Safilo Group has returned to sales growth and improved profitability in the first quarter of 2025 despite ongoing macroeconomic uncertainty.

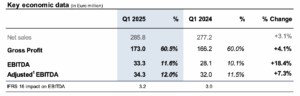

In the three months ending 31 March 2025, Safilo posted net sales of €285.8 million, up +2.2% at constant exchange rates and +3.1% at current exchange rates versus Q1 2024. Growth was recorded across most of the group’s brands and regions, with Europe and Asia Pacific delivering strong results, and a notable recovery seen in North America.

Safilo also reported improvements in profits and margins. Gross profit reached €173 million, a +4.1% increase year-on-year, with gross margin improving to 60.5%, up 50 basis points.

Adjusted EBITDA rose +7.3% to €34.3 million, with the adjusted EBITDA margin climbing to 12.0% compared to 11.5% in Q1 2024. The improvement was supported by a favourable price/mix effect and operating leverage, which helped offset increased marketing investment across the brand portfolio.

By brand, Smith further consolidated its market leadership in North America’s winter sports segment. Carrera and David Beckham also continued their strong momentum from 2024, while Polaroid saw further gains following its Q4 2024 recovery. Key licensed brands, including Tommy Hilfiger, Carolina Herrera, BOSS, HUGO and Marc Jacobs, also contributed positively to overall group sales.

Safilo Chief Executive Officer Angelo Trocchia commented, “We began 2025 with encouraging momentum, particularly in January, when North America built on the positive recovery trends seen at the close of 2024. During the quarter uncertainty increased with escalating geopolitical tensions gradually impacting customer confidence.

“In this complex context, we delivered a solid first quarter,” he added. “Europe continued to be where our innovation and customer focus aligned most effectively, helping to drive broad-based growth across markets and brands. In North America, despite a still uneven landscape, we recorded a moderate improvement, supported by Smith’s winter sports products and the resilience of the prescription frames business.

“From a financial standpoint, we achieved solid growth across all margins and delivered a strong acceleration in cash generation.

“As the tariff landscape continues to evolve, we maintain a prudent and flexible approach, leveraging the current challenges to accelerate the diversification of our supply chain. Our commitment to long-term brand building, operational agility, and financial resilience remains unchanged.”

Regional performance

Asia Pacific delivered a standout performance, with net sales of €14.4 million, up +18.5% at constant exchange rates and +21.2% at current exchange rates. Growth was led by Carrera in Australia, supported by co-branding campaigns and the launch of a dedicated women’s collection. The region also benefitted from favourable shipping times to major accounts.

In Europe, net sales totalled €128.9 million, up +2.8% at constant exchange rates. Growth was broad-based across Safilo’s owned and licensed brands, with particularly strong performances from Tommy Hilfiger, Marc Jacobs and BOSS. France and Eastern Europe remained dynamic growth markets, while the independent optician channel saw solid gains in Italy, Spain and Germany.

North America recorded sales of €118.8 million, up +1.0% at constant exchange rates. While the winter sports category performed well, the eyewear segment posted mixed results. Smith recorded double-digit growth both in sports stores and in the direct-to-consumer channel thanks to a favourable ski season.

Blenders was impacted by a promotional entry-price market, whereas prescription frames saw growth through the wholesale channel. During the period, Tommy Hilfiger, Carrera, David Beckham, Carolina Herrera and Marc Jacobs confirmed their role as key growth drivers in North America.

Sales in the rest of the world declined -2.9% at constant exchange rates to €23.7 million, affected by weaker trading in India and Mexico. However, Safilo recorded growth in the Middle East and Brazil. ✈