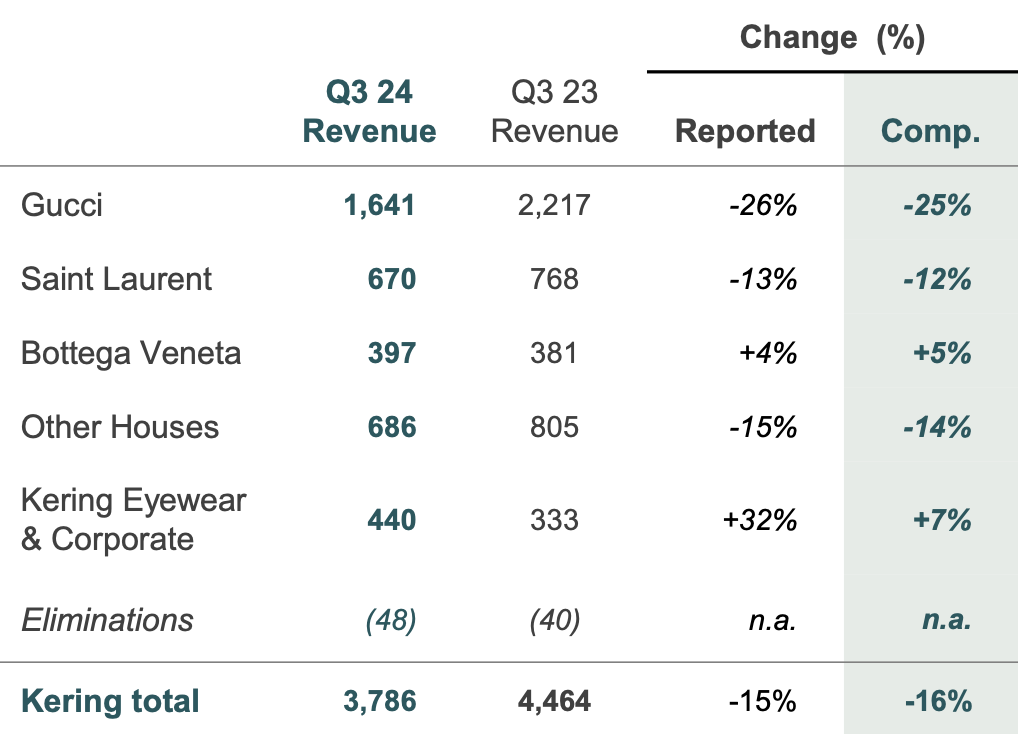

Kering Group today announced third-quarter revenue of €3.8 billion, down -15% on a reported basis and -16% on a comparable basis. The performance was in large part due to a -26% reported (-25% like-for-like) slide in revenues from the largest brand, Gucci, to €1.6 billion.

The group also warned on its profits outlook, saying that “major uncertainties” were likely to weigh on demand among luxury consumers in the coming months. Following what it termed the “larger-than-expected slowdown” in the third quarter of the year, Kering’s recurring operating income in 2024 could total around €2.5 billion, the company said, compared to €4.75 billion in 2023.

Q3 sales from the group’s directly operated retail network fell -17% on a comparable basis, adversely affected by lower store traffic. At Gucci, sales at its owned network fell by -25% year-on-year.

