SOUTH KOREA. As it bounces back strongly from a severe MERS-related sales downturn in June and July, The Shilla Duty Free is gearing up for three major openings in downtown Seoul, Changi Airport and Incheon International Airport, respectively. But in a key development, powerhouse French beauty brand won’t be part of the Incheon mix for Shilla’s new perfumes & cosmetics contract that begins next month.

Senior Executive Vice President and Head of The Shilla Duty Free, Jeong-Ho (Jason) Cha told The Moodie Report during an extensive interview at company headquarters in Seoul yesterday that the recovery from the MERS downturn is gathering momentum, though business is still well down on last year.

“The worst week downtown [in July] was almost a -90% decrease compared with last year,” he said. “The worst week at the airport was -50%. But at the same time the Koreans still travelled a lot and that compensated a lot. I think things won’t get back to normal until October – the peak season for Chinese travellers. Compared to this time last year we’re [currently] about 50% down in traffic and spending.”

|

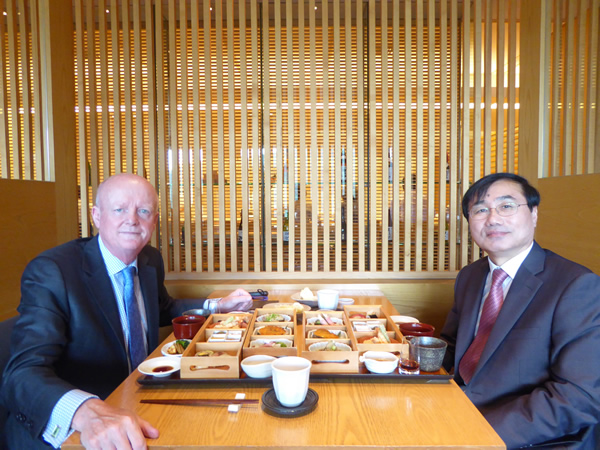

Senior Executive Vice President and Head of The Shilla Duty Free, Jeong-Ho (Jason) Cha and The Moodie Report Chairman Martin Moodie talk over a business lunch at The Shilla Hotel |

|

Business at The Shilla Duty Free’s flagship store in Seoul is recovering steadily from the MERS crisis but sales are still off by around -50% year-on-year |

|

Chinese tour business has been slow due to the health crisis but is expected to be back in full swing by October |

In more upbeat news, the retailer’s spectacular new Seoul downtown duty free store in partnership with Hyundai Development Company at the Yongsan I’Park Mall will open as planned in late 2015. As reported, Shilla and Hyundai Development Company won one of the three hotly contested new Seoul downtown duty free licences awarded earlier this year.

“We expect to open in late December,” Cha said. The duty free offer, one of Asia’s most ambitious and expansive, will occupy the third to eighth floors (the latter for back office space) of the former department store building, and will be targeted principally at Chinese shoppers.

| When Jason Cha entered the business in 2007, Shilla generated sales of around US$300 million. Last year they were close to US$3 billion, a ten-fold increase. |

“Basically we have finalised the drawings,” Cha said. “There are a lot of challenges for the Korean duty free business but there are even more opportunities – that’s why our government issued these new licences. As a big operator, we have the capability to manage this type of challenge and opportunity. So we have an optimistic view.”

The sheer scale of the new environment will allow Shilla to diversify its offer, presenting different categories, approaches and ambiences on the respective floors. While there be a luxury offer, Shilla will also present alternative ranges and environments for a younger clientele with different purchasing profiles.

“The advantage of the new store is that there also a department, discount shops and a lot of restaurants on the same site so people can enjoy everything in one place,” said Cha, noting a contrast with Shilla’s current downtown store adjacent to The Shilla Hotel, which is located away from other attractions.

STEP-BY-STEP AT INCHEON – BUT NO CHANEL

Meanwhile Shilla is set to begin its new Incheon International Airport duty free concessions from 1 September. As reported, the retailer was awarded three licences, comprising four beauty shops and five liquor & tobacco stores in Passenger Terminal Building West and 11 general merchandise shops in Passenger Terminal Building East.

It will operate initially out of temporary shops, renovating on a “step-by-step” basis (with perfumes & cosmetics opening in early November followed by liquor & tobacco and general merchandise before an overall Grand Opening in early 2016).

However one brand it will not stock within its beauty offer is Chanel. Over the past few months Chanel has been in dispute with Shilla and its arch-rival Lotte Duty Free over space demands at Incheon. Chanel, long piqued as a company by the blockbuster 550sq presence of Louis Vuitton at Incheon since September 2011, had demanded a doubling of its current 30sq m space in both retailers’ main beauty stores under their newly won contracts.

|

Chanel beauty enjoys a strong presence with The Shilla Duty Free in Seoul downtown and at Changi Airport but it won’t be part of the retailer’s new Incheon International Airport offer |

That demand prompted a furious response from at least one of Chanel’s major rivals (and concern from others), and Chanel’s Incheon exit has been a subject of constant conjecture over the past few months. The Moodie Report held off the story last month due to commercial sensitivities but the die has now been cast with Shilla at least.

Lotte yesterday told The Moodie Report that Chanel’s presence was still “under discussion” for the new Incheon contract. Incheon International Airport Corp has tried to encourage a resolution over recent weeks, admitting its disappointment to The Moodie Report at the prospective loss of Chanel.

The brand is known to be keen on securing stand-alone beauty space at Incheon. We’ll bring you more details on this development in a separate report.

ANOTHER STOREY IN THE CHANGI STORY

Chanel will, however, feature very prominently at Singapore Changi Airport when The Shilla Duty Free opens the much-anticipated top-floor of its duplex beauty store towards the end of September (a formal opening ceremony is expected during the first week of October).

The upper-floor will feature extensive areas from four blue-chip beauty brands – Chanel, SKII, Dior and La Prairie. “Each brand has its own concept,” Cha said.

He said the Changi business continues to improve after a tough (and heavy loss-making) start. “This month is very strong,” Cha commented. “It’s still a little bit less than our original plan but we’re almost reaching 90% of our plan – so it’s getting better.”

NOTE: The full version of this interview will appear in an extensive South Korean travel retail market report in the October (Cannes) issue of The Moodie Report Print Edition.