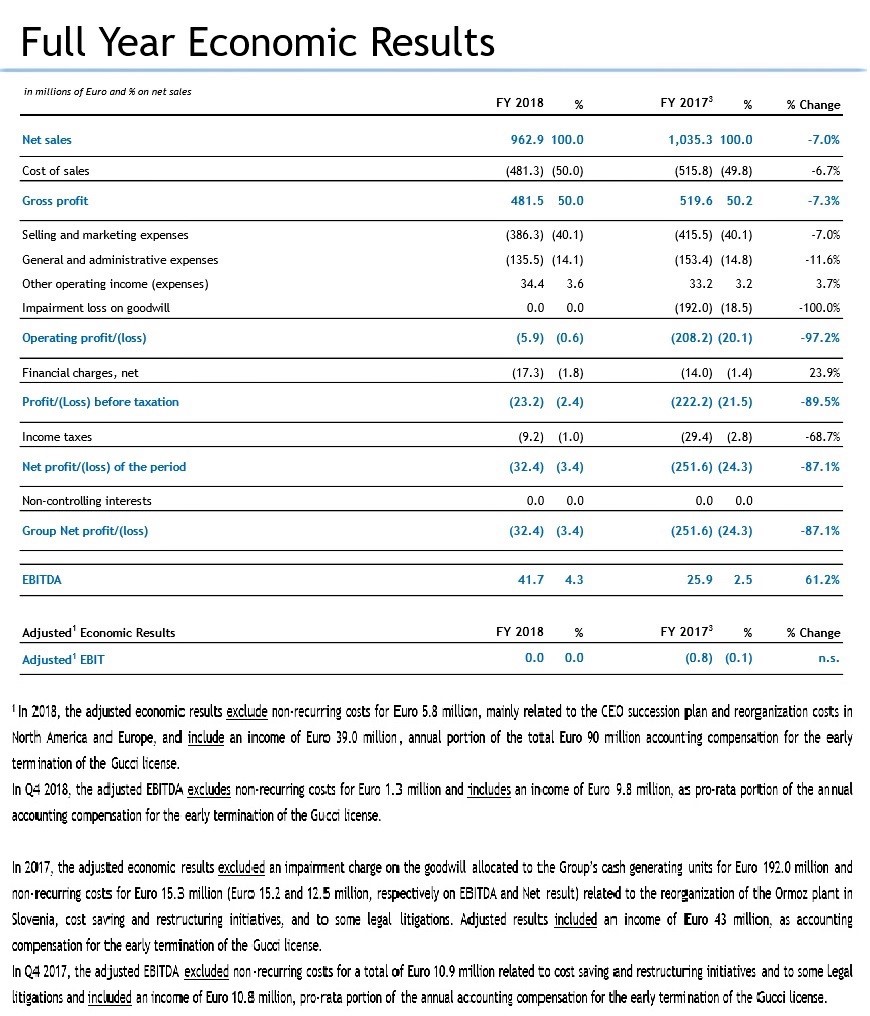

Safilo’s full-year 2018 results can be seen in the table below.