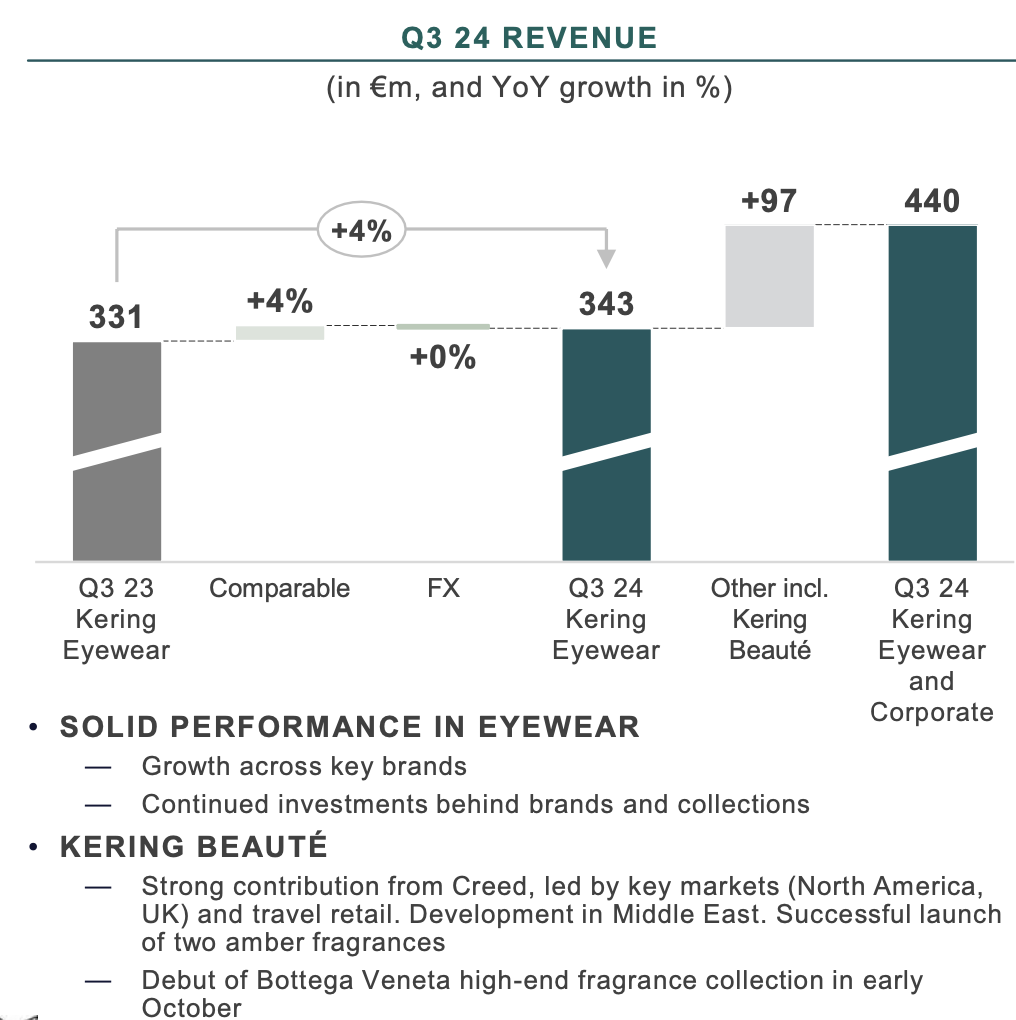

More positively, Q3 revenue from the Kering Eyewear and Corporate segment amounted to €440 million, up +32% on a reported basis. Kering Eyewear revenue rose by +4% on a comparable basis during the quarter. The company highlighted growth and continued investment behind key brands and new collections.

The segment also encompasses the activities of Kering Beauté, which was boosted by the contribution of Creed, led by key markets such as North America and UK plus travel retail. A new Bottega Veneta high-end fragrance collection made its debut this month.

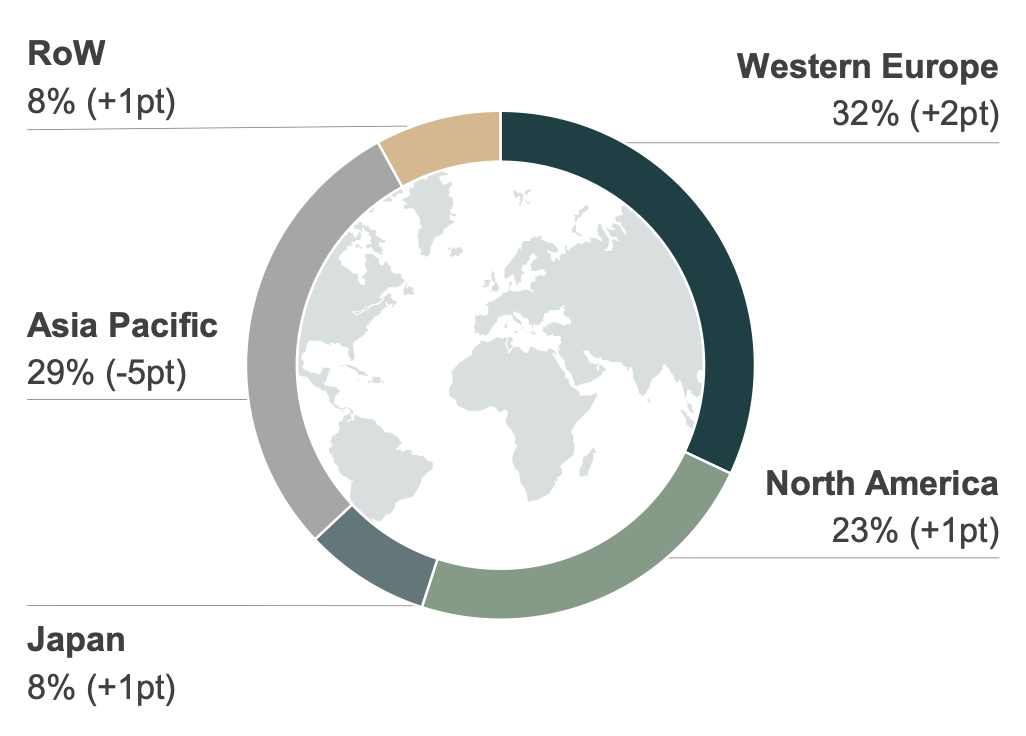

At group level, trends across the regions weakened by comparison with the second quarter, with a particular slowdown in Asia Pacific in Q3.

