|

Executive Vice President Christian Hother Sørensen: upbeat about the future following a year of great change |

SCANDINAVIA. This year has seen a major restructure at Scandinavian Tobacco; July saw the sale of the group’s subsidiary cigarette company House of Prince to British American Tobacco, along with the Snus (snuff) operations. But the company that has emerged remains a powerful player in the tobacco market, and sees a vital role for travel retail in the future. That’s according to Executive Vice President Christian Hother Sørensen, who addressed the media during last month’s TFWA World Exhibition.

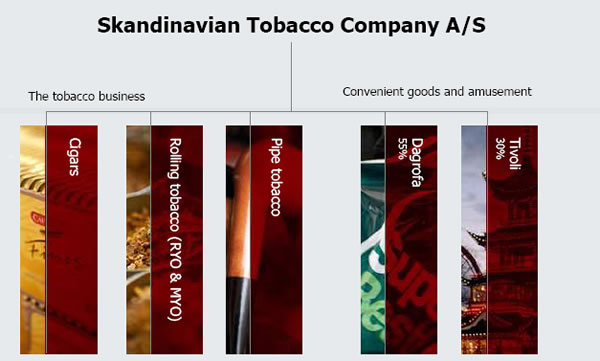

Following the House of Prince deal British American Tobacco withdrew from Scandinavian Tobacco as a shareholder and now operates House of Prince as sole owner. That meant Scandinavian Tobacco had to re-evaluate its core areas of focus, according to Sørensen. The group is now planning to grow its business in three key areas: cigars, rolling tobacco and pipe tobacco.

Growth will be driven partly by the development of the group’s brands and partly by geographical expansion, Sørensen confirmed.

Currently Scandinavian Tobacco is the largest pipe tobacco producer in the world; it is also the number one producer in Europe of cigars – and stands third globally in cigar production.

The group employs 9,400 people and has nine factories in five countries, with additional sales companies in seven countries.

The group’s consolidated revenue amounts to about DKK26 billion (US$4.3 billion), although the greater proportion of this is generated through side interests – Dagrofa, the Danish convenience foods chain of which Scandinavian Tobacco owns 55%, and the Tivoli amusement park in Copenhagen, in which it has a 30% stake.

Presently Dagrofa contributes DKK23 billion to the consolidated revenue total of the group, giving a clear indication of size of Scandinavian Tobacco’s newly restructured tobacco business.

The group’s tobacco business has now been clearly segmented into three divisions: a cigar division, a rolling tobacco (make-your-own and roll-your-own) division, and the pipe tobacco division.

Currently the cigar business produces 1.7 billion sticks per year, turning over DKK2 billion (US$336 million). It houses international brands such as Café Crème (the world’s biggest selling cigar), Henri Wintermans, Colts, Nobel Petit, CAO and Mercator.

The pipe tobacco arm produces 4.737 tonnes annually, turning over DKK2.6 billion (US$437 million) with the Clan, Orlik, Erinmore and Sweet Dublin brands in the portfolio. The group considers the pipe tobacco market to be a declining one; it does however aim to maintain its volumes in this category through brand consolidation.

Scandinavian Tobacco’s rolling tobacco division houses the Escort, Bali, Crossroad, Lighthouse and Home Roll brands. Its largest markets currently are Denmark, Germany, The Netherlands, Canada, France, the UK and the US.

The group sees potential growth markets for rolling tobacco in Romania, Russia, Czech Republic, Malaysia, Saudi Arabia, the US, Belgium, Hungary and Italy.

Travel retail also has a large part to play in the development of the new-look Scandinavian Tobacco, said Sørensen, with the group now “dedicating specific sales resources directly at the channel. Duty free has a much higher profile within the group overall”, he said.

The reorganisation of the group following the sale of the tobacco has also allowed the Scandinavian Tobacco’s management to more clearly identify areas of growth for the remaining divisions.

“Previously two thirds of the group’s overall profit came from the cigarette brands, and this naturally led to an over-concentration on that facet of the business. With the cigarette business now gone, we are free to focus on developing the other areas of the group,” Sørensen said.

|

How the new-look Scandinavian Tobacco group shapes up after the recent consolidation |

Speaking later to The Moodie Report about the brand portfolio, Senior Vice President Marketing Lars Wassberg confirmed that travel retail remained a vital channel for the group after the consolidation.

He said: “Travel retail is one of the top ten channels for the group in terms of volumes. It serves a strategic purpose and holds important commercial value too. Our products are also attractive to retailers in this channel as they offer good margins in comparison to cigarettes.”

The company’s signature Café Crème brand continues to drive the growth of the business. The brand was repackaged last year, while this year has seen new shelf displays and gondolas, which can be tailor-made for specific retailers’ requirements.

Head of Brands Karin Linders said: “Our goal is to keep the dynamism in the Café Crème brand, by introducing travel retail-specific packs and creating points of difference. That attracts consumers to trial the brand.”

Among the other brands in the portfolio, CAO International has introduced a special leather case of ten cigars for the travel retail market, each rated at over 90 in the Cigar Aficionado scale. Other display ideas and new packaging are set to follow.

The company is also placing emphasis on its pipe tobacco brands, of which three are significant for travel retail: W.O. Larsen, Clan and Erinmore.

Wassberg said: “Larsen is a Danish brand but is gaining an international focus. Each year we now see a new tin or blend and it’s very much a collector’s item.

“Likewise, Clan and Erinmore have strong followings around the world, which we want to leverage in global travel retail. We want to maximise the opportunities of these brands – it’s about getting the right visibility and distribution.”

[comments]

Your post will appear – once approved – in The Moodie Forum on our home page

MORE STORIES ON SCANDINAVIAN TOBACCO