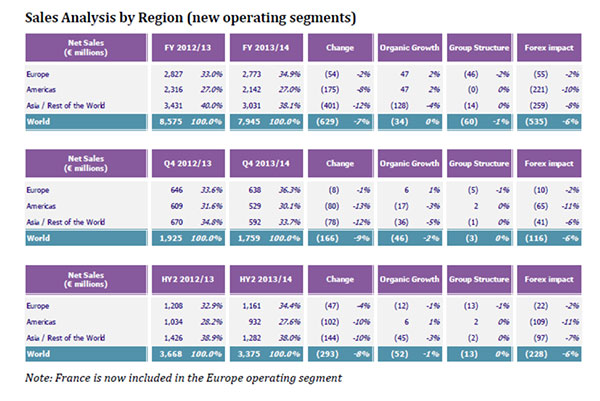

Pernod Ricard sales for the 2013/14 financial year hit €7,945 million, down by -7% year-on-year. An unfavourable currency impact and a sharp slowdown in the business in China were blamed for the decline.

Chinese sales plummeted by -23%, dragging down sales in the Asia/Rest of the World division by -4%. The Chinese business has been hit by the crackdown on luxury consumption and official/corporate gift-giving.

Outside China the Asian business grew by +5%. This was boosted by a good performance from travel retail, noted the group, especially from Martell and Royal Salute.

There was a “marked improvement in Europe,” noted the group, with sales up +2%.

The Americas also posted +2% growth, though this was slower than previously due to a tough US market and also to a double-digit decline in sales in travel retail. On travel retail in this region, the company said the year had been “challenging” and was “adversely affected by the destocking of certain distributors, trade disputes and the weakening of certain South American currencies”.

|

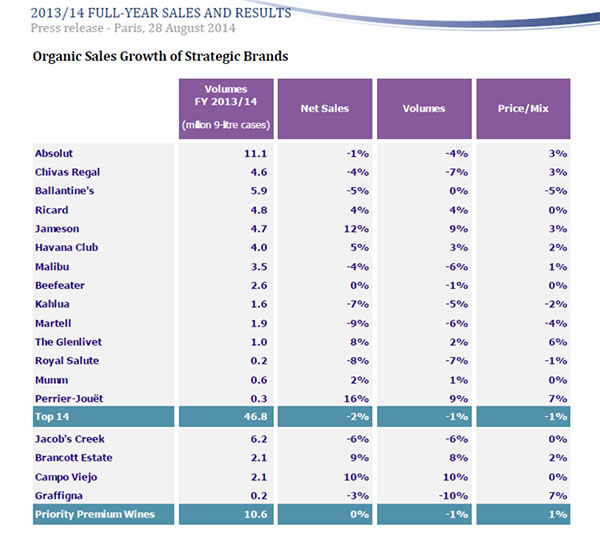

The Top 14 strategic brands declined by -2% in sales as a result of a slight reduction in volumes and unfavourable mix (principally the decline of Martell in China). Despite “a more challenging business environment”, pricing remained solid at +2%.

The best performers in terms of net sales growth were Jameson (+12%), The Glenlivet (+8%) and Perrier-Jouët (+16%). Of the top brands by volume, Absolut posted a -1% dip in net sales, Chivas Regal fell -4% and Ballantine’s was down by -5% year-on-year.

The company also noted the “good performance of Key Local Brands”, which posted +4% growth, supported by positive pricing.

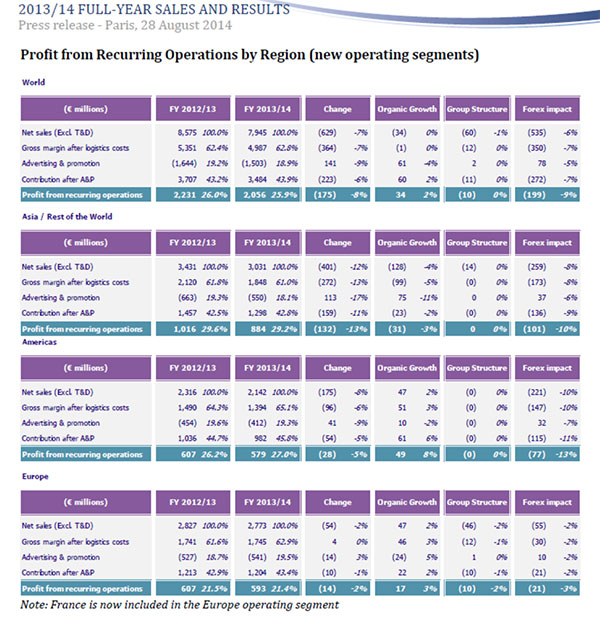

The operating margin rate increased +52 bps in organic terms, the strongest increase in four years. As a result, profit from recurring operations recorded organic growth of +2% to €2,056 million.

The foreign exchange impact was highly unfavourable (€199 million). It had a significant impact on the reported change in profit from recurring operations (-8%).

Group share of net profit from recurring operations decreased by -3%. In organic terms, it grew +9%.

|

Pernod Ricard CEO Pierre Pringuet said: “Despite an environment that was more difficult than anticipated, we have delivered the guidance announced in February, proof of everyone’s commitment, which I would like to commend. We are seriously committed to the Allegro project: this operational efficiency project must enable us to maximise our future growth while generating a hard figure of €150 million of savings.”

Deputy CEO & Chief Operating Officer Alexandre Ricard added: “In this context which will remain challenging, we anticipate a gradual improvement in our sales growth, and we will increase the investment behind our brands and priority innovations in order to sustain long-term growth.”

|