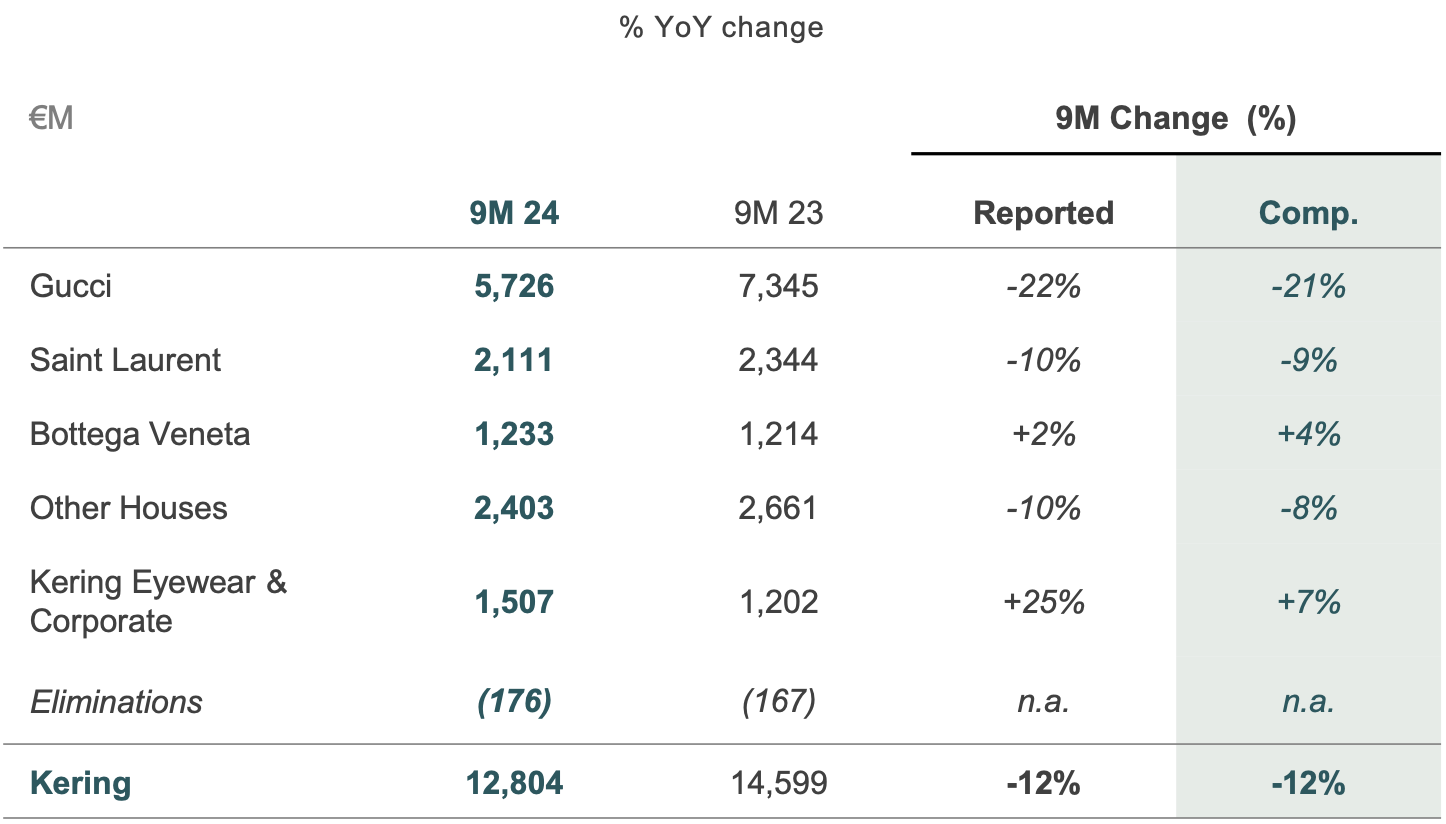

In the first nine months of the year, the Group generated revenue of €12.8 billion, down -12% both as reported and on a comparable basis. Within this, Gucci revenues fell by -22% as reported and -21% on a comparable basis.

Kering Eyewear & Corporate posted +25% revenue growth on a reported basis (+7% comparable) in the nine months to €1.5 billion.

Kering Group Chairman and CEO François-Henri Pinault said: ‘With discipline and determination, we are executing a far-reaching transformation of the group, and at Gucci in particular, at a time when the whole luxury sector faces unfavourable market conditions.

“This severely impacts our performances in the short term. Our absolute priority is to build the conditions for a return to sound, sustainable growth, while further tightening control over our costs and the selectivity of our investments. We have the right strategy, organisation and talents to achieve these goals.” ✈